Tax fraud costs the U.S. nearly $700 billion per year in lost tax revenue according to the IRS.1 One way people commit this fraud is through tax identity theft. By combining tax fraud and identity theft, the criminal can pin the fraud on someone else. For instance, they may claim a return under your name and leave you with the bill. When you go to file your taxes, you end up with a major headache dealing with the IRS to sort things out.

Staying prepared for tax identity theft is the best way to protect yourself. So, bear with us while we cover everything you need to know so you don’t end up having to deal with the headache we just described. Then, check out our guide on identity theft protection to round out your preventative measures.

Key Findings

- At almost $700 billion per year in lost revenue, tax fraud takes a major toll on the country’s finances.

- There’s now an online portal for reporting identity theft to the IRS. It used to be a paper form you had to mail in.

- If someone claims a refund using your identity, you won’t be able to file your taxes online. But, you still need to pay and file your taxes on time.

- Use the tools the IRS provides to prevent tax identity theft like their Identity Protection PIN.

What is Tax Identity Theft?

Tax identity theft is when someone submits a fraudulent tax return filled out with a different person’s information. The criminal fills it out to maximize the return they receive. Then, the person whose information they used gets a letter in the mail from the IRS saying they owe money.

You know how every April, you file your taxes? If you work a regular nine-to-five, you probably get money back at the end of each year. That’s based on the information your employer already filled out on your behalf. But, there are other forms you can file yourself that can change the amount you get in a return or how much you owe when you file your taxes. Those forms are what tax identity thieves defraud.

>> Read About: Is a Home Security System Tax Deductible?

How Does Tax Identity Theft Happen?

The main piece of information a criminal needs to commit tax identity theft is someone’s Social Security number (SSN). Once they get that number, they can figure out most of the other information. They use SSN reverse lookup tools that provide them with the rest of the information in a few clicks. Scary, right?

FYI: It’s not the end of the world if you lose your Social Security card. If you do though, you need to take steps right away to keep your identity safe.

From there, the criminal takes one of two approaches. One type of criminal doesn’t bother verifying the information and claims a refund with the information directly from the SSN reverse lookup tool. Thieves in this category tend to have a bigger supply of SSNs so they don’t need every attempt to work.

The other type of thief intensively verifies the information associated with the SSNs that they steal. This way they can use the identity for as long as possible without getting caught. They try to stay under the radar until they steal as much money as they can. Since all of the information is verified so well, these thieves can go undetected unless you’re actively looking for signs of identity theft.

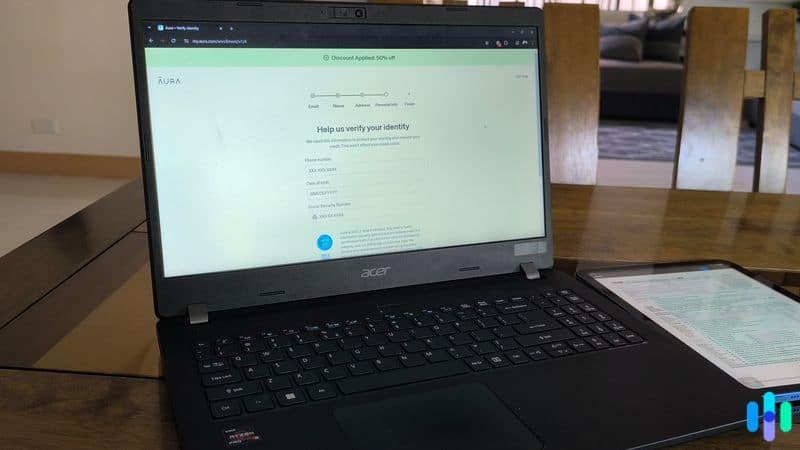

Get ID Theft Protection

Check out our favorite identity theft protection services.

How to Prevent Tax Identity Theft

Since tax identity theft revolves around your SSN, preventing it from happening to you comes down to keeping your SSN secure. That includes both your online and physical security. Whether it’s a document with your SSN on it or an online form that requires your SSN, you can take precautions to minimize the chances of someone getting their hands on your information.

Did You Know: We made a guide on how to keep your confidential personal data secure online and offline. To make that guide, we talked to data security professionals about the most commonly overlooked vulnerabilities in securing personal data.

Here are the precautions you can take to prevent tax identity theft:

- Never carry around documents with your SSN — We keep our Social Security card in a safe in our house. Even though it would fit in a wallet, do not keep it there.

- Shred before disposing of documents with personal information — Investing in a shredder is one of the best investments you can make for your identity theft protection. We recommend a micro-cut shredder which means it rips the paper apart into smaller pieces than traditional cross-cut shredders.

- Install a home security system — Since you store your confidential documents in your home, one of the best home security systems can help keep those documents safe.

>> Learn More: What Is A Home Security System and How Does It Work?

- Set IRS Identity Protection PINs — You can request an IRS identity protection PIN through your online IRS account. This PIN adds another piece of information a criminal needs to commit tax identity theft against you.

- Use antivirus on all devices — Spyware is one-way criminals steal SSNs. They look for nine number sequences typed in three-digit, two-digit, and then three-digit increments. Keeping the best antivirus software up-to-date on your devices keeps you protected.

- Keep online connections secure with a VPN — Similar to spyware on your computer, other criminals try to intercept your internet connection so they can see the data you send to websites. That means if you ever submit your SSN on an online form, it could get stolen. The top VPNs protect you against this vulnerability by encrypting your online connections.

Tax Identity Theft Warning Signs

Ideally, you find out about any tax identity theft attempts against you before you get a letter from the IRS. That way you can proactively clear up any issues before it escalates. Getting ahead of identity theft minimizes the damage and makes the recovery easier.

Pro Tip: There are a lot more types of identity theft than tax identity theft and they all have different warning signs. So, we made an up-to-date guide on how to check if someone is using your identity in 2025 with current identity theft trends in mind.

Here’s how you can identify tax identity theft to get ahead of the criminals:

- Rejected return due to duplicate filing — Your tax filing will get rejected if someone files a tax return using your SSN. In that case, the IRS will tell you they rejected it due to a duplicate filing. If this happens, request a copy of the return to verify that it was someone else using your identity.

- Unknown dependent claims — When filing your taxes online, you’ll get a notification if someone claimed you as their dependent or someone said that they were your dependent on their return. Verify the accuracy of this information as an unknown person showing up here is a sign of tax identity theft.

- Unsolicited tax transcript — Using your SSN, someone can request a tax transcript. That’s when the IRS sends you your old tax returns. The thief then tries to intercept these transcripts to get the rest of your information so they can successfully file a fraudulent return.

- Suspicious online account activity — The IRS will send you a letter if someone uses your identity to create an online account. They’ll also let you know of suspicious activity or if your account gets disabled.

- Employee Identification Number (EIN) assigned to you — Some identity thieves create corporations using stolen identities. In this process, they’ll apply for an EIN which can be used to file taxes. If you get a letter confirming your EIN, take action immediately.

How to Recover From Tax Identity Theft

Most of the time, you’ll find out about tax identity theft through a letter from the IRS stating you filed your taxes incorrectly and need to rectify the issue. It will sound like you owe the money but you never received the return mentioned in the letter. So, you need to take a step back and plan for recovery. Here are the steps our experts would take:

- Contact our identity protection service — We always have a subscription to one of our favorite identity theft protection services, so contacting them would be our first step. They’ll set us up with experts to guide us through every step of the recovery process.

- Create a recovery plan and file an identity theft report — Our experts from our identity theft protection service will create a recovery plan for us. Without this support, you can create one on your own through IdentityTheft.gov.2 That’s where we’d go to file an identity theft report too.

>> Learn About: Best Identity Theft Restoration Services in 2025

- File and pay our taxes — While dealing with tax identity theft, it’s still important to file and pay our taxes on time. We would mail our paper return and complete Form 14039 online to report our identity theft.3

- Request a copy of any fraudulent documents — We mentioned this when talking about rejected returns, but it applies to any fraudulent documents you learn about. Always request copies so you have records of your identity theft incident.

- Consult a tax professional or accountant — Normally, we recommend talking to a lawyer, but in the case of tax identity theft, a tax professional or accountant would offer us more help. They’re more used to dealing with the IRS. That said, a consultation with a lawyer as well wouldn’t be a bad idea.

Final Thoughts

Nothing can get our hearts racing more than a letter from the IRS. Even though we always pay our taxes on time and in full, we still don’t want the headache of getting audited or any other issue with the IRS. But these notices can tip us off to a tax identity theft attempt.

We can’t rely on the IRS etirely though and you don’t have to with our expert help. Now that you’re armed with the advice of an identity theft protection expert, you can start taking an active role in your identity protection. Of course, a subscription to an identity theft protection service always helps too.

FAQs About Tax Identity Theft

-

Do I report tax identity theft to the IRS?

Yes, you should report tax identity theft to the IRS using Form 14036, Identity Theft Affidavit.

-

Someone filed taxes in my name. What should I do?

If someone filed taxes using your name, you need to report it to the IRS immediately and then start a recovery process. An identity theft protection service can help you reclaim your identity.

-

Can I protect myself from tax identity theft?

Identity theft is an unfortunate reality of our world and nobody can guarantee their safety. But, there are steps you can take to reduce your exposure like shredding documents with personal information and keeping your devices secure.

-

How can I tell if communication from the IRS is legitimate?

The IRS will always send letters first. You can verify their authenticity by logging into your IRS Online Account and finding a copy of the communication. If there are no records of the letter, it’s most likely fraudulent.

-

Will my identity theft protection service help me with tax identity theft?

As long as you’re using a quality identity theft protection service, they will help you deal with tax identity theft. They also offer comprehensive monitoring to help prevent identity theft before it happens.