We found out identity theft impacts over a third of Americans in our identity theft consumer shopping study. This used to involve thieves stealing your exact identity for nefarious purposes like taking out a loan in your name or draining your bank account. That means one mistake by the criminal could tip you off that your identity is at risk. Especially if you have an identity theft protection service that looks for suspicious activity like a loan application with an incorrect security question.

But that was the old way criminals stole identities. Nowadays, it’s more sophisticated. The Federal Trade Commission estimates that up to 85 percent of identity theft is synthetic identity theft instead of what we described above.1 This type of identity theft is trickier because it only uses portions of your real identity mixed with made-up information that looks real.

So, let’s go over everything you need to know about this new age of identity theft.

Key Findings

- Synthetic identity theft is when someone only uses portions of your identity to create a partially fake identity.

- Most Americans do not know what synthetic identity theft is.

- There are steps you can take to reduce your risks of becoming an identity theft victim.

- If you notice any signs of synthetic identity theft, take action immediately.

What is Synthetic Identity Theft?

We found out that most adults are not familiar with synthetic identity theft. Most hadn’t heard the term when we surveyed over 700 adults. Here are the results:

| How familiar are you with the term “Synthetic Identity Theft?” | |

|---|---|

| Not at all familiar | 67 percent |

| Not so familiar or somewhat familiar | 32 percent |

| Very or extremely familiar | 1 percent |

So, let’s clear up what it is. While synthetic identity theft can involve any of your personal information, criminals often try to get your Social Security number (SSN) first. Then, they use your stolen SSN along with made up details to apply for anything from loans and credit cards to unemployment benefits and Social Security benefits.

>> Read More: What To Do If You Lose Your Social Security Card

That said, a criminal can’t take out a huge loan with just your SSN and a fake name. Synthetic identity theft is a long con. Before applying for a loan, they need to build out a new identity using your SSN. This can involve anything from applying for a library card to incorporating a business with your SSN and the fake name. By applying for these seemingly inconsequential documents, the criminal can start building out the synthetic identity making it seem real.

FYI: Criminals have successfully defrauded the federal government using synthetic identity theft tactics. Adam Arena, an identity thief, stole close to $1 million dollars through the Payment Protection Plan loans during the COVID lockdown.2 If these methods can fool federal programs, private lenders can be fooled too.

Eventually, they build up the identity enough to successfully apply for a credit card. Starting small lets them build a credit score against this fake identity that’s tied to your SSN. This can damage your credit score and becomes a major hassle to rectify once it starts impacting your life.

How Fraudsters Steal SSNs

With everything going digital nowadays, fraudsters look for devices and accounts they can exploit. Many times though, the person who steals a SSN is not the same person that creates a synthetic identity. The thief specializes in stealing SSNs and sells them on dark web marketplaces where synthetic identity theft experts buy them.

Pro Tip: You don’t need to do it all on your own. We rounded up the best identity theft protection services with dark web monitoring. These services check popular dark web marketplaces for your information and then send you a notification if they find any.

Based on our surveys and research, we’ve found that the most common places SSNs get stolen include:

- Unprotected smartphones

- Unprotected computers

- Information submitted via unsecured network connections

- Your snail mail (don’t let mail sit too long in the mailbox)

- Your garbage (where mail and other important documents end up; shred that stuff)

- Flash or thumb drives

- Data hacked from government, property, tax, veteran’s affairs sources

- Data stolen from banks, utility companies, retailers, credit processors, etc.

- Data stolen from health care facilities, educational institutions, various associations, and even alumni groups

- Your employer’s records and laptops

Differences Between Synthetic and Regular Identity Theft

Like we mentioned, regular ID theft is when someone uses your exact identity. They’ll use your name, address, SSN, and all of your actual information to steal from you whether through your unemployment benefits or a new line of credit. Synthetic identity theft pairs a few pieces of real information with fake information to create a new hybrid identity that they build up into legitimacy.

To you, this difference might seem minor. But as identity protection experts, we can tell you that this difference is big when it comes to monitoring your identity. If an identity protection service only monitors for exact matches of your identity, they’ll miss synthetic identity theft until it’s too late. Or, they might not be monitoring for the piece of real information that a thief could use to build a synthetic identity.

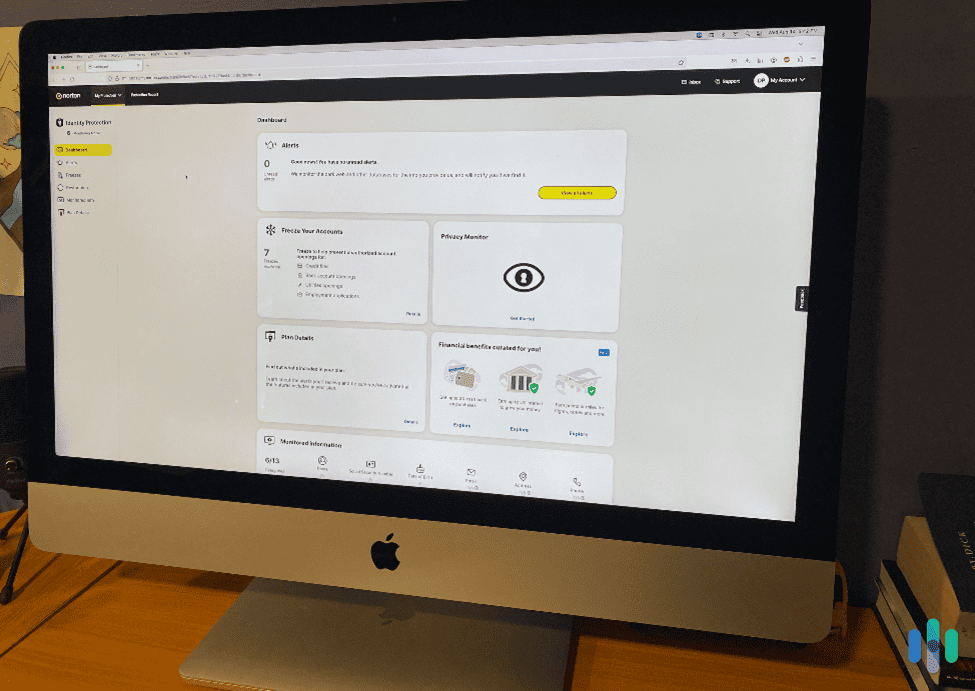

So, to keep up with current threats, make sure to choose an identity theft protection service with synthetic identity monitoring. Most recently, we tested LifeLock’s synthetic identity monitoring capabilities and were left impressed.

>> Learn About: LifeLock Identity Theft Protection Cost & Plans in 2025

How to Prevent Synthetic Identity Theft

We’ll get the bad news out of the way first. We can’t tell you a foolproof way to prevent synthetic identity theft. That’s because there isn’t one. So, we spent our time figuring out how to minimize risks to your identity. This revolves around securing your devices and documents as well as properly disposing of and deleting documents with sensitive information.

- Shred documents with sensitive information — It’s not enough to just throw out old bills in the trash. Synthetic identity thieves can use old bills and other documents with your information on them as proof while building their fake identities.

- Securely store physical documents — We secure all of our documents with our sensitive information in a safe in our home. For added security, we also use one of our favorite home security systems at all times.

- Use an antivirus software — Whether it’s a keylogger tracking everything you type looking for patterns that look like a SSN or a spyware that can watch your screen as you input sensitive information, there are plenty of threats to your identity in the digital world. Keeping your devices protected with one of the best antivirus software keeps your digital files with sensitive information safe.

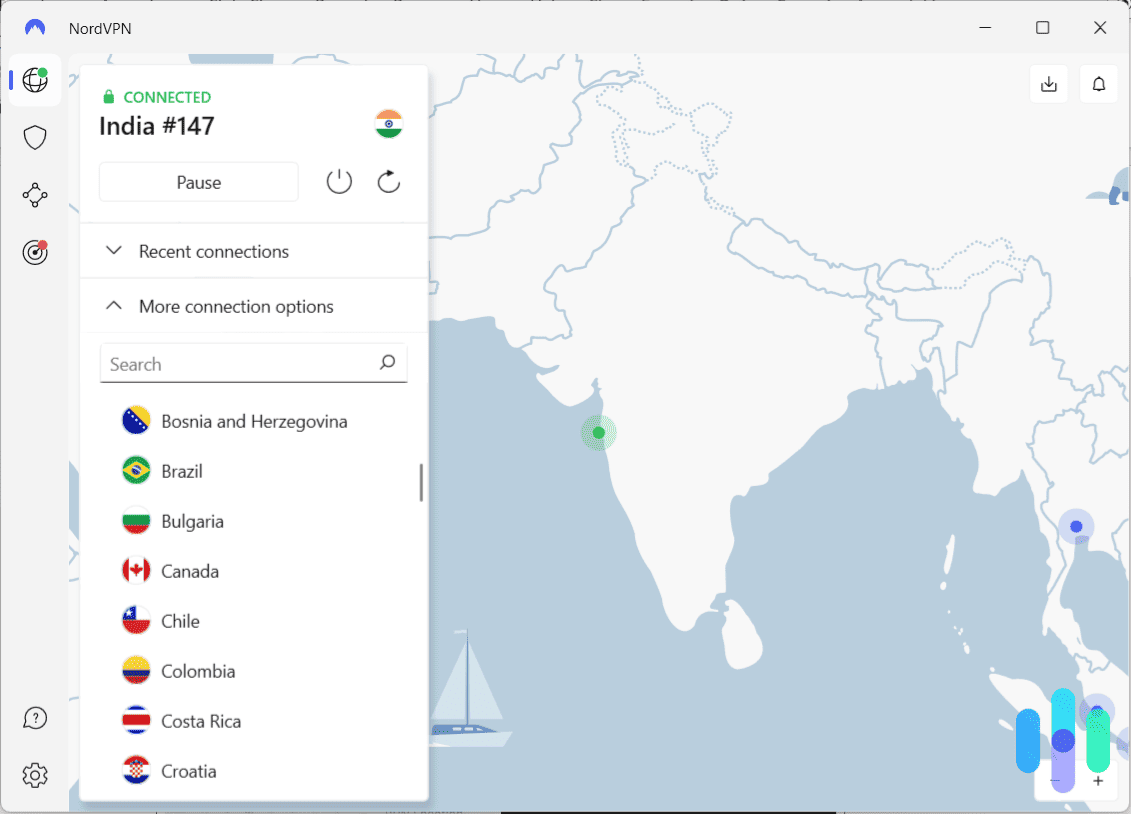

- Connect to the internet through a VPN — Some thieves try to steal your information by intercepting your internet connection. Connecting through a top-tier VPN encrypts the connection before it leaves your computer.

- Limit information in social media posts — You might just be posting a selfie in your office, but in the background, there could be your old tax return with your Social Security number or other sensitive document. That’s why we always take a minute or two going over any photos we plan to post to make sure our background is clean.

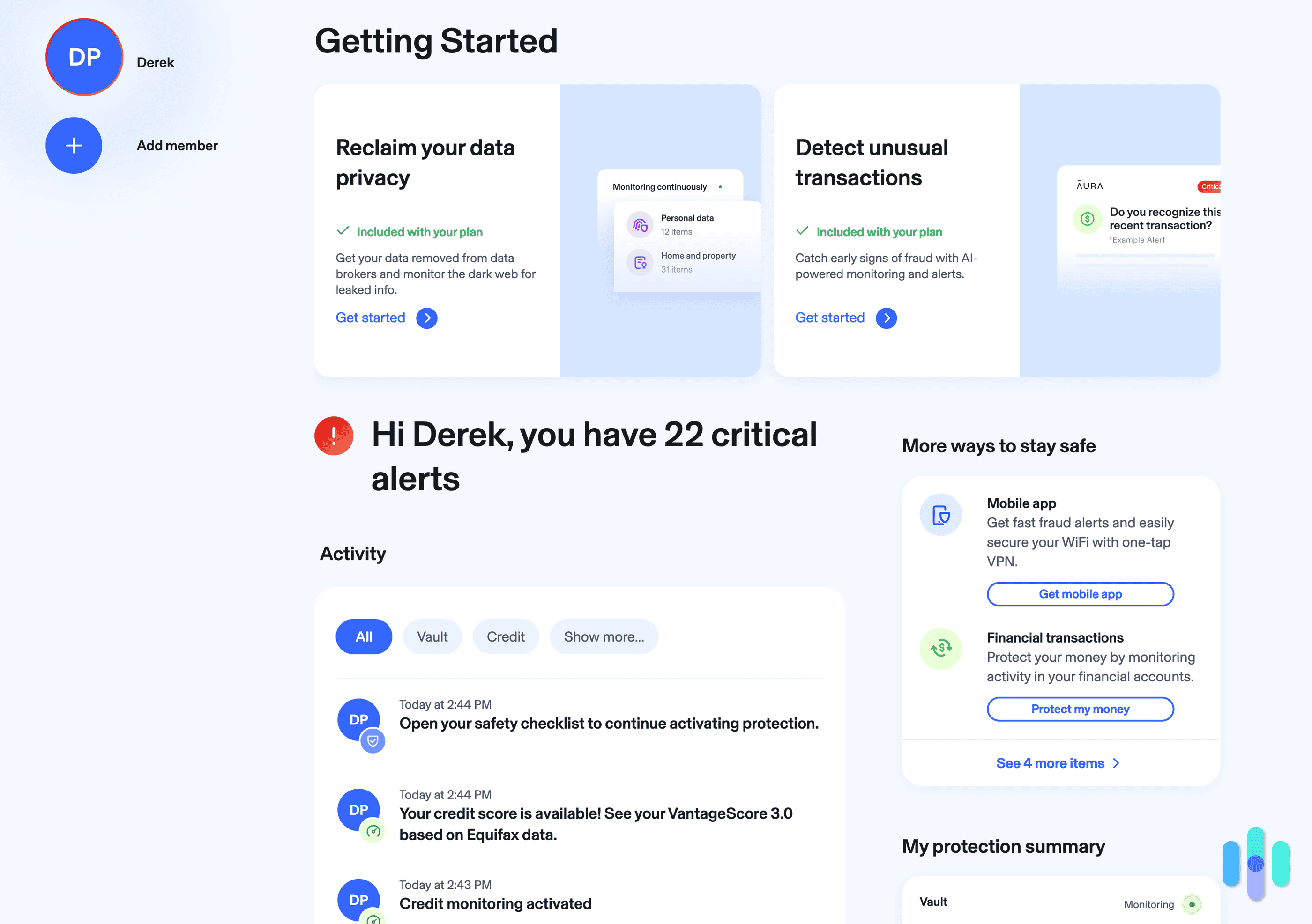

- Use identity theft protection services — On top of monitoring for exposed information, the top identity theft protection services also offer identity theft coverage. That means they’ll cover the costs you incur if your identity gets stolen whether through traditional or synthetic identity theft.

How to Recover From Synthetic Identity Theft

Once someone gets a hold of your SSN and starts using it to build a fake identity, it’s important to take action immediately. The longer you wait, the higher the risk of them successfully applying for major loans or stealing significant benefits that should go to you. But before you can recover from synthetic ID theft, you need to identify it. So, we’ll start there.

>> Read About: Best Identity Theft Restoration Services in 2025

Identifying Synthetic ID Theft

You’ll need a sharp eye to notice the signs of synthetic ID theft since most of the actions these thieves take seem innocuous. After all, we wouldn’t think much if we got a notification that a library card was denied in a different state than where we live. That could be the first warning sign of a synthetic ID theft attempt. But, it’s far from the only warning sign.

Here are the top warning signs that indicate a synthetic ID theft attempt:

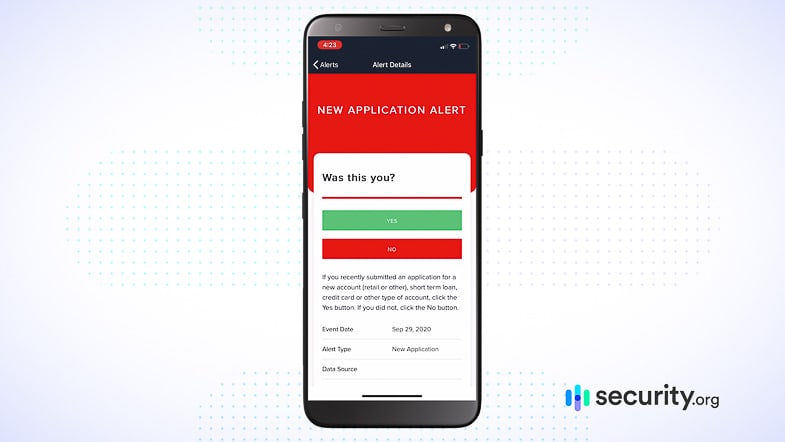

- Application results — Whether it’s an acceptance or a denial, any results from any type of application you didn’t apply for should be a warning sign that something’s wrong. Always check with the organization to learn more about your application so you can find out if it was an error on their end or a synthetic ID theft attempt.

- Mail you didn’t sign up for — Check your mail for any magazines you didn’t sign up for or spam from companies you don’t recognize. Synthetic ID thieves can use everyday mail as proof of residency for building a synthetic identity around.

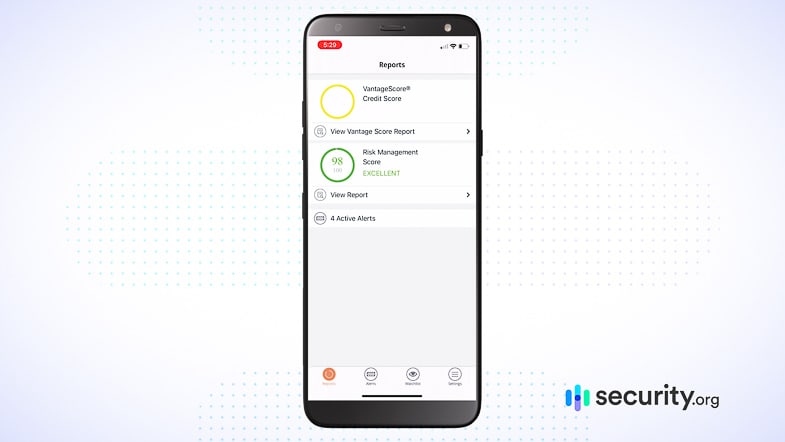

- Credit lines you don’t recognize — The easiest way to check your credit lines is through a top credit protection service. What we like most about these services is that they show you your open and closed credit lines. That means if a synthetic ID thief opens a credit line and then pays it off quickly, you’ll still see the line of credit you don’t recognize.

Did You Know: You can get a free credit report each week. But, you need to apply for it yourself. It’s easy to do through AnnualCreditReport.com.3 When the site started, credit reports were only available once a year. Hence, the name that no longer makes sense.

- Government letters with suspicious information — Any letters from the IRS or other government agencies containing information that doesn’t line up with your actions such as delinquent tax payments or government benefits should raise a few eyebrows. Look for an online portal where you can confirm any activity or a hotline for the agency in question.

- Student loan updates — Always check the name and information on any student loan updates you receive. Identity thieves can try and change the address associated with your student loans so they receive copies of your bills which they’ll then use as proof of their identity to take out more loans.

- Incorporation documents — Like we mentioned, some identity thieves incorporate companies using your information. Then, they can take out loans in the company’s name which they have all of the paperwork for.

Recovering From Synthetic Identity Theft

When you notice one of the signs of synthetic ID theft, you’ll need to take action immediately. Here’s an overview of the most important steps we would take if we noticed our identities being used:

- Notify our identity theft protection service — We’re always subscribed to an identity theft protection service. So, at the first sign of identity theft, we would notify them immediately. They would connect us with an identity theft restoration specialist to help us start the process of reclaiming our identity.

- Change usernames and passwords — Before changing our usernames and passwords, we create a list of all our online accounts. That way we can cross them off one by one and ensure we hit everyone.

- Start a recovery plan — Since we use an identity theft protection service, they would help us create a recovery plan. But, you can also get help through identitytheft.gov. It’s a federal resource where they create a recovery plan for you based on the information you provide.

- Call our bank and all lenders — This step should be a part of the recovery plan, but either way, we always call our banks and lenders to notify them of any signs related to identity theft. That way, they can keep an eye out for anyone trying to initiate a transaction based on the information we thought was compromised.

- File an identity theft report — If you started your recovery plan through identitytheft.gov, you’ve already filed a report. Since we go through our identity theft protection service, we need to file a report separately. Make sure to file a police report as well.

Final Thoughts

Just like the technology around us evolves, so do the threats. And identity theft is no different. Criminals are constantly pushing the bounds of what is possible when it comes to using your information for nefarious purposes. The most recent threat is synthetic identity theft.

Now that you’re armed with our expert knowledge of identity protection, you can start taking the steps to reduce your risks. To thwart most attempts, we only need to make our information more difficult to steal than it’s worth. After all, these thieves are looking to make the biggest profit with the least effort. So, the tips in this article will make your identity more difficult to steal than average and therefore make you a less attractive target.

FAQs About Synthetic Identity Theft

-

What is synthetic identity theft?

Synthetic identity theft is when a thief uses part of your identity like your Social Security number to build a new identity. They’ll use fake information like a name, tie it to your SSN through innocuous forms of identity like library cards, and then take out loans or steal from you with the hybrid identity.

-

Can you prevent synthetic identity theft?

While there’s no way to guarantee your safety against synthetic identity theft, you can reduce your risk of falling victim to it by securing your confidential and personal information.

-

Should I report a sign of identity theft?

Yes, you should always report any signs of identity theft no matter how small the sign. Getting ahead of identity thieves is the best way to thwart their attempts.

-

What should I do if my identity gets stolen?

If your identity gets stolen, immediately report it to your identity theft protection service if you have one. Otherwise, go to identitytheft.gov and fill out a report there. They will help you create a recovery plan.

-

How do I keep my identity safe?

Keeping your identity safe all comes down to securing everything that contains your confidential information. Whether that’s your mail, smartphone, laptop, or loan application, keep all of these documents and devices in secure locations with appropriate security measures.