Identity theft is tricky. How can you protect something that is intangible from thieves? If you’re trying to safeguard a prized heirloom, you can lock it up in a safe or put it in a safety deposit box. You can’t exactly do the same to your personal information.

Sure, you can keep documents with your sensitive information in a safe, but the information they contain will always be out there. We use our personally identifiable information (PII) to pay taxes, apply for loans, buy houses, seek jobs, and so on. What’s worse, we can’t control how these companies handle our PII.

So, how do you protect yourself from identity theft? Hear it straight from our identity theft experts.

How to Protect Yourself From Identity Theft

Identity theft is a crime that covers a wide scope. It’s actually one of the most complex crimes to talk about because there’s a massive number of things that can cause it. It also doesn’t end the same way for every victim. If someone has stolen your identity, they could use it for a number of things like insurance fraud, tax fraud, loan fraud, and so on.

Naturally, if you want to protect your identity, you have to consider making serious lifestyle changes. And as you’ll see in the lists below, you’d need to consider more than physical factors. You also have to think about your digital security.

What You Should Do at Home

While it’s unlikely that someone will break into your bedroom drawer to steal your Social Security ID, there are things we might overlook that could endanger our identity. So let’s start with the things that you can and should do at home to prevent identity theft.

- Clear your mailbox. Do not leave mail sitting in your mailbox, as it contains your personally identifiable information (PII). If you’re going away for more than a day, ask someone you trust to clear the mailbox for you or get a P.O. box.

- Destroy sensitive documents. Tear or shred documents that contain your personal data before throwing them out. You never know where those documents might end up. Whenever possible, subscribe to paperless billing to reduce your paper trail.

- Be wary of random phone calls. Be defensive when it comes to providing information over the phone. Do not give away any information until you’ve confirmed that the call is legitimate. And even then, ask the caller why they need the information, what they’ll do with it, and if it’s really necessary for you to provide it.

- Register your phone to the national Do Not Call list. Doing so will take your contact information off the lists of legitimate telemarketers. That means if you get a sales call, there’s a good chance that it’s from a scam artist and that you should not entertain it. You can register your phone numbers on the national Do Not Call Registry by visiting its website, linked below.1

What You Should Do To Protect Your Finances

Identity theft can have far-reaching consequences, but one of the most daunting ones is financial loss. Follow these tips to keep your finances safe.

- Protect your SSN.

It’s normal for legitimate companies to ask for your Social Security number (SSN), but before you provide it, ask if the last four digits would suffice. If they require your entire SSN, ask them about their privacy policy, and make it clear that you don’t want your information given to anyone else. - Check your credit score and reports. Get a copy of your credit report and thoroughly inspect it. Besides looking for errors, you should also look for suspicious activities like credit accounts and/or inquiries you don’t recognize. You can get a free credit report from Experian, TransUnion, and Equifax once a week, but monthly monitoring should suffice. If you don’t have the time to do all that, consider getting a credit protection service. We’ve listed the best credit protection services here.

- Review your credit card statements. It’s easy to miss small, fraudulent purchases made using your credit card, so check every transaction carefully. Look out for merchants, locations, and purchases that are unfamiliar to you. If you see discrepancies, immediately call your credit card company, dispute the charges, and request a new credit card.

- Freeze your credit. One of the most surefire ways to protect your credit is to freeze it. That way, no one can pull your credit and open new credit accounts in your name. Freezing your credit is free, and so is lifting the freeze temporarily or permanently (if you need to apply for a loan, for example). In some states, a credit freeze expires after seven years.2

| How to place a security freeze | Equifax | Experian | TransUnion |

|---|---|---|---|

| By phone | 800-685-1111 | 888-397-3742 | 888-909-8872 |

| Online | https://www.equifax.com/personal/credit-report-services/credit-freeze/ | https://www.experian.com/freeze/center.html | https://www.transunion.com/credit-freeze |

- Sign up for alerts. Most banking platforms and financial institutions give their customers the option to sign up for alerts. It may be annoying to receive a text every time you make a purchase, but those alerts can spare you the headache of dealing with fraudulent transactions.

- Be vigilant during tax season. IRS scams are rampant during tax season. Keep in mind that the IRS will never ask you to provide PII via phone calls, emails, or text messages.

- Pick up your checkbook from the bank. Rather than having the bank mail your checkbook reorders to your home, pick them up directly at your branch. Doing so reduces the risk of someone intercepting your checkbook delivery or stealing it after it’s been delivered. In our package theft survey, 38 percent of respondents reported that they’ve had packages stolen from their doorsteps. You don’t want to be added to that number, especially if the package contains sensitive financial information.

- Consider switching to digital wallets. Instead of using your credit card, use a secure digital wallet to avoid credit card skimming. Digital wallets are apps that contain digital versions of credit and debit cards. In addition, digital wallets encrypt your payment information, so using one to pay for online transactions is safer than providing your card information.

From Our Experts: PayPal is one of the most widely used digital wallets. In another post, our experts examined how safe PayPal is. We concluded that it’s a safe platform with more-than-sufficient security measures. However, there are also dangers to using digital wallets like PayPal. Find out more in our PayPal safety assessment.

What You Should Do While Traveling

We are most vulnerable to theft when traveling, since it’s easy to lose track of things while enjoying a stroll in a new city. And the thing is, losing your wallet, phone, and other valuables can also lead to identity theft. Do these things the next time you’re on vacation:

- Leave your Social Security card. When you’re out and about, leave your Social Security card somewhere safe at home. Carrying it with you only increases the risk of identity theft in case you lose your wallet or someone steals it. And just in case, know what to do if you lose your Social Security card.

- Password-protect your devices. With all the personal information we store in our phones, tablets, and laptops, it’s only logical to protect our devices using passcodes or even better, biometric locks.

- Do not leave a paper trail. Do not leave paper trails of your transactions, such as ATM, credit card, or gas station receipts. Hold on to them and get rid of them at home.

- Keep an eye on your credit card. When paying with your credit card, never let it out of your sight to avoid skimming. You should especially be careful when you’re in an unfamiliar city. Whenever you’re in doubt, use cash to pay.

- Limit the number of credit cards. Don’t take all your credit cards with you. Just take a couple and leave the rest at home. Carrying multiple credit cards only increases the risk of losing them, not to mention that it isn’t easy to cancel multiple credit cards while on vacation.

- Cover your PINs. When using an ATM, cover your hand as you enter your PIN. Also, do not ask for assistance from strangers.

- Leave your checkbooks at home. Checkbooks are unnecessary when traveling, since many establishments don’t accept checks nowadays. It’s better to leave your checkbooks at home than risk losing them on vacation.

- Clear browsing histories. If you use public computers or hotel room computers, log out of all your accounts, and clear your browsing histories. Not sure how to clear histories? We outlined how to delete your browsing history on some browsers in this internet and data privacy article. Or better still, avoid using public computers at all when traveling.

Hot Tip: Before traveling, especially abroad, check online for tourist scams specific to the place you are about to visit.

How to Avoid Online Identity Theft

Identity theft can also happen online. Tech-savvy criminals can hack into computers; create malware that spies on users, otherwise known as spyware; execute phishing scams; or steal browsing data. With all the dangers lurking online, it’s vital that we practice safe online behaviors. Here are the steps we recommend that you follow:

- Password managers are a must. Most of us have multiple online accounts, and it’s not a good idea to use the same passwords for all of them. If you have the same password for your email and banking accounts, for instance, a criminal only needs to find out one password to access both accounts. That’s where password managers come in. Password managers are services or apps that create strong passwords and store them in encrypted digital vaults. If you want to do it manually though, check your password strength and make changes accordingly. You can also use a password generator like the one we created.

- Use two-factor authentication. Using two-factor authentication is another way to protect your online accounts. By adding a second layer of authentication, usually a one-time PIN or a passcode sent to your mobile number, you can make your accounts several times harder to hack.

- Don’t fall for phishing scams. Phishing scams come in different forms. As a rule of thumb, don’t enter personal or financial information just because an email, company, or website told you to. Verify first that the website is real by checking that the URL matches the official website URL of the company that contacted you. Phishing scammers often create websites similar to the official website, but the URLs are slightly different, so check and double-check the URLs’ spelling. Also, be vigilant of even the slightest grammatical or spelling errors when on a website. These might be signs of fake websites. You can also use website-safety-checker tools such as the one from Trend Micro.3

- Update your device software. Outdated software versions may contain vulnerabilities that hackers can exploit. Whenever a new version of software becomes available, always update your device. Software updates often contain security and bug fixes. Better still, turn on auto-update.

- Shop wisely online. Use only reputable websites when making online purchases, that is, well-known websites with customer reviews. It’s a best practice not to purchase from websites you’ve never heard of and to verify businesses first before transacting with them online. A good way to verify businesses is to read consumer reviews posted on third-party consumer websites like the Better Business Bureau.

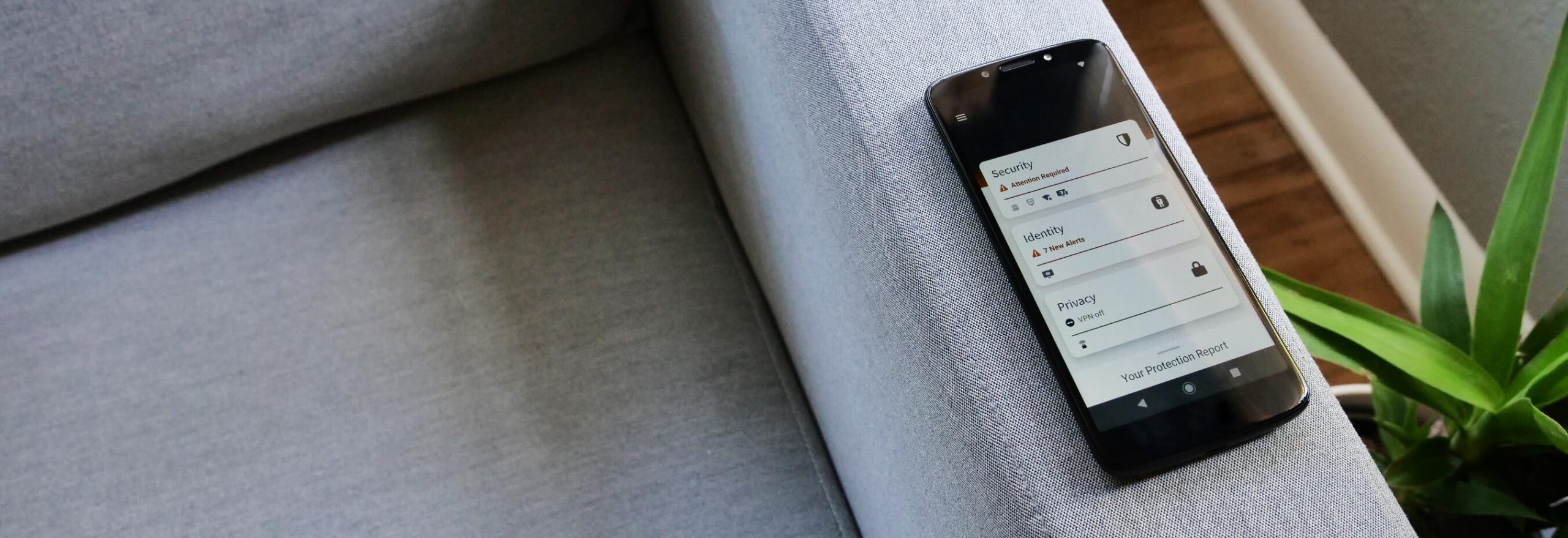

- Use a VPN. VPNs encrypt your traffic so hackers don’t see what you’re doing online. You can install and use VPNs anytime and anywhere, but definitely use a VPN if you’re on public Wi-Fi. Public Wi-Fi networks are particularly vulnerable because anyone can connect to them, including hackers. And if you’re connected to the same Wi-Fi network without a VPN, they can track what you’re doing online along with your device’s IP address.

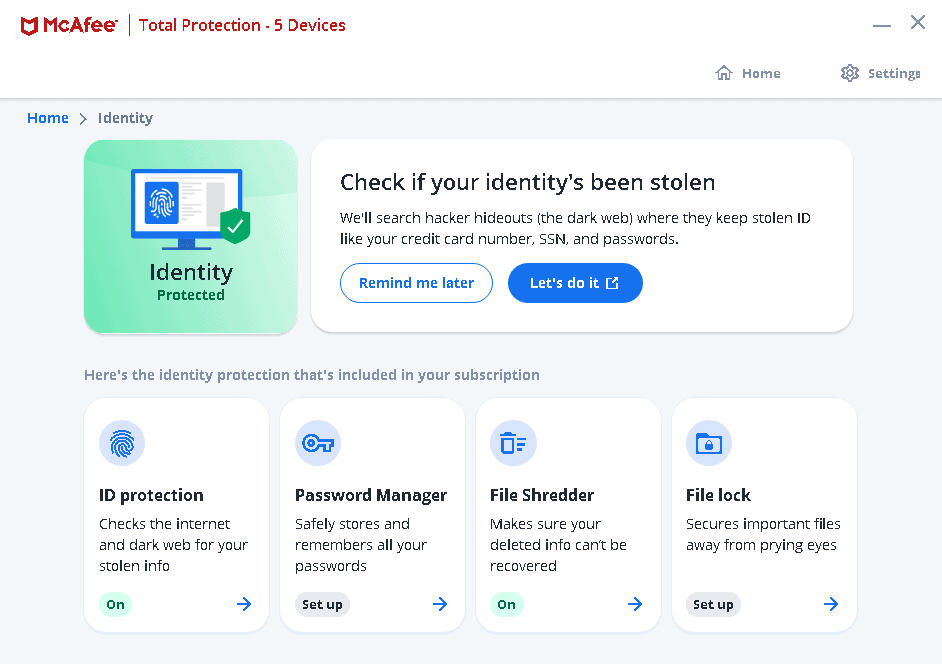

- Install antivirus software. Antivirus software detects and removes malware, so installing it on your devices is vital in stopping malware that can steal your data.

What Is Identity Theft?

We’ve been talking about identity theft from the beginning, but what is it really? Identity theft is a crime that involves wrongfully obtaining someone’s personal and financial information and then using it to commit fraud. It sounds simple, but it covers a wide scope of offenses. There’s credit card fraud, insurance fraud, tax fraud, benefits fraud, and health care fraud, just to name a few.

Remember when Dwight Schrute from the TV show “The Office” said, “Identity theft is not a joke, Jim!”?

Well, he’s not wrong. According to the Federal Trade Commission (FTC), they received 1,387,615 reports of identity theft in 2020.4 That’s a 113 percent jump compared to the 650,523 reports they received the previous year. So yes, Jim, identity theft is not a joke. It’s a real problem and it’s only getting worse.

Types of Identity Theft

There are several types of identity theft based on who the target is and how the thief uses the stolen information. To better equip ourselves against identity theft, it’s important to know who and what types of data identity thieves target.

- Credit: Credit identity theft occurs when a criminal steals personal information such as an SSN and uses it to open credit accounts or take out loans.

- Medical: Medical identity theft happens when a criminal uses the personal and medical insurance information of someone else to see a doctor, obtain prescriptions, or claim insurance benefits.

- Criminal: In cases of criminal identity theft, the offender commits crimes using the victim’s name to avoid prosecution or being arrested under their own name.

- Business: Businesses also suffer from identity theft. More specifically, criminals can make fraudulent tax benefit claims and business returns.

- Taxpayer: Similarly, identity thieves can use a taxpayer’s SSN to file false tax returns or steal tax refunds.

- Children: Child identity theft uses children’s information, such as SSNs, to take out loans; open credit accounts; rent homes; or apply for phone, gas, or electric services. Child identity theft often goes undetected, since children don’t usually check their credit scores until they apply for student loans.

- Account takeover: Online banking accounts are common targets of identity theft. When criminals gain access to online banking accounts, they change the passwords and take them over so they can take money out of the accounts. And according to our research, account takeover is a growing threat.

- Synthetic identity theft: Sometimes, criminals don’t just use a single stolen identity; they create fictitious persons by patching together various identities. They then use these new identities to take out loans and apply for credit cards.

These are just some of the most common types of identity theft, and the list is always growing. Opportunistic criminals take advantage of trends to find new ways to use stolen identities.

The More You Know: Identity theft dates as far back as the 1800s in the form of voter fraud.5 Now, fraudsters use stolen identities to commit all kinds of fraud, including credit card, health insurance and care, and tax fraud.

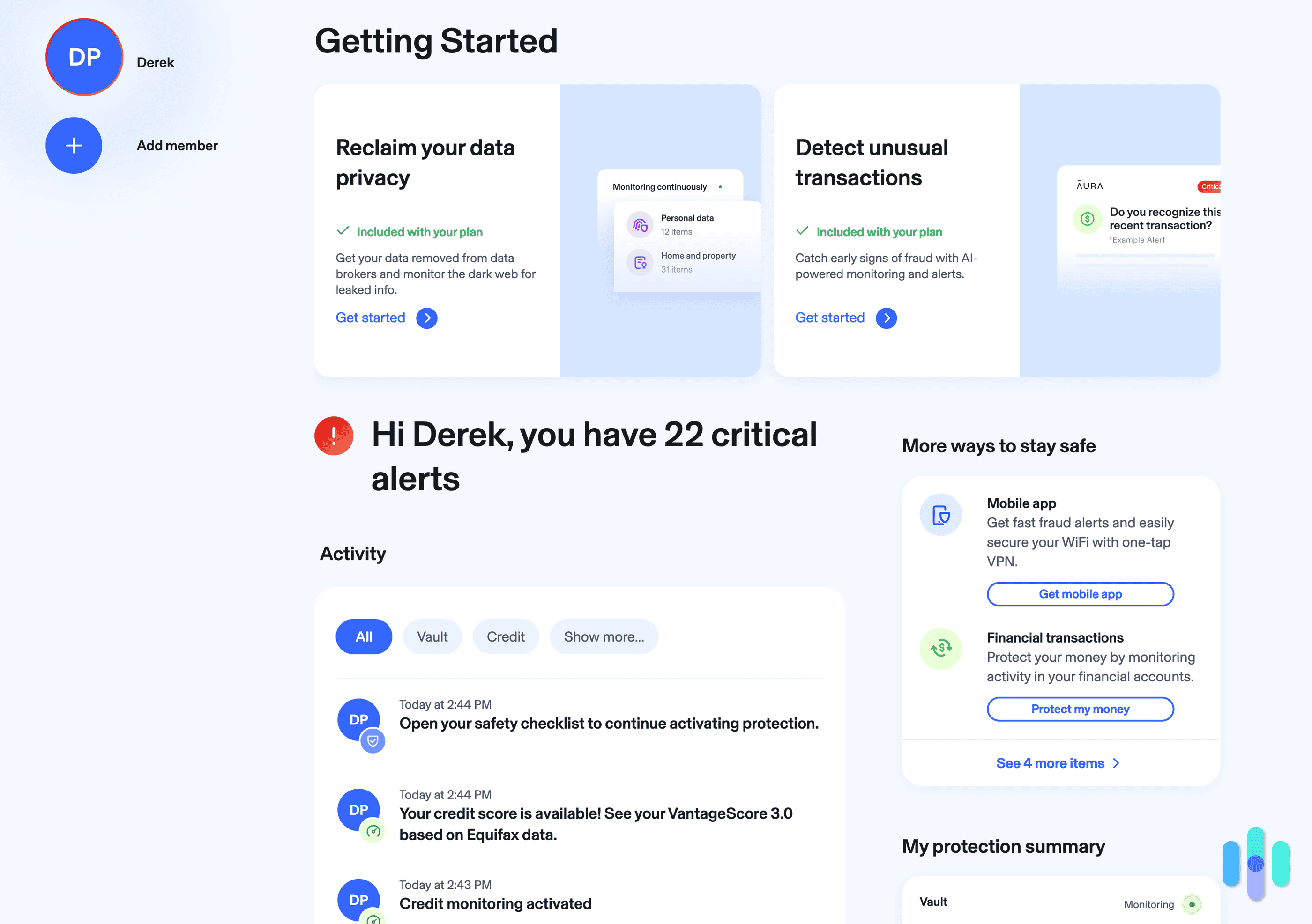

The Best Protection Against Identity Theft

In 2017, Equifax, one of the three major credit bureaus, experienced a data breach that affected the data of 147 million people. 6That goes to show that no matter how hard we try to protect ourselves from identity theft, there are things outside of our control that can compromise our identities. What’s the best type of protection we can get against identity theft, then? The answer is simple: identity theft protection services that can detect identity theft early, minimize the losses, and assist in identity restoration.

What To Look For In Identity Theft Protection Services

There are five main features we look for in identity theft protection services:

- Credit monitoring: Credit monitoring involves monitoring the users’ credit and alerting them to potential fraud. In most cases, ID theft protection services monitor credit scores and reports from all three major credit bureaus: Equifax, Experian, and Transunion.

- Identity monitoring: Identity monitoring comes in many forms. Usually, it involves monitoring websites, the dark web, public records, and other areas for the user’s PII. For instance, if your PII pops up on an underground forum on the dark web, an ID theft protection service with dark web monitoring will alert you that someone could be selling or using your identity.

- Identity recovery service: In case you become a victim of identity theft, most ID theft protection services offer identity recovery, i.e., case managers or trained counselors to build action plans on how you can recover your stolen identity. That may include writing letters to collectors and creditors, freezing your credit, and filing reports to the proper authorities.

- Identity theft insurance: If you suffer losses due to identity theft, ID theft protection services usually come with insurance coverage. The insurance covers direct losses as well as indirect losses such as legal fees.

- Family coverage: In our research, we found that over 14 percent of parents had children that fell victim to identity theft. So aside from adults, ID theft protection services offer coverage for children living with their parents. Learn more about the best identity theft protection for families.

Those were exactly the features we found in the best identity theft protection services we tested.

How Identity Theft Happens

Identity theft protection services can shield us from losses that identity theft might cause, but it’s up to us to reduce our chances of becoming victims in the first place. To be more effective in doing that, we must understand how identity theft happens.

- Lost or stolen wallets: Our wallets contain IDs, medical, credit, and ATM cards, all of which are prime sources of information about us.

- Mailbox theft: Mailboxes often contain documents with our sensitive information, both financial and personal, such as credit card statements.

- Public Wi-Fi lurkers: When we connect to public Wi-Fi, there’s no telling who can see our internet traffic. There could be a hacker out there stealing data from our computers.

- Data breaches: Financial institutions, universities, hospitals, and many more companies hold data about their customers. If their databases are not secure, one breach is all it takes to leak information about millions of people.

- Phishing: Phishing schemes fool targets into entering information about them into seemingly legitimate websites, email forms, and so on.

- Credit card skimming: Skimming involves scanning credit cards using small devices to obtain credit card information, which criminals can use for credit card fraud.

- Phone scams: To pull off phone scams, criminals ask for their victims’ personal, banking, or credit information. They pretend to be calling from legitimate companies or entities, such as the IRS.

- Malware: Cybercriminals can write computer malware, such as trojans, viruses, computer worms, ransomware, or adware, that can steal data and passwords from computers.

- SIM swap: Many companies verify their customers’ identities by texting codes to their phone numbers, which is why criminals hijack SIM cards.

- Stolen PINs and passwords: Although rare, a criminal can steal your ATM PIN or online account passwords simply by looking over your shoulder. This can happen at ATM queues, libraries, hotel lobbies, and other public places.

Signs That You’re Already a Victim

When it comes to identity theft, early detection is the key to preventing losses. But how do you know if you’re already a victim? Look for these warning signs of identity theft:

- Missing mail: If you used to get your credit card statements in the mail, but not anymore, that may be a sign that someone changed your billing address. Fraudsters do that to prevent you from seeing your credit card statements, likely because they are using your credit cards fraudulently.

- Turned-down applications: If you applied for loans or new credit accounts and got turned down despite having strong credit, that may be because someone hurt your credit score by taking out loans under your account.

- High-interest loans: If you applied for loans and got higher interest rates than you expected based on your credit history, your credit score might have taken a hit because someone else is using it.

- Ghost purchases: If you see items you don’t remember buying in your credit card statements, that’s a huge red flag. That could mean that someone is paying for their purchases using your credit cards. If it isn’t your children or spouse, then it’s an identity thief.

- Test charges: If you see test charges, usually less than $5, in your card statement, that could be an identity thief testing if your credit card is active. They usually do that after buying credit card information from online black markets.

- Fraud alerts: If your online purchases got rejected due to potential fraud, that could mean that someone tried to pay using your card but failed to pass the merchant website’s authentication.

You can also do an identity theft check using this guide that we put together, or read our list of the best identity theft protection with fraud detection.

From Our Experts: Don’t wait for these signs of identity theft to show up; get an identity theft protection service to increase your chances of catching identity theft earlier.

What to Do in Case of Identity Theft

If you see any of those signs of stolen identities, it’s best to assume that your personal or financial information is already out there and that you’re at high risk of identity theft. What should you do now that your identity has been stolen?

The first thing you should do is file a fraud report with the FTC and obtain a recovery plan; write prefilled letters to banks, merchants, and financial institutions affected; and create an Identity Theft Report that you can use as an official “]statement. You can either file directly on the FTC’s IdentityTheft.gov website or call the FTC identity theft hotline at 877-438-4338. Here are instructions for a couple other types of identity theft:

Credit card fraud:

- Contact your bank or credit card company and explain the situation.

- Ask them to hold any new transactions.

- Cancel your existing cards as well and ask for a new card.

Fraudulent loans or credit accounts:

- Request credit reports from the three major credit bureaus.

- Call the credit bureaus and ask for a security freeze.

- Review the transactions and look for fraudulent loans or credit accounts opened in your name.

- Contact the creditors of the fraudulent loans or credit accounts and coordinate with them for possible solutions.

- If you find inaccurate information in your credit reports, such as a wrong address, dispute it with the appropriate bureau.

Recap

Protecting ourselves from identity theft is never easy, but with all the tips we shared in this post, you can make yourself less of a target. However, with constantly changing trends, it’s vital to stay updated on the latest types of identity theft. Feel free to browse our resources for fresh, up-to-date research and data about identity theft, and more.

Frequently Asked Questions

Now to answer the most frequently asked questions about protecting oneself from identity theft.

-

Can identity theft be prevented?

Identity theft can’t be prevented entirely, but you can make yourself less likely to become a victim. Safe online practices, such as using VPN when connected to public Wi-Fi and installing antivirus software on your computer, can help a great deal.

-

How do I stop someone from using my identity?

To stop someone from using your identity, you can seek help from services that offer identity restoration services. Most identity theft protection services offer this feature, but you can also get help from the FTC by filing an identity theft report. Finally, place a fraud alert and security freeze on your credit report with Equifax, Experian, and Transunion, either online or over the phone.

Equifax contact details Experian contact details TransUnion contact details 800-685-1111 888-397-3742 888-909-8872 https://www.equifax.com/personal/credit-report-services/credit-freeze/ https://www.experian.com/freeze/center.html https://www.transunion.com/credit-freeze -

How do I protect my identity after being scammed?

You can protect your identity after being scammed by reporting it to the FTC. You can do so on the FTC’s IdentityTheft.gov website or by calling the FTC’s identity theft hotline at 877-438-4338. The FTC will provide you with an official Identity Theft Report; prefilled letters to send to affected banks, merchants, and financial institutions; and a recovery plan.

As an extra measure, you should also freeze your credit with Experian, Equifax, and TransUnion. To freeze your credit, you can call their phone numbers listed below, or visit their respective websites. It’s free to create, remove, or temporarily lift credit freezes, and in most states, credit freezes last indefinitely until you remove them.

- Equifax: 800-685-1111

- Experian: 888-397-3742

- TransUnion: 888-909-8872

-

How do I find out if someone is using my identity?

To find out if someone is using your identity, you can get an identity theft protection service to monitor your free credit reports and scores. Most identity theft protection services also offer identity monitoring. They look at public records, websites, the dark web, and other areas where your personal information might pop up if someone stole it. If they find your information, they notify you.