NordProtect Review & Pricing in 2025

Can our favorite VPN provider make a great identity theft protection service too? We tested NordProtect ourselves to find out.

Cort Honey, Home- and Digital-Security Expert

Last Updated on Apr 10, 2025

Cort Honey, Home- and Digital-Security Expert

Last Updated on Apr 10, 2025

What We Like

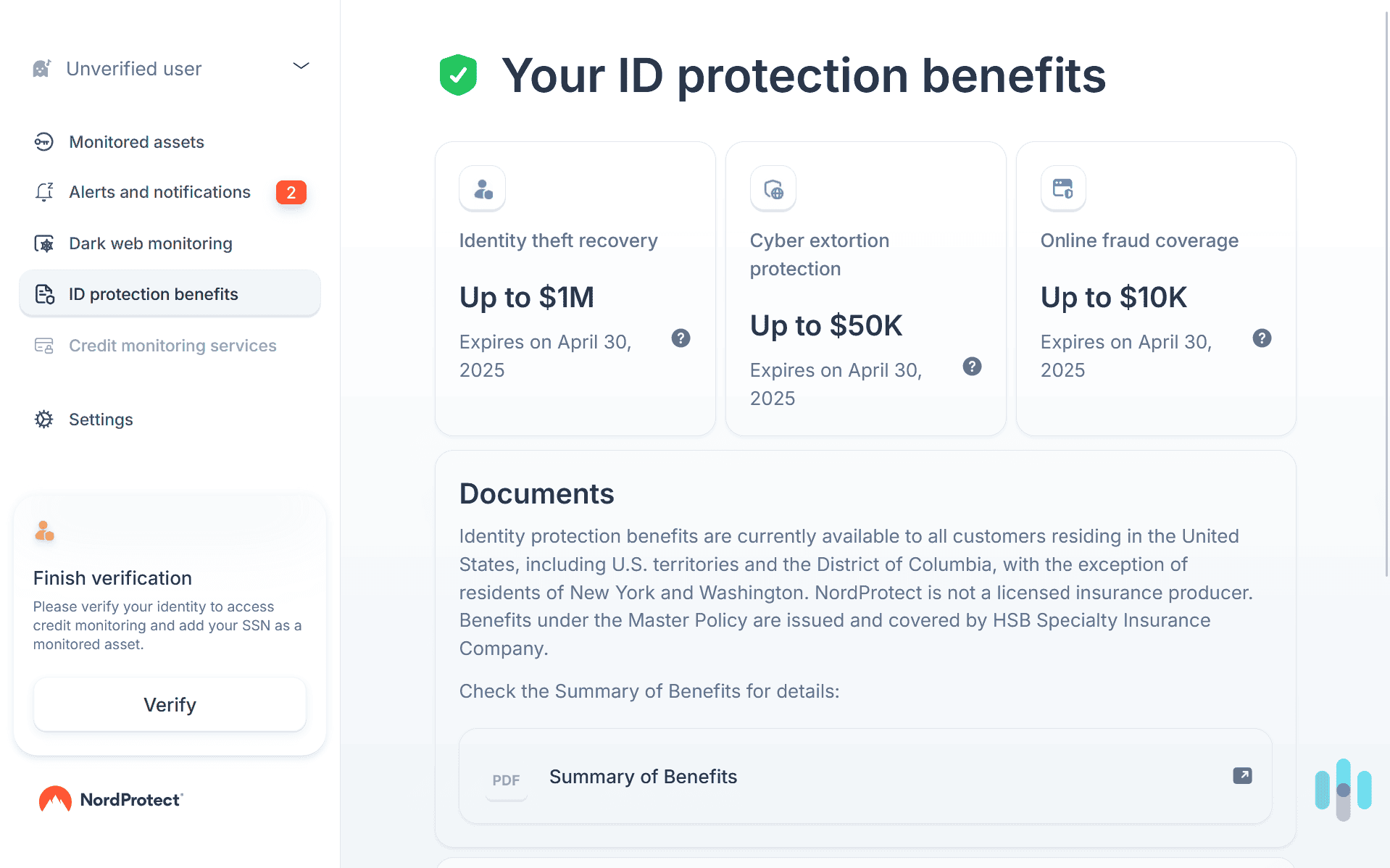

- Identity theft insurance coverage: NordProtect includes $1 million identity theft insurance, $50,000 cyber extortion insurance, and $10,000 online fraud reimbursement.

- Identity restoration: It also provides a dedicated identity restoration case manager for all claims, and we found the claims process straightforward.

- Affordable bundles: You can bundle NordProtect with other Nord Security products, including their highly-rated VPN, starting at $6.99 per month if you sign up for two years.

What We Don't Like

- Lacking some identity and credit protection features: Unlike most other identity theft protection services, NordProtect offers no coverage for home title fraud and monitors only one credit bureau (TransUnion).

- Limited availability: NordProtect is not available to users living in the states of New York and Washington.

- No family plan: There’s also no option to buy a family subscription, which means every member of the family will have to pay the full price to enjoy full protection.

Bottom Line

NordProtect offers all the basics we look for in an identity theft protection service, such as credit monitoring, $1 million identity theft insurance, and dark web monitoring. But its low price means you only get one-bureau credit monitoring.Nord Security is well-known as a cybersecurity company, and that shows with their identity theft protection service, NordProtect. It offers more protections than we normally get from services made by VPNs. Still, it lacks a few premium features we typically look for in the best identity theft protection services, such as three-bureau credit monitoring.

Does that mean NordProtect doesn’t offer adequate protections? It does, especially with up to $1 million in identity theft insurance built in. They’d want to avoid paying out insurance, so they’ll do everything to make sure you’re protected. NordProtect just takes a different approach than other services, focusing more on monitoring your credit score and online threats instead of full credit reports from all three bureaus.

We tested NordProtect ourselves, using it for nearly two months, so let’s dig into what makes NordProtect a solid choice for identity theft protection. We’ll also discuss who it’s best for, and give you a clearer picture of what NordProtect can do to protect your identity.

NordProtect Pricing

There are a couple of different ways to buy NordProtect. It can be bought on its own or as a bundle with NordVPN, NordPass, and NordLocker. Surprisingly, the full bundle barely costs more than buying NordProtect on its own. Because of this, we generally recommend buying the bundle through the NordVPN site instead of directly through NordProtect. That is, if you need the other bundled services – they come highly recommended by us, especially NordVPN and NordPass. Otherwise, we think NordProtect’s pricing as a standalone service is just right.

Here’s a look at NordProtect’s pricing:

| Subscription Plan | NordProtect | NordVPN Bundle with NordProtect, NordPass, and NordLocker |

|---|---|---|

| One month | $15.49 | $17.99 |

| One year | $89.88 ($7.49 per month) | $107.88 ($8.99 per month) |

| Two years + three free months | N/A | $188.73 ($6.99 per month) |

That’s right. Nord’s bundle with all of their consumer products can cost less per month than NordProtect on its own. But, you need to be ready to commit for two years. Well, kind of.

That two-year plan still comes with a 30-day money-back guarantee. In fact, all of Nord’s plans come with a 30-day money-back guarantee. Taking advantage of it is easy, too. All you need to do is request a refund in their live chat and they’ll refund you right away. It only took us about 10 minutes for them to initiate our refund.

>> Read More: NordVPN Pricing & Plan Cost in 2025

Expert Insight: We’d like to note that NordProtect currently doesn’t offer a family plan like Aura and Identity Guard do, although it has features that can benefit multiple household members. Dark web monitoring, for example, watches over up to five email addresses and phone numbers. That said, if you’re looking for full protection for the whole family, check our list of the best identity theft protection services for families.

NordProtect Features

Whether you buy NordProtect on its own or in a bundle through NordVPN, you get access to all of the same features and capabilities. Let’s take a look at how NordProtect keeps your identity safe and helps you recover your identity if it gets stolen. If you need recovery services specifically, head over to our roundup of the best identity restoration services.

Identity Theft Insurance

With every NordProtect subscription, you get up to $1 million of identity theft insurance. That covers cyber extortion costs, online fraud reimbursement, legal costs, lost wages, miscellaneous expenses, and even mental health counseling. The good part of NordProtect’s insurance is that it activates as soon as you subscribe. The bad news is that it comes with a $100 deductible per incident, meaning you need to pay $100 of covered expenses for every identity theft incident before the insurance kicks in.

NordProtect also puts limits on each category for their insurance. The $1 million of insurance is only uncapped for legal costs related to recovering your identity. Here are the caps on the other categories of insurance that NordProtect offers:

| NordProtect Insurance Category | Reimbursement Cap |

|---|---|

| Cyber extortion | $50,000 |

| Online fraud reimbursement | $10,000 |

| Lost wages, child care, and elderly care | $5,000 |

| Mental health counseling | $1,000 |

| Miscellaneous expenses | $1,000 |

From Our Experts: NordProtect’s cyber extortion insurance is noteworthy. Most other services we’ve researched don’t specifically include cyber extortion in their coverage, which can be expensive to recuperate from. If you’re looking for more coverage, though, you might want to see our recommended cyber insurance providers.

If our identity was stolen during our time testing NordProtect and we missed one week of work to recover our identity, NordProtect would have reimbursed our weekly salary. But, if we needed to miss a month of work during our entire recovery process, we could only qualify for $5,000 in reimbursement despite our monthly salary being over $5,000.

That approach is not uncommon. For instance, when we tested Aura, they capped our lost wage reimbursement at $1,500 per week for a maximum of five weeks. That allows for more potential reimbursement, but the odds of you missing out on five weeks of work due to an identity theft incident is fairly low.

That said, LifeLock is still one of the best we’ve tested when it comes to identity theft insurance. Its higher-tier plans offer up to $1 million in personal expense reimbursements, separate from the $1 million coverage each for stolen funds and legal fee reimbursements ($3 million total). LifeLock’s pricing is higher than Aura and NordProtect, though, with the top-tier plan costing $34.99 per month.

>> Learn About: Aura vs. LifeLock – Our Expert Take

Pro Tip: Make sure you keep track of every expense related to recovering your identity. That miscellaneous expense coverage can include everything from wear and tear on your vehicle when driving to a courthouse to office supplies for filling out paperwork.

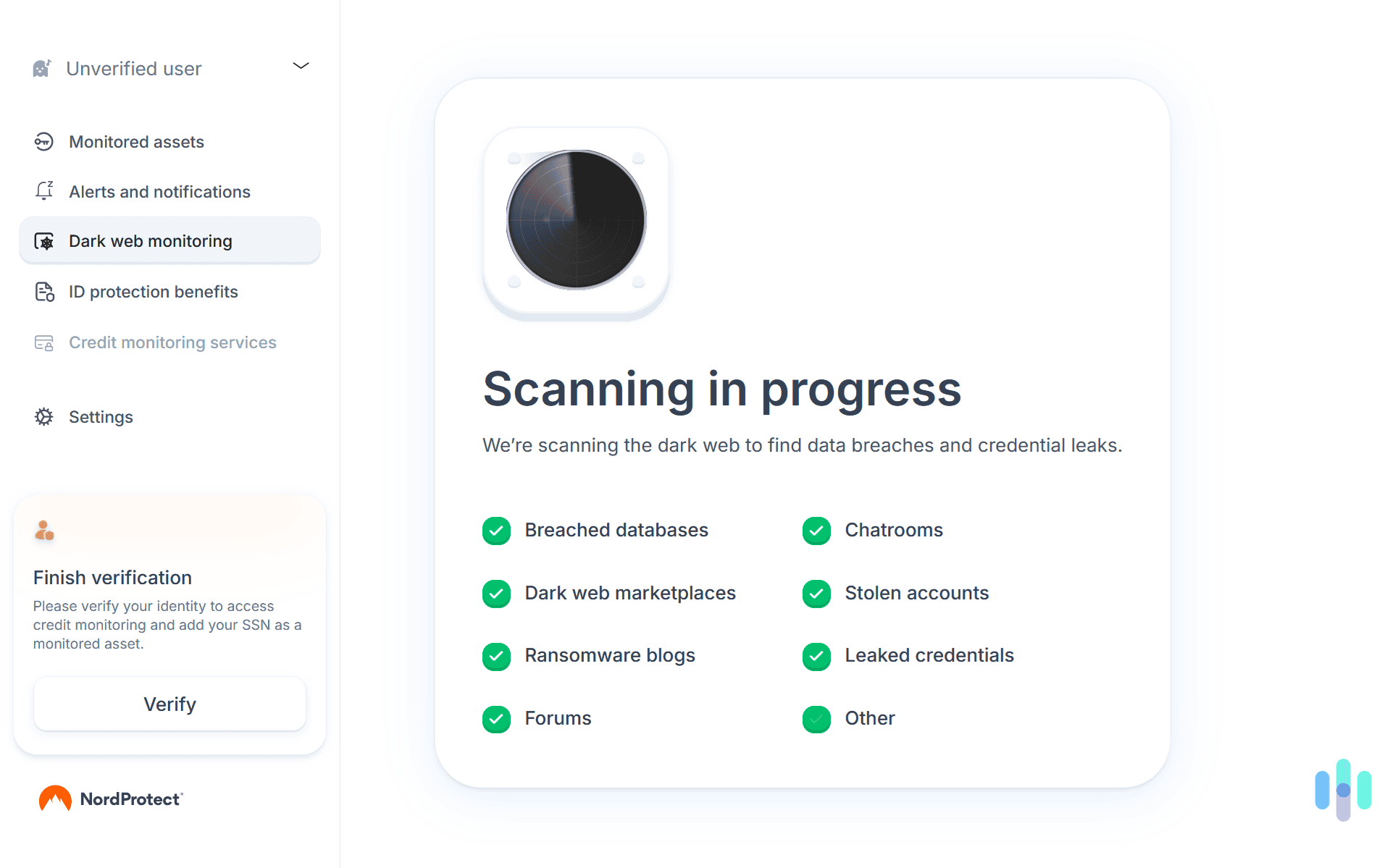

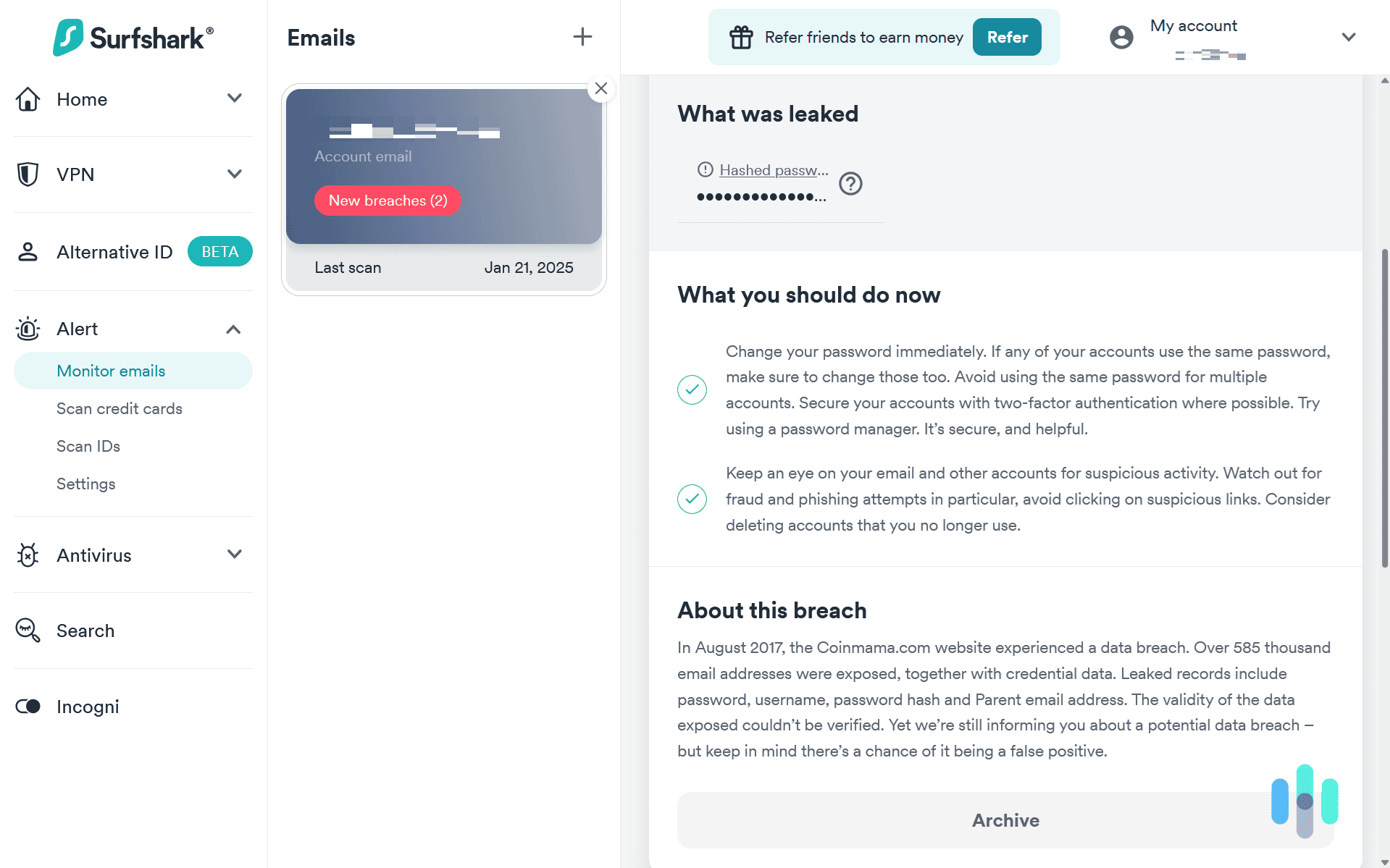

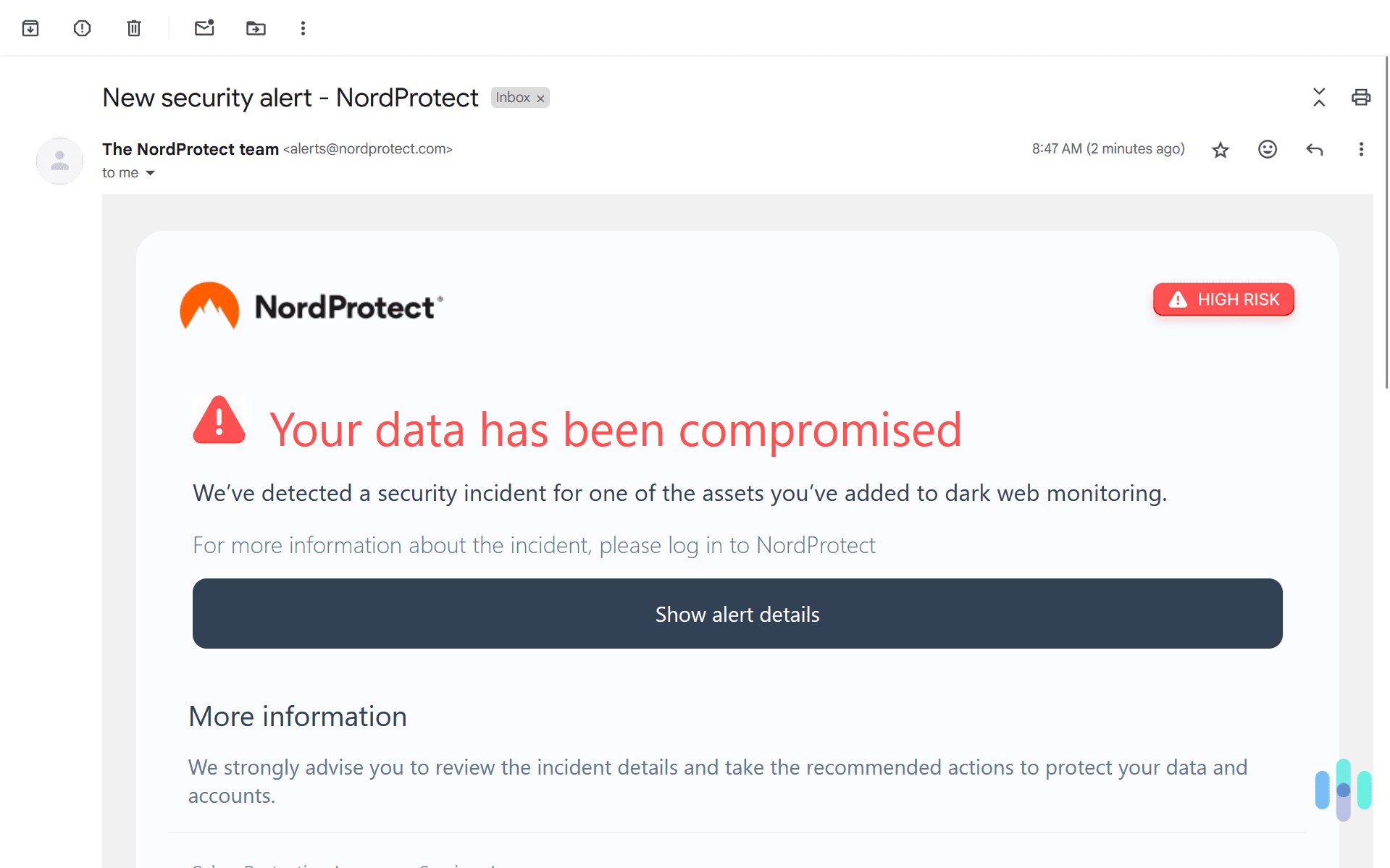

Dark Web Monitoring

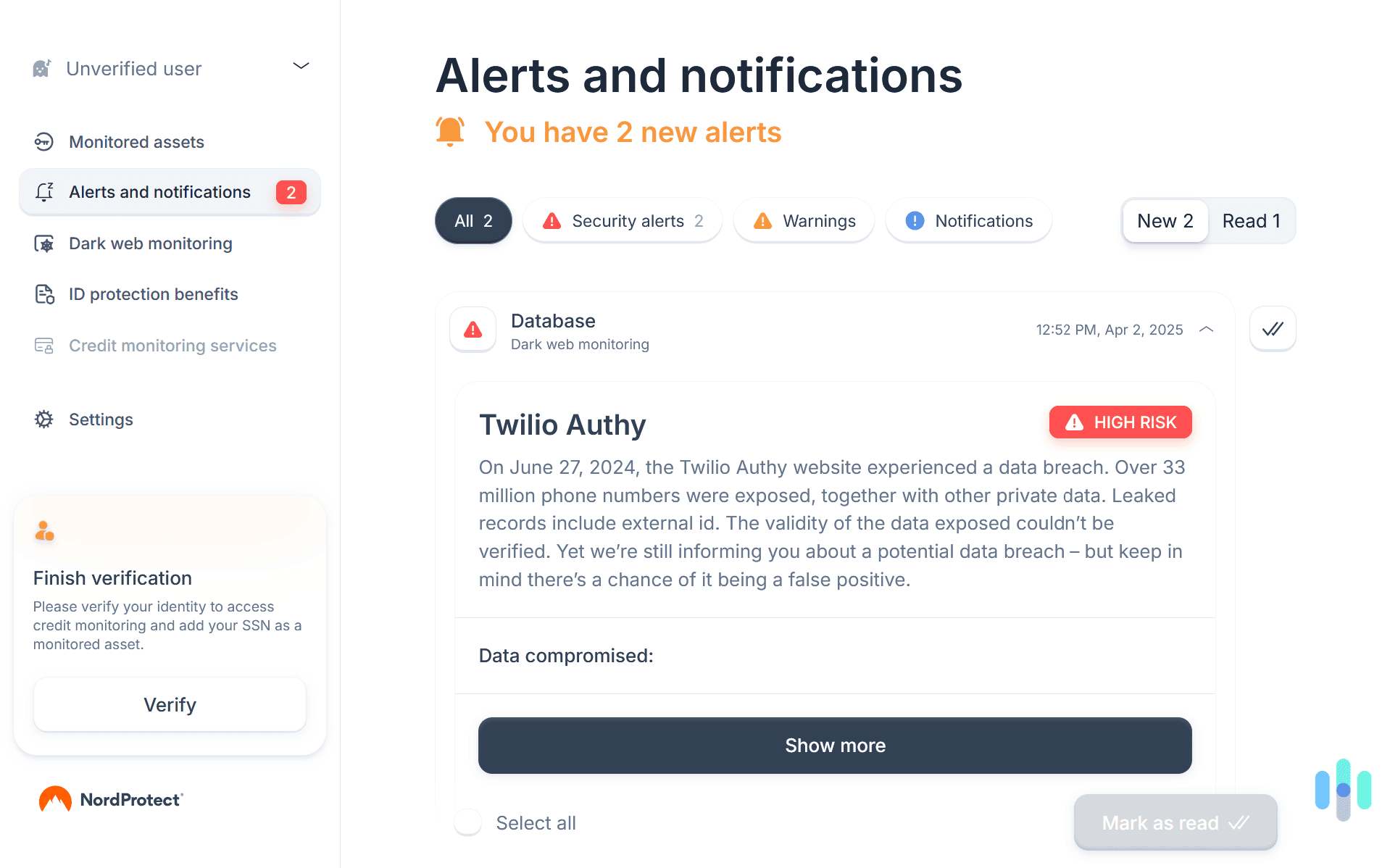

We were impressed with NordProtect’s dark web monitoring services, although, at first we were surprised with their limit of monitoring five emails and five phone numbers. Once we tested it out though, we saw that they offer stronger monitoring than most competitors. They found our email address leaked in a data breach from July of 2024 that most other services we’ve tested missed. For instance, when we tested Surfshark Alert, they missed this leak.

This comprehensive level of monitoring made us feel like our Social Security number (SSN) was safe as well. But, we wish NordProtect offered this level of monitoring for more pieces of information. Although Surfshark Alert missed a data breach, they let us monitor our credit cards, passport, and driver’s license numbers as well. Since we’re forced to pick, we prefer the in-depth dark web monitoring that NordProtect provides. If they extended it to other pieces of information, it’d be the best of both worlds.

FYI: Other identity protection services offer more than just dark web monitoring as part of their identity monitoring. We typically see features such as home and auto title monitoring, synthetic identity theft monitoring, and even data removal from people search sites.

Credit Monitoring

Most high-quality identity theft protection services offer three-bureau credit monitoring. That means they go through your Experian, Equifax, and TransUnion credit report on a weekly, monthly, or quarterly basis looking for suspicious activity. NordProtect takes a different approach.

Instead of monitoring every credit report for suspicious activity, they primarily keep an eye on your credit score and lines of credit. This gives prompt notifications anytime your credit score changes or there’s an unexpected activity with one of your lines of credit. NordProtect also alerts you to new lines of credit.

FYI: While both three-bureau credit monitoring and NordProtect’s approach look for the same things, we prefer three-bureau credit monitoring. It’s more comprehensive and more likely to notice small changes that would signify identity theft before a thief takes bigger actions. If that’s what you’re looking for, check out our roundup of the best credit protection services.

Identity Recovery

No identity theft protection service is complete without identity recovery. Restoring your identity after it gets stolen is no easy task. Even as security experts ourselves, we’d get overwhelmed if we had to recover our identity on our own. To help you get back on track, NordProtect provides an identity restoration case manager as soon as you submit a claim. From there, they do most of the legwork to get your identity back on track.

Did You Know: We created a complete guide on what to do if your identity is stolen. In it, we walk you through every organization you need to contact so you can minimize damage and recover as many of your assets as possible.

NordProtect Limitations

Of course, it’s not all peaches and roses. NordProtect has some limitations you should be aware of before purchasing a subscription.

One-Bureau Credit Monitoring

Like we’ve mentioned, NordProtect only monitors one credit bureau. This is a weakness because most lines of credit won’t pull a credit check against all three bureaus. You won’t know the fraudulent credit check occurred unless it’s successful and it impacts your credit score or a new line of credit shows up on TransUnion.

That notification of a credit check can prevent a fraudulent line of credit being pulled on your credit file. If you act immediately, you can freeze your credit before the identity thief can successfully sign up for a new line of credit under your name.

Pro Tip: Although NordProtect only offers one-bureau credit monitoring, you can take your credit monitoring into your own hands. AnnualCreditReport.com offers weekly credit reports for free from all three bureaus. Once you get used to reading credit reports, reviewing them shouldn’t take more than half an hour of your time. Check out our guide on how to get a free credit report for more details.

Limited Access

We have bad news for anyone outside of the U.S. and anyone living in New York or Washington state. NordProtect is entirely unavailable for you. There’s no option for a plan with limited functionality or an alternative service. So, if you live in New York, Washington state, or outside of the U.S., stick with Nord’s other online protection services.

>> Read About: What Type of Fraud Is Most Common in Your State?

Home and Auto Title Fraud

Some of the top identity theft protection services include home title monitoring. For instance, when we tested LifeLock, we received home title monitoring. Aura expands on that with home and auto title monitoring. Those mean that if someone pulled a line of credit against our registered properties, we’d get notified. NordProtect explicitly does not offer this monitoring. They also do not insure against this type of identity theft.

While this is a bit of a bummer, it’s somewhat expected considering NordProtect’s commitment to online protections.

Family Plan

Identity thieves target every member of the family, including children. In fact, a study reveals that child identity theft cases in just one year have cost families $540 million in out-of-pocket expenses.1 This highlights the importance of getting protection for every member of the family. Most services offer discounted family plans. Aura, for example, can cover up to five adults and unlimited minor dependents in a household for only $50 per month at most. This saves you money compared to paying five $15-per-month individual memberships.

Unfortunately, NordProtect doesn’t offer family plans. You’d have to buy the service for each member of your household, and the cost would quickly pile up.

Pro Tip: Seniors also need identity theft protection, even if they’re retired. One in 10 older adults fall victim to identity theft every year on average.2 If you have senior family members in your household, see our recommended identity theft protection services for seniors.

NordProtect Bundles

Since we recommend opting for the bundle through NordVPN that includes NordProtect, we wanted to cover everything you’d get in that bundle. Even though it costs less than NordProtect on its own if you’re ready to sign up for two years, it comes with a lot more functionality. And even if you’re not ready to sign up for two years, the bundle still only costs $1.50 or $2.50 more per month depending on if you sign up for the one year or month-to-month plans.

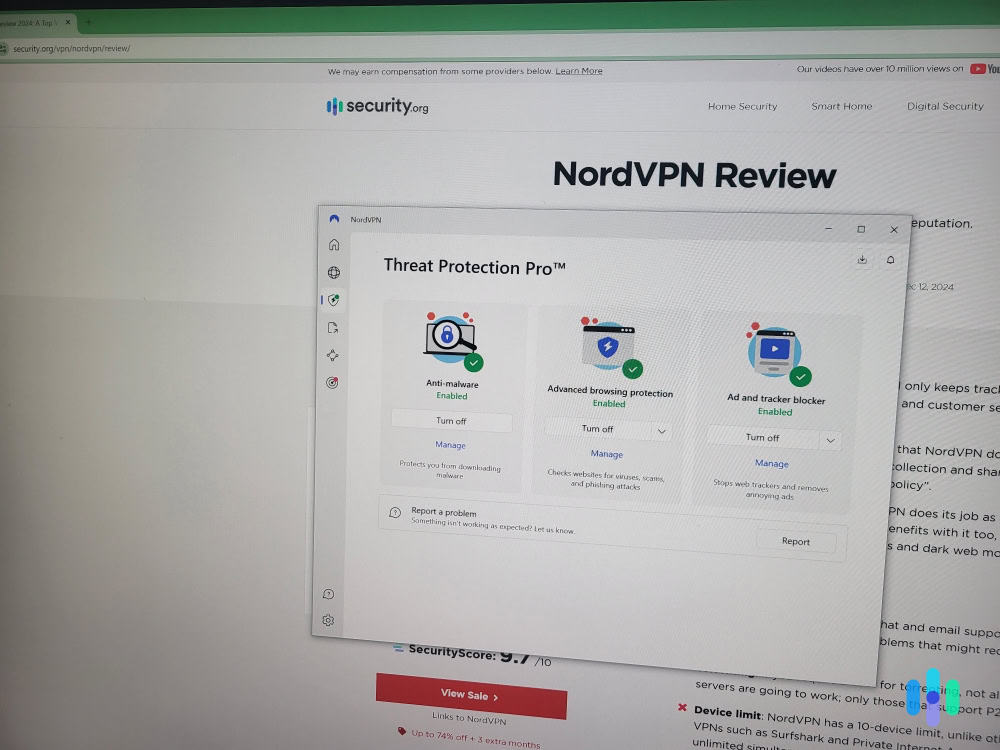

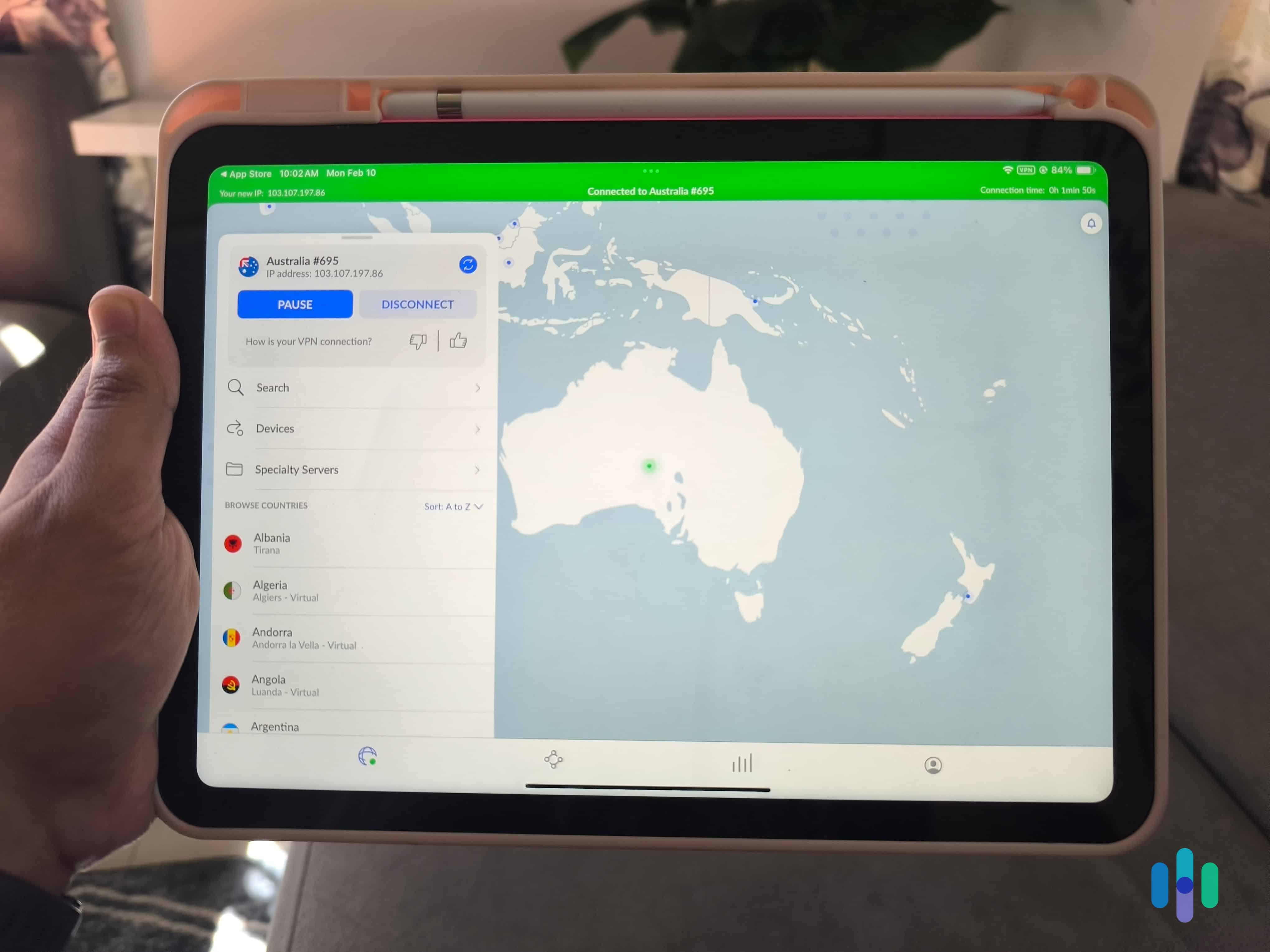

NordVPN

NordVPN is Nord Security’s flagship product and it’s one of the best VPNs of 2025. After we tested NordVPN, we switched to using it as our primary VPN service. It reliably keeps our internet browsing private while barely slowing down our connection. Plus, it includes key security features like an online malware filter and tracker blocker. While it’s not as powerful as the Norton antivirus software we tested, the fact that the malware filter and VPN are bundled makes it a good all-around cybersecurity tool. Plus, you can bundle it with a LifeLock subscription.

>> Learn More: The Best Antivirus and VPN Bundles of 2025

NordLocker

NordLocker is a cloud drive, not unlike Google Drive or iCloud. Unlike those popular cloud services, however, everything you upload to your NordLocker storage gets encrypted immediately. We haven’t written a review of NordLocker yet, but we have tested it when using NordVPN. It comes with 1 terabyte of cloud storage and uses a combination of the top encryption protocols that exceeds military standards.

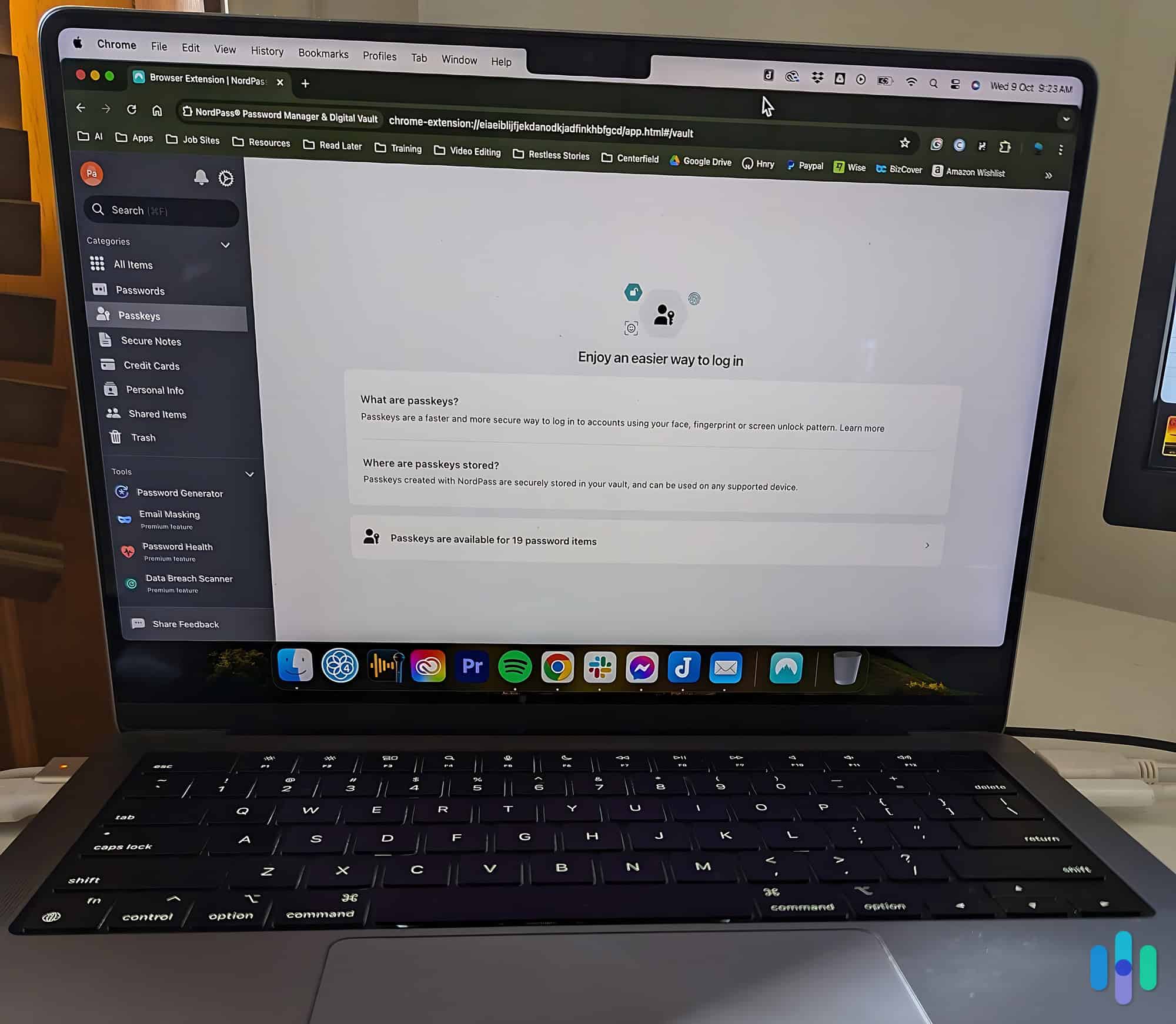

NordPass

Similar to NordLocker, NordPass is an encrypted storage but for your passwords and other sensitive files (credit card information, digital IDs, etc.). It’s a password manager, which can help you protect your online accounts (and thus your personal information) by letting you use a unique and secure password for each account. While you can access NordPass for free, the NordVPN Prime bundle includes the premium version of NordPass.

On top of storage for unlimited passwords, the premium version of NordPass that we tested includes a password health monitor, data breach scanner, and cross-platform compatibility. It also performed well in our tests, which is why it’s on our current list of the best password managers.

Expert Insight: What we like about Nord’s approach is that individually, these other products included in the NordVPN Prime bundle are at the top of their respective fields. There are some more affordable identity theft protection services that include a VPN, password manager, and antivirus, but those inclusions are typically not full-featured. For example, Aura’s VPN can only connect to U.S. servers, whereas NordVPN has servers in 118 countries and offers advanced VPN features such as double hop.

Our Experience Using NordProtect

Honestly, our experience using NordProtect could have been smoother. We ran into a couple of snags while setting up our protections. We were able to resolve them with the help of their customer support, but nonetheless, issues are issues. Considering NordProtect is a relatively new service, we hope Nord makes the process of using their service easier in the future.

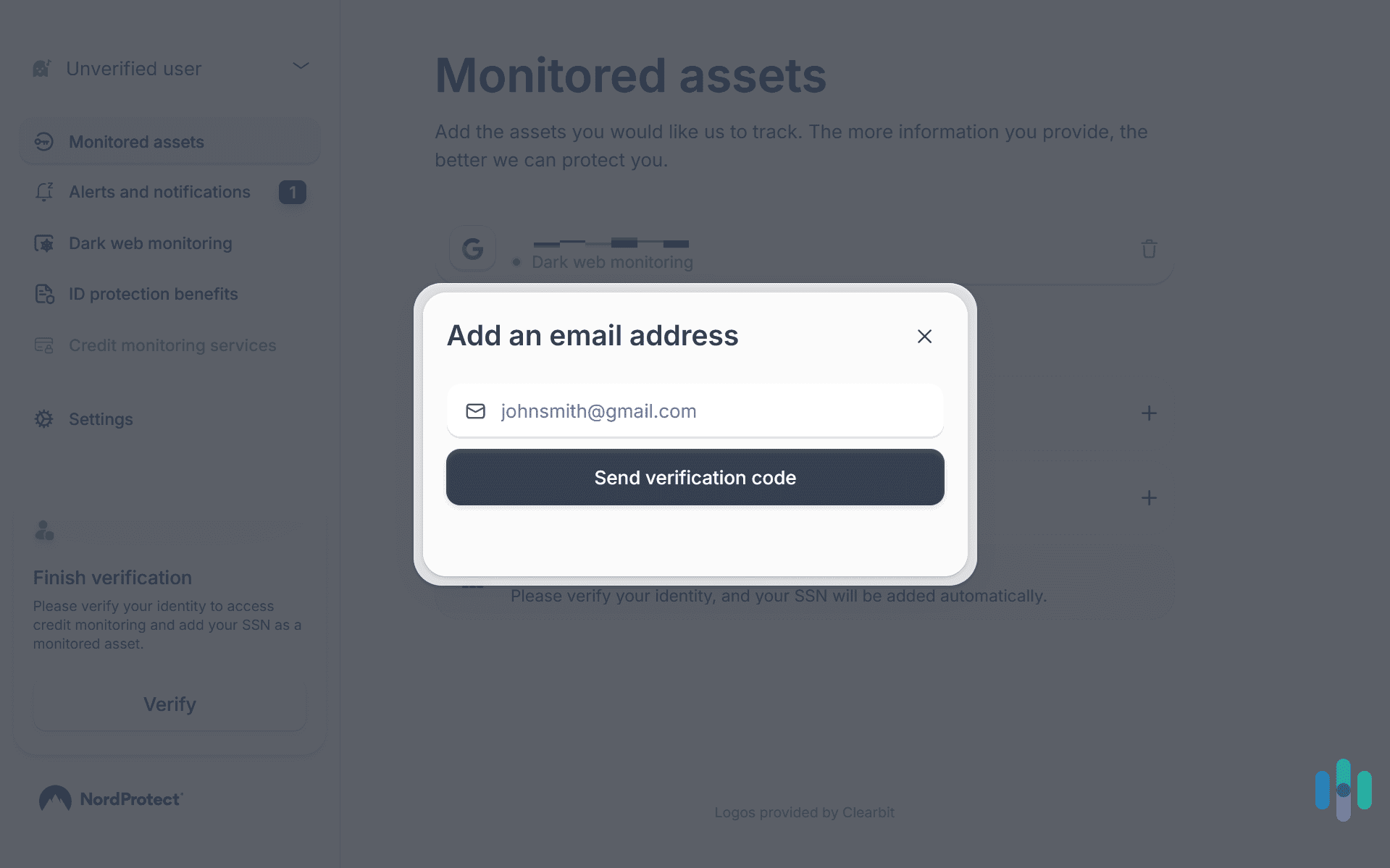

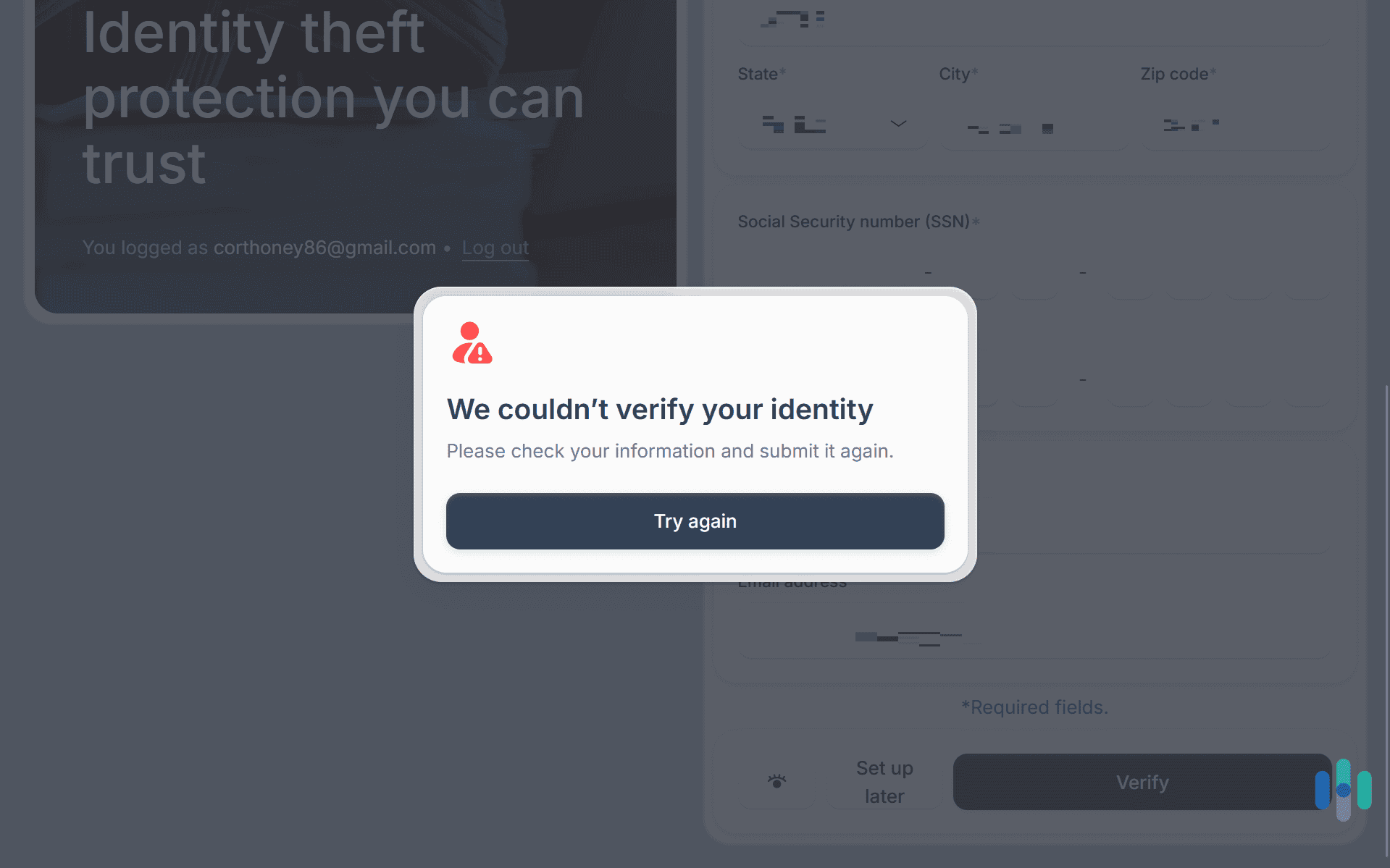

Setting Up Our Identity Protections

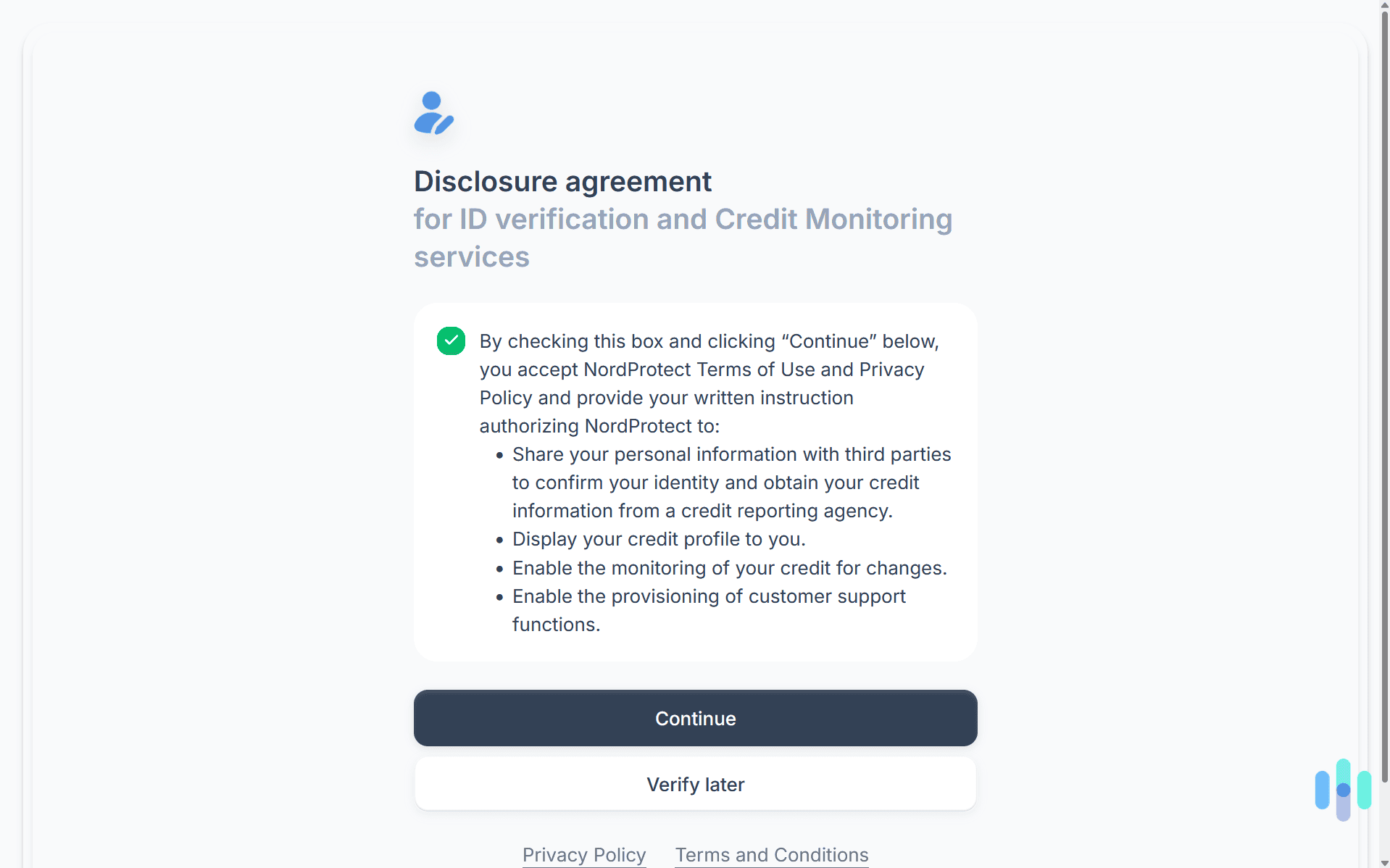

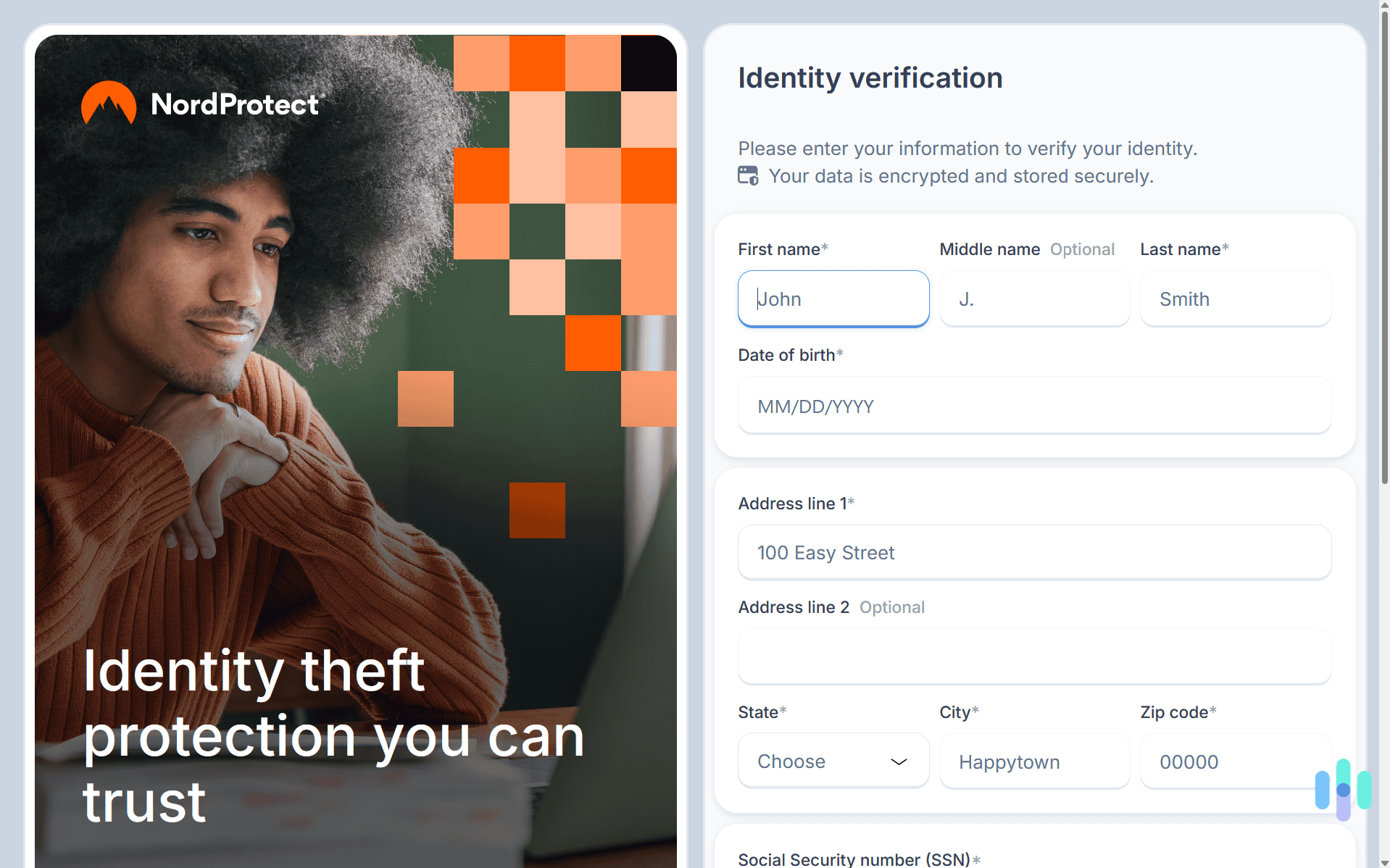

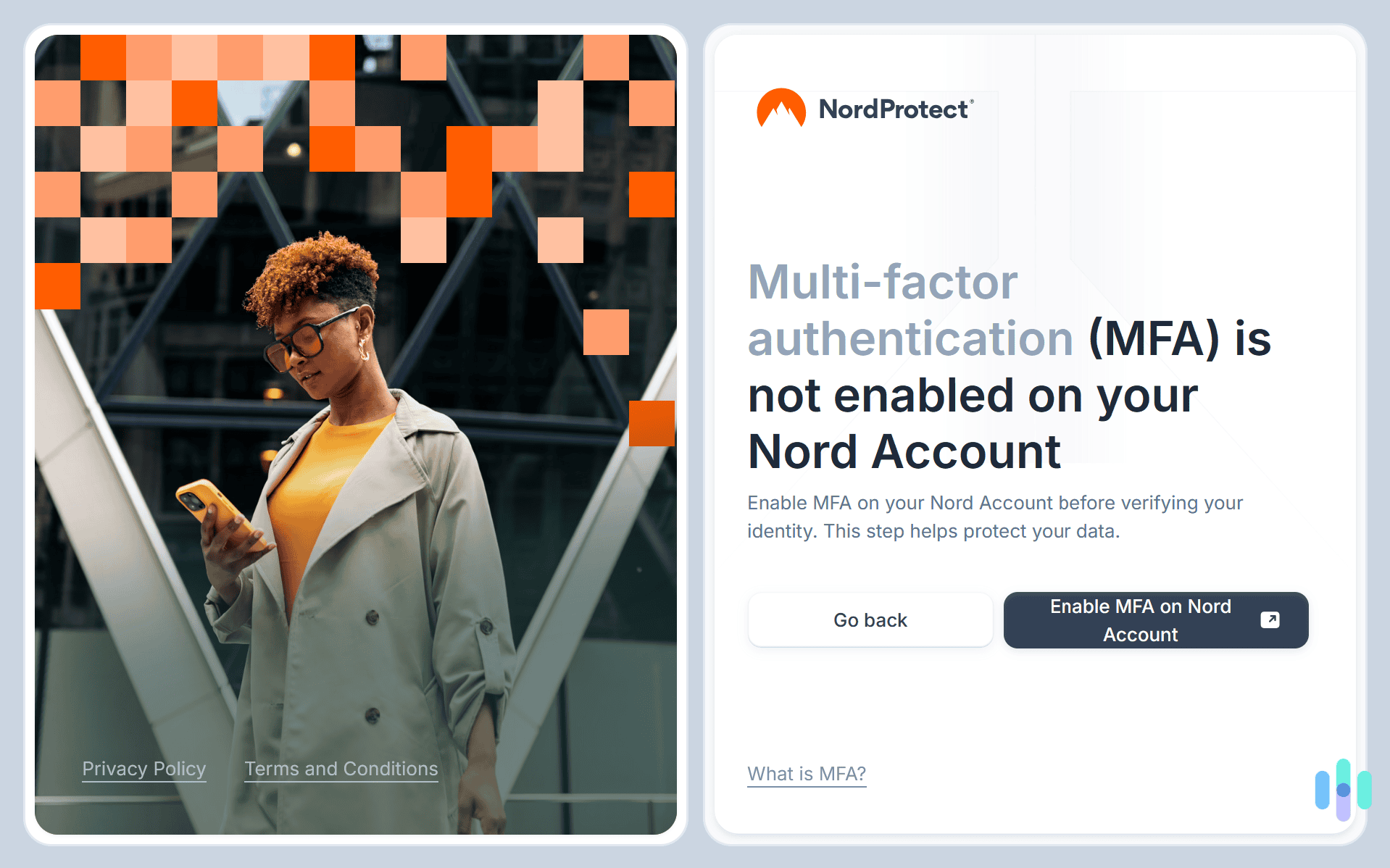

Buying our NordProtect subscription was easy. We just went with NordProtect for one month this time to test out the service. After buying our subscription, we followed their process for setting up our identity protections. First, we needed to enable MFA for our account. We appreciated that extra step to secure our account before we input any of our sensitive information like our address or SSN. It was easy to do as well. We used Microsoft Authenticator, which we already had installed on our phone.

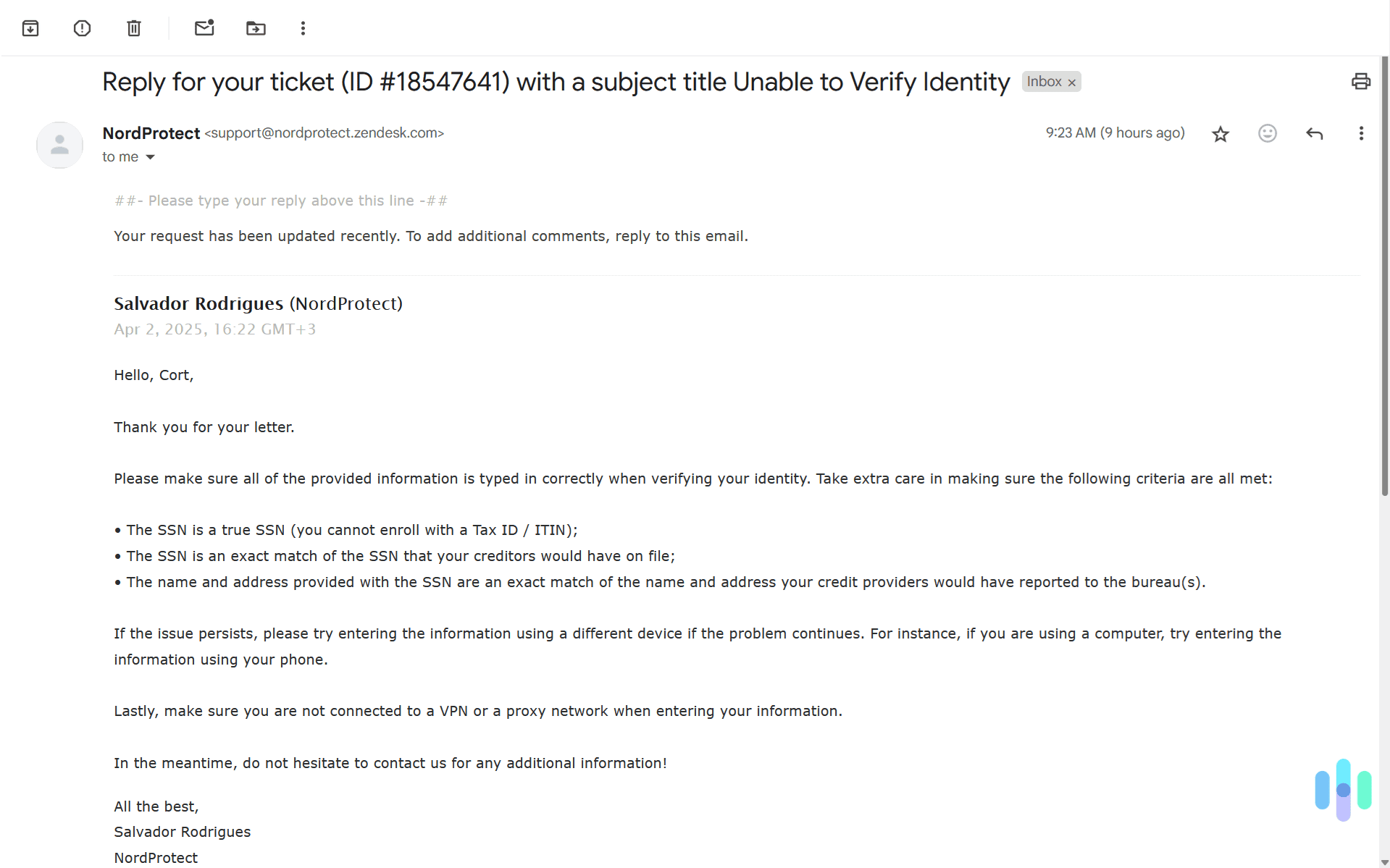

The next step didn’t go as smoothly. We had trouble verifying our identity. NordProtect checks the information you input against their credit monitoring tools to ensure you provide valid information. When we put our current information in, though, it told us our identity couldn’t be verified. So, we tried using our previous address too, but that didn’t work either. After an email to NordProtect’s customer service, we found out we were getting denied because we were connected through a VPN.

Maybe we take our data privacy too seriously, if that’s even possible, but we don’t like having to input our SSN when not connected through a VPN. It could leave our data exposed if someone spoofed our Wi-Fi. And being a VPN brand as well, we think Nord should have been OK with that.

Did You Know: VPNs encrypt all traffic when you’re connected through one unless you use a VPN split tunneling feature. That encryption masks all of the data you submit on web forms before it leaves your computer and gets sent through the network you’re connected to.

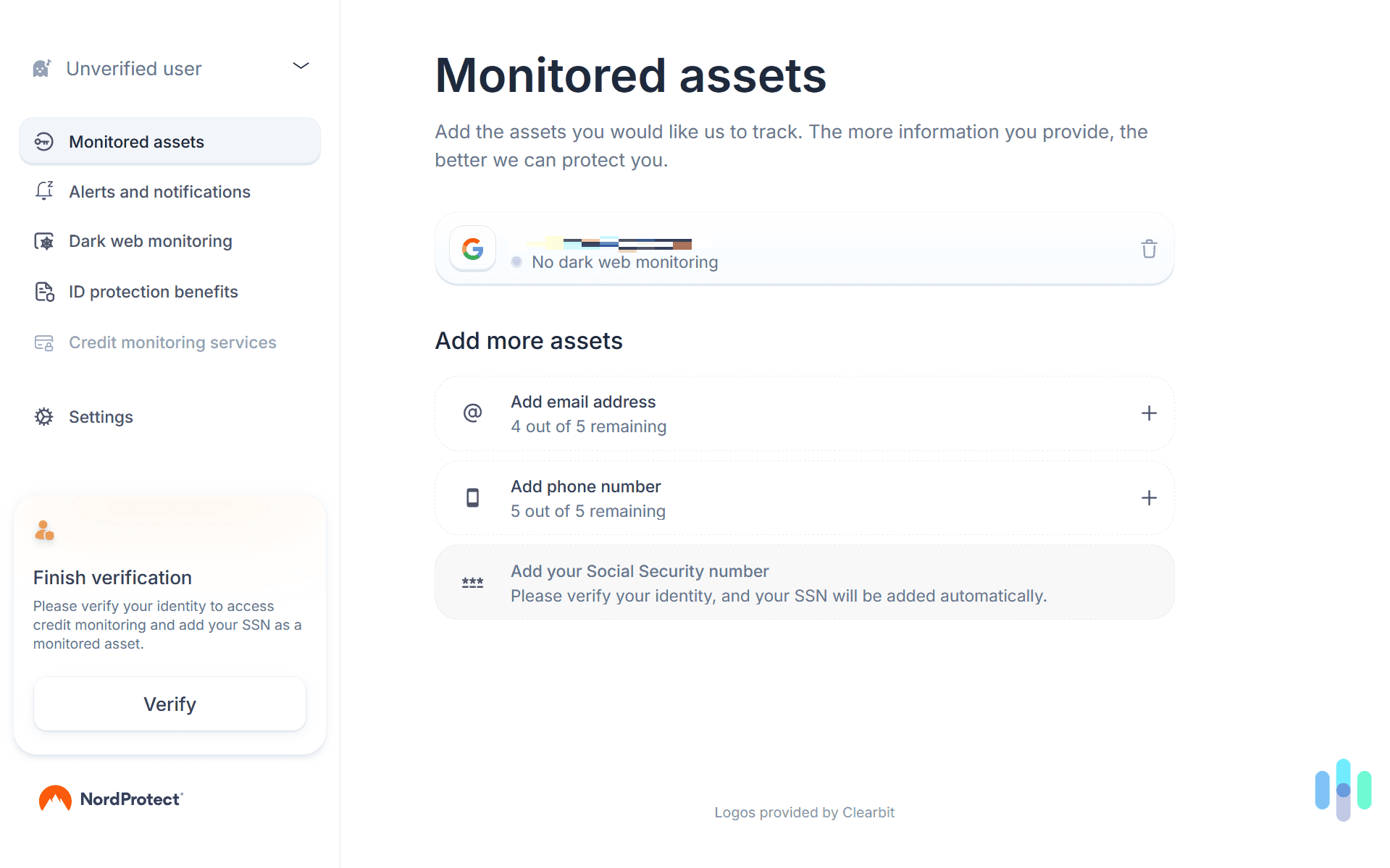

Scanning for Dark Web Breaches

Compared to other identity theft protection services, NordProtect’s dark web scanning stands above the rest. They are primarily a cybersecurity organization, after all, so it makes sense they’d have a solid dark web scanning solution. Once we ran a scan on our email address, NordProtect found it in two leaks that also appeared in scans from other services. NordProtect found a leak for our phone number, though, which most other services miss.

One of our complaints with NordProtect’s dark web scanning service is that they cap you at five email addresses and five phone numbers.

As a side note, Nord Security has a separate offering for businesses that need protection for multiple email addresses. It’s called NordStellar. We reviewed NordStellar, and we think it’s one of the best identity theft protection services for businesses.

FYI: NordProtect only allows you to input your SSN, email address, and phone number for dark web monitoring. We wish they would let us add our credit card numbers, passport number, and driver’s license numbers for data breach monitoring as well.

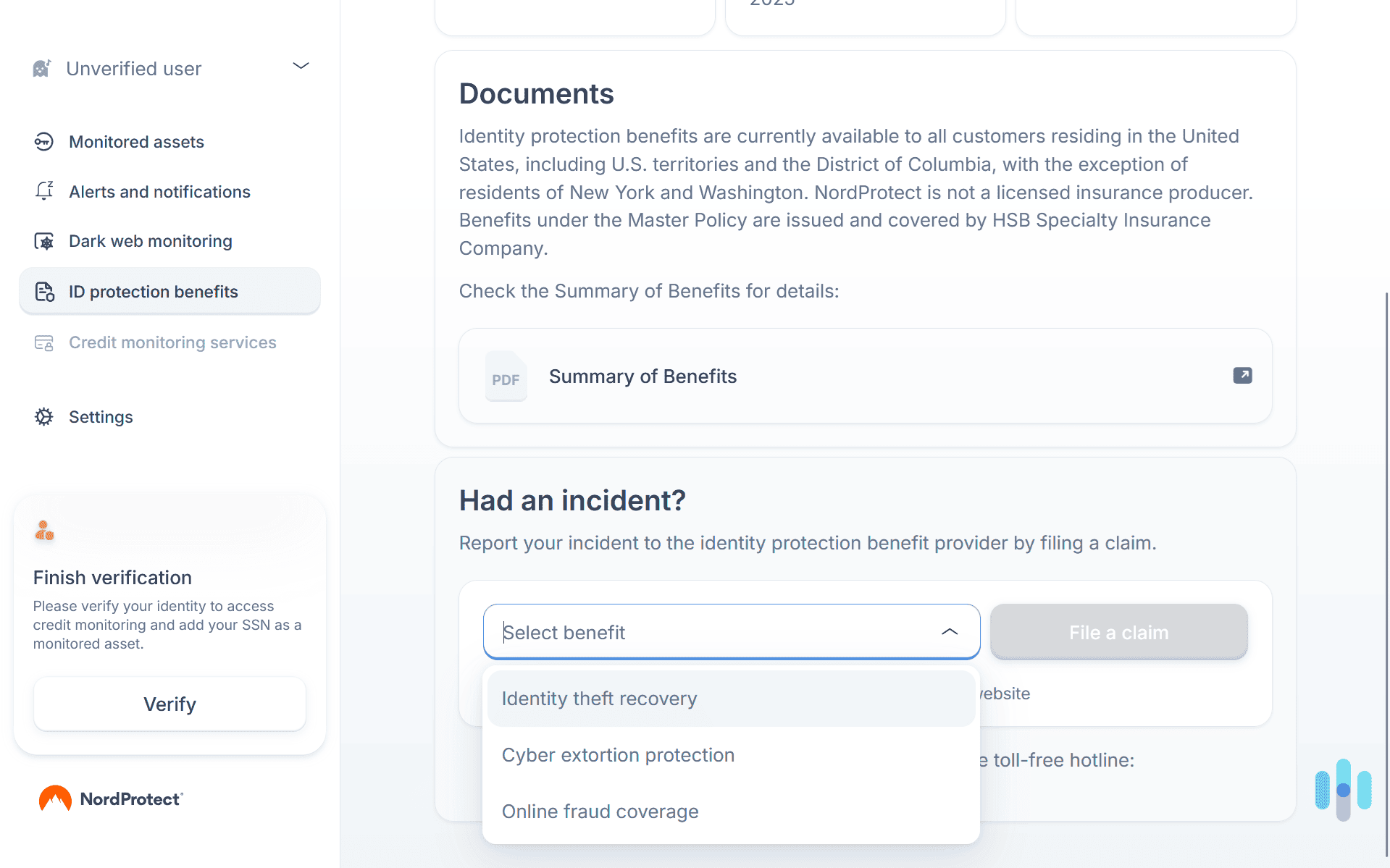

Submitting a Claim

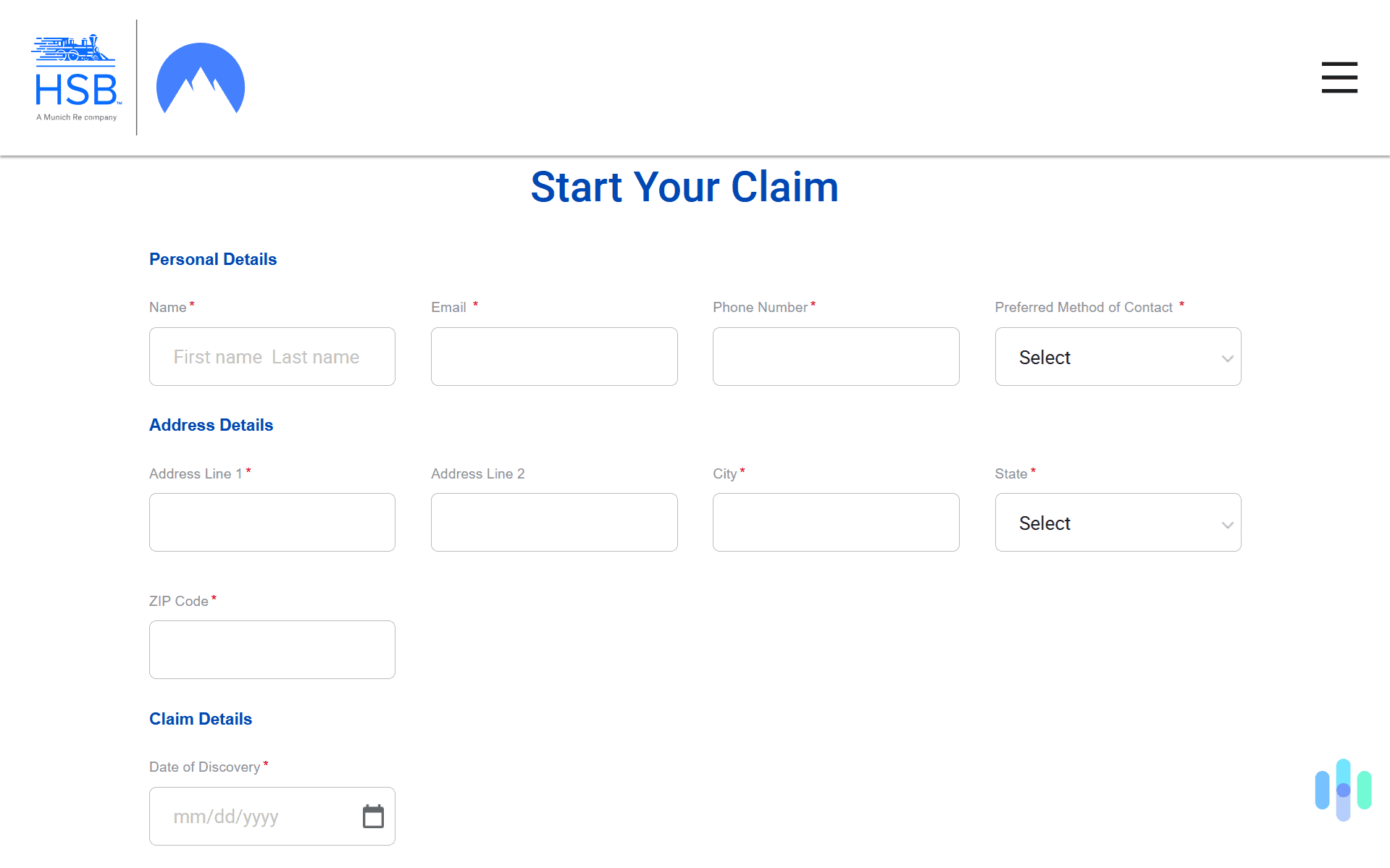

At the bottom of NordProtect’s ID protection benefits tab, there’s a drop-down menu to submit a claim. Since NordProtect uses HSB to fulfill their insurance, once you pick the category of your claim, they direct you to HSB’s form. In that form, you need to provide your name, address, contact information, and details of your claim. Be prepared to put down the date of the event and a written description of the event. We also recommend adding screenshots and forms showing why you believe your identity was stolen.

>> Learn More: Identity Theft Prevention: Tips and Techniques for 2025

Final Thoughts: Is NordProtect a Complete Identity Theft Protection Service?

After using NordProtect for about a month, we can appreciate some of the protections it offers. There’s a clear focus on online threats, which is Nord’s area of expertise. But, we felt that it left us vulnerable for home title fraud and credit fraud. There were some protections for credit fraud such as credit score monitoring and one-bureau credit monitoring, but we prefer three-bureau credit monitoring.

We must say, though, the value that NordProtect provides is top-notch. They offer one of the most affordable services starting at $6.99 per month and that includes a VPN, encrypted cloud storage, and a password manager. While they might not provide the strongest identity protections, they offer an affordable service that still provides $1 million in identity theft insurance.

FAQs About NordProtect

-

How many credit bureaus does NordProtect monitor?

NordProtect offers one-bureau credit monitoring. They monitor your credit report from TransUnion. But, they also monitor your VantageScore 3.0 credit score, which uses all three credit bureaus.

-

Where is NordProtect available?

NordProtect is available in all U.S. territories aside from New York and Washington state.

-

What’s the cheapest way to get NordProtect?

The cheapest way to buy NordProtect is actually through the NordVPN website. NordVPN’s Prime bundle includes NordProtect along with the rest of Nord’s consumer products. A two-year subscription of that bundle costs less per month than buying NordProtect on its own.

-

Does NordProtect offer a free trial?

No, NordProtect does not offer a free trial, but every subscription comes with a 30-day money-back guarantee you can use to test out the service before fully committing.

-

How much insurance does NordProtect provide?

There’s a $1 million cap on the insurance provided by NordProtect. That $1 million cap includes the $50,000 in cyber extortion and $10,000 in online fraud reimbursement.

Javelin. (2018). 2018 Child Identity Fraud Study.

https://javelinstrategy.com/research/2018-child-identity-fraud-studyNational Institute of Health. (2020). Identity Theft Among Older Adults: Risk and Protective Factors.

https://pmc.ncbi.nlm.nih.gov/articles/PMC7743147/