LifeLock Identity Theft Protection Review 2025

This feature-stacked contender offers device protection with the Norton 360 antivirus add-on.

Aliza Vigderman, Senior Editor, Industry Analyst

&

Aliza Vigderman, Senior Editor, Industry Analyst

&

Gabe Turner, Chief Editor

Last Updated on Oct 15, 2025

Gabe Turner, Chief Editor

Last Updated on Oct 15, 2025

What We Like

- Identity, credit and investment monitoring: LifeLock provides monitoring for identity, credit and financial accounts, including the dark web, all three credit bureaus and investment accounts.

- Valuable insurance: LifeLock’s top-tier protection plan promised to reimburse us for up to $1 million of stolen funds and personal expenses from identity theft.

- Norton security + VPN: The Norton 360 and LifeLock pairing provided us proactive protection from online threats, including malware that can steal our digital identities. Courtesy of Norton Secure VPN, the virtual private network encrypted our connections and let us browse the internet anonymously.

What We Don't Like

- Expensive after the first year: Once LifeLock’s one-year promotional period expires, prices go up. For example, LifeLock’s most expensive individual plan goes from $239.88 in the first year to $339.99. The same plan for families is $467.88 in the first year and renews at $799.99.

- Lower cost, less insurance: Only LifeLock’s expensive plans cover up to $1 million in losses and personal expenses related to identity theft. The least costly plans reimburse up to $25,000 in stolen funds. All subscribers are covered for up to $1 million in fees for lawyers and other experts.

- Confusing purchasing process: Since they offer so much, it can be difficult to figure out where to purchase exactly what you need.

Bottom Line

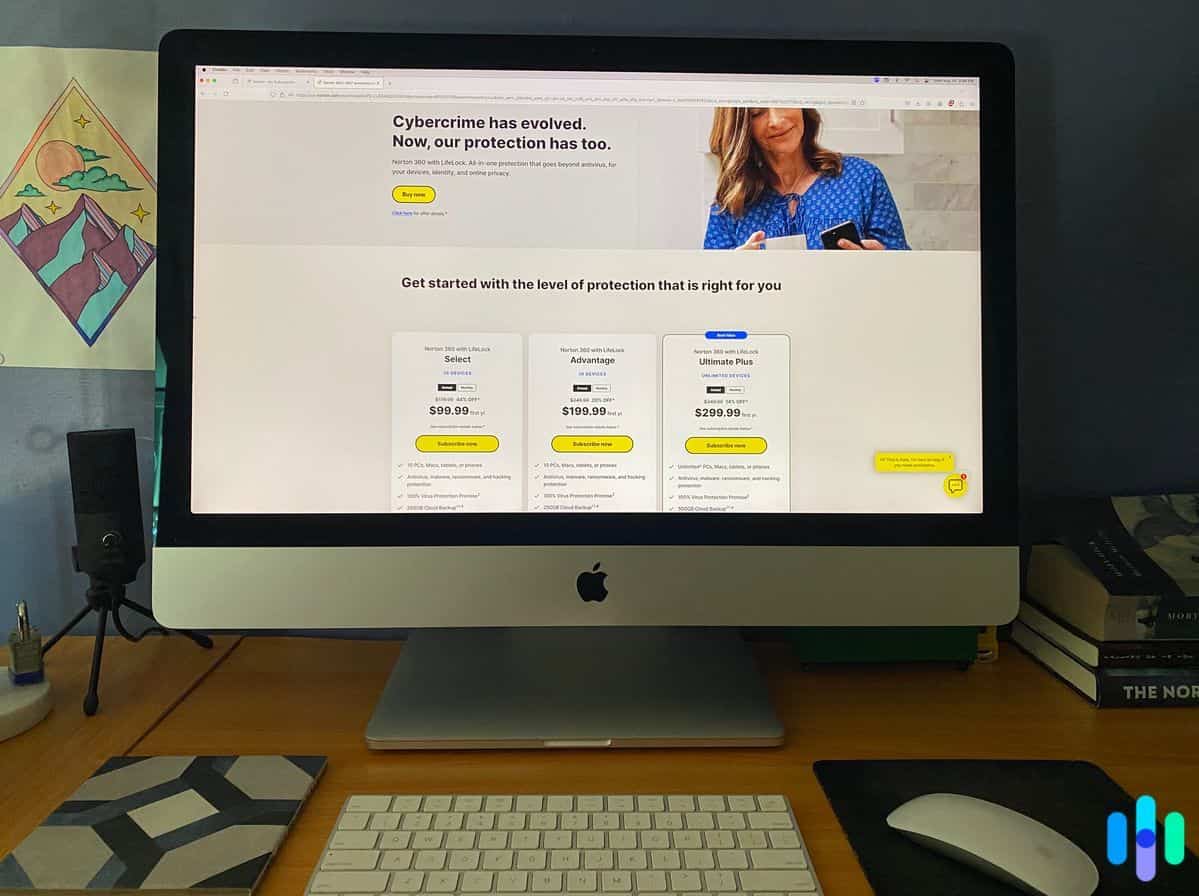

You might know Norton as one of the best antivirus programs on the market. In addition to blocking phishing and malware, Norton also offers an identity theft protection service. You can use it to monitor your financial accounts, scan the dark web, and freeze your credit.

After spending a month testing LifeLock, we can confirm it’s one of the best identity theft protection services available. It’s not perfect. There are a lot of LifeLock plans to get your head around and you need to use two apps to make the most of all the features. You’ll find all the pros and cons below. Let’s take a look.

- Full-service identity theft and credit monitoring

- Device protection with Norton 360 antivirus

- Reputation for outstanding customer service

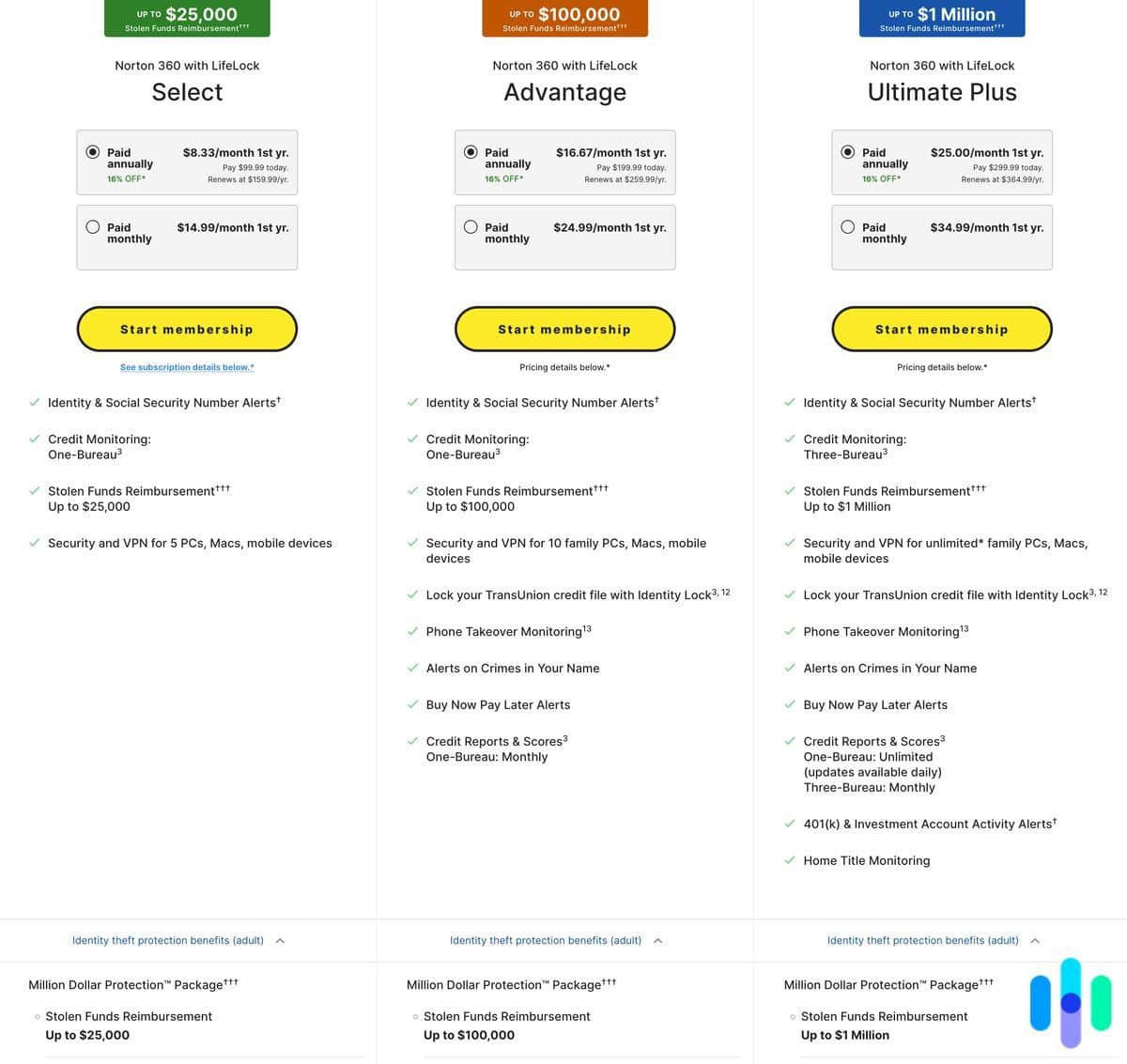

LifeLock’s Plans

LifeLock is packed with services and features. We go into more detail in our LifeLock subscriptions guide, but here’s a taste of what’s available. Each plan is priced for individuals, couples, and families. The family option covers two adults and up to five kids. Here’s what the plans include.

| Feature | Identity Advisor | Standard | Advantage | Ultimate Plus |

|---|---|---|---|---|

| Identity and Social Security number alerts | Yes | Yes | Yes | Yes |

| Credit monitoring | No | Single bureau | Single bureau | Triple bureau |

| Stolen funds reimbursement | No | Up to $25,000 | Up to $100,000 | Up to $1M |

| Credit lock | No | No | Yes | Yes |

| Phone takeover monitoring | No | No | Yes | Yes |

| Crimes in your name protection | No | No | Yes | Yes |

| Buy now, pay later alerts | No | No | Yes | Yes |

| Credit reports and scores | No | No | Single bureau, monthly | Single bureau, daily; triple bureau, monthly |

| Investment account protection | No | No | No | Yes |

| Home title monitoring | No | No | No | Yes |

| Norton 360 Add-On (antivirus and VPN) | Not available | +$1.33 per month for five devices | Not available | +$5.01 per month for unlimited devices |

| Monthly price average | $3.33 | $7.50 | $14.99 | $19.99 |

| Annual price | $39.99 | $89.99 | $179.99 | $239.99 |

| Annual price renewal | $49.99 | $124.99 | $239.99 | $339.99 |

These are the core features you’ll find in each plan, but there’s more under the hood. Each tier includes extra tools like a password manager and data breach notifications. Keep in mind these prices cover just one person. If you’re looking to protect your partner or entire household, you’ll need to budget accordingly. Here’s how much it costs for couples:

| Standard | Advantage | Ultimate Plus | |

|---|---|---|---|

| Monthly price average | $14.99 | $28.79 | $39.59 |

| Annual price | $179.88 | $345.48 | $475.08 |

| Annual price renewal | $299.99 | $575.99 | $815.99 |

And here’s a breakdown of those costs for families:

| Standard | Advantage | Ultimate Plus | |

|---|---|---|---|

| Monthly price | $22.19 | $35.99 | $46.79 |

| Annual price | $266.28 | $431.88 | $561.48 |

| Annual price renewal | $431.99 | $695.99 | $959.99 |

How do Norton’s prices stack up against the competition? If we compare LifeLock to Aura, LifeLock costs more for comparable coverage. Aura’s individual plan that’s most comparable to Ultimate Plus costs about half the price at $12 per month. However, it only comes with $1 million insurance and not quite as comprehensive of monitoring. We also like that LifeLock offers budget-friendly plans with scaling capabilities.

LifeLock’s Features

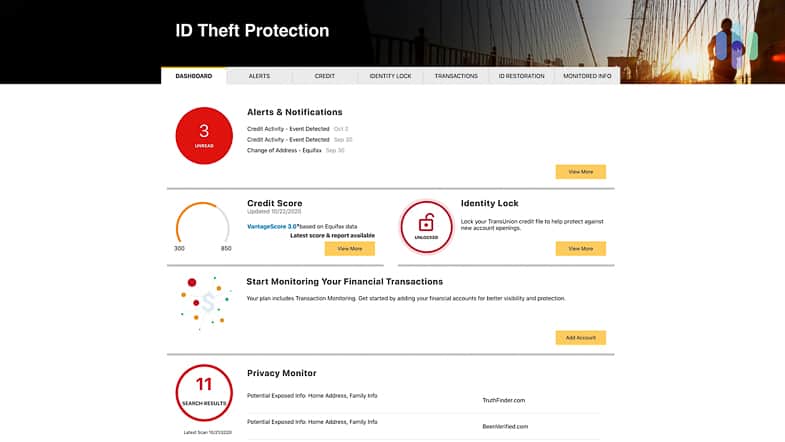

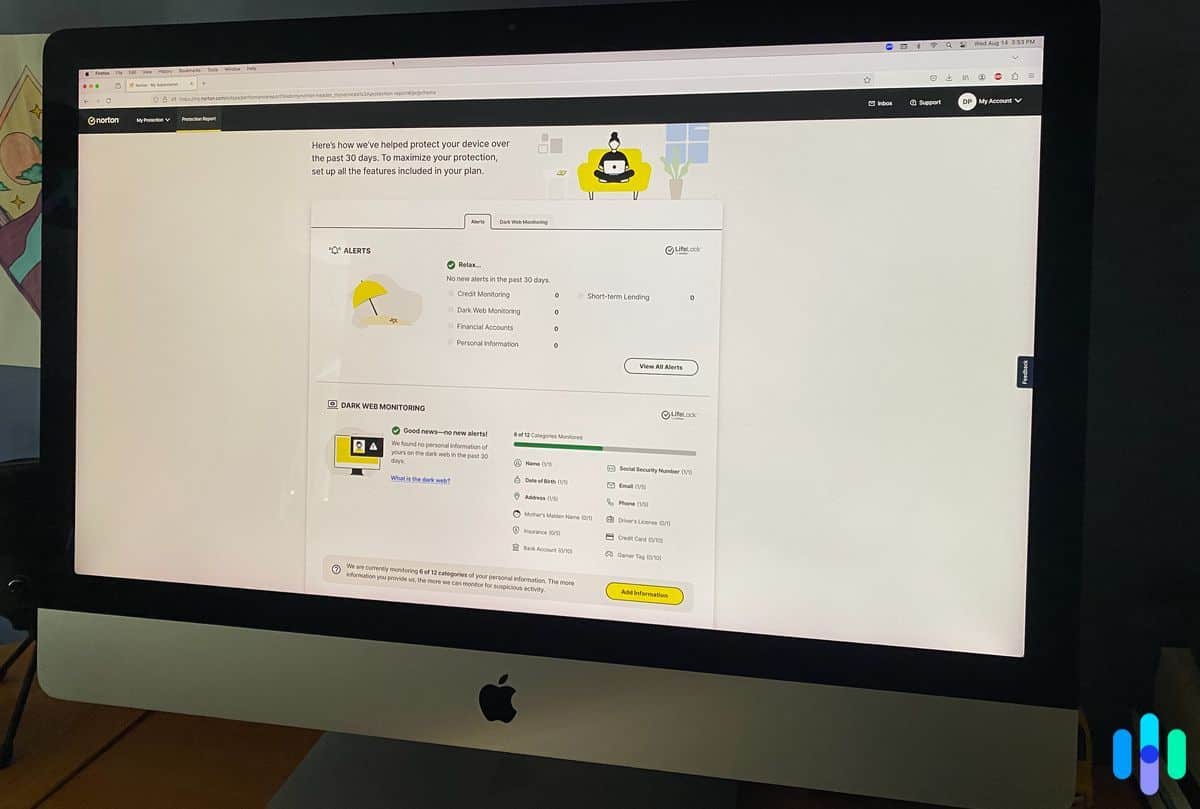

During our testing, we noticed each feature is categorized into alerts, identity monitoring, credit monitoring, financial monitoring, and digital protections. This made it easy to navigate through the menus to find the service we were looking for.

Even LifeLock’s entry-level plans deliver substantial value. Let’s break down each category to see what level of protection you need.

Monitoring and Alerts

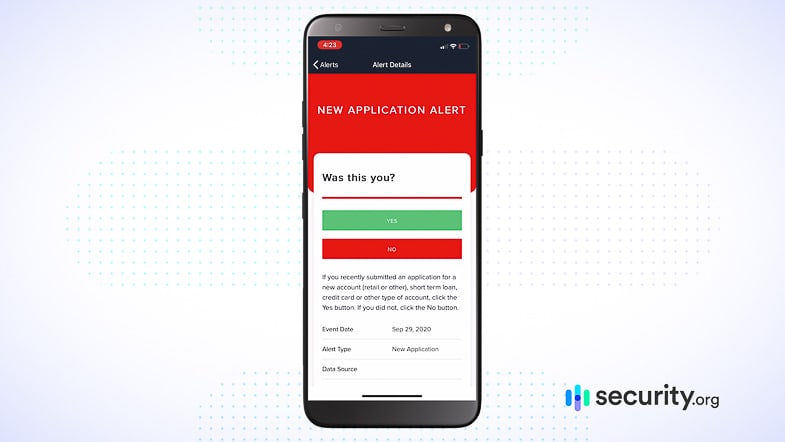

All identity theft protection services monitor your personally identifiable information and alert you when something suspicious occurs. The best services send instant notifications so you can act quickly and avoid any potential damage.

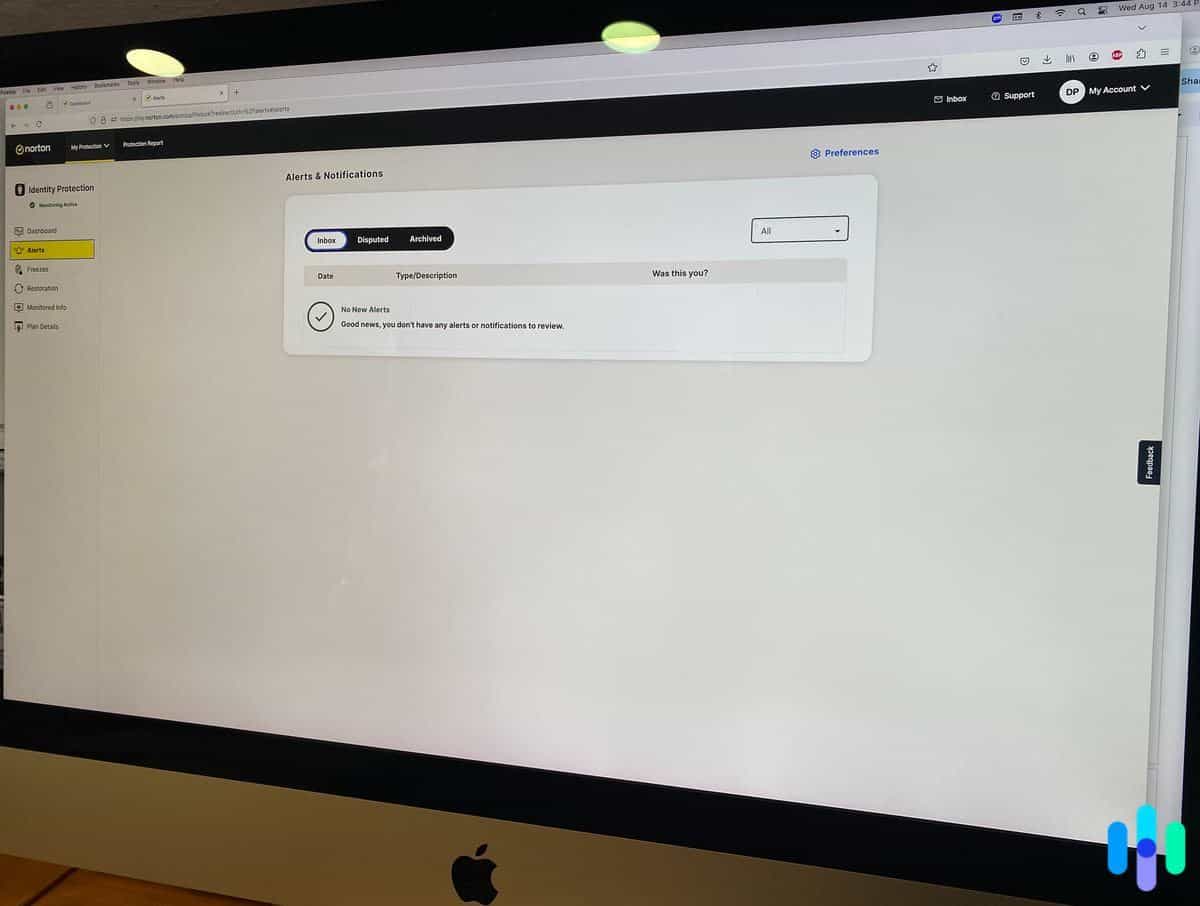

While testing LifeLock, it sent us alerts within 60 seconds of an event. For instance, after submitting a change of address form with USPS during a recent move, LifeLock notified us in 53 seconds. This is a useful feature, as scammers will change addresses via the USPS to redirect mail to them. They’ll use the information to take out loans or steal your identity.

The extent of credit monitoring depends on your subscription. With our Ultimate Plus plan, we had monitoring at all three major credit bureaus. However, the Standard plan only has one bureau monitoring. While some experts argue single-bureau monitoring suffices, we believe three-bureau coverage eliminates any potential blind spots in credit fraud detection.

>> Compare: A Comprehensive Comparison of Identity Guard and LifeLock

Identity Monitoring

All LifeLock plans have the standard identity monitoring features we expect, like dark web monitoring, ID verification, and data breach notifications. LifeLock has also added utility account creation monitoring, which requires a credit check but doesn’t impact your score. Some of the identity monitoring features are:

- USPS address changes

- Crimes registries

- Court records

- Sex offender registries

- Dark web content

- Data breach notifications

If any changes occur or if your personal information appears in places like data breach lists, LifeLock will let you know. That is vital, because if any of those identity theft signs appear, someone likely got ahold of your personal information. With LifeLock keeping watch, you stand a fighting chance to prevent identity theft, or at least minimize the damages of an identity theft.

Our testing period was relatively quiet alert-wise, which is a good thing. We do our best to remain anonymous online, so that lack of alerts suggests LifeLock minimizes false positives. That doesn’t mean it’s not thorough. LifeLock flagged several dormant accounts, prompting us to delete those forgotten profiles. This helped reduce our attack surface, so we appreciated the reminder.

Good to Know: One of our favorite LifeLock features detects synthetic identity theft. This is when criminals create a fake persona using your personal details and use it for fraud. It’s not easy to detect because not all the information matches you, but LifeLock knows what to look for.

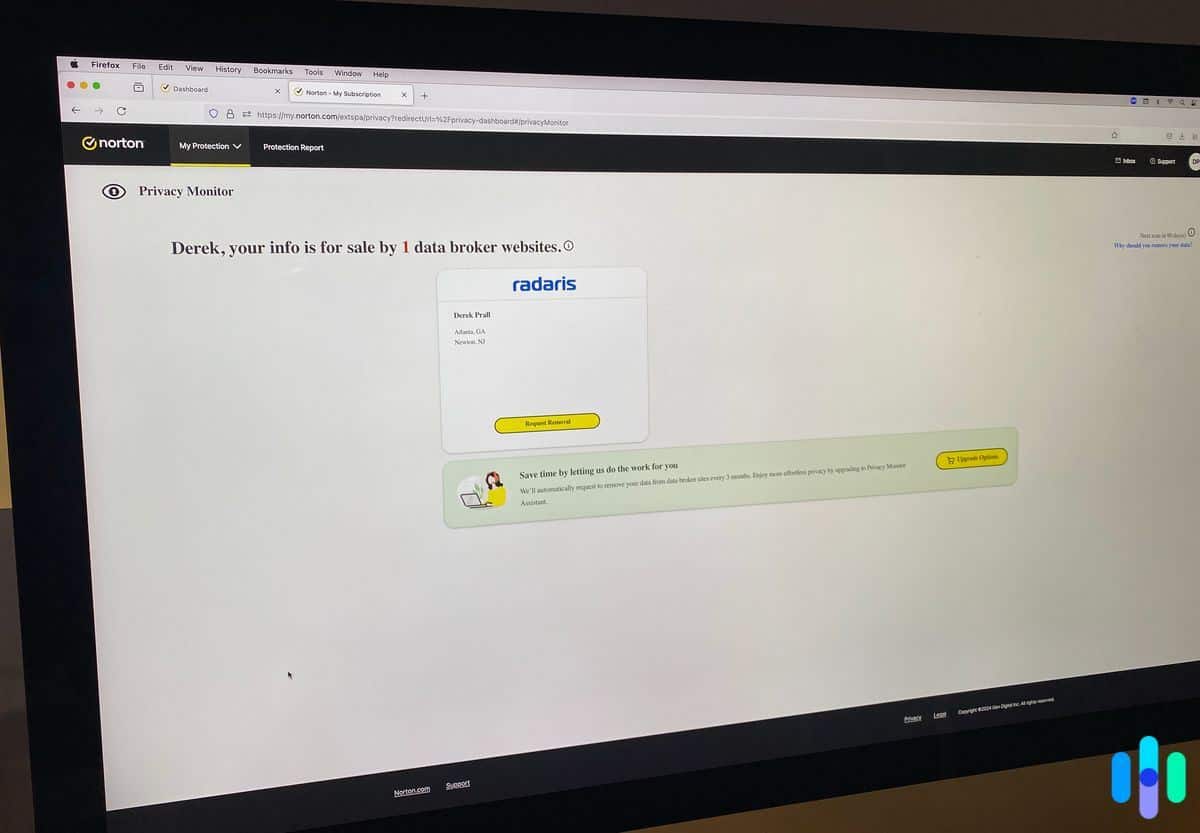

In addition to monitoring, LifeLock takes a proactive approach with their Privacy Monitor feature that acts as a data removal service. It helps you scrub personal information off people-search sites that cobble together public information to create profiles that list your name, age, address, phone number, and more. During our tests, Privacy Monitor found a website with our personal information so we could have it taken down.

We advise everyone to keep track of those data broker sites. Many keep your data archived even after removing it from their site. That means it could resurface later and require another opt-out request. Our favorite data removal services, like Incogni, automate this process, so you don’t have to think about it.

Pro Tip: The Privacy Monitor feature is only included in Norton 360 with LifeLock plans. Prices start at $8.33 per month and include access to antivirus protection, a VPN, and a password manager.

Credit Monitoring

With our Ultimate Plus subscription, LifeLock provided us with comprehensive triple-bureau credit monitoring complete with credit reports and score updates from all three bureaus. Credit reports arrived monthly, while the credit score on the app updated daily.

Triple-bureau credit monitoring is the gold standard in credit protection. It’s a key reason LifeLock ranks among the best identity protection services with credit monitoring and reporting.

Not all LifeLock plans include three-bureau credit monitoring. Only the Ultimate Plus plan offers it. The lower-tier plans will only monitor one credit bureau, and with the most basic subscriptions, free credit reports are not included.

Pro Tip: You can get free credit reports every week. They’re just not automatic like they are with LifeLock. You need to manually request them from the Annual Credit Report website.1

LifeLock also offers a proactive approach to protecting your credit by helping you file a TransUnion credit lock. This prevents anyone, including yourself, from opening new credit lines without filing a request to unlock your credit. While this extra step might seem inconvenient, it’s an effective firewall against credit fraud.

We discovered this feature’s effectiveness firsthand. When setting up a joint savings account, the bank couldn’t access our credit file. A quick login to LifeLock, a toggle of the credit lock, and we were back in business. That reassured us that this security measure works as advertised.

Of course, for complete protection, you’ll also need to freeze or lock your accounts with the other two major credit reporting bureaus: Experian and Equifax. You can’t do that with the help of LifeLock, unlike with TransUnion, but you can contact Experian and Equifax directly to freeze your credit for free.

FYI: One-bureau credit monitoring is still better than none. Identity Guard’s Value plan doesn’t include any credit monitoring and is the same price per month as LifeLock Standard for individuals. You need to upgrade to a more expensive Identity Guard plan for in-depth financial and identity monitoring.

Financial Monitoring

With an Ultimate Plus subscription, LifeLock monitored our credit, checking, and savings accounts. We could get alerts when our money moved in those accounts, or someone requested information changes. LifeLock also monitored for new accounts with our name and changes to our 401(k) investment accounts.

Our testing period remained fairly quiet on the financial alert front, exactly what you want to see. Still, we recommend activating all available alerts. Any unexpected activity in these areas could signal identity theft in progress.

LifeLock also offers reimbursement in the event that we experienced losses due to identity theft. Our Ultimate Plus subscription covers up to $1 million in losses, which is standard across the identity monitoring industry. However, LifeLock goes above and beyond by offering an additional $1 million coverage for personal expenses and $1 million coverage for legal fees. That’s $3 million in total protection.

The $1 million legal fee coverage is included in every LifeLock plan, but the compensations for personal and legal expenses scale with the plan you have. It starts at $25,000 for each if you have the lowest-tier plan and increases to $100,000 each for the mid-tier Advantage plan. The $1 million coverage we mentioned applies only to the Ultimate Plus plans.

FYI: If you want a service that provides the same coverage for every subscriber, check out Aura’s plans, which all provide $1 million coverage for stolen funds and legal reimbursements.

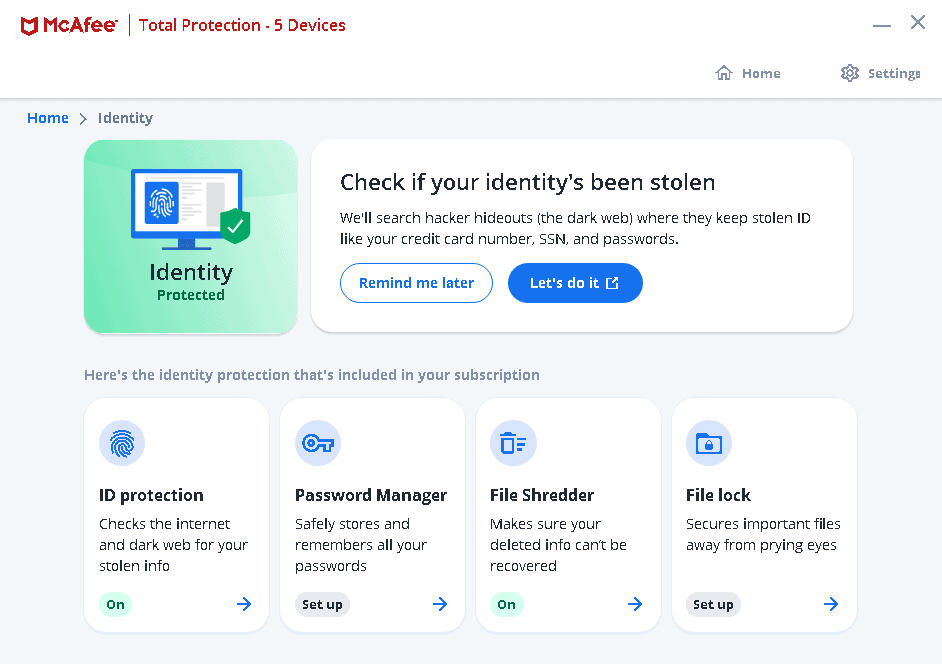

Digital Protections

Although we’re talking about identity theft protection services, Norton is best known for its Norton antivirus software. You can bundle in the Norton 360 software with LifeLock’s Select and Ultimate Plus plans.

LifeLock’s monitoring features help you respond to identity theft red flags. Norton 360 aims to prevent those red flags from appearing in the first place. The antivirus software shields you from devastating viruses and malware designed to harvest your personal data.

Norton 360 also includes a VPN, which is the same as the Norton Secure VPN we reviewed. While it lacks the advanced features of the best VPN services, it effectively masks your IP address and encrypts your connection. There’s also a password manager that helps you manage a secure vault of robust passwords.

Remember, these digital protection tools require active participation. Schedule regular virus scans, activate your VPN before browsing, and use the password manager consistently to maximize your security.

Did You Know: We made a roundup of the best antivirus and VPN bundles. These are great for pairing with a standalone identity theft protection. For instance, even though we bought the premium plan when testing Identity Guard, it did not come with online or device protections.

Now that you have a good idea of the features included with LifeLock, let’s change gears and talk about what it’s like to use this service on a daily basis.

Setting Up and Using LifeLock

As with other identity theft services we’ve tested, we lived with LifeLock for several months to get a sense of the daily experience. This started with the setup process and continued as we attempted to get the most value out of our sizable investment.

To set up LifeLock, we created a password and entered our basic information. Then, we entered our billing information and paid for the year. Once we made the purchase, the LifeLock dashboard appeared on our screen.

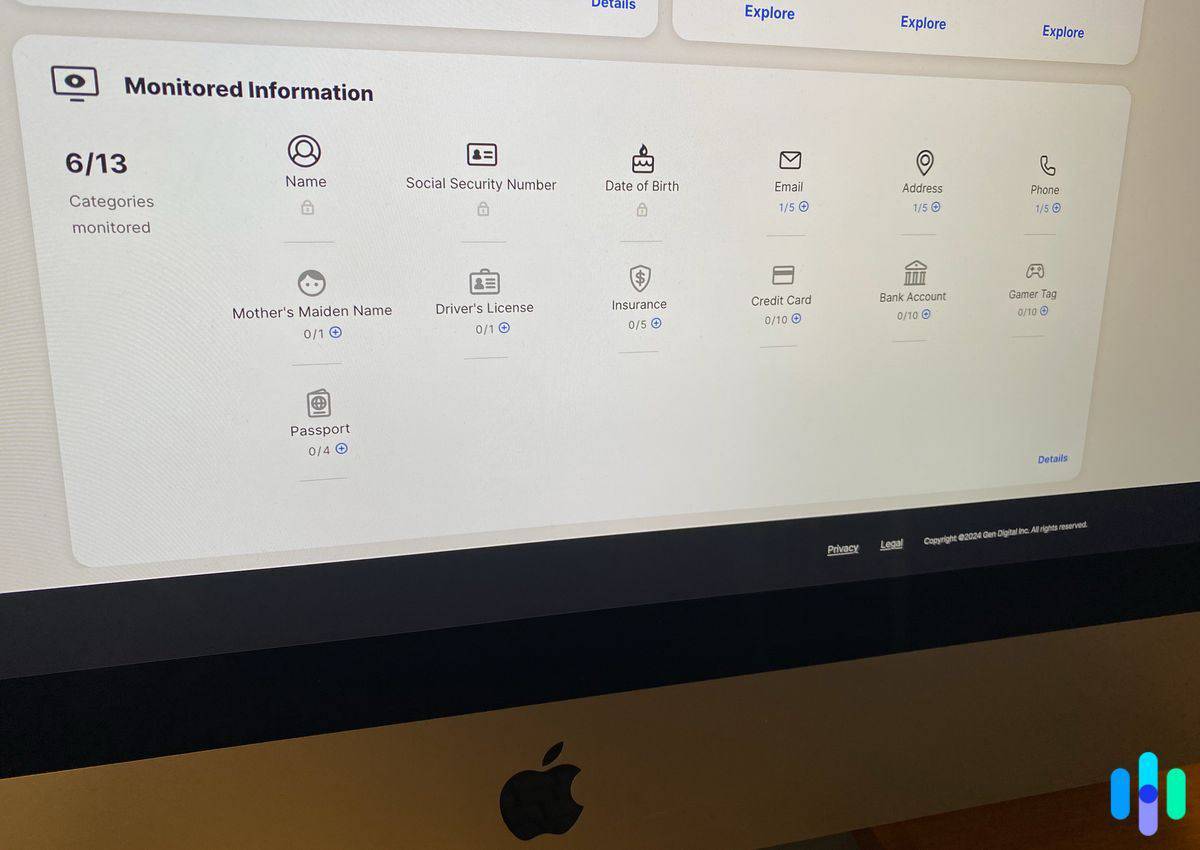

Once at the dashboard, we were asked if we wanted to add more personal information including:

- Insurance information.

- Bank account numbers.

- Driver’s license number.

- Credit card numbers.

We strongly advise providing as much information as possible. The more data LifeLock has, the better it can detect potential identity theft. LifeLock and similar services can only monitor the information you share with them.

Adding all of our information took about 45 minutes. Following that, we appreciated the desktop app’s refreshingly intuitive interface. Many competitors have cluttered, confusing apps that actually make protection harder. Norton 360’s streamlined approach made it easy to use all of its protection features.

That said, let’s take a minute to discuss some of the potential drawbacks of using LifeLock.

>> Further comparison: Lookout Identity Protection Review

LifeLock Drawbacks

One significant challenge with LifeLock is its complexity. The purchasing process requires careful attention. There are multiple plan tiers and add-on options to choose from. It’s easy to miss features you need or buy ones you don’t.

The two-app situation adds another layer of confusion. Since Norton and LifeLock operate as separate entities, mobile users must download both apps to access all features. It also means switching back and forth depending on the feature you’re looking for. We got used to it within a few days, but the learning curve can get frustrating.

Price is another consideration. LifeLock isn’t the most expensive option out there, but its premium plans are far from budget-friendly. Their renewal rates nearly double after the first year, too. That’s fairly standard for the industry, but it can still catch you off guard.

Identity theft protection is typically a long-term commitment. Before choosing LifeLock, ensure the renewal rates fit your budget, not just the promotional pricing.

With those two drawbacks in mind, let’s move on to the final word. Do we recommend LifeLock or not?

Is LifeLock Worth It?

Whether or not LifeLock is worth it comes down to your individual needs and budget, but here are a few key factors to consider when deciding if it’s right for you.

We’d go with LifeLock if you’d like…

- Identity monitoring and device security: LifeLock, through its Norton 360 with LifeLock plans, offers more features than any other similar service we’ve reviewed.

- Powerful protections: From credit freezes to dark web monitoring, LifeLock’s protections are comprehensive.

- User-friendly dashboard: LifeLock’s online dashboard is easy to navigate.

But you might consider…

- Convoluted purchasing process: Since they offer so many features, it’s easy to get overwhelmed.

- Confusing app: With two apps, it can be confusing to know which one to use and how to sign in.

- Price increase: After the first year, all of LifeLock’s plans increase in price.

LifeLock FAQs

-

How much does LifeLock cost?

LifeLock offers a wide range of pricing options, from $3.33 monthly for basic individual monitoring to $799.99 annually to renew family plans with comprehensive protection.

-

How does LifeLock work?

LifeLock alerts customers to potential indicators of identity theft from changes in credit reports to instances of their names being used in court documents. LifeLock also offers reimbursements for identities that are stolen while you have a subscription.

-

Is LifeLock good for families?

Yes, LifeLock offers a family plan that covers two adults and up to five children. That plan offers child-specific protections and can help alert you if your child is the victim of identity theft or fraud.

-

Is LifeLock a scam?

LifeLock had legal trouble in the past related to overpromising on services and incorrect handling of customer data, but they’ve since cleaned up their act. So much so that we don’t have a problem recommending them.

-

What are some alternatives to LifeLock?

LifeLock offers some of the most comprehensive identity theft protection in the business, but we’d say Aura offers better value.

-

Annual Credit Report. (2024). Review your credit reports.

https://www.annualcreditreport.com/index.action