LifeLock Identity Theft Protection Alternatives

LifeLock is the first choice for many when it comes to identity theft protection, simply because it’s one of the most recognizable providers. But LifeLock isn’t the only identity protection service, and it’s far from the only good option. In fact, if you’ve done your research or read our LifeLock review, you know that it has several downsides – high subscription prices, low identity theft insurance coverage on some plans, and confusing subscription options.

If you’re open to trying out LifeLock alternatives, our identity protection experts recommend starting with these three: Identity Guard, IdentityForce, and IdentityIQ.

LifeLock Identity Theft Protection Alternatives

-

1. Identity Guard®

View Plans Links to Identity Guard®Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $6.67 and up Family Monthly Plans $10 and up LifeLock and Identity Guard offer a lot of similar services, including:

- Credit monitoring and reports from all three bureaus

- Financial account monitoring

- Identity monitoring

- Dark web monitoring

- Identity theft insurance with reimbursements up to $1 million

That said, Identity Guard’s advantage is that all users get that $1 million coverage. With LifeLock, your reimbursements will depend on which plan you’re on, starting from $25,000.

Identity Guard’s pricing structure is also easier to understand, not to mention, slightly cheaper. Plus, Identity Guard offers a 14-day free trial. LifeLock doesn’t have any free trials.

We’d also like to put it out there that unlike LifeLock, Identity Guard has never run into issues with the FTC. If you’ll recall from our LifeLock review, the company has faced multiple issues throughout the years and paid millions in settlements.

In 2015, for example, LifeLock had to pay $100 million for violating a previous order from 2010 about securing customers’ personally identifiable information (PII) and advertising truthfully.1 So, in terms of trustworthiness, Identity Guard takes the cake over LifeLock. Learn more in our Identity Guard review or our head-to-head comparison of Identity Guard vs. LifeLock.

Of course, Identity Guard isn’t the perfect alternative to LifeLock. It’s missing a few features that LifeLock customers enjoy, namely, digital protection. With LifeLock and Norton partnering up, LifeLock users get the option to bundle antivirus and identity protection packages together. With Identity Guard, only a password manager and secure browser are included.

-

2. IdentityForce

Product Specs

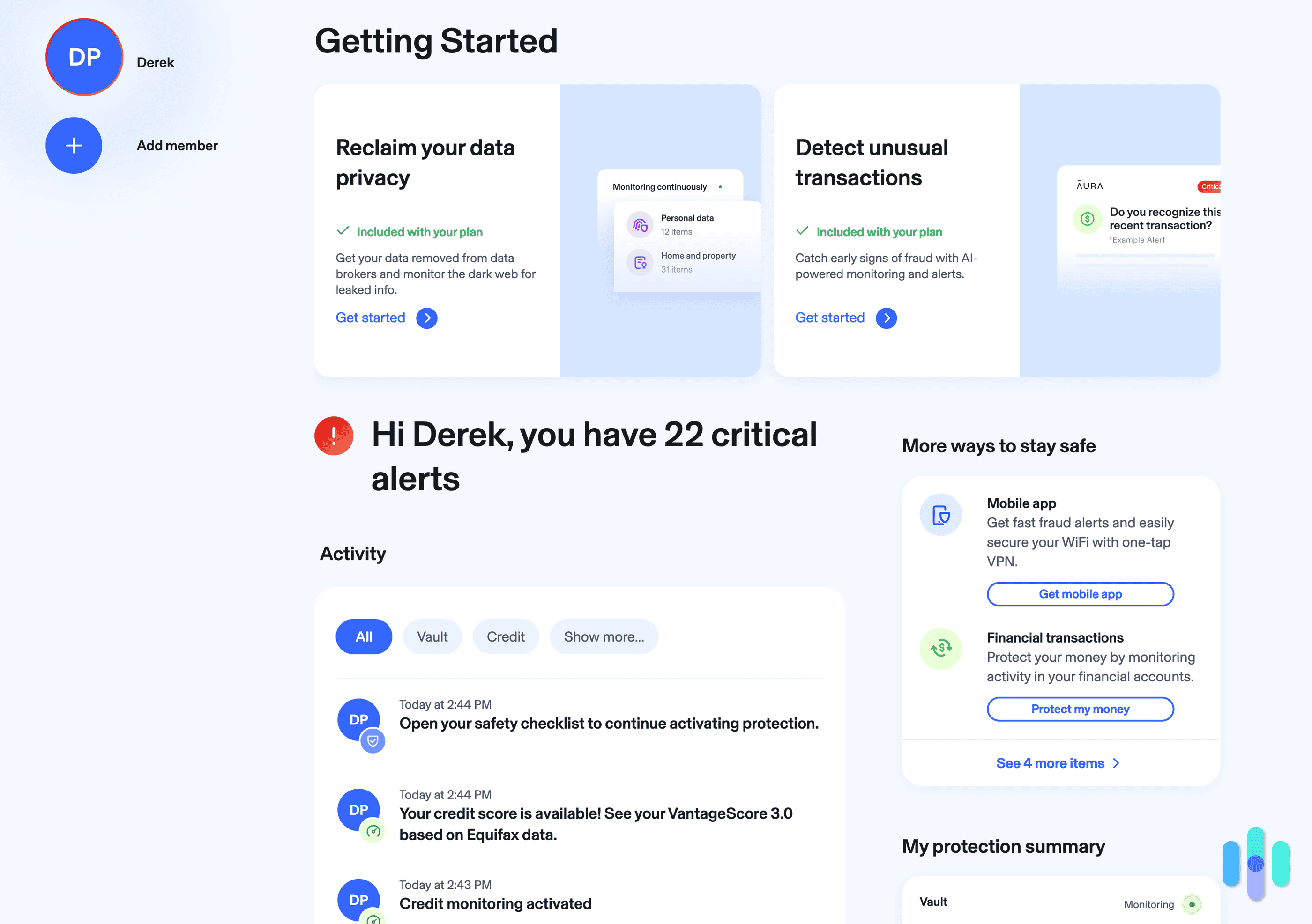

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $19.90 and up Family Monthly Plans $39.90 and up Another option is IdentityForce, which you can read about in more detail in our IdentityForce analysis or our LifeLock vs. IdentityForce comparison. IdentityForce offers comprehensive coverage for identity theft protection, which includes monitoring in these areas:

- USPS change-of-address requests

- Dark web

- Court records

- Payday loans

- Sex offender registries

- Social media accounts

- Bank accounts and credit

- Savings accounts

IdentityForce even removed our names from junk mail lists, as that mail could contain a lot of our personal information. If you want identity theft protection for businesses, IdentityForce is also a good option with free trials. Dive deeper in our IdentityForce subscriptions page, or compare Identity Guard vs. IdentityForce.

The downside with IdentityForce is that the base plans to include credit monitoring at all. We consider credit monitoring an essential identity theft protection feature, as your credit line is most likely to be the first one affected by identity theft. At least with LifeLock, you get credit protection – albeit a limited one – even with the cheapest plans.

NOTE: The IdentityForce website doesn’t include any pricing information for business plans. To get a quote, you’ll need to contact the company directly.

-

3. IdentityIQ

View Plans Links to IdentityIQProduct Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 7-day Individual Monthly Plans $8.49 and up Family Monthly Plans $25.50 and up Lastly, we recommend the Secure Max plan from IdentityIQ, which we detailed in our IdentityIQ review. With the Secure Max plan, we got monthly credit reports from the three credit bureaus.

FYI: The three major credit-reporting bureaus in the U.S. are Experian, TransUnion, and Equifax. Experian has its own identity theft protection service, which we tested in our Experian IdentityWorks review.

What’s included Secure Plan Secure Plus Secure Pro Secure Max Number of credit bureaus monitored 1 1 3 3 Dark web / online monitoring Yes Yes Yes Yes $1 million identity theft reimbursement maximum Yes Yes Yes Yes How often you receive credit scores and reports No Annually Biannually Monthly Enhanced credit report monitoring No No Yes Yes Crime record alerts No No Yes Yes Credit score change alerts No No Yes Yes Credit score tracker No No No Yes Credit score simulator No No No Yes Family protection No No No Yes Fraud restoration with LPOA No No No Yes Monthly price $8.99 $11.99 $21.99 $32.99 Monthly price with annual plan $7.67 $10.25 $18.75 $28.08 Like LifeLock, IdentityIQ isn’t cheap. Currently, as you can see on our IdentityIQ pricing page, the Secure Max plan costs $32.99 a month with a monthly payment plan or $28.08 a month if you sign up for a year. LifeLock charges similar prices, with the Ultimate Plus plan coming in at $29.99 a month. However, that price will increase after the first year, as will all of LifeLock’s pricing.

Note that the Secure Max plan from IdentityIQ also includes the Bitdefender VPN, which we tested out. So if you want an identity theft protection service and a VPN, the Secure Max plan will save you money.

Summary

Identity Guard, IdentityForce, and IdentityIQ aren’t the only LifeLock alternatives. You should also check out the best identity theft protection services overall, the best identity theft protection for seniors, the best credit protection, and the best identity restoration services.

Using a service like this is the best way to prevent identity theft, and it will still help you even if your identity is stolen in an event like a data breach that’s out of your hands. With identity theft insurance that offers reimbursement up to $1 million and identity restoration specialists, you’ll be back in control of your PII in no time.

In 2020, the FBI counted 43,330 victims of identity theft.2 Don’t become a victim this year; protect your identity, debit and credit cards, credit information, Social Security number, and other important data with identity theft services.

Federal Trade Commision. (2015). LifeLock to Pay $100 Million to Consumers to Settle FTC Charges it Violated 2010 Order.

ftc.gov/news-events/press-releases/2015/12/lifelock-pay-100-million-consumers-settle-ftc-charges-it-violatedFederal Bureau of Investigation. (2020). Internet Crime Report.

ic3.gov/Media/PDF/AnnualReport/2020_IC3Report.pdf