LifeLock vs Zander ID Theft Protection

Which identity monitoring service is more trustworthy, LifeLock or Zander Insurance? Our experts weigh in.

Aliza Vigderman, Senior Editor, Industry Analyst

&

Aliza Vigderman, Senior Editor, Industry Analyst

&

Gabe Turner, Chief Editor

Last Updated on Oct 07, 2024

Gabe Turner, Chief Editor

Last Updated on Oct 07, 2024

- Full-service identity theft and credit monitoring

- Device protection with Norton 360 antivirus

- Reputation for outstanding customer service

- Affordable plans start at just $6.75 per month

- Up to $2 million in stolen funds reimbursement

- Unlimited recovery services with no time or monetary limits

How do LifeLock and Zander Insurance compare for identity theft protection? This article compares LifeLock vs Zander prices and features.

Before we delve into details, here are three takeaways from this comparison:

- Both LifeLock and Zander provide generous insurance policies. Their ID theft insurance can replace stolen funds, pay lawyers, and otherwise help restore your identity. Even so, the cheaper Zander policy has an even higher potential payout compared with two of three LifeLock plans.

- Zander is more affordable. This holds true for individual coverage and whole-family protection alike.

- LifeLock has a wider range of features. At all price tiers they include Norton 360 and at least single-bureau credit alerts. Zander doesn’t provide antivirus software or credit bureau alerts, but they can send alerts based on other sources.

When you look at Zander Insurance’s website, it looks like they have two plans for ID theft protection. But, really, they only have one ID theft protection plan. The other plan on the ID theft protection page is a bundle of services on top of ID theft protection. They charge a pretty consistent rate of $6.75 per month for individual adults or $12.90 per month for families. You can bring these prices down even further with the annual plans that cost $6.25 per month for individual adults or $12.08 per month for families.

LifeLock pricing is more complicated. The company often experiments with price changes and has online sales. At last check, their three plans had introductory prices ranging from $7.50 to $34.99 per month per adult, and $5.99 per month per minor. LifeLock prices increase after a year.

Next we give company overviews, explain Zander ID theft protection, and compare the Zander plan with all three LifeLock options.

Zander and LifeLock Company Profiles

Zander Insurance is a family-run business headquartered in Nashville, Tennessee. It touts itself as the only ID theft protection company endorsed by Dave Ramsey, a nationally syndicated radio personality focused on financial education for consumers. Zander is unique in other ways too:

- It’s the only fraud protection company we review that’s primarily an old-fashioned insurance agency. Along with ID theft insurance they can broker automobile insurance, homeowners insurance, life insurance, and other types of financial protection.

- Zander Insurance is much older than LifeLock and many other main competitors. It dates back to 1925 whereas others emerged in the Digital Age.

- The company is 49% employee-owned. Many competitors are more beholden to public shareholders.

Zander has an A+ rating from the Better Business Bureau and is a BBB-accredited company. Assurant is their underwriter.

LifeLock is primarily focused on identity theft protection. The company was founded by two businessmen in 2005. Both entrepreneurs have moved on to other projects. Leaders formerly from Yahoo and other big-name companies have taken their roles. The company is now owned by the California-based software company Symantec and is traded on the NYSE. Customer service is provided from Tempe, Arizona.

LifeLock is not BBB-accredited and has an A+ Better Business Bureau rating for 2024. The company lost some esteem in the 2010s when found guilty of misleading customers about the degree to which ID theft can be prevented. This scandal circles around those ads you might remember of the CEO sharing his social security number saying that LifeLock will still keep his identity safe. Well, it didn’t. Zander presents LifeLock’s troubled past as a reason for their own heavier focus on identity restitution versus ID theft prevention.

ID theft insurance from LifeLock is underwritten by AIG.

Zander Pricing & Cancellation vs LifeLock

With Zander you can choose month-by-month payment or save slightly with an annual plan. Either way, you’ll pay less compared with LifeLock and other leading providers. Zander ID protection prices are:

- Individual Plan: $6.75 per month, or $75 with annual payment (Works out to $6.25 per month)

- Family Plan: $12.90 per month, or $145 with annual payment (Works out to $12.08 per month)

Yearly Zander subscriptions can be refunded on a prorated basis at any time. This means, if you can afford the annual subscription, it’s definitely worth it. Even if you decide you want to cancel after the fifth month of your subscription, you’ll get the money back for the remainder six months of your subscription. So, you’d get a prorated refund of $37.50 for an individual plan or $72.50 for a family plan.

LifeLock offers annual subscriptions only. Prices range from $8.99 to $25.99 per adult each month during the first year of service. The company offers limited options for family plans. You can either choose a plan for two adults or a plan for two adults and five children. That doesn’t really cover many families, so we recommend tailoring your plan to your family with LifeLock Junior accounts for minors that cost $5.99 per month for each of your kids. LifeLock offers a refund only during the first 60 days of membership.

Read more about Lifelock in our 2025 LifeLock Identity Theft Protection Review.

Zander ID Theft Insurance

The Zander plan for ID theft protection has three main parts. It can:

- Monitor your accounts, the dark web, and other sources for signs of fraud

- Compensate you for stolen funds and other theft-related expenses

- Save your time by providing help with paperwork, phone calls, and other aspects of identity restoration

The benefits count as “comprehensive.” Still they’re not as broad as what some others provide, and that helps explain why Zander ID theft insurance costs less… even though their insurance payout can be higher.

Read more about Zander in our Zander Identity Theft Review.

What Can Zander Monitor?

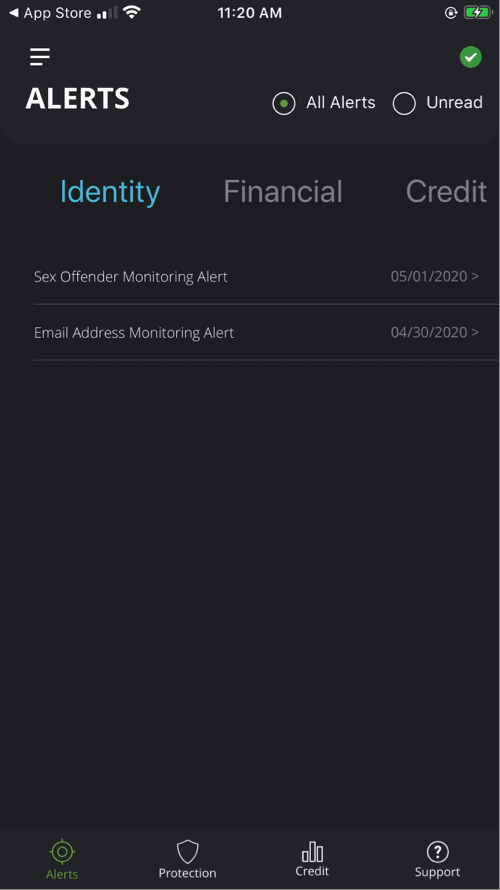

While they don’t connect with credit bureaus, Zander Insurance can monitor a wide variety of sources for the early detection of identity fraud. Protection includes dark web alerts, which means that Zander can notify you if your personal data is leaked or posted for sale… and 24/7, they can help you understand how to respond.

The company also monitors for the fraudulent use of your identity data in:

- Court records

- Employment applications

- Medical records

- Tax return filings

- Vehicle title applications

- And more

Types of data they can look for include your name, SSN, driver’s license number, phone number (up to five), and email address (up to five). The company also monitors change of address notifications filed with USPS.

Furthermore, Zander ID theft protection can monitor your accounts for signs of criminal targeting. Here are the types of accounts/numbers that you can have tracked for signs of mayhem:

- Bank accounts

- Credit and debit cards

- Email accounts

- Medical ID numbers

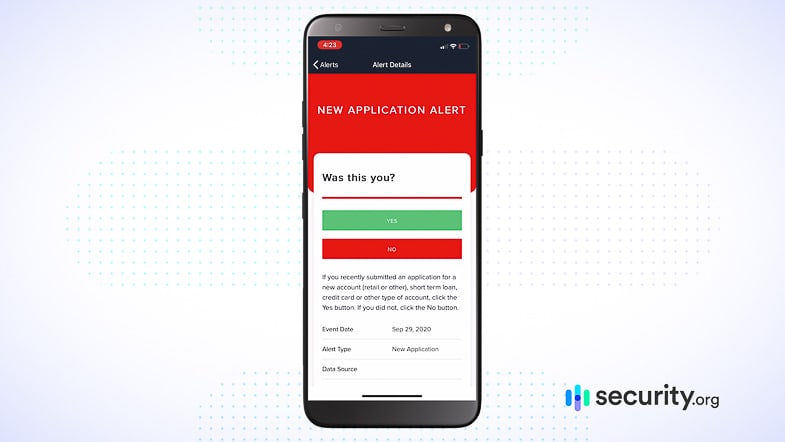

Zander scans its sources daily. If potential trouble is detected, they send alerts by email and/or via the Zander ID Theft Protection mobile app.

What’s Missing

Zander’s list of proactive measures is impressive. Still, you’d miss out on three-bureau credit alerts and reports by choosing Zander vs LifeLock’s best plan (UltimatePlus, $25.99 per month and up). If you opt for Zander’s more affordable service, then it’s a good idea to supplement it with free credit reports.

According to federal law you’re entitled to a free report from each bureau (Equifax, Experian, and TransUnion) once per year. As Zander’s website points out, you can stagger your requests to get a free credit report every four months.

Compensation and Identity Restoration

Zander’s deal on ID theft protection is especially valuable in case trouble strikes. Each member is covered with a $1,000,000 insurance policy to replace stolen funds and another $1,000,000 policy to cover expenses incurred for ID theft restoration. The family plan comes with a $2,000,000 insurance policy to replace stolen funds.

The company can replace up to $7,500 per month in lost wages if you lose work hours because of identity restoration efforts. However, Zander ID theft insurance is meant to minimize your lost time. They’ll connect you with a certified ID fraud case manager, and this person can work on case resolution for up to three years.

You can assign limited power of attorney to let the case manager work with creditors, law enforcement, and others on your behalf. The person will also scan databases for other signs of crimes for up to three years.

Lost wallet service is part of membership too. If your wallet is lost or stolen, Zander can quickly deactivate and replace the credit and debit cards, SSN card, health insurance cards, and more.

More About Zander Family ID Protection

Compared with LifeLock, Zander provides especially affordable ID protection for families. With a $12.08 per month Zander policy a “family” can include a primary adult member, a second adult, and up to 10 minors. Typically the second adult is the primary member’s spouse or partner, but the person could instead be their parent, sibling, adult child, or any other adult living at that address.

The primary member’s children can continue getting some benefits of the plan even after turning 18 years old; special clauses apply for adult children who remain dependent because they are in college full-time (through age 26) or have a disability.

Plans from LifeLock vs Zander

How does LifeLock compare with Zander? Pricewise, their closest option is called LifeLock Select.

- For single adults Zander Insurance and LifeLock Select have similar costs on annual plans: $6.25 per month and $8.99 per month, respectively.

- For families LifeLock Select can cost significantly more. Zander has a flat rate of $12.08 per month while LifeLock charges separately for each adult and child.

LifeLock Select vs Zander

Like the Zander plan, LifeLock Select monitors the dark web and other sources for signs of identity theft. Regarding the “other sources,” each company has advantages over the other:

- Zander scans a wider variety of databases and will also track your financial accounts. Some of their services, such as tracking your bank accounts, are only available with LifeLock Ultimate Plus, not with Select.

- Only LifeLock can send alerts based on credit report changes. With LifeLock Select you’ll get the benefit of their checking with Equifax every day.

Another big LifeLock advantage is the inclusion of Norton 360 software. A Select subscription lets you protect up to five desktop and mobile devices with VPNs, a password vault, anti-phishing software, cloud backup, and other features for computer safety. The $8.99 per month LifeLock Select plan for one adult is a bargain considering that Norton 360 alone goes for $9.99 per month.

But how does coverage compare in case of trouble? Zander could provide almost $1M more. Here’s the breakdown:

LifeLock Select

- $25,000 stolen funds

- $25,000 personal expense compensation

- $1,000,000 for lawyers and other experts in ID restoration

Zander ID Theft Insurance

- $1,000,000 for funds stolen through fraud, embezzlement, or forgery

- $1,000,000 for expenses incurred because of ID theft, such as lost wages; lawyers; travel; eldercare and childcare

In sum, LifeLock’s cheapest plan is more focused on ID theft prevention through computer safety. Zander has a more robust insurance plan and can monitor more accounts. This makes it our preference for ID theft protection under $10 per adult, provided that you have another source (e.g., your credit card provider) for credit bureau change alerts.

LifeLock Advantage vs Zander

LifeLock Advantage is the company’s mid-tier plan. It initially costs $17.99 per month per adult, and then $24.99 monthly after a year. Compared with LifeLock Select, it expands ID theft compensation by up to $150K. However, financial compensation still falls short of what Zander Insurance would deliver. Advantage includes:

- $100,000 stolen funds

- $100,000 personal expense compensation

- $1,000,000 for lawyers and other experts in ID restoration

Other upgrades with LifeLock Advantage compared with Select are court records monitoring and bank account/credit account monitoring. These services are included with the much more affordable Zander plan.

Finally, LifeLock Advantage lets you install Norton 360 on more devices compared with LifeLockSelect. The limit is ten instead of five.

All in all, Zander seems like the better buy when compared with LifeLock Advantage.

LifeLock Ultimate Plus vs Zander

The premium LifeLock plan, Ultimate Plus ($25.99 per month), has insurance compensation to outshine Zander and the other LifeLock plans. It includes:

- $1,000,000 stolen funds replacement

- $1,000,000 personal expense compensation

- $1,000,000 for lawyers and other experts in ID restoration

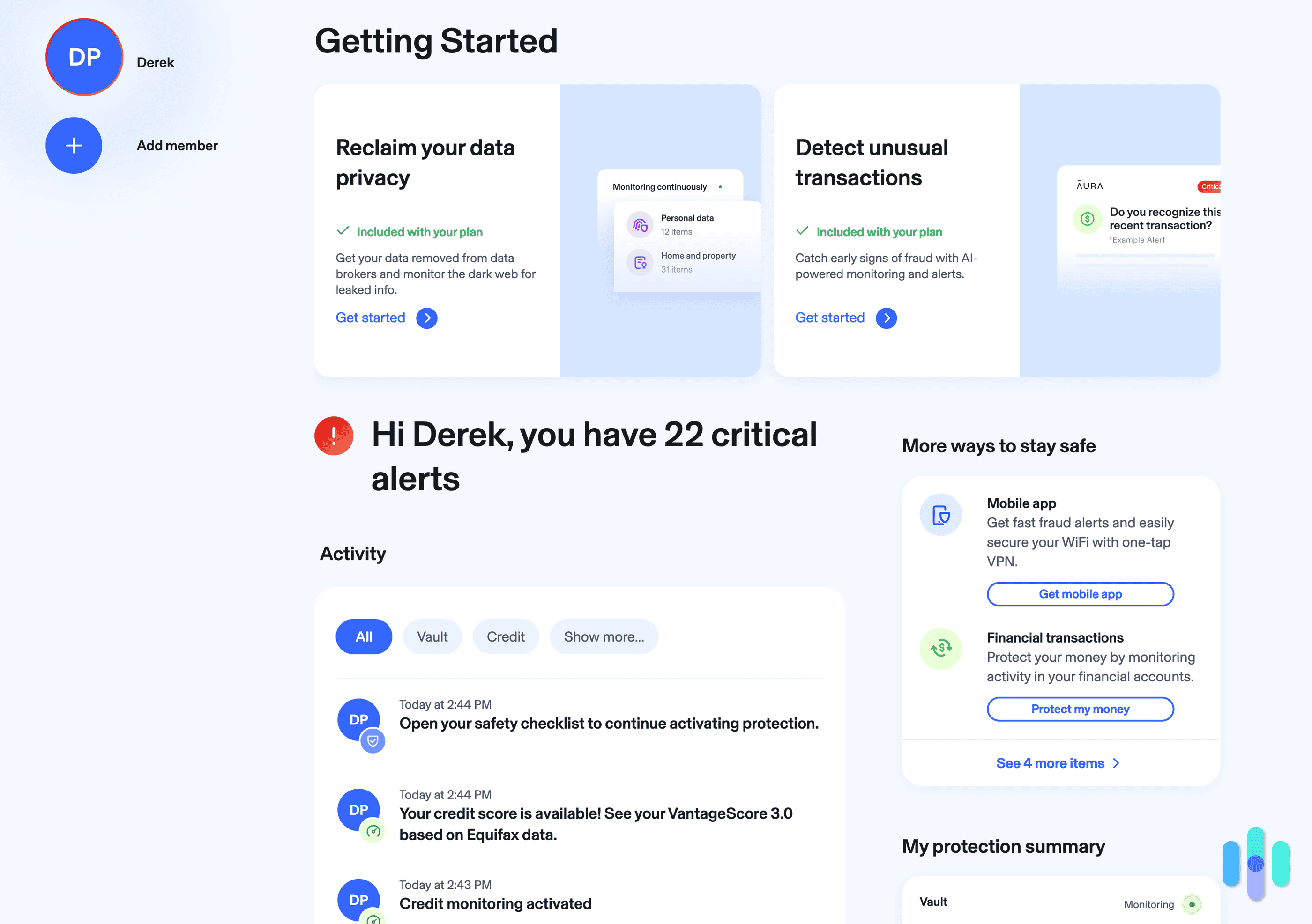

Other important features are activated with the Ultimate Plus upgrade: With this plan LifeLock will send three-bureau credit alerts, provide annual credit reports with Vantage scores, and monitor your banking and investment accounts. Zander, in contrast, doesn’t have the credit bureau and credit report options.

Furthermore with LifeLock Ultimate Plus you can install Norton 360 on virtually unlimited devices.

Compared with Zander, LifeLock Ultimate Plus gives more insurance, provides valuable credit bureau alerts, and can protect and backup all your computers and mobile devices. It costs a lot more than Zander but many customers find it worth the extra expense.

Summary

The question of whether LifeLock or Zander is superior may come down to how much you’re willing to spend, and whether you’re more concerned about theft or recovery.

Generally speaking LifeLock places more emphasis on data protection with its Norton 360 perk, and Zander provides better value in case trouble strikes.

LifeLock has the edge in credit bureau alerts and credit bureau reports, but Zander offers bank account monitoring and other benefits for less.

Zander is more affordable overall and especially after the first year of service.

Not sure if Zander or LifeLock is right for you? Read our guide about the Best Identity Theft Protection Services in 2025.

*LifeLock does not monitor all transactions at all businesses.

**Terms apply to all LifeLock plans.

***The credit scores provided are VantageScore 3.0 credit scores based on data from Equifax, Experian and TransUnion respectively. Any one bureau VantageScore mentioned is based on Equifax data only. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

****Reimbursement and Expense Compensation, each with limits of up to $1 million for Ultimate Plus, up to $100,000 for Advantage and up to $25,000 for Select, when purchased in Norton 360 with LifeLock plans. And up to $1 million for coverage for lawyers and experts if needed, for all plans. Benefits under the Master Policy are issued and covered by United Specialty Insurance Company (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: LifeLock.com/legal.