LifeLock vs IdentityForce

Aliza Vigderman, Senior Editor, Industry Analyst

&

Aliza Vigderman, Senior Editor, Industry Analyst

&

Gabe Turner, Chief Editor

Last Updated on Aug 23, 2024

Gabe Turner, Chief Editor

Last Updated on Aug 23, 2024

- Monthly plans cost between $19.90 and $39.90

- Yearly plans cost between $199.90 and $399.90

- Save up to $78 with the annual plans compared to the month-to-month plans

- Full-service identity theft and credit monitoring

- Device protection with Norton 360 antivirus

- Reputation for outstanding customer service

LifeLock and IdentityForce compete to protect adults, children, and businesses from identity theft and fraud. For a flat monthly fee, they provide:

- Preventive services

- ID fraud alerts

- Stolen funds replacement

- Fully managed identity restoration

Two of the Best Identity Theft Protection Services, membership with either company could save you countless work hours on identity restoration. It could also help you recover a million dollars or more! Prices range from $9.99 to $34.95 per adult account each month. With IdentityForce only, people sharing a home can share an account.

Read on for a detailed LifeLock vs IdentityForce comparison with prices for individuals and families. We personally tested LifeLock and IdentityForce to create a detailed comparison based on our real experience. The main sections of this guide are:

- Key Differences Between LifeLock and IdentityForce

- Company Profiles

- Overall Price Comparison – LifeLock vs IdentityForce

- Credit Monitoring Comparison – LifeLock vs IdentityForce

- Other Features – Best LifeLock vs IdentityForce Plans

- Compare LifeLock vs IdentityForce Family Plans

Key Differences Between LifeLock and IdentityForce

Which company could serve you best? The following points might help you decide. Reading them, remember that the most effective ID theft protection plans will alert you to credit report changes from all three major credit bureaus: Equifax, Experian and TransUnion.

- IdentityForce has the best ID protection deals for couples and for subscribers protecting children from SSN theft and other identity crimes. You could pay about half as much compared with choosing LifeLock. Details are below under “LifeLock vs IdentityForce Family Plans.”

- For middle-income shoppers we generally recommend IdentityForce over LifeLock. IdentityForce gives the best value on ID theft protection with three-bureau credit reporting. Their premier plan, called UltraSecure+Credit, costs $19.99 per month per adult and about $2.25 per month per child if you choose 12 months to start. A 30-day risk-free trial is included with yearly subscriptions. You can also choose month-to-month service with slightly higher fees.

- For high-income customers LifeLock may be best. That’s because compared with the best IdentityForce plan, the best LifeLock plan with three-bureau reporting gives even more insurance to cover stolen funds and pay lawyers’ bills. Called Ultimate Plus, it costs $29.99 per month per adult and $5.99 per child. A year-long commitment is required but you get 60 days to back out.

- LifeLock is also better price-wise if you’re seeking very cheap ID protection. The Select plan is just $9.99 per month during the first year of service. However, a big drawback of this cheap LifeLock plan is skimpy credit monitoring! You could miss out on big clues that ID theft is underway.

Again, IdentityForce has the best deal overall on ID theft protection with three-bureau credit monitoring.

Company Profiles

Both LifeLock and IdentityForce are American corporations founded in 2005. From opposite coasts, they serve all 50 states. LifeLock is based in Tempe, Arizona and IdentityForce is in Framingham, Massachusetts.

IdentityForce was formed by the brother-sister duo Steven Bearak and Judy Leary. They launched the company as experts in the asset protection industry. Since 1978 their family had operated a thriving business, Stop-Loss Associates, that used credit and non-credit information to help protect government agencies and corporate clients from fraud. IdentityForce is a more personal version of Stop-Loss with its individual and family accounts.

LifeLock was started by the former business majors Todd Davis and Robert Maynard, Jr. Davis had been a star student at Baylor University, and Maynard graduated from college with honors in just five semesters. The two attracted start-up capital from Goldman Sachs and other major investors. Since 2017 LifeLock has been a subsidiary of Norton Symantec. The business arrangement has benefited LifeLock customers by adding Norton LifeLock anti-virus and anti-phishing software to accounts at all price points.

Finally, IdentityForce has been accredited with the Better Business Bureau since 2007. The company has an A+ rating. LifeLock is not BBB accredited but it still has an A+ rating from the Bureau.

Has Your Identity Been Stolen? If you think someone may have stolen your identity, check out our full guide on How To Check If Someone Is Using My Identity.

Overall Price Comparison – LifeLock vs IdentityForce

Compared with IdentityForce, LifeLock has both cheaper and pricier plans. In our review, an IdentityForce deal is best. Here is an overview of each company’s rates and policies for you to easily compare prices:

- LifeLock prices per adult range from $8.29 to $34.99 per month with an annual plan.

- Discounts for partners and families are not offered.

- Month-to-month plans aren’t offered.

- After 12 months LifeLock prices increase: The cheapest plans are bumped to $11.99 per month; the mid-tier Advantage plan moves from $19.99 to $24.99; and Ultimate Plus jumps from $29.99 to $34.99.

- IdentityForce prices per solo adult are $14.99 and $19.99 per month with annual plans.

- Month-to-month plans for one cost $17.99, or $23.99 with three-bureau credit reporting.

- Couples and other families get discounts.

- Rates aren’t set to increase after a year of service. That’s an important difference when you compare LifeLock vs IdentityForce.

LifeLock has the cheapest plan overall… but is their $8.29 deal worthwhile? Generally no, as you’ll miss out on three-bureau credit alerts, credit reports, and credit scores. Also consider that the $8.29 LifeLock plan has a low insurance payout of just $25,000 for stolen funds. For comparison the cheapest IdentityForce plan has a $500,000 policy for stolen funds and to cover other expenses, and it costs just $6.70 per month more. On top of the lack of key features, LifeLock’s plans also increase in price after the first year. So, the second year of LifeLock will cost you at least $12.50 per month if you renew for a year. That brings the price difference down to just $2.49 per month.

Credit Monitoring Comparison – LifeLock vs IdentityForce

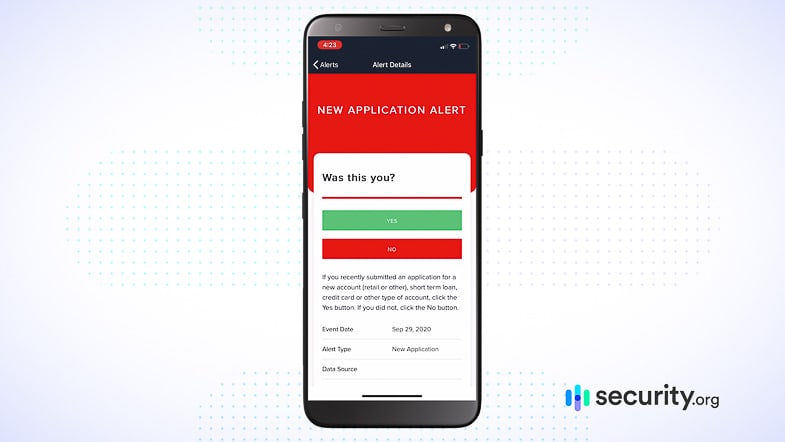

Monitoring your credit reports can help you identify fraud in its early stages. Obviously, this gives you a better shot at avoiding more serious consequences of identity fraud. For instance, with credit monitoring, you could be notified within a few minutes if somebody applied for a car loan in your name. This would give you time to contact the dealership before a fraudster drove away with your name tied to a big new investment.

ID protection companies can alert you in virtually real-time by smartphone, email, or a landline call. If you didn’t have credit monitoring, on the other hand, you might not be alerted to the problem until “your” first car payment was 60 days overdue.

The best ID protection plans from LifeLock and IdentityForce include alerts if your credit profile changes with Equifax, Experian or TransUnion. You can get notice right away of credit inquiries, new accounts, late payments and more. Furthermore the plans supply you with credit reports and scores.

IdentityForce has the better price on ID theft protection with three-bureau credit reporting: $19.99 per month with annual plans vs LifeLock’s $24.99 per month rate, which eventually increases to $29.16 per month. They also have superior credit-related features which makes them one of the best credit protection services on the market.

IdentityForce Ultra Secure+Credit

The top IdentityForce plan is called UltraSecure+Credit. Credit-related features help set it apart from the cheaper IdentityForce option called UltraSecure. You’ll get these extra benefits:

- Three-bureau monitoring for credit change alerts

- Quarterly three-bureau FICO credit scores & reports

- Monthly FICO credit score tracker

- FICO credit score simulator

Prices for UltraSecure+Credit

- IdentityForce UltraSecure+Credit for one adult costs $23.95 per month without a contract, or $19.99 per month with 12 months of service.

- It costs $36 per month for two adults with a 12-month agreement. Adults can’t see each other’s private account info.

- Children can be added for $2.75 month-to-month or even less at $27.50 per year.

LifeLock Ultimate Plus

LifeLock’s subscriptions include three main plans for ID theft protection. Starting rates for adults are $9.99, $19.99 and $29.99 per month. Children can be added to any adult plan and receive similar benefits for $5.99 per month.

Only the $29.99 plan, LifeLock Ultimate Plus, has three-bureau credit monitoring. You could get single-bureau monitoring (Equifax) with the $19.99 plan… but excluding TransUnion and Experian would be like locking your home’s front door and leaving other entrances wide open.

LifeLock Ultimate Plus provides annual three-bureau reports with Vantage 3.0 scores. Combining these with the free annual credit reports to which all consumers are entitled, you can keep a better eye on your credit profile.

Still IdentityForce has the better deal. IdentityForce UltraSecure+Credit lets you pay less and see your quarterly FICO scores within their app. The plan also includes a monthly credit score tracker and a credit change simulator to help you make the best financial decisions.

Review

Compared with LifeLock, IdentityForce can provide more valuable credit reporting.

- Top-tier IdentityForce membership includes quarterly credit reports and scores from all three bureaus. LifeLock limits credit scores to annual reports.

- IdentityForce has the advantage of dealing in FICO scores while LifeLock gives Vantage scores. FICO scores are more popular with lenders.

- Only with IdentityForce can you get a monthly credit score tracker.

Additionally, with IdentityForce, you’ll get a credit score simulator. That’s not included with LifeLock Ultimate Plus or any other LifeLock plan.

Other Features – Best LifeLock vs IdentityForce Plans

As explained above, IdentityForce UltraSecure+Credit is superior in terms of credit reporting. A possible advantage with LifeLock Ultimate Plus though is $1,000,000 legal expense insurance policy. That’s in addition to $1,000,000 insurance for stolen funds. With IdentityForce, lawyers’ bills and stolen funds replacement would be deducted from a single $1M policy. You wouldn’t need to pay a deductible with either company.

Here are some features that both top-tier plans share:

- Two-factor authentication

- Mobile and desktop account access

- Dark web monitoring

- SSN fraud alerts

- Banking and investment account alerts

- Alerts about crimes committed in your name

- Alerts about sex offenders in your neighborhood

- Lost wallet protection

Only IdentityForce will also monitor payday lenders, vehicle registration databases, medical insurance records, and social media sites for identity fraud.

LifeLock might have special appeal with its Norton computer protection. However, IdentityForce provides similar benefits with its dark web monitoring, anti-keylogging software, and other features for safer web use with Android and iOS equipment.

Compare LifeLock vs IdentityForce Family Plans

IdentityForce wins in price comparisons for couples and for singles or partners with children. Only IdentityForce offers discounts to couples and other families. Also, IdentityForce has lower prices per child.

With IdentityForce a couple and children can share an UltraSecure+Credit account for $36 per month. With LifeLock two adults would pay a total of about $60 per month for top-tier service, plus a $5.99 fee would be added for each child. Besides that, LifeLock prices for adults increase after 12 months; a bill for two would increase from $59.98 per month to $69.98.

Going a la carte with IdentityForce, a single adult could get top-tier service for just $19.99 per month and add children for about $2.25 each, or $2.75 each month-to-month.

Conclusion

In a LifeLock vs IdentityForce showdown, generally IdentityForce has the advantage. It’s true that LifeLock has an eye-catching $9.99 rate… but considering its non-relationship with the credit bureaus, the attached plan leaves you more vulnerable compared with a $19.99 IdentityForce deal. Furthermore the cheap LifeLock plan would have your back legally but could only replace $25K in stolen funds. The best IdentityForce plan could provide up to $1 million in stolen funds replacement and legal services.

You could get more insurance coverage from LifeLock by upgrading to their $29.99 plan… but all in all, IdentityForce would still be the better service in more situations. The UltraSecure+Credit plan monitors a variety of sources such as payday lenders and medical insurance billers that aren’t part of the LifeLock world. It’s also the better buy in comprehensive ID theft protection for partners and adults with children.

Want to learn more about IdentityForce? Read our detailed IdentityForce review or how they compare to Identity Guard.

*LifeLock does not monitor all transactions at all businesses.

**Terms apply to all LifeLock plans.

***The credit scores provided are VantageScore 3.0 credit scores based on data from Equifax, Experian and TransUnion respectively. Any one bureau VantageScore mentioned is based on Equifax data only. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

****Reimbursement and Expense Compensation, each with limits of up to $1 million for Ultimate Plus, up to $100,000 for Advantage and up to $25,000 for Select, when purchased in Norton 360 with LifeLock plans. And up to $1 million for coverage for lawyers and experts if needed, for all plans. Benefits under the Master Policy are issued and covered by United Specialty Insurance Company (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: LifeLock.com/legal.