ID Watchdog: Your Payment Options

- Secure two-factor authentication

- Outstanding credit monitoring features

- Complete identity theft restoration

Your identity – your personally identifiable information – might be intangible, but it’s a prime target for thieves. Criminals are looking to steal personal information to use in fraudulent activities, and the worst thing is, you might not immediately realize if it gets stolen. Your personal information isn’t something you can simply lock away in a vault.

Fortunately, there are identity theft protection services that, for a fee, will watch your identity like a dog watches a bone. ID Watchdog is one of those services, and it’s from Equifax. Yes, the same Equifax that makes up one-third of the major credit bureaus in the U.S. Curious to see what they offer? We bought a subscription ourselves so we could cover all that and more below.

Pros and cons

| Pros | Cons |

|---|---|

| Affordable | Based in the U.S. |

| Daily credit reports | Poor iOS app |

| $1 million reimbursement maximum | Data breach |

Our Favorite Features

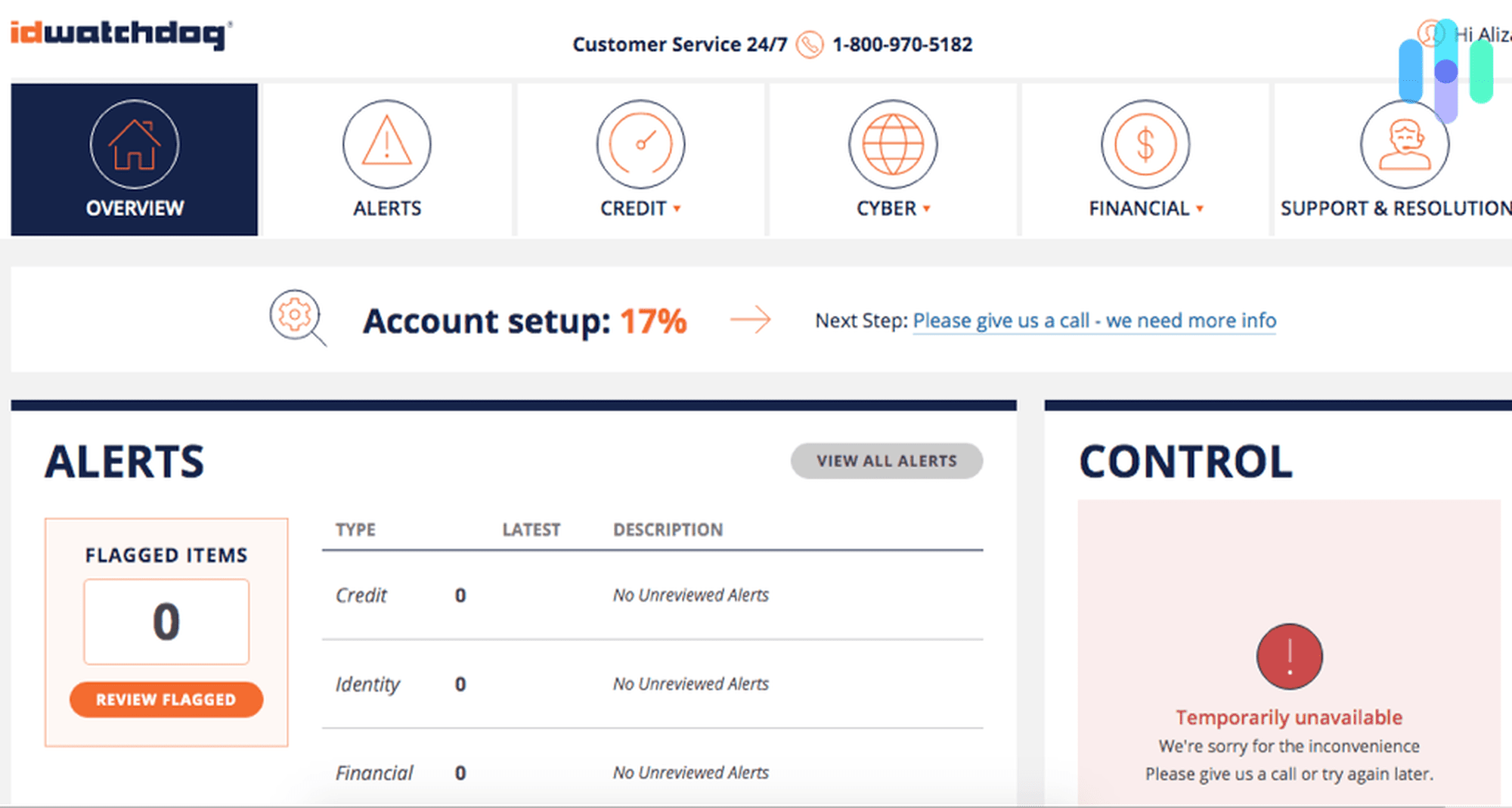

ID Watchdog offers a competitive package compared to companies like myFICO that can charge up to $49.95 per month for identity and credit monitoring. Although they may be missing some of the more niche or luxury amenities of a more expensive package, they provide a great service for the money. Now, we know the importance of getting credit monitoring results from multiple credit bureaus and since that is only available through ID Watchdog’s Premium subscription, we decided to go for the upgrade. Without any more fanfare, let’s jump right into our favorite features of ID Watchdog.

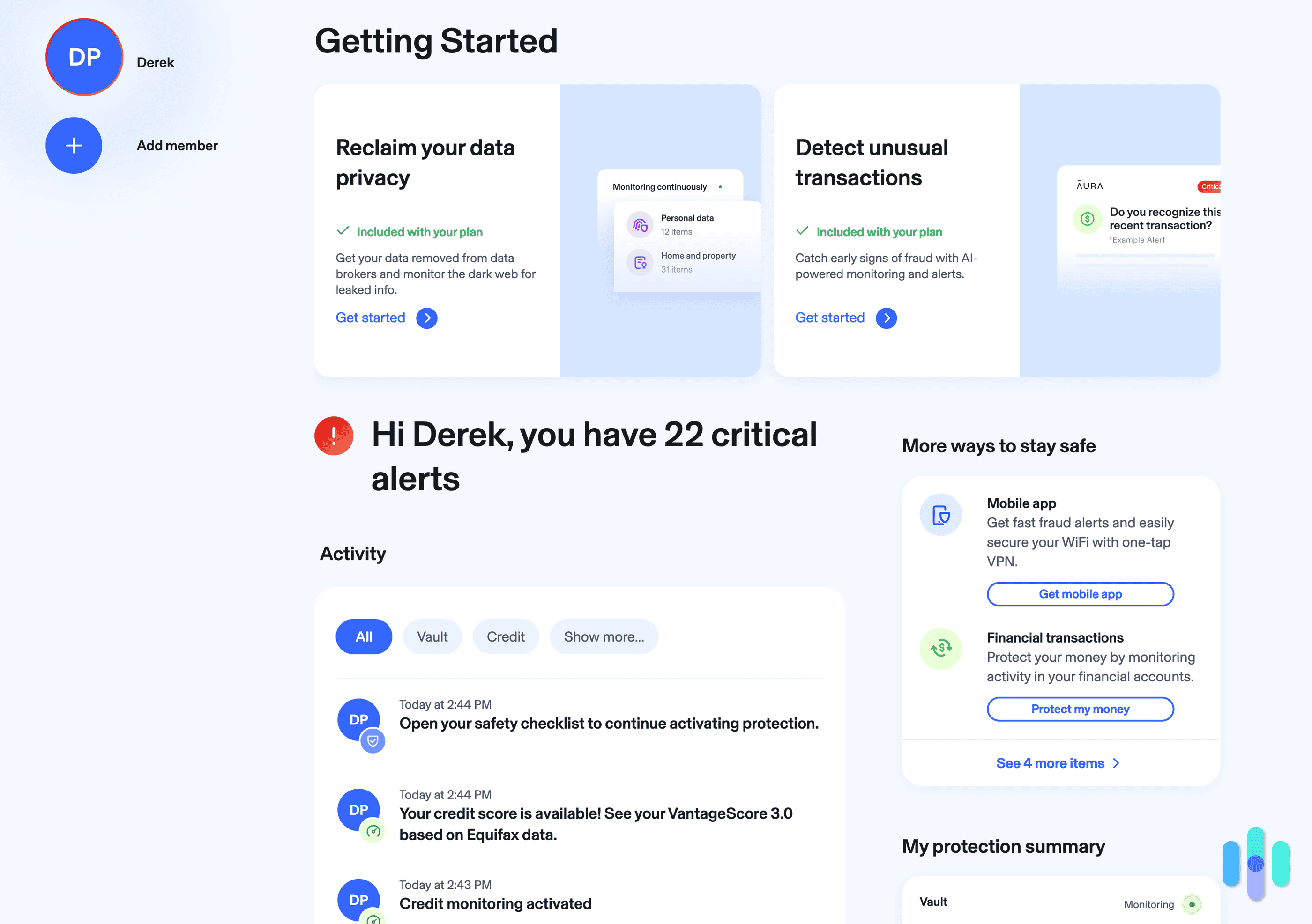

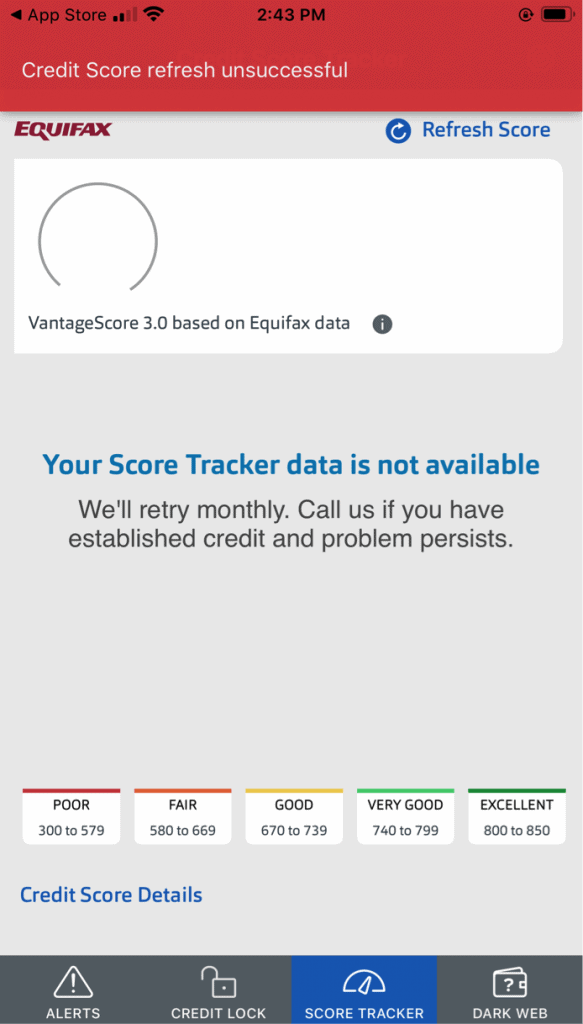

- Credit score tracking: We were sent daily credit score reports from the owners of ID Watchdog, Equifax. This was helpful in making sure there were no sudden dips in our score that we needed to attend to.

- Credit reports: We were happy to learn monthly reports were delivered from all three credit bureaus: Equifax, Experian, and TransUnion.

- VantageScore Credit Scores: VantageScores (like FICO scores) are an estimate of many factors: your number of open accounts, total levels of debt, and repayment history, etc. Unlike your FICO score, VantageScore was developed and is owned by the three major credit bureaus1 and it can also be used to determine if you get a loan or not.

- Lock Credit Reports: If we found something fraudulent after using the tools above to check our credit score, we could lock our credit reports from any or all of the three bureaus.

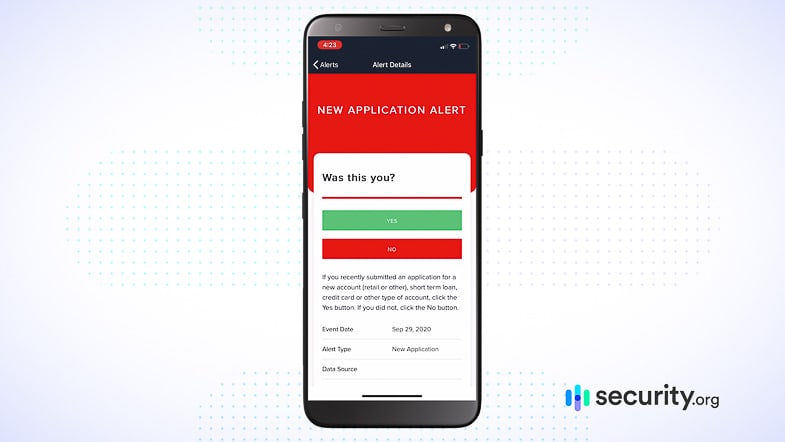

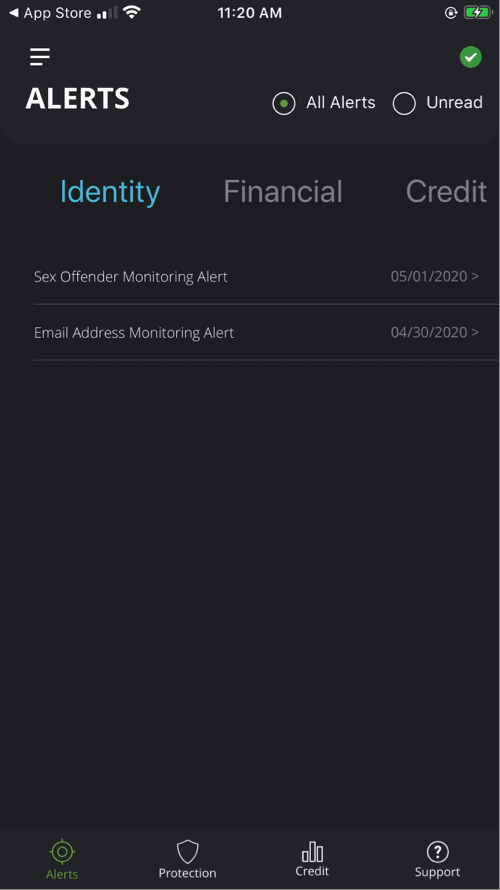

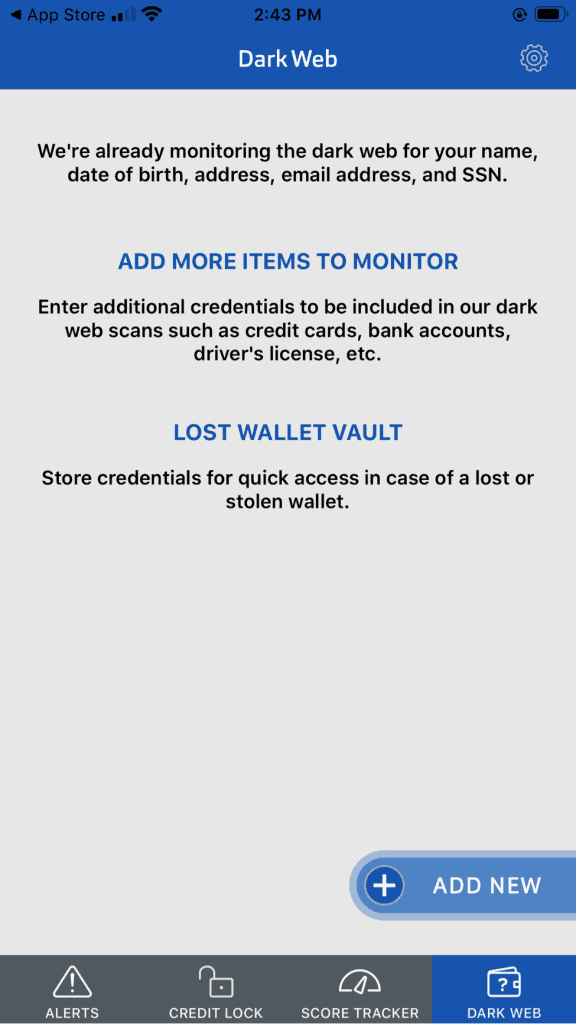

- Identity monitoring: ID Watchdog’s identity monitoring covers a wide scope, including the dark web, sex offender registries, USPS change of address requests, and other online and public records. It even covers data breaches, which we find ironic because Equifax experienced one of the most infamous data breaches of recent memory. In any case, anytime your identity shows up where it normally shouldn’t, ID Watchdog will let you know.

- Financial accounts monitoring: This is another feature that’s vital with any identity protection service. If a thief gets access to your personal information, the first thing they are likely going to target are your financial accounts. So keeping a close watch of your credit cards, investment, and savings account is critical. ID Watchdog monitored those after we provided them our accounts information.

- Assistance for lost wallets: The first thing that worries people when they lose their wallets is the cash they have in there, but IDs and credit cards are far more valuable. They have your personal information and can be used for fraudulent transactions. In case you lose your wallet, a team at ID Watchdog will help you cancel credit cards and gym memberships. They can’t help you recover your IDs, unfortunately, but their other monitoring features will make sure your information isn’t used by identity thieves.

- Assistance for fraud alerts: Some folks aren’t identity monitoring experts like us, but with ID Watchdog, that’s no big deal. Customer service reps are available to help users set up fraud alerts with all three bureaus.

- Assistants for credit freezes: The best you can do to prevent credit fraud is to freeze your credit with all three major credit bureaus. You can do that for free even without ID Watchdog, but be prepared to be on the phone for hours. If you have ID Watchdog, a team of dedicated experts will help you do that more conveniently.

- Solicitation reduction: Another day, another mailbox stuffed with credit card offers, and endless telemarketing calls to boot. One of our absolute favorite features of ID Watchdog was that they put our phone number on the national Do Not Call registry to reduce the junk mail sent to our address. There’s nothing more beautiful than an empty mailbox!

- Resolution specialists: From the point of fraud detection to getting our identity back, a real person was just a phone call away if our identities were stolen.

- Identity theft insurance: We always recommend going with an identity monitoring option that has identity theft insurance. ID Watchdog meets the industry standard of up to $1 million in reimbursement if our identities were stolen.

- 401(K) HSA Stolen Funds Reimbursement: This was a surprising, unique and welcomed feature. If money was stolen out of our 401(K) or HSA funds, ID Watchdog would reimburse us up to $1 million! We were glad to see ID Watchdog had our savings protected as well.

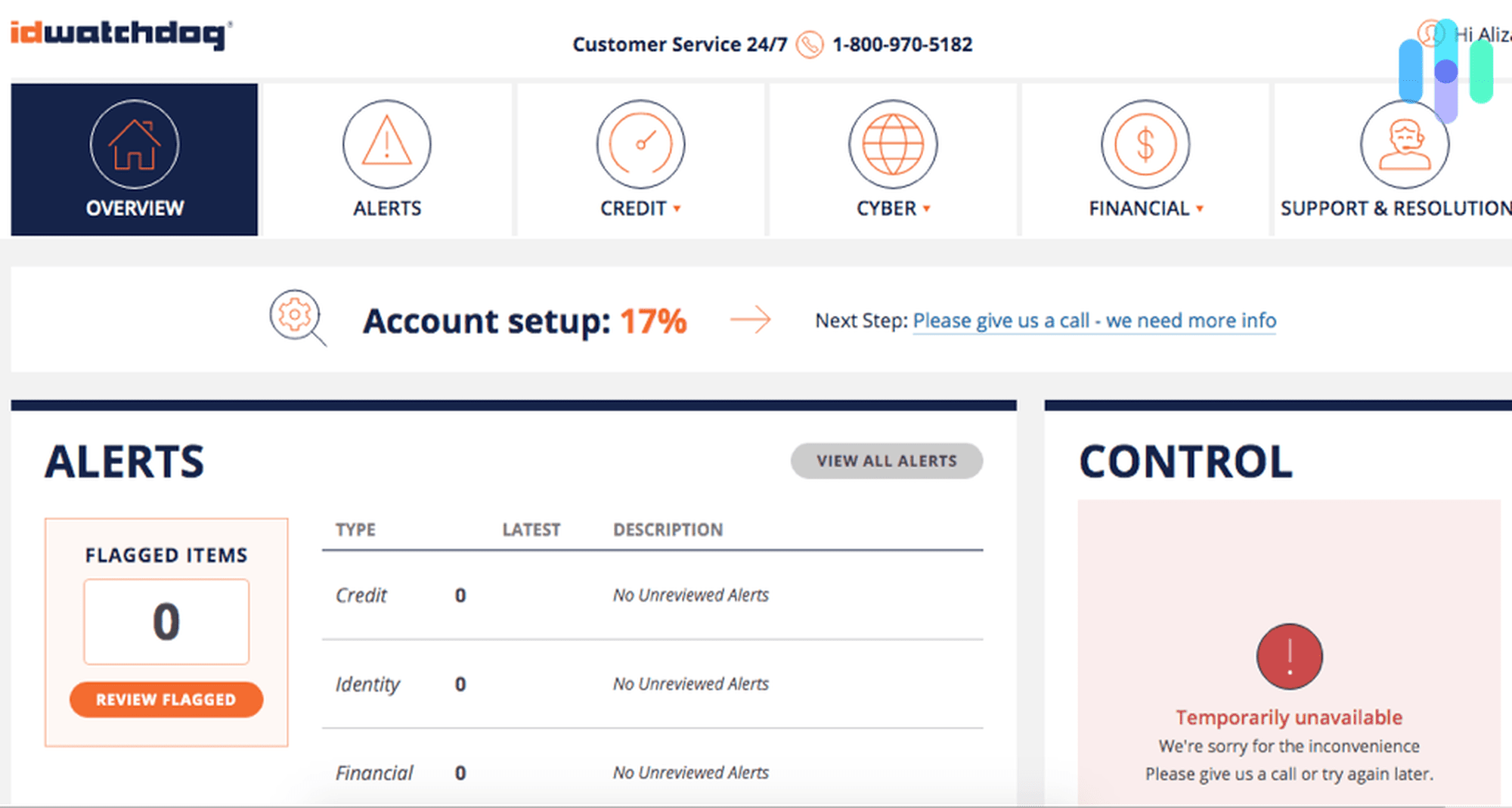

If you’re interested in seeing how ID Watchdog stacks up, we did an even deeper dive on all of ID Watchdog’s features, and their in app experience in our ID Watchdog review.

Did You Know: An easy way to add an extra layer of defense to your identity is by using VPN to access public WiFi services. As the first line of defense, a reliable VPN. service can strengthen your security profile AND protect your data.

See How ID Watchdog Compares to the Competition

ID Watchdog is produced by Equifax, one of the three major credit bureaus, so we knew we could count on them not only to protect our identity but any attempts to undermine our credit rating as well. Of course, Equifax experienced a large data breach in 2017, and though they have taken important steps to avoid future breaches, that past mistake could dissuade some users. If you’re a little nervous about ID Watchdog, you might try one of our recommended ID theft monitoring services:

Can I Try It For Free?

Unfortunately, ID Watchdog does not offer a free option. You can, however, get a free credit report from ID Watchdog’s parent company, Equifax, on their website.2

Pricing and Packages

ID Watchdog made things really simple with only two subscription options and family plans that extended to two adults and four children. Considering most family plans protect two adults and up to ten children, this feature was a little disappointing. Other services from LifeLock and Identity Guard offer several different plans for adults and children, which is nice for folks who like variety, though it can be confusing to figure out what you get with each plan. Read our Identity Guard pricing page and our LifeLock pricing page for more options.

We opted to go with the Premium subscription for $21.95 per month. Although we could have saved $43.40 by going with an annual subscription, we prefer the flexibility of a month to month plan.

| ID Watchdog Select | ID Watchdog Premium | |

|---|---|---|

| Number of Credit Bureaus Monitored | 1 | 3 |

| Credit Score Tracker from 1 Bureau Frequency | Daily | Daily |

| Credit Reports from 1 Bureau and VantageScore Credit Scores from 3 Bureaus Frequency | No | Daily/ Annually |

| Number of Credit Bureaus With Reports That Can Be Locked | No | 3 |

| Monitoring for dark web, high-risk transactions, subprime loans, public reports, change of address, sex offender registry | Yes | Yes |

| Assistance for lost wallets, fraud alerts, credit freezes | Yes | Yes |

| Solicitation Reduction | Yes | Yes |

| Financial Accounts Monitoring | No | Yes |

| Equifax Child Credit Lock with Family Plan | No | Yes |

| Identity Theft Resolution Specialists | Yes | Yes |

| Identity Theft Insurance up to $1 Million | Yes | Yes |

| 401(K)/ HSA Stolen Funds Reimbursement up to $1 million | No | Yes |

| Individual Monthly Cost | $14.95 | $21.95 |

| Individual Annual Cost | $150 | $220 |

| Individual Annual Savings | $29.40 | $43.40 |

| Family Monthly Cost | $23.95 | $34.95 |

| Family Annual Cost | $240 | $350 |

| Family Annual Savings | $47.40 | $69.40 |

Although ID Watchdog’s Select plan gave users a great baseline for monitoring, their Premium plan was the only one that included 401(K)/HSA and identity theft insurance. When it came to protecting our identities and bank accounts, those two services were essential.

FYI: No identity protection or monitoring services are bulletproof. That’s why to make sure we could bounce back from the worst-case scenario, by going with a subscription option that includes identity theft insurance.

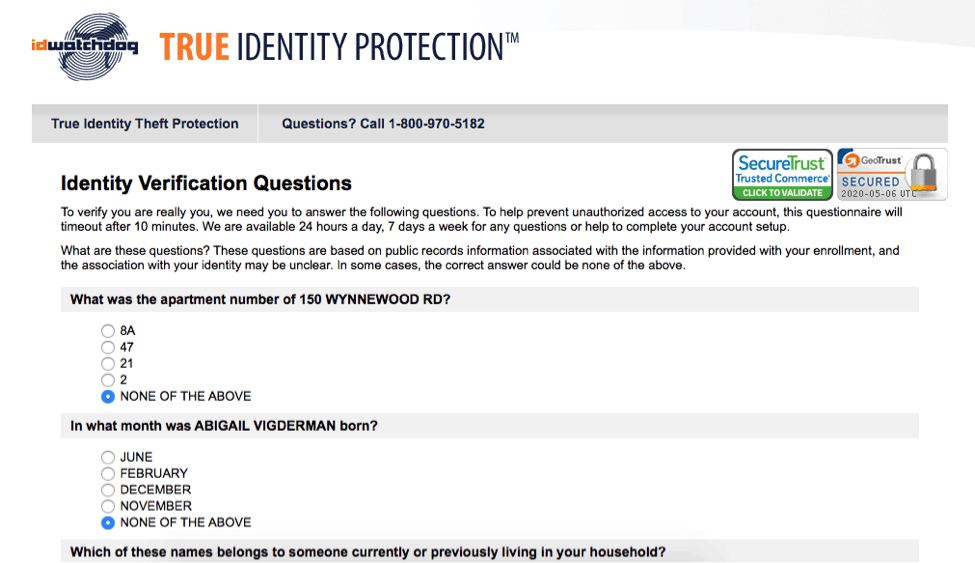

Safety and Security of ID Watchdog

After going through everything ID Watchdog had to offer, one of the biggest questions we had ringing in our heads was, “After the Equifax breach in 2017,3 can we trust ID Watchdog?” Following a lot of research, we decided that yes, we could trust them with our data. However, it is up to each individual how much and to what companies they are comfortable disclosing their information to.

Here are the facts: ID Watchdog encrypted our data using a TLS system. TLS stands for Transport Layer Security. This allowed ID Watchdog to authenticate our sessions and make sure our connections were secure. Unfortunately, there is a provision that allows ID Watchdog to keep our personal information and data, even if we cancel our subscription. On the flip side, they refuse to share our data with third parties for marketing purposes.

If you’re very protective over your data, and not so quick to forget about the 2017 breach, ID Watchdog might not be for you. Considering major companies like, Amazon’s Ring,4 and most recently, the GPS and wearable company Garmin,5 have been victims of data breaches, it seems like this is a regular part of operating a large business that consumes massive amounts of data. The best defense against these attacks is an identity monitoring program, and we think ID Watchdog’s is reasonably priced, with great service.

Cancellation Policy

Thankfully, ID Watchdog made it really easy for us to cancel our account. While other identity monitoring services made us jump through hoops with call forwarding, email confirmations, and specific opt-out dates, ID Watchdog was straightforward. We cancelled our ID Watchdog account by calling ID Watchdog Customer Care at 1800-970-5182. They are available 24 hours a day, 7 days a week, 365 days a year, a welcome and honest approach to cancellation.

Conclusion

Equifax data breach aside, we have nothing but good things to say about ID Watchdog. Their service and coverage proved comprehensive; with all parts of the web monitored, a great insurance policy for both your savings and high risk accounts for fraud, we were really pleased. Not to mention all of this was provided at a reasonable price! Although we never had to use it, their customer service was available at all times and their cancelation policy didn’t give us a headache. Overall, ID Watchdog is a great option to both avoid fraud and resolve fraudulent issues if they should occur.

Frequently Asked Questions

-

Is ID Watchdog legitimate?

Yes, ID Watchdog is legitimate, owned by a major credit bureau, Equifax, and it even has an A+ rating from the Better Business Bureau.

-

How much does ID Watchdog cost?

ID Watchdog’s cost varies depending on which plan you select. Here’s the breakdown for the Select and Premium plans for ID Watchdog:

ID Watchdog Select ID Watchdog Premium Individual Monthly Cost $14.95 $21.95 Individual Annual Cost $150 $220 Individual Annual Savings $29.40 $43.40 Family Monthly Cost $23.95 $34.95 Family Annual Cost $240 $350 Family Annual Savings $47.40 $69.40 -

What are the best identity theft protection services?

The best identity theft protection services are:

- Identity Guard – Best ID Theft Protection Overall

- LifeLock – Best ID Theft Prevention with Antivirus

- IdentityForce – Best Child ID Protection

- ID Watchdog – Best Identity Theft Resolution Service

- Experian IdentityWorks – Best Credit Monitoring

- Credit Sesame – Best Free Credit Reporting with Extras

- PrivacyGuard – Best Customer Service

- Zander Insurance – Best Insurance Bundling with ID Protection

- IDShield – Best Family ID Protection

- IDnotify – Best Value Identity Protection

-

Is ID theft protection necessary?

Yes, identity theft protection is necessary if you’re serious about protecting yourself from fraud. Services like ID Watchdog can offer you peace of mind, not to mention, they can help you recover your identity if you’re a victim. These programs monitor everything from your credit to the dark web in order to make sure that your identity is safe.

-

Does ID Watchdog have a mobile app?

Yes, ID Watchdog does have a mobile app so you can access your identity monitoring on the go. The app offers two-factor authentication and an easy-to-use interface.

VantageScore. (2020). About Us.

your.vantagescore.com/why-we-existEquifax. (2020). Free Credit Reports.

equifax.com/personal/credit-report-services/free-credit-reports/FTC. (2020). Equifax Data Breach Settlement.

ftc.gov/enforcement/cases-proceedings/refunds/equifax-data-breach-settlementNew York Times. (2019). Somebody’s Watching: Hackers Breach Ring Home Security Cameras.

nytimes.com/2019/12/15/us/Hacked-ring-home-security-cameras.htmlSky News. (2020). Garmin ‘paid multi-million dollar ransom to criminals using Arete IR', say sources.

news.sky.com/story/garmin-paid-multi-million-dollar-ransom-to-criminals-using-arete-ir-say-sources-12041468