A credit report pretty much sums up your creditworthiness, and since we’re living in a credit-based economy in the U.S., it’s something you should keep a close eye on. But here’s the thing: Many Americans don’t know they are entitled to receive a copy of their credit reports for free. Although there are companies that offer to get you a credit report for a fee, you can actually get your credit report straight from the source – the three major credit reporting bureaus – and not pay a single cent. Here’s how:

How To Get a Free Credit Report

You are entitled to a free credit report from AnnualCreditReport.com in seconds. If you’re more traditional, you can also call the Annual Credit Report Request Service or mail your Annual Credit Report Request Form to its Atlanta office. We recommend the online version, as we looked at our report less than a minute after filling out some basic information.

| URL | Phone number | Mailing address |

|---|---|---|

| AnnualCreditReport.com | 877-322-8228 | Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348 |

What Information You’ll Need

To get your free credit report, you’ll need to provide some information about yourself, including the following:

- Name

- Birthday

- Social Security number

- Current address and if you’ve lived there for two years or more

- Previous U.S. address if you’ve lived at your current address less than two years

After filling out this information, we answered a few identity confirmation questions and then accessed our reports. As you can see, we didn’t need identity theft protection with credit monitoring or credit protection services to get our credit reports for free.

When You’re Eligible

You probably think based on the website’s name (AnnualCreditReport.com) that your eligibility for a free credit report is once a year. That was the case before, up until 2020. When the lockdowns due to the pandemic started, a lot of people experienced financial troubles from losing their jobs and not being able to pay their bills. As an act of goodwill, the three credit bureaus started a program giving everyone free weekly credit reports. That program was extended twice before it was made permanent in 2023.

That’s right; you can now get a copy of your credit report once a week for free. You don’t need to monitor your credit report that closely, though. Companies that report credit information to the credit bureaus do so once a month, so we believe that’s a more reasonable interval for getting and checking your credit report. Reserve your remaining eligibility to get a credit report before applying for a new loan, to apply to a new job, or when you think your identity might have been stolen.

How Long It Will Take

If you request your free credit report online, you can access it as soon as you finish filling out the forms. However, if you are requesting your credit report to be mailed to you, it might take up to 15 days (from the day the request is received) to process.

Impostor Credit Report Websites

Because it’s instant, we highly recommend getting your free credit reports online. However, we should also warn you that there are impostor credit report websites. These websites aren’t part of the government program of providing free credit reports. They may try to charge you for the service, or worse, ask for your personal information (a standard process when requesting credit reports) only to steal it.

When requesting credit reports online, make sure you only go to AnnualCreditReport.com. Check that every character in the URL is accurate, as we’ve seen websites that slightly misspell it to trick people into using their services.

Why Should I Look at My Credit Report?

You should look at your credit report because lenders, employers, utility companies, and more use it to decide if they should offer you:

- Loans of various interest rates

- Insurance

- Housing rentals

- Cable TV

- Internet

- Electricity

- Gas

- Cellular service

- Employment2

In a nutshell, credit reports help lenders make decisions that could have huge effects on your life, like where you live, what job you do, and whether you can get that car loan you so desperately need. That’s why it’s important to check your credit report and make sure the information is accurate and up to date before you go for that big mortgage. Checking your credit report is also a good way to prevent identity theft; learn more in our identity theft guide.

What Credit Reports Include

Once you get your credit report, you’ll notice a few key pieces of information.

- PII: Credit reports include your PII, or personally identifiable information, like your name, current and former addresses, date of birth, Social Security number, and phone number.

- Credit accounts: They also include your current and past credit accounts and what types of credit accounts they are; your limits, amounts, balances, and payment histories; the dates you opened or closed your accounts, and the names of your creditors.

- Collection items: If you’ve ever had a bill go to a collection agency, that will appear on your credit report.

- Public records: Credit reports include information on your civil suits or judgments, bankruptcies, liens, foreclosures, or overdue child support if you have any.

- Inquiries: The companies that have accessed your credit report will be listed as well.

How To Read Your Credit Report

Credit reports contain a lot of information, from that Old Navy credit card you forgot you had to that time you were late on the internet bill five years ago. What account information is the most important, though?

What To Look For

Check for outdated information and inaccuracies, as these will affect your credit scores. That being said, your credit report doesn’t include your actual credit scores, so you’ll need to get these from each bureau — Equifax, Experian, and TransUnion — separately. 3

Credit Scores vs. Credit Reports

Credit reports are part of credit scoring systems. In other words, credit scores are based on the information on credit reports, which includes your current credit situation and credit activity. You can also think of credit scores as calculations of your credit activity, and credit reports as your actual credit activity. If credit reports are all of the essays you wrote for your English class, credit scores are your final grades.

Do I Need Credit Reports From All Three Bureaus?

Even though they’re all based on the same credit activity, your credit reports and scores from the three major credit reporting agencies will differ. What does that mean for you? Let’s take a step back.

What Are the Three Main Credit Bureaus?

The three major credit bureaus are Experian, TransUnion, and Equifax. It’s best to check your reports from all three for errors, as these bureaus may have different scores and reports, and third parties could use any bureau to determine your eligibility for loans, employment, etc.

What if I Find Errors on My Credit Report?

If you’ve found inaccurate information on your report when you checked for identity theft, then you can dispute your credit report. You can either contact the Consumer Financial Protection Bureau online or by phone at 855-411-2372.4 Another option is to call the credit bureau directly, using the contact information below.

| Credit bureau name | URL | Phone number | Mailing address |

|---|---|---|---|

| TransUnion | https://dispute.transunion.com | 800-916-8800 | TransUnion LLC, Consumer Dispute Center P.O. Box 2000 Chester, PA 19016 |

| Experian | https://usa.experian.com/registration/?offer=at_fcras102,at_ltdreg100&phx=disable | 888-397-3742 | Experian P.O. Box 4500 Allen, TX 75013 |

| Equifax | my.equifax.com/consumer-registration/UCSC/#/personal-info | 866-349-5191 | Equifax Information Services LLC P.O. Box 740256 Atlanta, GA 30348 |

Note: Correcting your credit report is free, as is filing complaints.

Common Errors

Even credit bureaus make mistakes. These are the most common types:

-

- Identity: Your report may have inaccurate names, numbers, or addresses. It may have been mixed up with someone with the same or a similar name as you. Also, if you’ve been a victim of identity theft, the report could include fraudulent accounts.

- Account status: Accounts that you’ve closed may appear as open. You may be reported to be the owner of an account rather than an authorized user. Accounts could be incorrectly reported as late or delinquent, dates could be off, and the same debts may be listed multiple times under different names.

- Data management: Even if the bureau corrected it, false information could be reinserted, or accounts could appear multiple times under different creditors.

- Balances: Accounts could have false current balances and/or credit limits.

What if They Won’t Make Corrections?

The bureau doesn’t correct all requested information automatically. If it believes that the information is accurate, it will remain on your credit report. However, you can request to put a statement explaining the dispute in your credit file; this will be included in future reports (more on that below).

How Long Can Credit Bureaus Report Negative Information?

Break a mirror and you’ll have seven years of bad luck. The same is true for negative information on your credit report, which can stay on for a minimum of seven years.

In some cases, it can stay on your report even longer. Lawsuits or judgments, for example, can remain for either seven years or whenever the statute of limitations runs out, whichever is longer. In the same vein, bankruptcies can stay on your credit report for 10 years.

Even after the negative information is removed from your credit report, the credit bureaus could keep it on file and report it if:

- You’re applying for a job with an annual salary of over $75,000.

- You’re applying for more than $150,000 of credit or life insurance.

Unfortunately, there’s no way to remove this information if it’s accurate, not even through cold, harsh cash. However, there is one saving grace.

Can I Explain Negative Information?

If you’ve tried to dispute negative information and it was found to be accurate, you can include a 100-word explanation with your credit report. Here, you’ll explain any abnormal circumstances that led to this negative information, like an illness or job loss.5

Who Can See My Credit Report?

You’re not the only one who can access your credit report, of course. These are some other people who can access your credit report:

- Potential employers

- Credit bureaus

- Potential lenders

- Government agencies checking eligibility for licenses

- Executive departments and agencies issuing government-sponsored travel charge cards

- Child support enforcement agencies

How To Report Scams

Maybe your information was involved in a data breach, or maybe you lost your Social Security card. No matter the reason, if you think you’ve been scammed, report fraud to the appropriate agency.

| Types of scams | Agency | Phone number | URL | Mailing address | Email address | Fax number |

|---|---|---|---|---|---|---|

| Phone, email, computer support, impostor, fake checks, demands to send money, student loans, scholarships, prizes, grants, sweepstakes | FTC | 877-382-4357 | https://reportfraud.ftc.gov/#/?pid=A | N/A | N/A | N/A |

| Identity theft | FTC | 877-438-4338 | https://identitytheft.gov/ | N/A | N/A | N/A |

| Online, international | FBI’s Internet Crime Complaint Center (IC3) | N/A | https://complaint.ic3.gov/default.aspx | N/A | N/A | N/A |

| IRS | Treasury Inspector General for Tax Administration | 800-366-4484 | https://www.treasury.gov/tigta/contact_report_scam.shtml | N/A | N/A | N/A |

| Social Security | Social Security Administration | 800-269-0271 | https://secure.ssa.gov/ipff/home | N/A | N/A | N/A |

| Loans | FBI | 800-225-5324 | https://www.fbi.gov/contact-us | N/A | N/A | N/A |

| Mortgages | Housing and Urban Development Office of the Inspector General | 800-347-3735 | N/A | HUD OIG Hotline (GFI) 451 7th St. SW, Washington, DC 20410 |

hotline@hudoig.gov | 202-708-4829 |

| Disaster, emergency | National Center for Disaster Fraud | 866-720-5721 | N/A | N/A | disaster@leo.gov | N/A |

Tip: If you’re unsure what kind of scam you experienced, contact the FTC, as it handles the most common types of scams and can point you in the right direction.

The Fair Credit Reporting Act

Your eligibility for a weekly free credit report is due to the Fair Credit Reporting Act (FCRA), a federal law. Here are some of the rights it guarantees you.

Summary of Rights

- You have the right to be told if information in your credit report is being used against you.

- You have the right to know what’s in your credit file.

- You have the right to an accurate credit report.

- You have the right to contest your credit report.

- You have the right to have up-to-date information on your credit report.

- Employers must get your consent before accessing your credit report.

- You have the right to seek damages if someone violates the FCRA.6

Credit Freezes

If you’ve been the victim of identity theft, it’s best to put a credit freeze on your report, preventing lenders from seeing it. This means that identity thieves won’t be able to use your PII to open new accounts, get new loans, etc. Here’s how to freeze your credit with all three bureaus:

| Credit bureau | Website | Phone number |

|---|---|---|

| TransUnion | TransUnion.com/credit-help | 888-909-8872 |

| Experian | Experian.com/help | 888-397-3742 |

| Equifax | Equifax.com/personal/credit-report-services | 800-685-1111 |

You should keep your credit frozen as long as your PII is at risk, but there’s no hard-and-fast rule on when you should end it.

Medical History Reports

Just as credit reports summarize your credit activity, medical history reports summarize your medical conditions. Insurance companies use medical history reports to decide whether or not they should insure you.7 But don’t get credit reports and medical history reports confused. Medical bills will only appear on your credit reports if you haven’t paid them for at least 180 days.8

Recap

Checking your credit report is necessary to prevent identity theft and get a handle on what you can do with your life. After all, credit reports are involved in so many major life decisions, from the house you can buy to the job you can take, so checking them for accuracy is essential. The best part is it’s free, thanks to the FCRA.

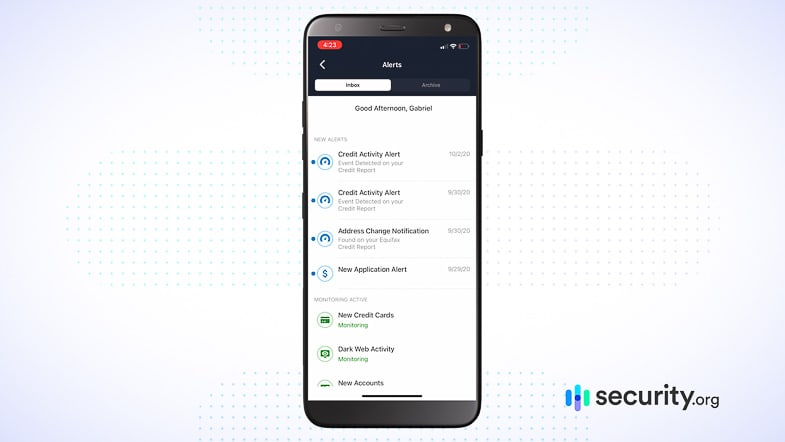

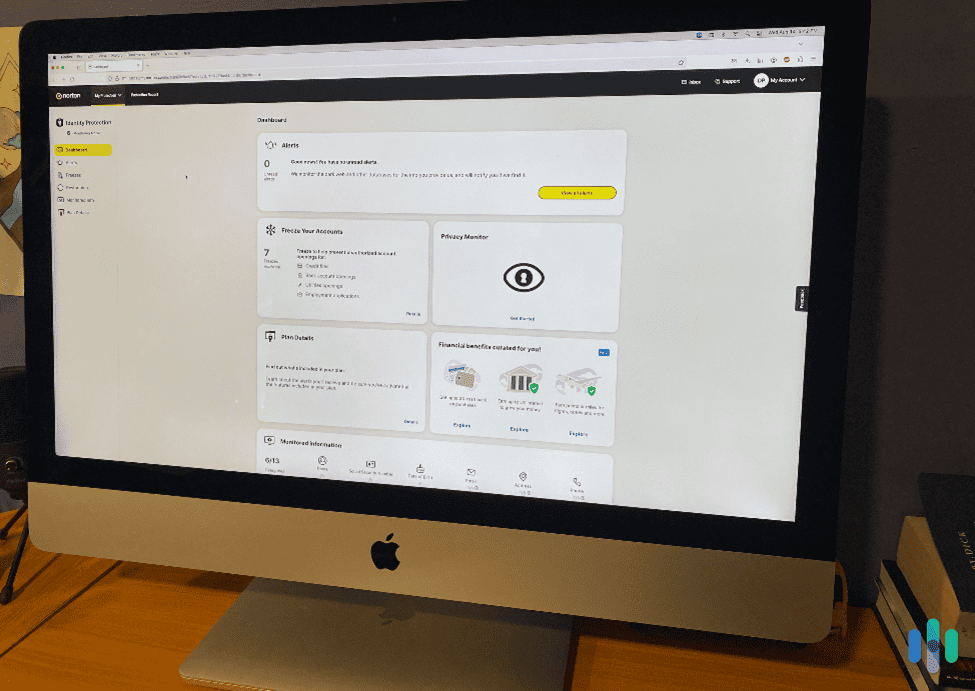

But checking your credit report isn’t enough to prevent identity theft. For that, you’ll need the best identity theft protection or the best identity theft protection with fraud detection.

Frequently Asked Questions

Lightning round! Here are the questions we receive most frequently about getting your credit report without spending a penny.

-

What is the best site to get a free credit report?

The best site to get a free credit report is AnnualCreditReport.com, a government-sponsored website.

-

Is AnnualCreditReport.com safe?

Yes, AnnualCreditReport.com is safe; it’s actually sponsored by the U.S. government and part of the FCRA.

-

Can I check my credit score for free?

You can check your credit score for free with services like Credit Karma, which includes scores from Equifax and TransUnion; you can get your score from Experian directly. Credit Sesame also provides free credit scores from TransUnion.

-

How long does it take to get a free credit report?

If you do it online at AnnualCreditReport.com, it will take you only seconds to get a free credit report. However, if you call or request your report over mail, it can take up to 60 days.