Credit Karma Review

Credit Karma is a free service that monitors your credit, but is it sufficient for identity monitoring overall?

Cort Honey, Home- and Digital-Security Expert

&

Cort Honey, Home- and Digital-Security Expert

&

Gene Petrino, Home Security Expert

Last Updated on Dec 05, 2025

Gene Petrino, Home Security Expert

Last Updated on Dec 05, 2025

What We Like

- Fast and free credit checks in the app

- Easy-to-use apps that let you monitor credit

- Direct Dispute button for Transunion reports

What We Don't Like

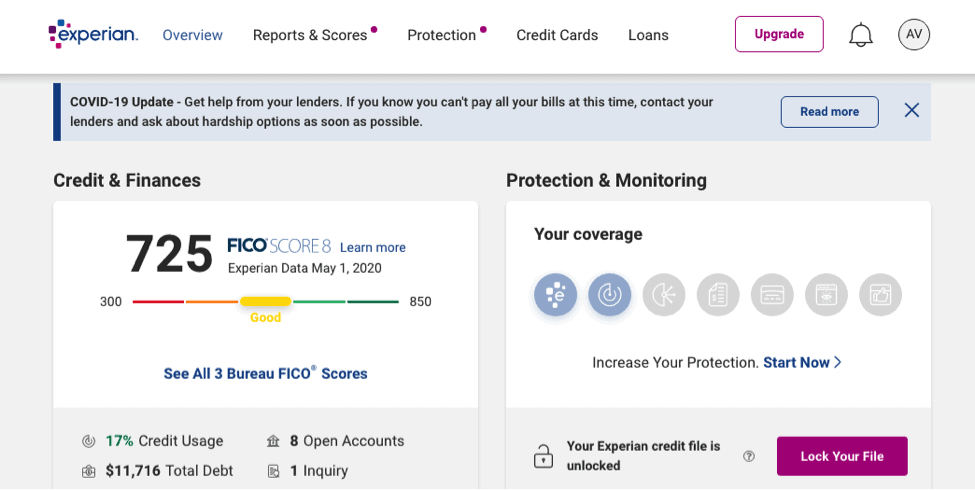

- Doesn’t check Experian credit scores

- No insurance options

- No live chat or phone support options

Bottom Line

Checking your credit score might seem like a chore, but there are plenty of services out there that will keep an eye on things for you — or at least claim to.

Credit Karma is one of those services. You can access free credit scores from TransUnion and Equifax, track changes to your credit reports weekly, and receive alerts about potential data breaches involving your personal information. Best of all? This service is 100 percent free.

But is monitoring this information with Credit Karma really enough to keep your identity safe?

We decided to test Credit Karma’s credit monitoring accuracy, update frequency, and security measures. Let’s see if it provides adequate identity protection for today’s digital threats.

Credit Karma Identity Theft Protection Features

| Dark web scan | Yes |

|---|---|

| Credit report agencies | TransUnion, Equifax |

| Identity theft insurance | No |

| Alerts | Email, SMS |

| Price | $0.00 |

- Free, weekly credit monitoring from TransUnion and Equifax

- Data breach and dark web monitoring

- Highly rated iOS and Android apps

Credit Karma Features

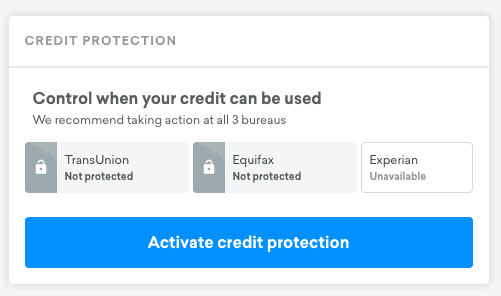

Credit Karma will check two out of the three credit-reporting agencies for any changes to your report, specifically TransUnion and Equifax. The absence of Experian monitoring is a limitation. In our experience, credit protection requires visibility across all three major bureaus. We find it’s easier to catch fraudulent activity that might only appear on one report. The good news is, you’ll get weekly credit reports so you can stay on top of everything.

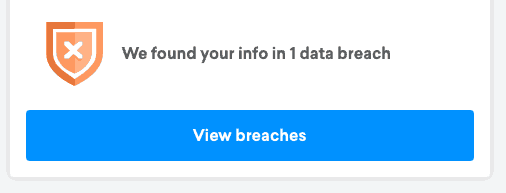

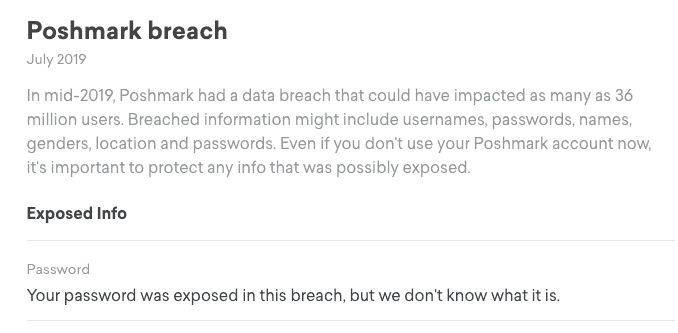

When you discover errors on your credit report, Credit Karma’s Direct Dispute feature initiates the correction process. We found it easy to launch a request on the platform. It eliminated the hassle of navigating multiple websites or mailing dispute letters. On top of that, Credit Karma will also scan the dark web for the email address associated with your account, plus, they’ll tell you if that email has been involved in any data breach. Looks like I wasn’t so lucky this time…

Oh, no, my email was involved in a breach!

And it’s from the clothing e-commerce website Poshmark, no less! But really, there was no need to worry, as Credit Karma told me exactly how to deal with this breach (for starters, change my password).

Data breaches are becoming more common, with over 3,122 publicly reported breaches affecting millions of records in 2023 alone.1 Unfortunately, companies aren’t always required to notify affected individuals. But with Credit Karma’s identity monitoring, I can know as soon as my information is involved in a breach so that I can take action. They even have email and SMS alerts, which is essential because honestly, this is some pretty urgent information.

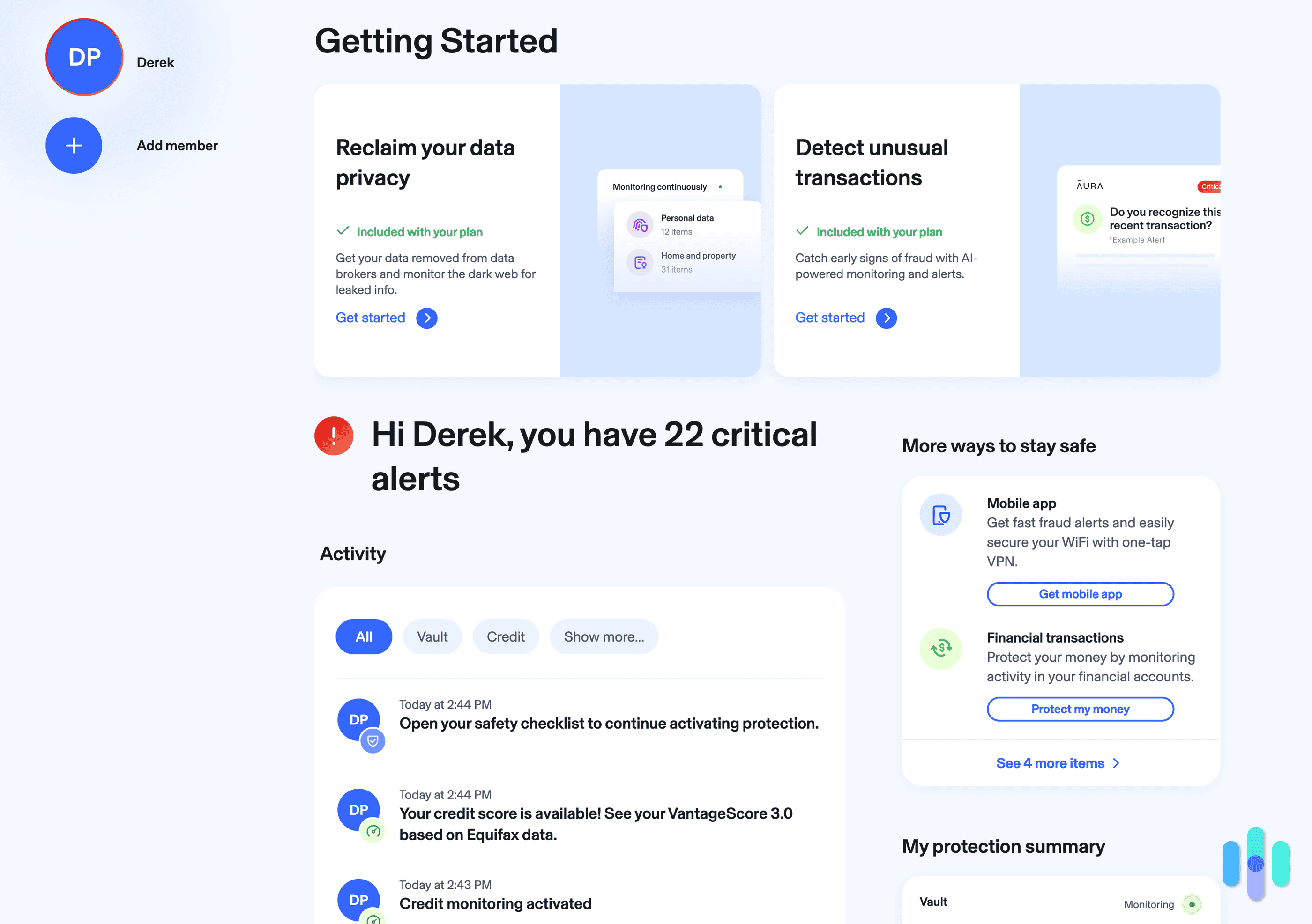

Unfortunately, Credit Karma doesn’t offer any paid options that would give you insurance money if your identity is stolen; rather, they can only tell you your credit reports and if your email was in a data breach or the dark web. In this regard, Credit Karma is missing some essential features of an identity monitoring service, which isn’t so surprising considering it’s free. Keep in mind that they also don’t monitor any bank accounts, credit cards, or investment accounts, so as far as identity monitoring goes, this service provides just the basics.

Credit Karma Privacy

To sign up for a Credit Karma account in the first place, you need to put in some personal information such as:

- Name

- Social Security Number

- Address

- Birthday

This is information I want to keep to myself, so I was curious about what Credit Karma does with my information. Do they encrypt it? Do they sell it to third parties so they can target me with ads? In this day and age, I wouldn’t put it past them!

It turns out that Credit Karma does keep quite a bit of information, from the personal information listed above to device, log and location information. However, the company does not share your credit reports, credit scores, or personal information with unaffiliated third parties, particularly for advertising and marketing. Credit Karma has strict data-sharing boundaries. They use aggregated and anonymized user data to offer personalized financial product recommendations. This is how they make money.

In fact, Credit Karma actually encrypts this information using AES 128-bit encryption. AES 128-bit encryption offers solid protection against current threats. However, we consider AES 256-bit encryption the gold standard. It’s a stronger layer of protection against future quantum computing threats. Another thing to keep in mind is the company’s physical location. Based in San Francisco, California, Credit Karma is subject to the Five Eyes, Nine Eyes, and 14 Eyes international surveillance alliances. While it’s unlikely, this does mean the that United States government could force Credit Karma to hand over customer data. This is the case with any company based here, of course, which is why it’s so important the Credit Karma encrypts customer data. Thank god for encryption!

How Easy Is Credit Karma To Use?

We set up Credit Karma in less than five minutes. The platform’s onboarding process guided us through the identity verification process, which involved using our SSN and answering a few security questions from our credit history. I actually had already set up an account and forgotten about it, which the site knew because of the matching Social Security number and birthday. From there, the website is easy to navigate. Once you click on identity monitoring, you can easily set up credit protection and data breach monitoring. They also have a section full of useful advice like password management (a topic I am already very well-versed in if I do say so myself). Overall, this website has a great user experience and made keeping my identity safe online a breeze.

Is Credit Karma Free?

Short answer? Yes, Credit Karma is free! As we mentioned earlier, the platform makes money through affiliate partnerships. Credit Karma earns commissions when customers sign up for recommended credit cards, loans, or other financial products. This allows them to offer credit monitoring for free. For example, if your identity is stolen, you don’t get any sort of reimbursement from the company, whereas you probably would if you paid a monthly or yearly subscription elsewhere. So while Credit Karma doesn’t cost anything, it certainly doesn’t provide the full-service identity protection you might be looking for. Still, as a free tool, credit and data breach monitoring are very useful.

Credit Karma Customer Support

Another disadvantage of a free service is the lack of customer support options. If you need help with your identity monitoring, you can only check out the online help center or submit a request to the support team. Unfortunately, there’s no live chat or phone number you can call, which is a bit of a disappointment. We found the response times varied significantly. We got some answers within hours. Others took days or weeks to resolve.

Of course, I don’t just want to go off of my experience, which is why I checked Amazon and Google to see what Credit Karma customers had to say about their support. On Amazon, Credit Karma has a 4.4 rating overall from 218 reviews, but unfortunately, none of them mention customer support. Google, on the other hand, was another story. The company’s San Francisco headquarters has a three-star rating overall from 89 reviews, and out of the 22 reviews that mentioned customer support specifically, they were all negative!

It seems like people shared my complaints about the lack of a phone line. Many also said emails took anywhere from days to months to answer. Google user Sheila McCabe wrote in a recent one-star review,

“Their identity verification is lax and their customer service is a joke. I decided to register for a Credit Karma account only to learn that someone else had already made an account using my personal information. If the thought of some impostor having access to all my information for who knows how long wasn’t bad enough, none of my messages to Credit Karma’s online-only support team have been addressed.”

Clearly, customer support is not Credit Karma’s strong suit.

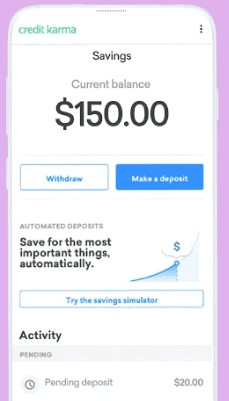

The Credit Karma App

The Credit Karma app allows you to check your credit and monitor the web for data breaches on the go. Fortunately, it’s highly-rated with a 4.7 from the Google Play store and a 4.8 from the Apple store. Personally, I found the app to be as easy to use as the website, and I like that you can get SMS notifications if you prefer. It’s clear that when it comes to designing a user-friendly experience, Credit Karma knows what they’re doing.

Our Credit Karma Research and Data

The following is the data and research conducted for this review by our industry-experts. Learn More.

Encryption

| In Transit | Yes |

|---|---|

| At rest? | Yes, with sugarsync |

| All network communications and capabilities? | Yes |

Security Updates

| Automatic, regular software/ firmware updates? | No |

|---|---|

| Product available to use during updates? | Yes |

Passwords

| Mandatory password? | Yes |

|---|---|

| Two-Factor authentication? | Yes |

| Multi-Factor authentication? | Yes |

Vulnerability Management

| Point of contact for reporting vulnerabilities? | Report to Hackerone |

|---|---|

| Bug bounty program? | Yes |

Privacy Policy

| Link | https://www.creditkarma.com/about/privacy |

|---|---|

| Specific to device? | No |

| Readable? | Yes |

| What data they log | Full name, street address, email access, social security number, phone number. Information like gender and income stored as aggregate. Usage information like device information, log information, IP address, browser configuration, time of access. Location data and GPS data is opt-in. |

| What data they don’t log | n/a |

| Can you delete your data? | No |

| Third-party sharing policies | Shares information with third-parties |

Surveillance

| Log camera device/ app footage | n/a |

|---|---|

| Log microphone device/ app | n/a |

| Location tracking device/ app | Yes |

Parental Controls

| Are there parental controls? | No |

|---|

Company History

| Any security breaches/ surveillance issues in past? | No |

|---|---|

| Did they do anything to fix it? | n/a |

Additional Security Features

| Anything like privacy shutters, privacy zones, etc.? | n/a |

|---|

Recap of the Credit Karma Review

We think Credit Karma is a valuable free entry point for credit monitoring. However, it doesn’t replace comprehensive identity protection services. Think of Credit Karma as a credit health thermometer rather than a full medical checkup. Without monitoring of Experian and with no identity theft insurance plans available, this service only skims the surface of identity monitoring. However, I do think it’s a good first step to get the basics of credit and data breach monitoring.

I’d only buy Credit Karma if you are fine with…

- No reimbursements: While Credit Karma can monitor your credit and tell you when a data breach has occurred, it can’t really help you if your identity is stolen.

- No Experian monitoring: Without monitoring from all the credit agencies, Credit Karma isn’t really doing it’s due diligence.

- 128-bit encryption: While I’m glad that your data will be encrypted, I wish it was with AES 256-bit, the current industry standard.

But avoid Credit Karma if you wanted…

- Great customer support: Credit Karma doesn’t have any phone or live chat support, so getting an answer could take you a while.

- Monitoring of all three credit-reporting agencies: It’s best to get credit reports from TransUnion, Equifax, and Experian.

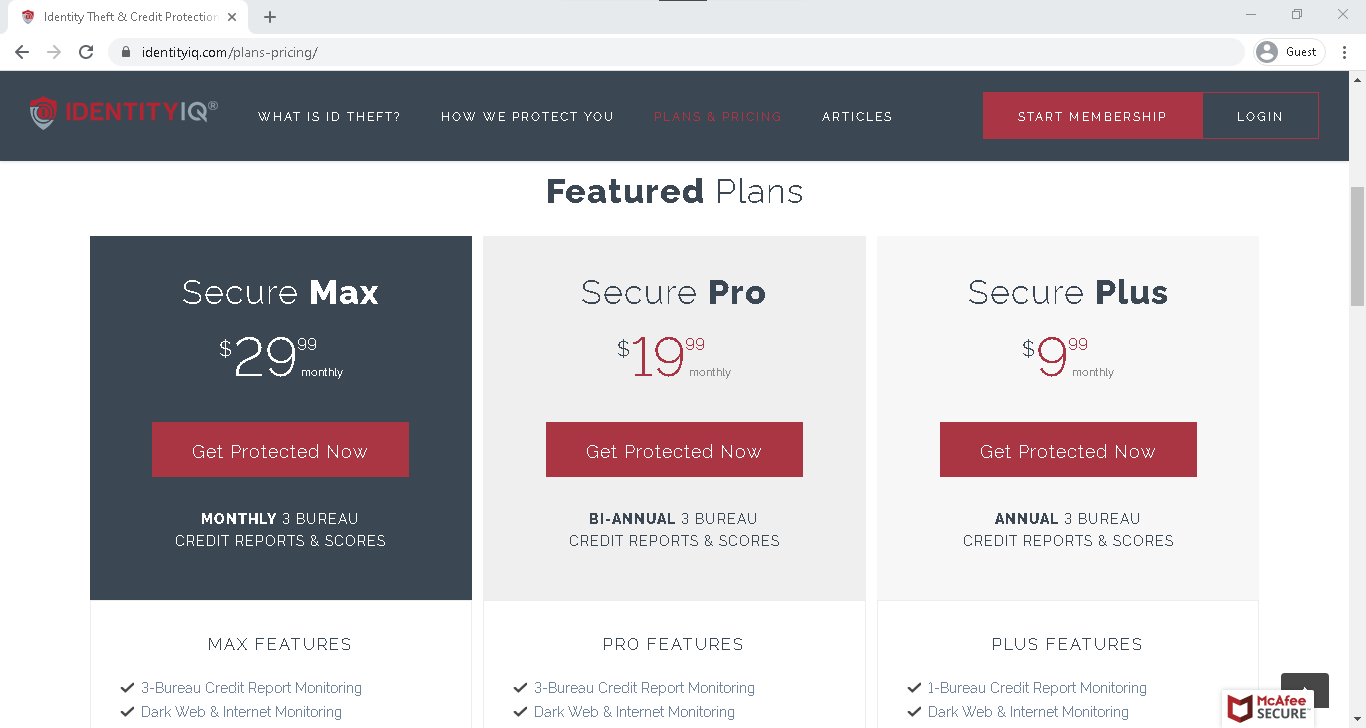

- Identity theft insurance: Premium identity protection services typically offer $1 million or more in coverage for expenses related to identity restoration. Credit Karma doesn’t offer this feature.

That’s it from me!

-

Identity Theft Resource Center. (2024). ITRC 2023 Annual Data Breach Report.

https://www.idtheftcenter.org/publication/2023-data-breach-report/