Best Credit Protection Services

LifeLock is our top recommendation, featuring account monitoring, credit lock, and multiple plans with 3-bureau checks.

- App includes one-touch credit freeze option

- Annual reports and scores from all three credit bureaus

- Norton 360 features help proactively protect your credit

- App includes one-touch credit freeze option

- Annual reports and scores from all three credit bureaus

- Norton 360 features help proactively protect your credit

- Account monitoring helps to ensure your credit remains in good standing

- Offers credit lock in case of lost or stolen personal data

- Plans available that monitor all three major credit bureaus

- Account monitoring helps to ensure your credit remains in good standing

- Offers credit lock in case of lost or stolen personal data

- Plans available that monitor all three major credit bureaus

- Utilizes IBM’s Watson to monitor your credit

- Protects your credit with an insurance plan of up to $1 million

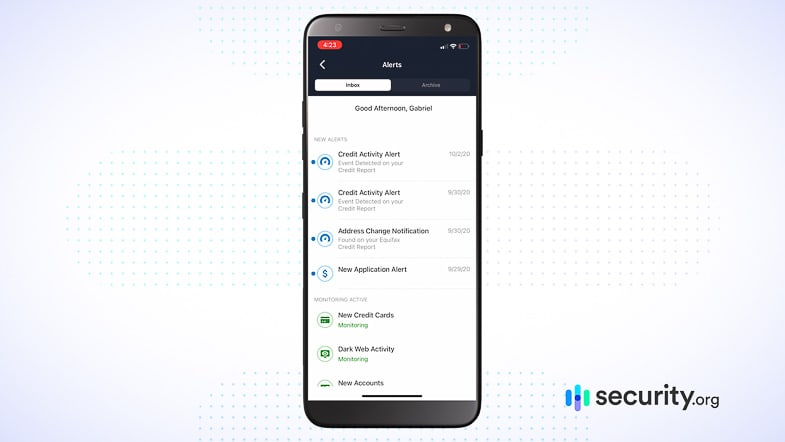

- Identity Guard app provides real time alerts of any suspicious credit activity

- Utilizes IBM’s Watson to monitor your credit

- Protects your credit with an insurance plan of up to $1 million

- Identity Guard app provides real time alerts of any suspicious credit activity

We live in a credit-based society where credit is king. So, we all try to build our credit because if we’re credit worthy, we reap a lot of benefits. Those of us that can build our credit score are rewarded in the form of mortgage and auto loan approvals, low interest rates, and a whole lot more!

Conversely, our quality of life can be greatly affected when our credit takes a dive. And did you know? Identity theft could cause your credit score to dip. That’s right; we’re talking about credit fraud.

Credit fraud is the main reason that credit monitoring services exist. These services keep a finger on the pulse of your credit by monitoring activity with the major credit bureaus. They come with a monthly fee ($10-$30/mo.), but it’s a no-brainer investment that will pay off in dividends if you become a victim of credit fraud.

But how do you find the right credit protection service that suits your needs? Well, you start right here in our Ultimate Guide to the Best Credit Protection Services. So let’s jump right in with our experts’ #1 pick.

Best Credit Protection in 2025

- LifeLock - Best Credit Reporting

- Aura - Most Well-rounded Protections

- Identity Guard® - Best Credit Monitoring

- Surfshark Alert - Most Affordable Protection

- IdentityIQ - Best For Families

- IdentityForce - Best Bank Account Alert

- ID Watchdog - Best Credit Theft Prevention and Detection

- Experian IdentityWorks - Best Credit Restoration

Comparison of the Best Credit Protection Services

| System |

LifeLock

|

Aura

|

Identity Guard®

|

Surfshark Alert

|

IdentityIQ

|

IdentityForce

|

ID Watchdog

|

Experian IdentityWorks

|

|---|---|---|---|---|---|---|---|---|

| Ranking | 1st | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th |

| Ratings | 9.7/10 | 9.6/10 | 9.5/10 | 9.5/10 | 9.3/10 | 9.4/10 | 9.0/10 | 8.7/10 |

| Number of credit bureaus monitored | 1-3 | 1-3 | 1-3 | None | 1-3 | 3 | 1-3 | 1-3 |

| Monthly cost range | $12-$50 | $16.67-$25 | $8.29-$20.99 | $2.69-$20.65 | $5.94-$29.99 | $23.99 | $14.99-$19.99 | $9.99-$19.99 |

| Insurance coverage maximum | $1 million | $1 million | $1 million | None | $1 million | $1 million | $1 million | $500,000-$1 million |

| Read Review | LifeLock Review | Aura Review | Identity Guard® Review | Surfshark Alert Review | IdentityIQ Review | IdentityForce Review | ID Watchdog Review | Experian IdentityWorks Review |

A Detailed List of the Best Credit Protection Services

-

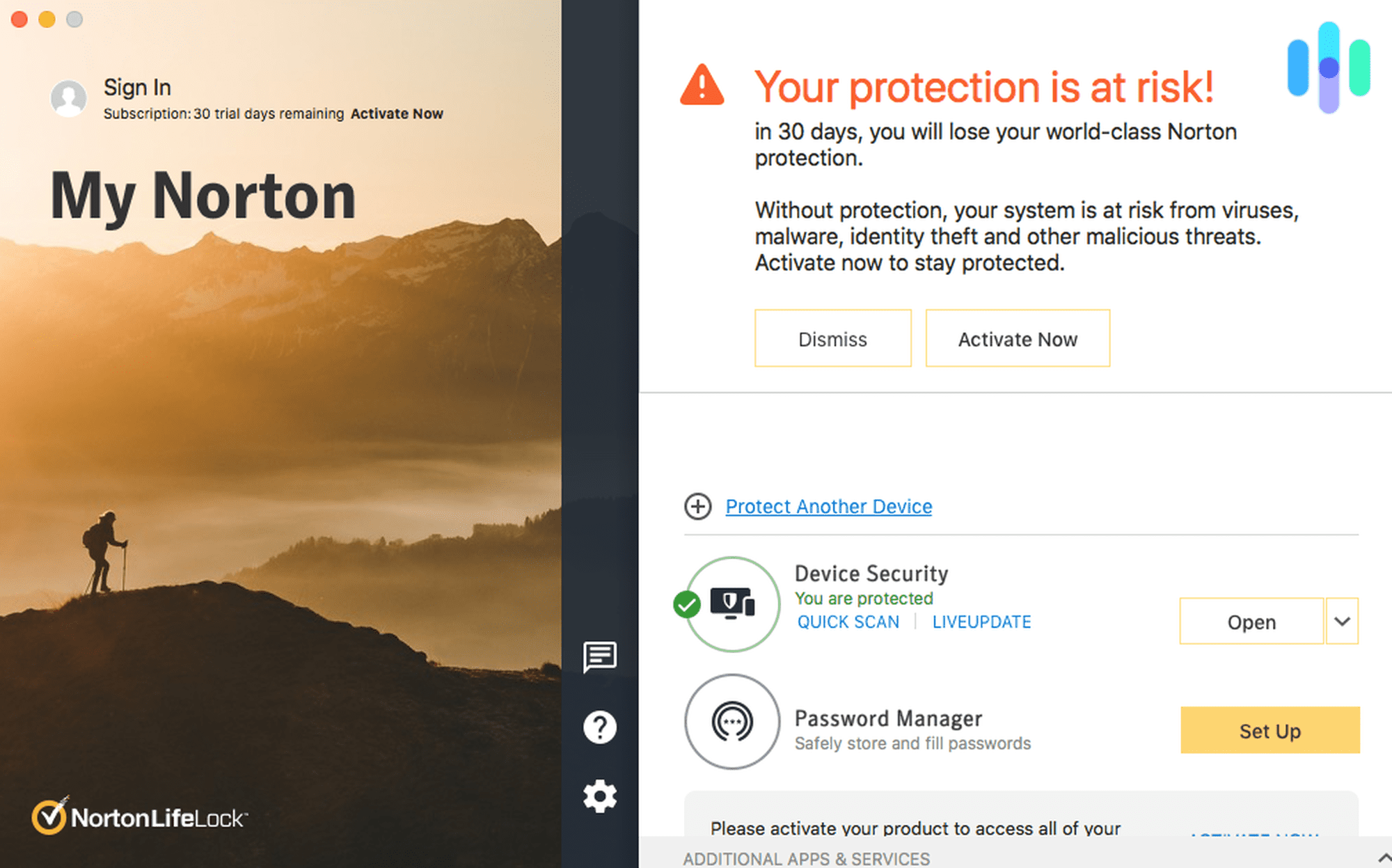

1. LifeLock - Best Credit Reporting

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $3.33 and up Family Monthly Plans $18.49 and up LifeLock consistently tops our list, so it’s no surprise they get our vote for Best Credit Reporting. They’re the best player in the credit protection field. The service includes $1 million in identity theft coverage, loads of fraud monitoring features and alerts, and a mobile companion app with a nifty one-touch credit freeze feature.

The credit monitoring is fairly advanced when you choose the LifeLock Ultimate Plus premium plan. This plan costs $24.99/mo. and includes annual credit reports and scores from all three major credit bureaus. Unfortunately, LifeLock’s more affordable mid-tier plan only includes reporting and scores from a single bureau.

Finally, LifeLock customers get access to the new Norton 360 antivirus device protection plan, and one of the best customer service teams in the business.

Pros

- 3-bureau monitoring and reporting (with premium plan)

- Impressive one-touch credit lock feature

- $1 million identity theft coverage

- Norton 360 antivirus device protection

Cons

- Lower-tier plans only offer 1-bureau monitoring

- Past legal trouble for deceptive advertising

- Premium plan is relatively expensive

What sets LifeLock apart from the competition

LifeLock leverages advanced technology to deliver best-in-class credit reporting; the service also offers a streamlined credit lock feature and a device protection package with Norton 360.

Who it’s good for

LifeLock is good for those who don’t mind paying a little extra for full-service identity theft protection, credit monitoring, and device protection.

-

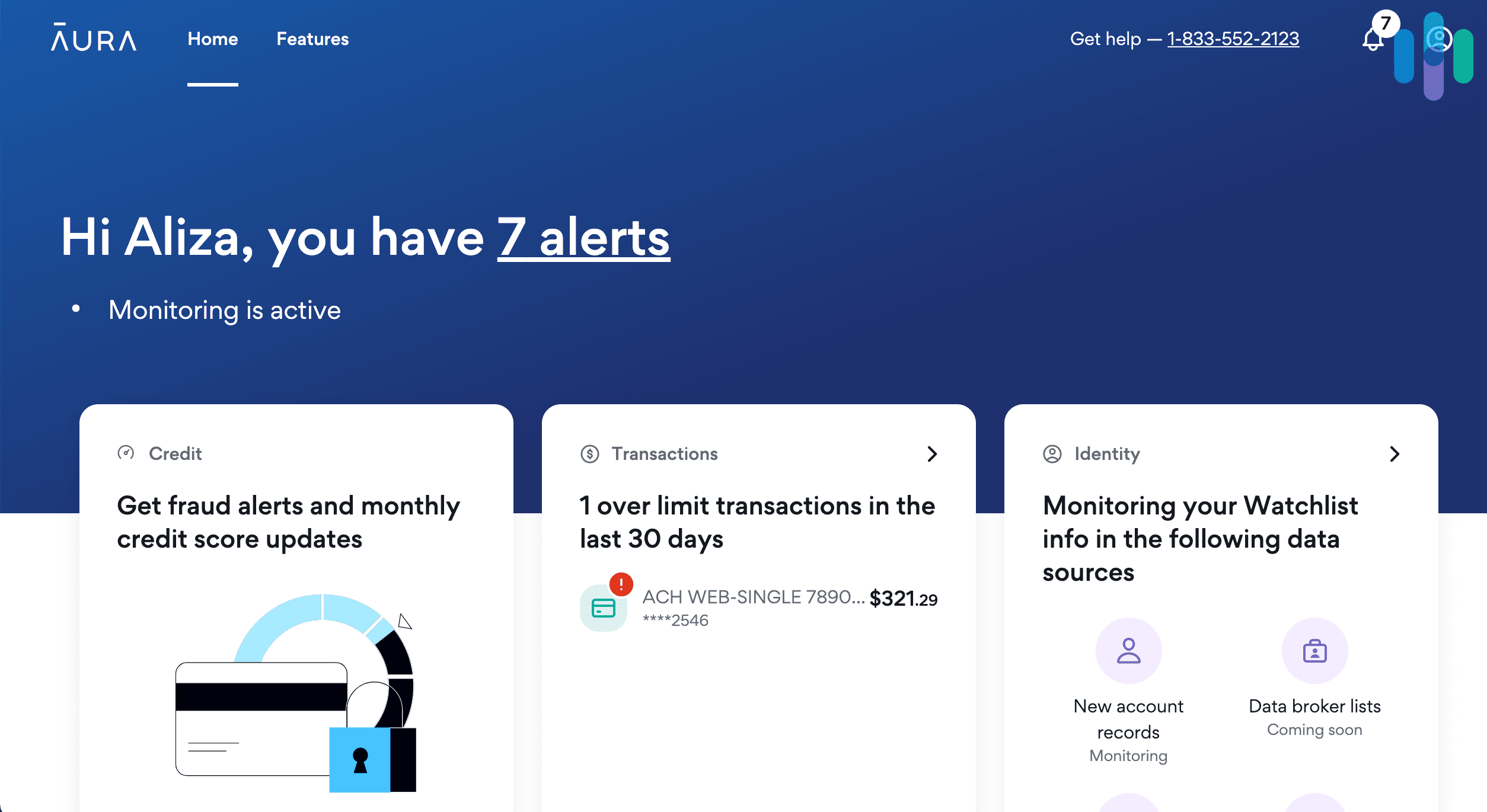

2. Aura - Most Well-rounded Protections

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 14-day Individual Monthly Plans $12 Family Monthly Plans $45 Aura isn’t just a credit protection service, but an all-around identity protection service. It’s one of the most well-rounded services there is. Aura subscriptions provide the same level of credit and identity protection no matter which tier plan you’re on.

For credit protection, Aura monitors credit accounts, bank accounts, financial transactions, and investment accounts. You can also use your Aura subscription to lock down your credit if you notice anything suspicious. And as a bonus, you can get a monthly credit score and annual credit report from all three credit reporting bureaus – all included with your subscription!

Aura Dashboard Of course, credit problems don’t occur in a vacuum. Often, they are the result of identity theft. That’s why in addition to its credit protection services, Aura offers a full range of identity theft protection services, including identity verification monitoring, account monitoring, and dark web scans. In fact, the company even provides tools to help prevent identity theft and financial fraud. The Aura VPN protects you from hackers and spies when you’re online, while antivirus software ensures you won’t become a victim of data-stealing malware.

In terms of subscription options, Aura keeps things nice and simple. There’s basically just one plan, but you can purchase it at an individual, couple, or family level. The individual plan is $15 a month, but if you sign up for an annual plan, that price falls to just $12 a month. On the other end of the spectrum, the family plan, which covers up to five individuals, costs $50 a month, or $37 a month with a year’s subscription. All those plans come with up to $1 million in insurance coverage per individual and VPN coverage for up to ten devices per individual.

What sets Aura apart from the competition

Aura’s greatest strength comes from the fact that it covers practically every base when it comes to credit and identity protection. It even offers cybersecurity tools like VPNs and antivirus software. More than that, Aura’s family plans can provide proactive protection even to children so their credit remains a clean slate.

Who it’s good for

Aura is an ideal choice for anyone interested in full-service credit protection. The company doesn’t stop at monitoring financial accounts. It keeps an eye out for anyone who might be using any of your personal information fraudulently. It does all this for one price, making Aura one of the best values on the market.

-

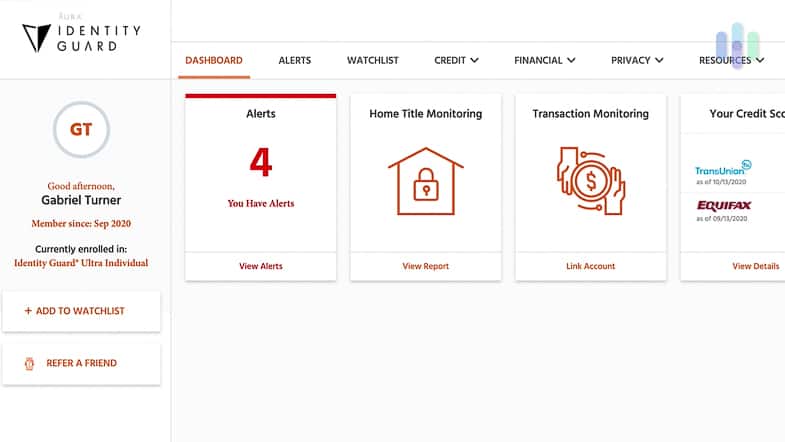

3. Identity Guard® - Best Credit Monitoring

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $7.50 and up Family Monthly Plans $12.50 and up With 50 million customers and counting, Identity Guard is by far the biggest identity theft protection and credit monitoring service in the industry. The company leverages highly-sophisticated tools (like IBM’s Watson AI) to monitor billions of data points to keep your name, finances, and credit in good standing.

You can sign up with one of Identity Guard’s three plan options, starting at about $9 per month for the Value plan and topping out at about $25 per month for the Ultra plan. For comprehensive credit monitoring, we highly recommend skipping the Value plan and going straight to the Total or Ultra plan. With either plan, Identity Guard will keeps tabs on all three major credit bureaus, using artificial intelligence to scour reports for your name and personal information. If suspicious activity is detected, you’ll be the first to know.

You also get access to Identity Guard’s other anti-fraud features which include dark web monitoring, account takeover alerts, social insight reports, cyberbullying alerts, a $1 million identity theft insurance plan, and more. Identity Guard customers also enjoy a sleek web app for on-the-go credit and identity theft monitoring.

Identity Guard Dashboard Pros

- Full-service credit monitoring and reporting

- Powered by IBM artificial intelligence

- Up to $1 million in identity theft coverage

- Excellent customer service with A+ BBB rating

Cons

- Pricey mid-tier and upper-tier plans

- Does not offer a money-back guarantee

What sets Identity Guard apart from the competition

Identity Guard uses artificial intelligence to speed up and make its credit monitoring more efficient. With IBM Watson on the job, it promises quick detection of anomalies so you can take action and prevent damage to your credit score.

Who it’s good for

Identity Guard is great for those who desire full-service identity theft protection and credit monitoring. If you’re strictly looking for credit monitoring, there may be better options out there.

-

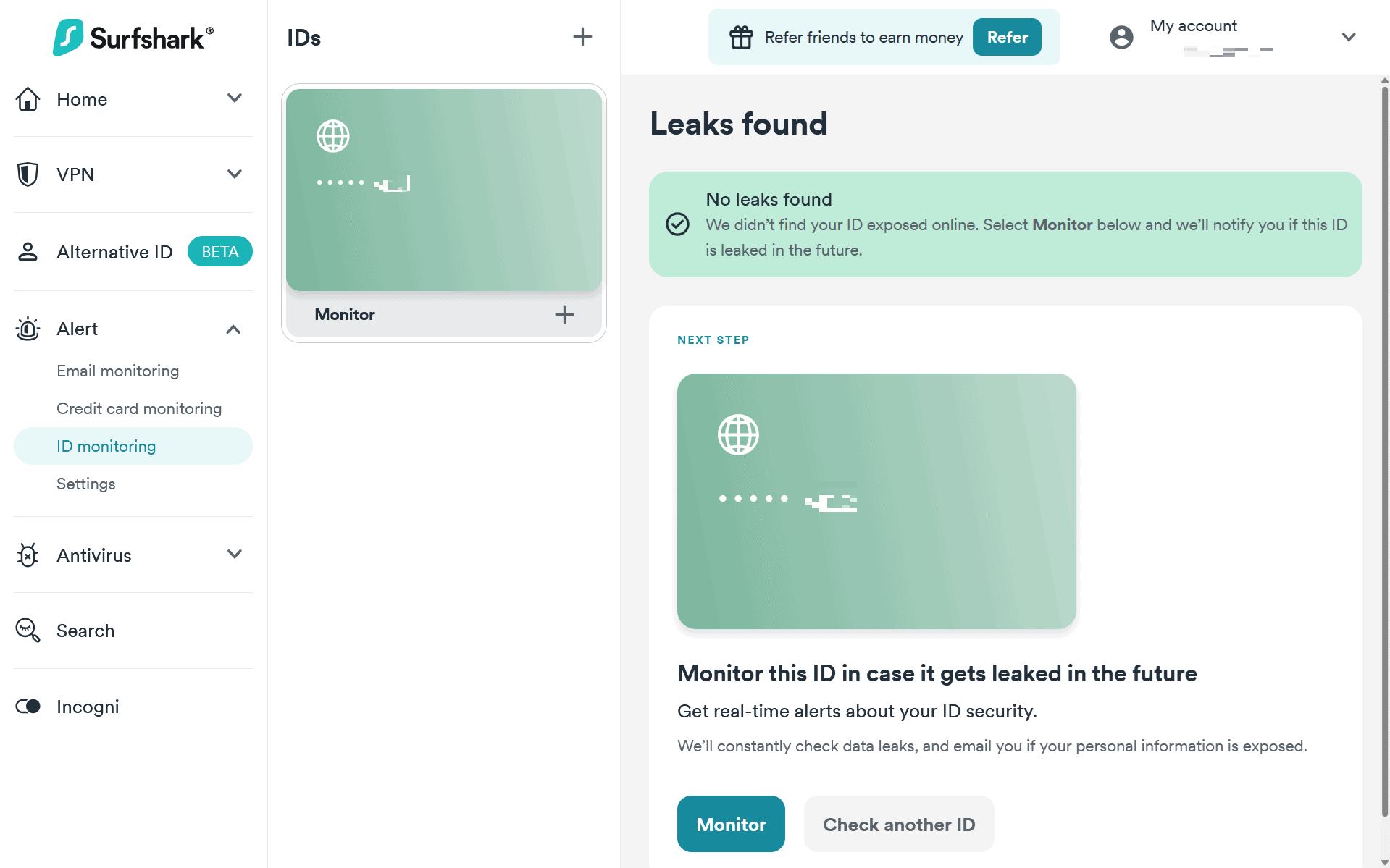

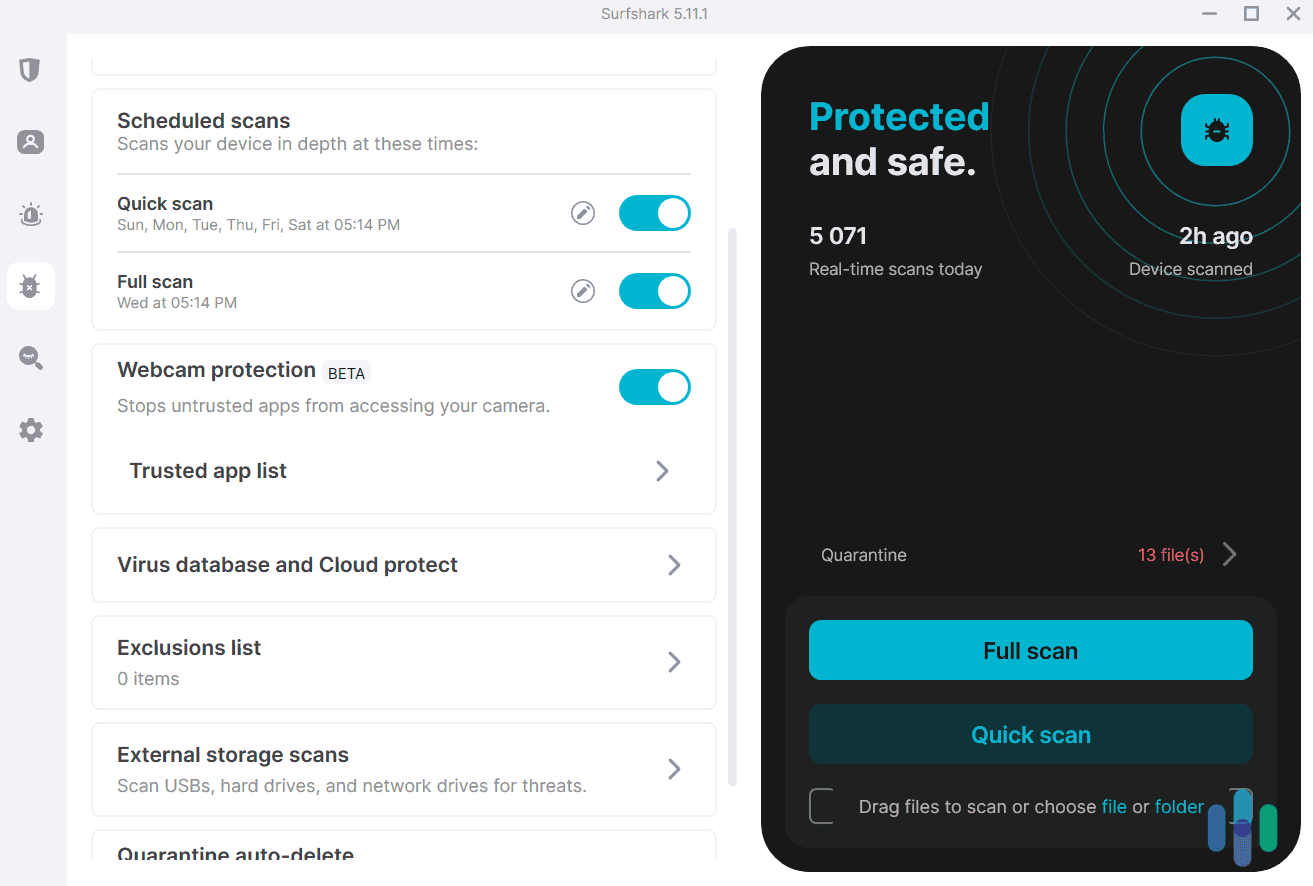

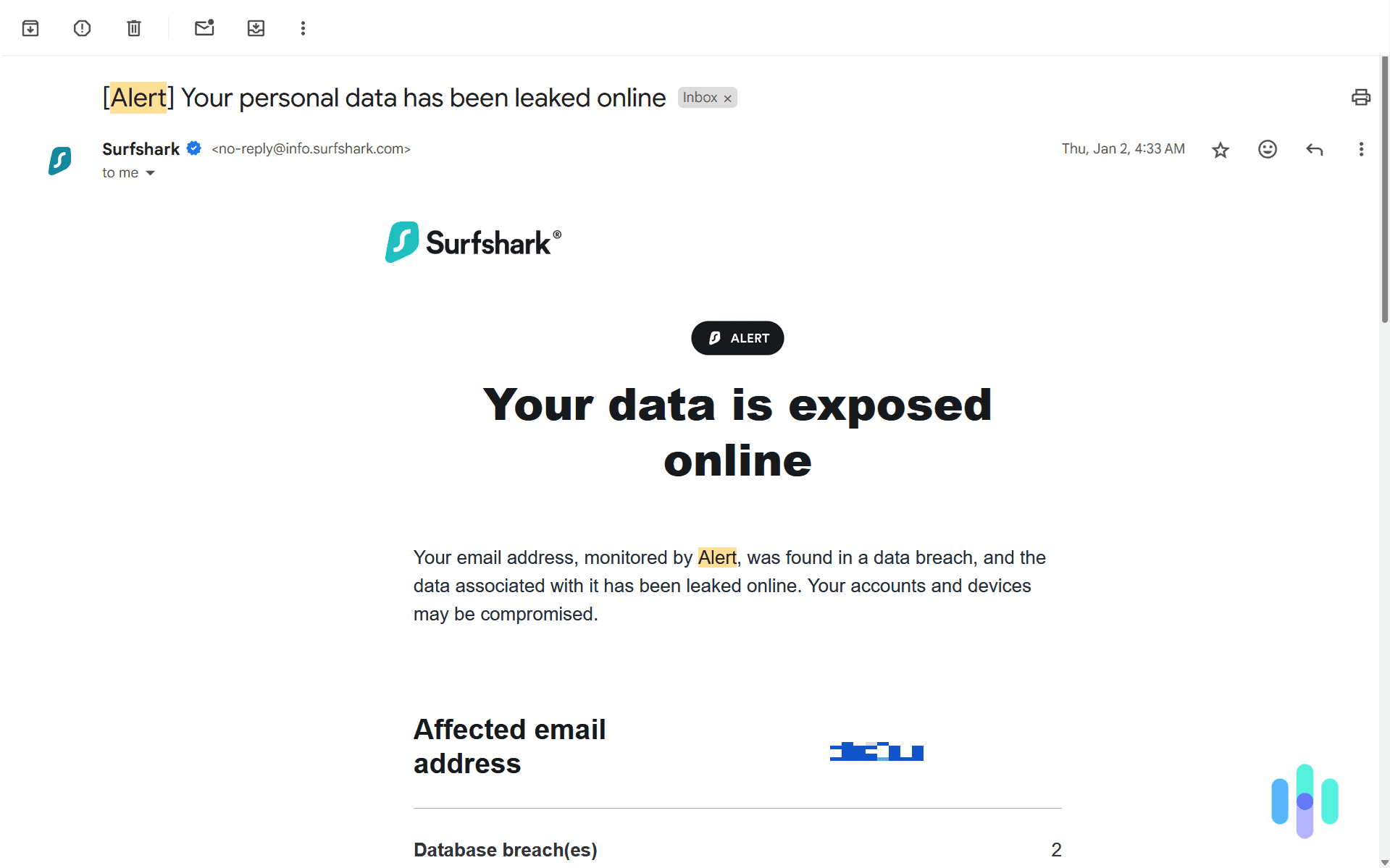

4. Surfshark Alert - Most Affordable Protection

View Packages Links to Surfshark.comProduct Specs

Dark Web Monitoring Yes Credit Reporting No Insurance Coverage No Free Trial 30-day money-back guarantee Individual Monthly Plans $2.69 and up Family Monthly Plans $2.69 and up After running an initial scan of our SSN for leaks, Surfshark actively monitored it. Surfshark offers some of the best prices around. Their rates start at just $2.69 per month and you don’t need to subscribe to a family plan at a higher cost to monitor everyone in your family. Their base subscription includes unlimited monitoring.

Low costs are great, but it comes with a tradeoff. They don’t offer any identity theft insurance. Instead, they focus on prevention with an included VPN and antivirus software in their basic subscription. Check out our review of Surfshark VPN and the results of our Surfshark Antivirus test to learn more about these services.

FYI: Surfshark’s premium One+ plan also includes a data removal service called Incogni. When we tested Incogni, it requested the removal of our data from 100 data brokers and people search sites within one week. Those results impressed us so much that we put it on our list of the best data removal services.

Here’s a quick look at Surfshark’s prices:

Surfshark Subscriptions Surfshark One Surfshark One+ Monthly plan $17.95 $20.65 Annual plan $50.85 ($3.39 per month) $91.35 ($6.09 per month) Two-year plan $72.63 ($2.69 per month) $115.83 ($4.29 per month) What We Like

- Any subscription works for an entire family

- Low prices starting at $2.69 per month

- Included VPN and antivirus software

- Step-by-step instructions for securing accounts after a data leak

What We Don’t Like

- No identity theft insurance

- Money-back guarantee instead of a free trial

- Limited protections for offline threats

- Only available in bundles

What sets Surfshark Alert apart from the competition

Surfshark Antivirus lets you perform multiple types of scans. The value you get from Surfshark Alert is unmatched in the industry. Add in one of the best VPNs and one of our favorite antivirus software and the value becomes unbeatable.

Who it’s good for

Anyone trying to get basic ID protection and digital security on a budget should go with Surfshark.

-

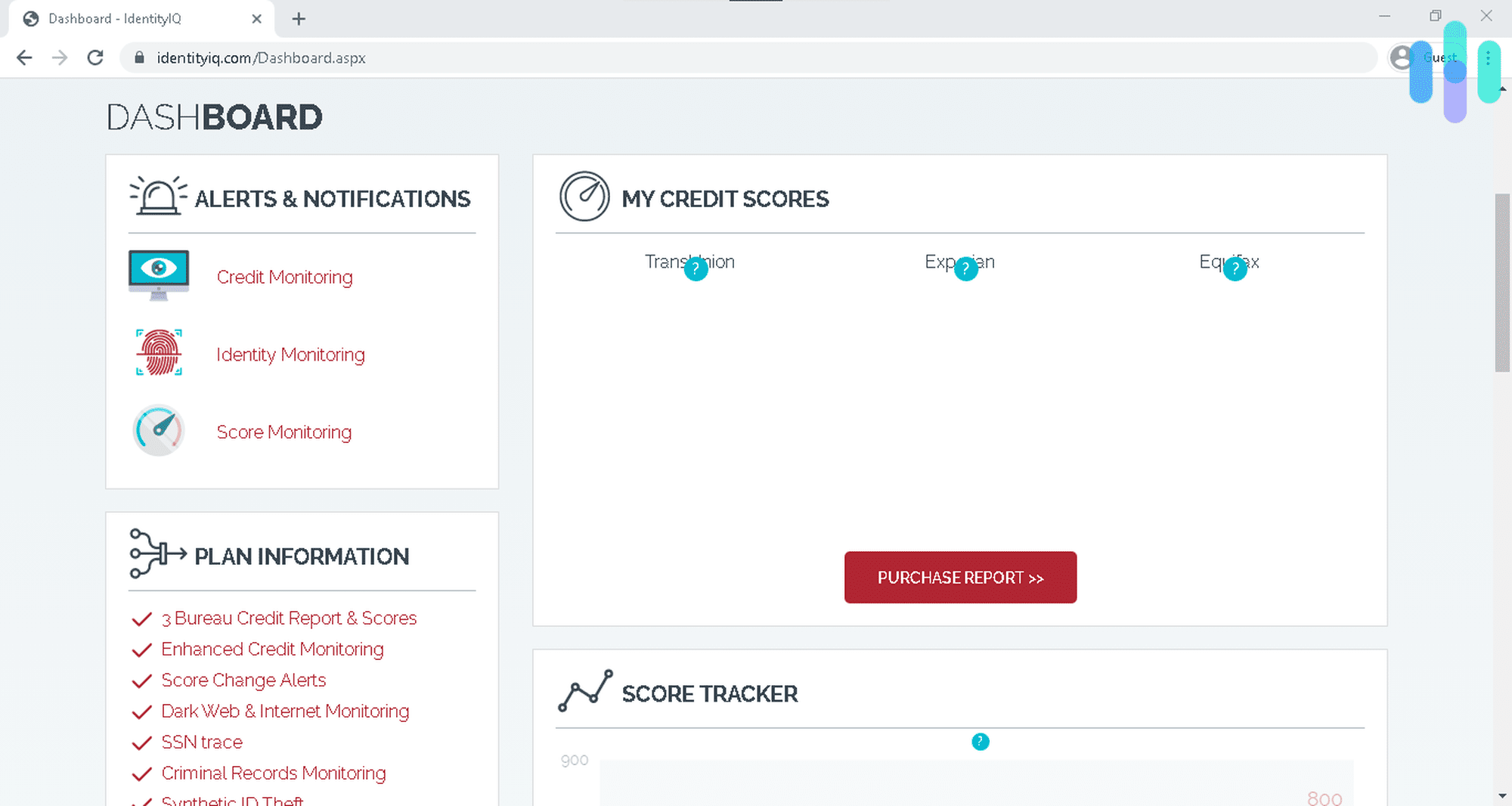

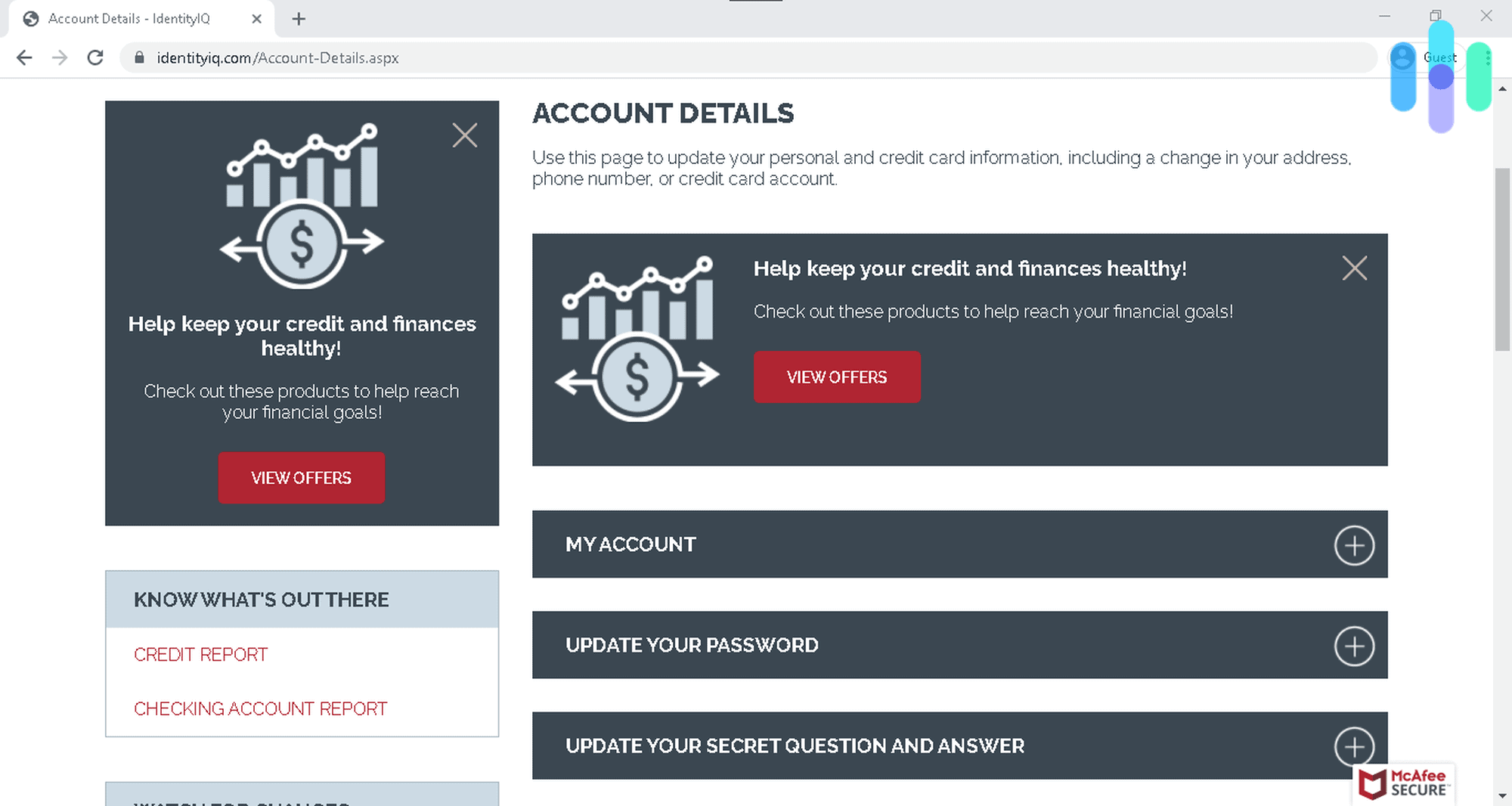

5. IdentityIQ - Best For Families

View Plans Links to IdentityIQProduct Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 7-day Individual Monthly Plans $8.49 and up Family Monthly Plans $31.49 and up There are lots of things to like about Identity IQ. Despite the fact that the company is a relative newcomer in the identity theft protection business, it’s already developed a reputation for great customer service, whether you’re calling to ask a question about a policy feature or you need restoration help following identity theft. As with any top-tier identity theft service, IDIQ monitors the dark web, searches through criminal records, and keeps track of Social Security Numbers, all in the name of keeping us safer. And we loved the fact that we not only got monthly reports from all three credit agencies but that IDIQ checked those reports every single day for any aberrations.

What really impressed us, though, was the family plan, which IDIQ calls Secure Max. This doesn’t just cover spouses and our children, it covers children until they are 24. That means they’re fully protected during those important years in their late teens and early 20s when they’re only just establishing their credit. In addition, the policy features $250,000 in identity theft insurance for every family member. That’s in addition to the $1 million dollars in insurance IDIQ gave us as principal policy holders.

IdentityIQ Main Dashboard on Chrome IDIQ’s Secure Max plan costs $29.99 per month, which is some $20.00 less than Aura’s top plan, but if you’re willing to commit to a full year of the service, that price drops even further to $25.50 per month. The Secure Pro plan, which offers biennial credit reports, is $16.99 per month with a year’s subscription, and the Secure Plus plan, which provides annual credit reports, is only $8.50 per month. IDIQ even has a just-the-basics plan for the price of $5.94 with a full-year agreement.

Pros

- Daily monitoring using all three credit bureaus

- $250,000 ID theft insurance coverage for all family members on the family plan

- Credit score simulator

- Lost wages protection

Cons

- No mobile apps

- Collected personal information about us and then shared it with third parties

- No social network monitoring

What sets Identity IQ apart from the competition

Identity IQ offers one of the most comprehensive family plans we’ve come across.

Who it’s good for

Identity IQ is perfect for anyone interested in protecting not just themselves but their entire family as well.

-

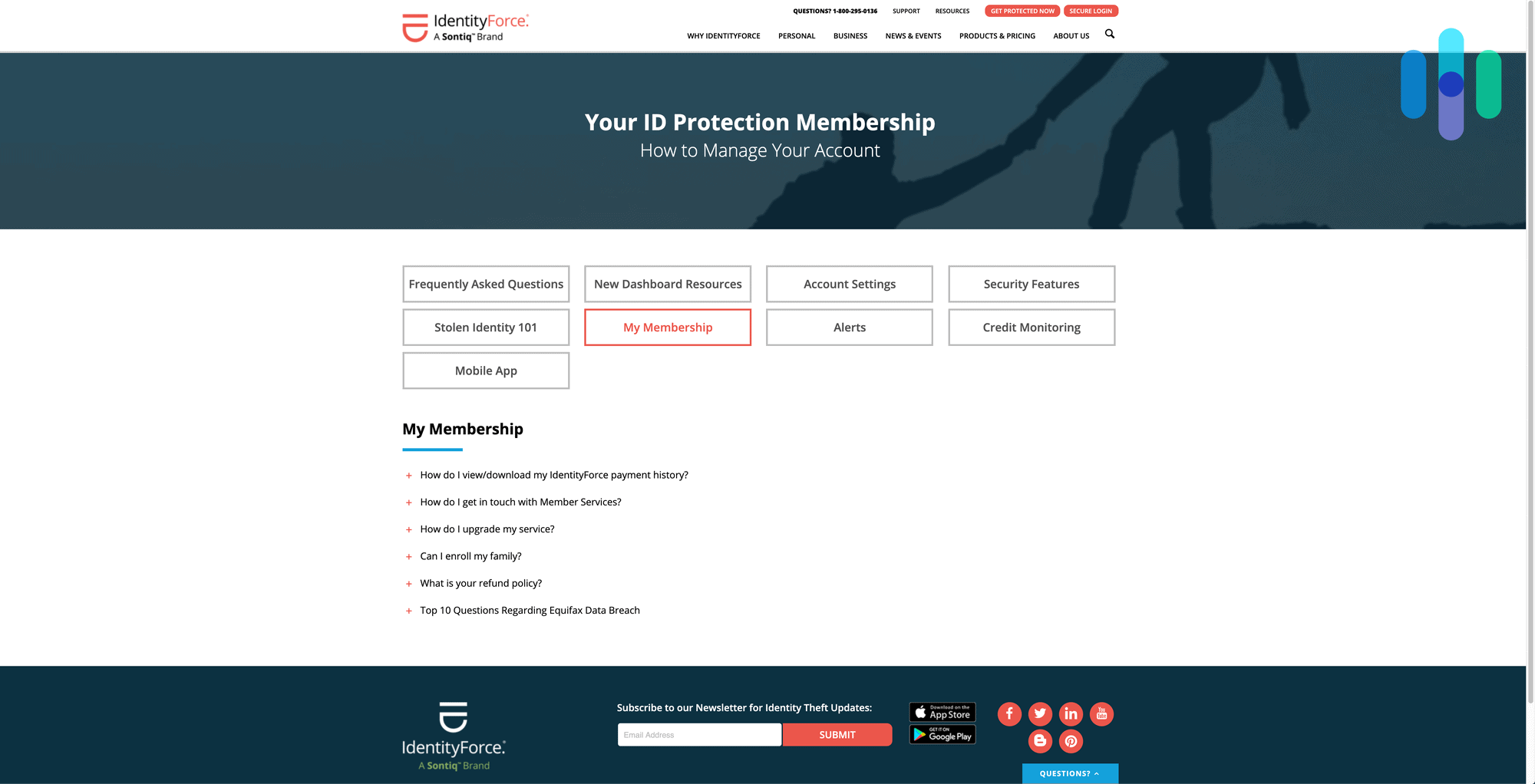

6. IdentityForce - Best Bank Account Alert

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $19.90 and up Family Monthly Plans $39.90 and up The best credit protection services allow users to set-up bank account alerts. These alerts are sent straight to your smartphone (or by email or phone call) the moment suspicious activity is detected. IdentityForce delivers A+ service in this category. The alerts detect all the classic fraud red-flags, like unusually high cash withdrawals, suspicious transfer requests, and nefarious transactions that deviate from your normal habits. Bank account alerts keep you in the loop on all of your accounts, all of the time.

IdentityForce also offers 3-bureau credit monitoring and reporting, as well as the best fraud resolution team in the industry. If your credit or bank accounts are compromised, rest assured their team of certified Protection Experts will be there to mitigate damages and help you to get back to pre-fraud status. This service is a natural extension of the family values they hold. After all, IdentityForce is family-owned, and they’ve been in the business of customer satisfaction for 40+ years.

IdentityForce Membership Dashboard Pros

- Best-in-class bank account monitoring and alerts

- 3-bureau credit reporting and monitoring

- Credit improvement simulator tools

- Excellent customer service with A+ BBB rating

Cons

- Cannot freeze or lock credit in dashboard

- Does not offer low-cost budget plan

- No 401(k) or retirement account monitoring

What sets IdentityForce apart from the competition

IdentityForce combines outstanding customer service with all the features needed to protect your identity, credit, and bank accounts.

Who it’s good for

This service is well-suited for those looking to protect their bank accounts from fraudsters. However, the service does not include retirement account monitoring, so it’s not ideal for seniors.

-

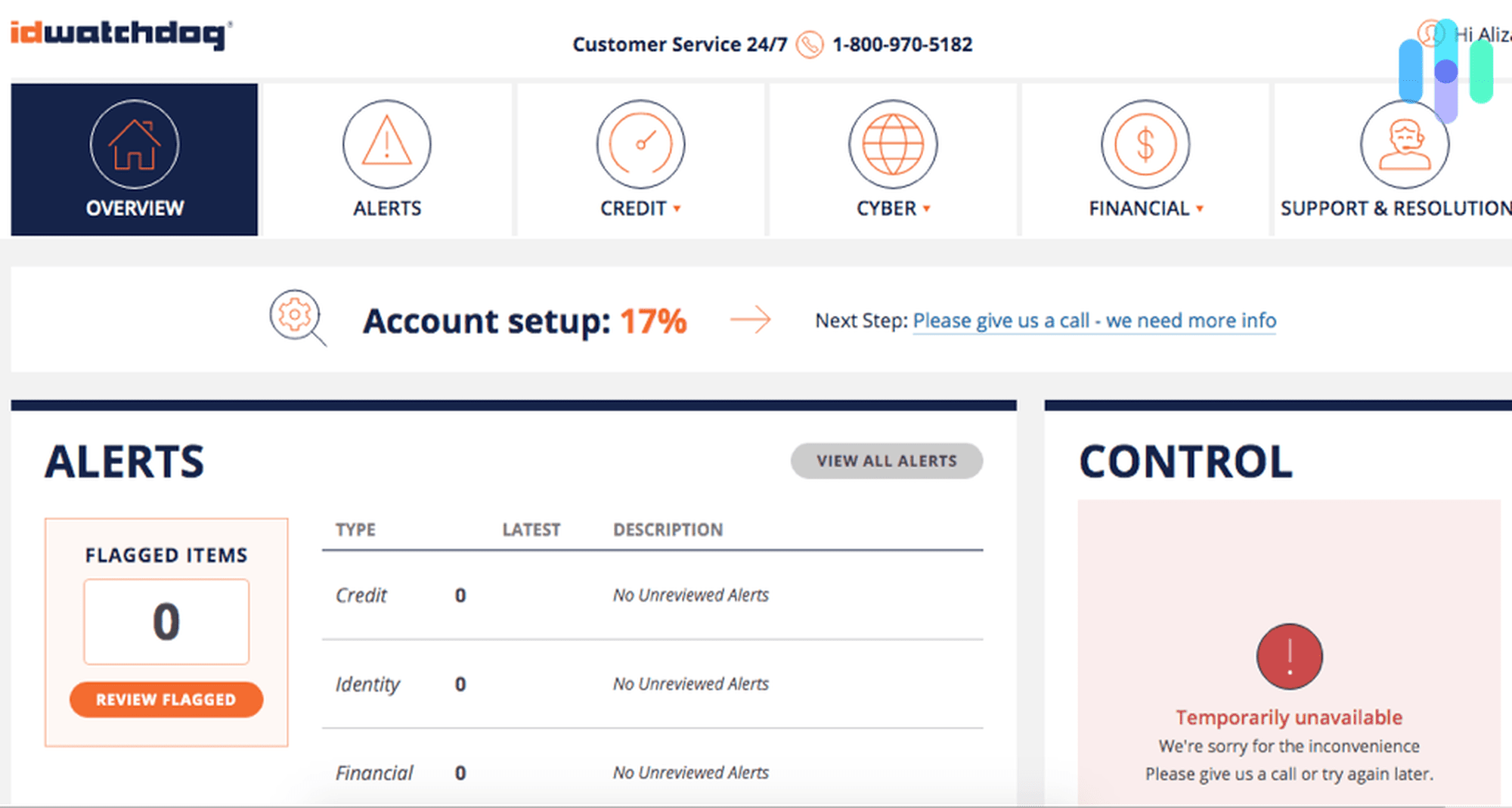

7. ID Watchdog - Best Credit Theft Prevention and Detection

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $12.50 and up Family Monthly Plans $20 and up The credit reporting giant Equifax is the company behind IDWatchdog, so it’s no wonder this credit protection service makes the cut. IDWatchdog gets our pick for best credit prevention and detection for a few good reasons.

First, they actively monitor the three major credit agencies, looking for your personal information linked to suspicious activity. They also monitor databases in the healthcare industry — a feature that some services simply don’t offer. And finally, the service scours billions of records (change of address records, payday loans, new applications, etc.) looking for your sensitive information used illegally.

IDWatchdog customers enjoy around-the-clock monitoring of their credit by Equifax, a company that knows credit perhaps more than any of the competition. Unfortunately, the service only offers annual credit reports (opposed to weekly, monthly, or quarterly). This might be a deal-breaker for some people. But overall, IDWatchdog does an effective job at protecting users’ identity and credit.

ID Watchdog Account Dashboard Pros

- 3-bureau full-service credit monitoring

- Owned by the credit-bureau Equifax

- Secure two-factor authentication

Cons

- No companion app for mobile access

- Reports yearly instead of monthly or quarterly

- Equifax was hacked in 2017

What sets IDWatchdog apart from the competition

IDWatchdog is owned by the credit-reporting agency Equifax, so customers enjoy the institutional experience and some of the best credit protection features in the business.

Who it’s good for

IDWatchdog is a safe bet for those who prefer working with a major credit bureau, and those who desire full-service ID theft protection and credit monitoring.

-

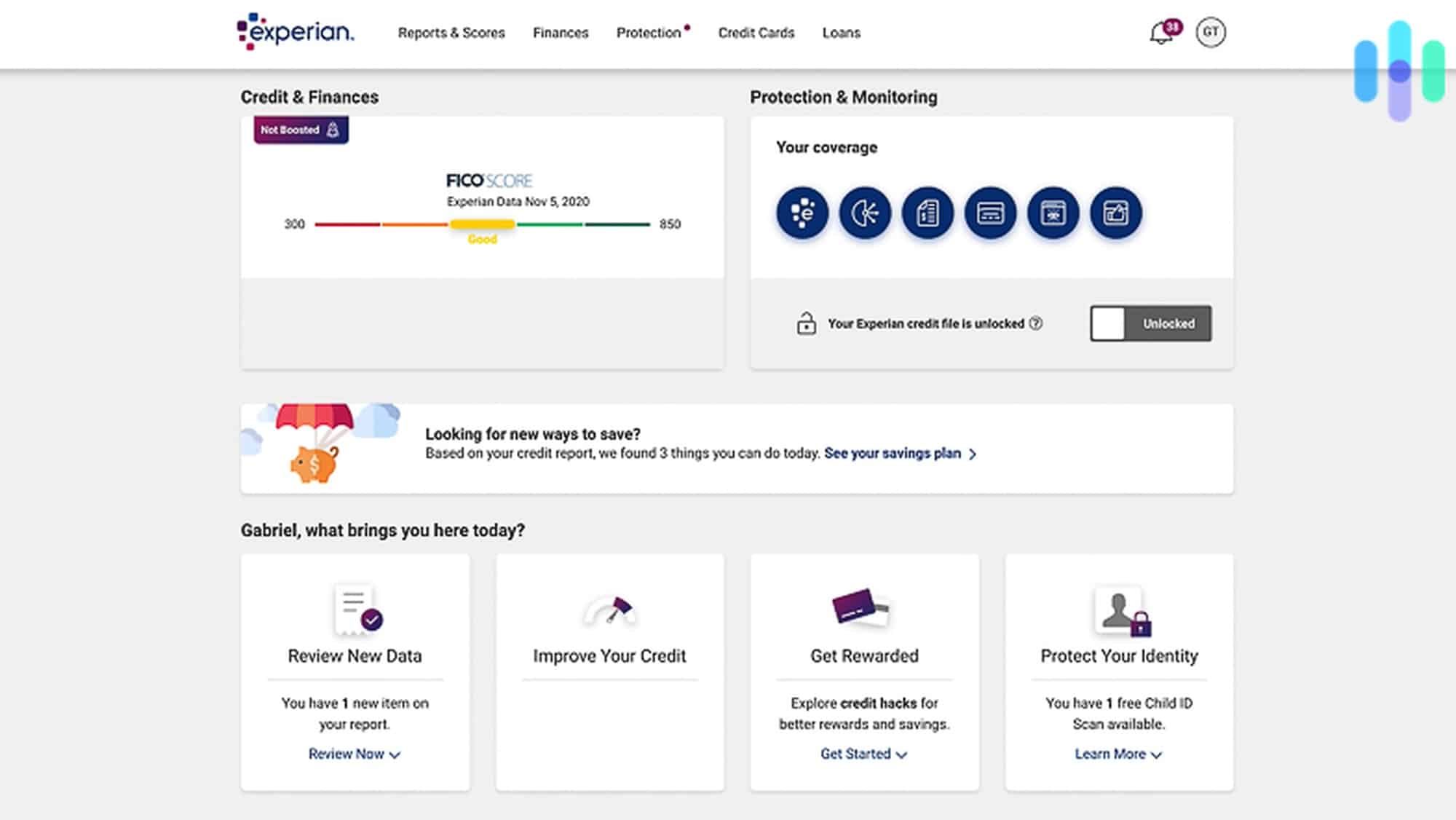

8. Experian IdentityWorks - Best Credit Restoration

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans Starting at $24.99 per month Family Monthly Plans $34.99 and up While the Experian IdentityWorks Plus plan only comes with $500k in credit fraud insurance, their Premium plan offers upwards of $1 million in coverage. But the restoration doesn’t stop at financial compensation. The credit protection service also puts a team of experts in your corner should your credit be compromised. The credit restoration is comprehensive, with a service department committed to restoring your credit back to pre-fraud status. Access to a service department of this caliber is worth every penny spent.

Experian IdentityWorks customers also enjoy the added benefit of working with a major credit-reporting agency. If anyone knows credit monitoring and protection, you can bet Experian does. The service offers 3-bureau credit monitoring and reporting, daily credit score tracking, one-touch credit freeze, and a full-suite of identity theft protection services.

Experian Dashboard Pros

- Owned by major credit-reporting agency Experian

- Three-bureau credit monitoring and reporting

- Daily credit score tracking and updates

- Low-cost standard plan

Cons

- Standard plan only offers $500k coverage

- Customer service could be improved

- Premium plan is relatively pricey

What sets Experian IdentityWorks apart from the competition

Much like IDWatchdog, IdentityWorks is backed by a major player in the credit reporting and monitoring space, Experian. Experian IdentityWorks customers are sure to get the best credit restoration available.

Who it’s good for

Experian IdentityWorks is best suited for those who desire a little extra peace of mind, and don’t mind paying for full-service credit protection and restoration.

Credit Breaches and Credit Protection

Hackers and other cyber-criminals don’t just hack into big-business databases to steal users’ sensitive information. They also go straight to the source — the major credit-reporting agencies. Credit breaches happen more frequently than you might think, and the effects can be devastating. Our entire credit history, — including SSN, opened accounts, payment history, etc. — are on file with agencies like Equifax, Experian, and TransUnion. And when these agencies are hacked, our information can be bought, sold, and traded to be used fraudulently.

As recent as 2017, the major credit bureau Equifax* was targeted by a hacker who got away with the sensitive information of 147 million people. Now, that’s not to say 147 million people were devastated by the credit breech, but that’s not really the point. The point is that Americans are supposed to trust credit bureaus, and when a data breach happens, that trust flies out the window.

While the major credit-reporting companies are not governmental agencies, they are in fact governed by the Consumer Financial Protection Bureau (CFPB). So you would think your information is safe and sound. But that’s just not the case. And Equifax isn’t the only one. Since 2012, Experian has succumbed to breaches three different times, while TransUnion was hit in 2012 when all three bureaus were hacked after the personal info of celebrities and politicians (like Michelle Obama, Hillary Clinton, Paris Hilton, and others) ended up on the website Exposed.

Considering the sophisticated tools and techniques of today’s cyber-criminals, it’s easy to see why credit protection is now more vital than ever.

(*As a result of the 2017 breach, Equifax is offering 10 years of free credit monitoring [if you file a claim] and up to $20,000 in compensation for any financial losses due to the breach. However, most people won’t follow through with these offers.)

Credit Monitoring & Reporting

It’s wise to seek credit protection with credit monitoring and reporting. The best identity theft companies offer affordable and accessible services to keep your credit in good standing. Of course, it’s impossible to completely eliminate all threats, but it’s entirely possible to catch credit fraud early on, before it becomes a big problem.

These services track changes, fluctuations, and habits of borrowers. Then, if and when something out-of-the-ordinary occurs, the activity is flagged and alerts are sent to the user. With credit reporting, users will receive updated reports on their credit accounts and credit scores. The credit score feature is especially helpful, as a sudden dramatic dip in your credit score is often a tell-tale sign that identity theft has taken place.

>> Related resource: Guide to Preventing Tax Identity Theft

Signing up with the best credit monitoring and reporting service can save you from costly credit fraud. Or, at the very least, you’ll rest a little easier knowing that experts are constantly keeping watch over your all-important credit accounts. And considering the low monthly price of these services (starting at just $8-$10/mo.), they are certainly more than worth it.

The Bottom Line

If you’re searching for identity theft and credit protection, you’re sure to find a service that checks all the boxes. We’ve showcased a handful of the best offers above, highlighting the pros and cons and the reasons they made our list. Whether you end up going with one of these services — or something completely different! — we highly recommend getting some sort of credit protection.

Remember, building and maintaining a healthy credit score is critical if you ever want to take out loans, open lines of credit, apply for a home mortgage or car loan, and the list goes on. At some point, nearly everyone needs to put their best foot forward in the credit department. And you don’t want to find out the hard way that your credit has been compromised due to identity theft. For these reasons and more, it’s a smart move to seek protection from a trusted credit protection company.

The good news is that your options are plenty and quite affordable. The best credit protection companies on our list do not require long-term contracts, and many even offer a money-back guarantee for good measure. So really, there’s no reason not to sign-up with identity theft protection and credit monitoring.