The Best Identity Theft Protection for Businesses in 2025

Our cybersecurity experts tested identity theft protection services for businesses, and NordStellar came out on top.

- Monitors the dark web and Telegram channels

- Customized pricing means all plans can scale alongside your business

- More advanced digital protections than any other business identity theft protection service

- Strong credit monitoring capabilities with unlimited credit reports

- Up to $3 million of identity theft insurance

- Identity Lock lets you toggle your TransUnion credit file on or off

- An intuitive interface lets you get set up and protected quickly

- Low, flat-rate pricing with three plans to choose from

- Alerts related to your identity and potential fraud arrive quickly so you can take action immediately

Modern identity thieves have moved on from only impersonating individuals; they now also target businesses. Just like someone can steal your personal identity and apply for loans in your name, they can also do the same with your business. But that’s not the only risk. To name a few more examples, identity thieves can target your company to steal your customers’ data, impersonate your employees, or use your corporate credit cards for their own purchases.

Protecting a business from identity theft is quite different from protecting an individual. That’s where identity theft protection services for businesses come into play. They offer specialized services tailored to the needs of your company, such as comprehensive threat management interfaces, session hijacking prevention, compromised account detection, and keyword-based dark web monitoring.

Not all business identity theft protection services are created equal. So, we put the top choices available today through our rigorous testing to get hands-on experience with each of them. Then we documented their best and worst aspects to make this list. Let’s dig in.

>> Read More: Identity Theft Prevention: Tips and Techniques for 2025

The Top 6 Identity Theft Protection Services for Businesses in 2025

- NordStellar - Best Comprehensive Protection

- LifeLock - Best Credit Monitoring

- Aura - Best Intuitive Interface

- Surfshark Alert - Best Value Protection

- Identity Guard® - Most Affordable

- IdentityIQ - Best for Leveraging Credit

Comparison of the Best Identity Theft Protection Services for Businesses in 2025

| System |

NordStellar

|

LifeLock

|

Aura

|

Surfshark Alert

|

Identity Guard®

|

IdentityIQ

|

|---|---|---|---|---|---|---|

| Ranking | 1st | 2nd | 3rd | 4th | 5th | 6th |

| Ratings | 9.8/10 | 9.7/10 | 9.6/10 | 9.5/10 | 9.5/10 | 9.3/10 |

| Credit monitoring | None | 3 bureaus | Up to 3 bureaus | None | Up to 3 bureaus | Up to 3 bureaus |

| Dedicated business solutions | Yes | No | No | Yes | No | No |

| Dark web monitoring | Yes | Yes | Yes | Yes | Yes | Yes |

| Pricing | Custom pricing | Starts at $12 per month | Starts at $3.33 per month | Starts at $2.69 per month | Starts at $7.50 per month | Starts at $5.94 per month |

| Read Review | NordStellar Review | LifeLock Review | Aura Review | Surfshark Alert Review | Identity Guard® Review | IdentityIQ Review |

-

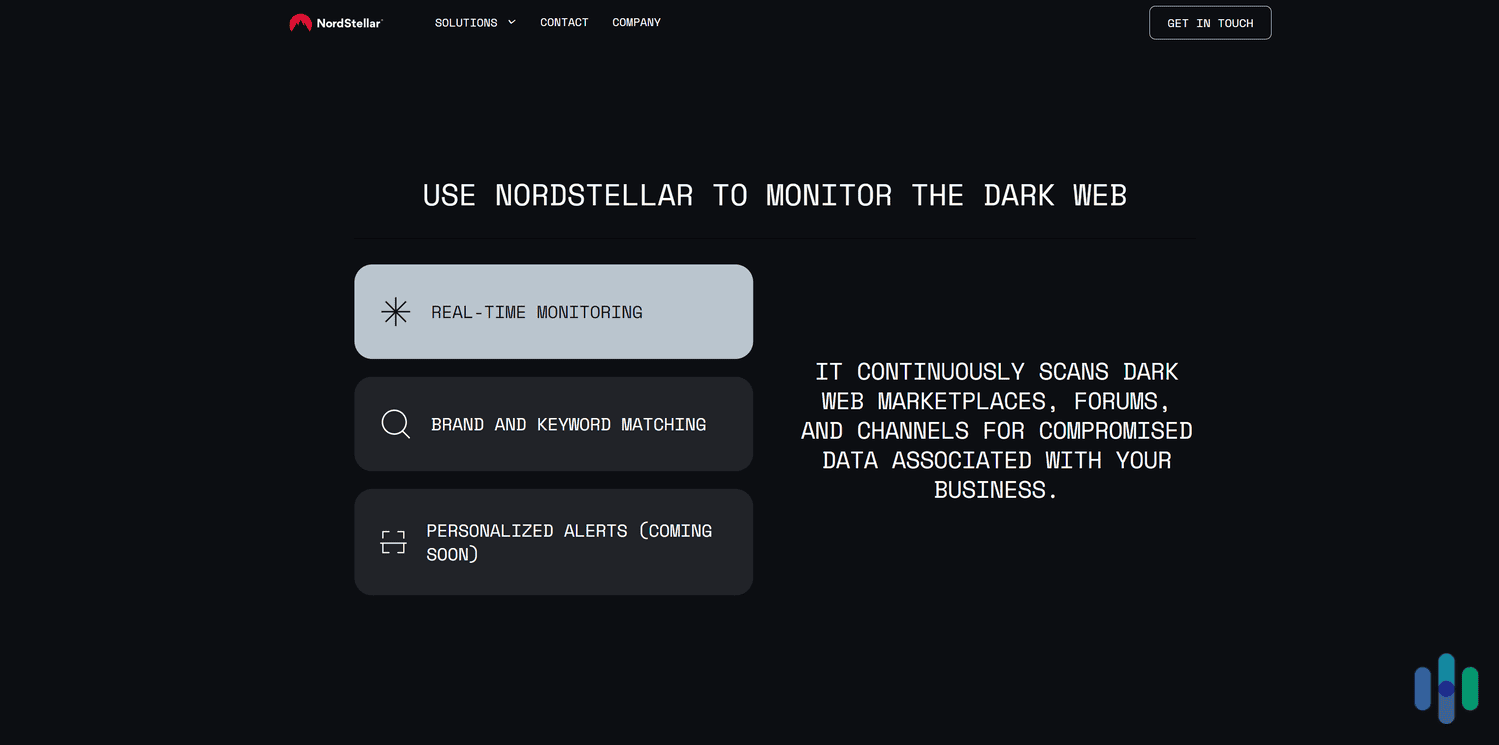

1. NordStellar - Best Comprehensive Protection

View Packages Links to NordStellarProduct Specs

Dark web monitoring Yes, for you and all employees Account takeover prevention Yes, for you and all employees Compromised credential detection Yes, for you and all employees Dedicated business plans Yes Pricing Custom pricing

Is NordStellar Right for Your Business?

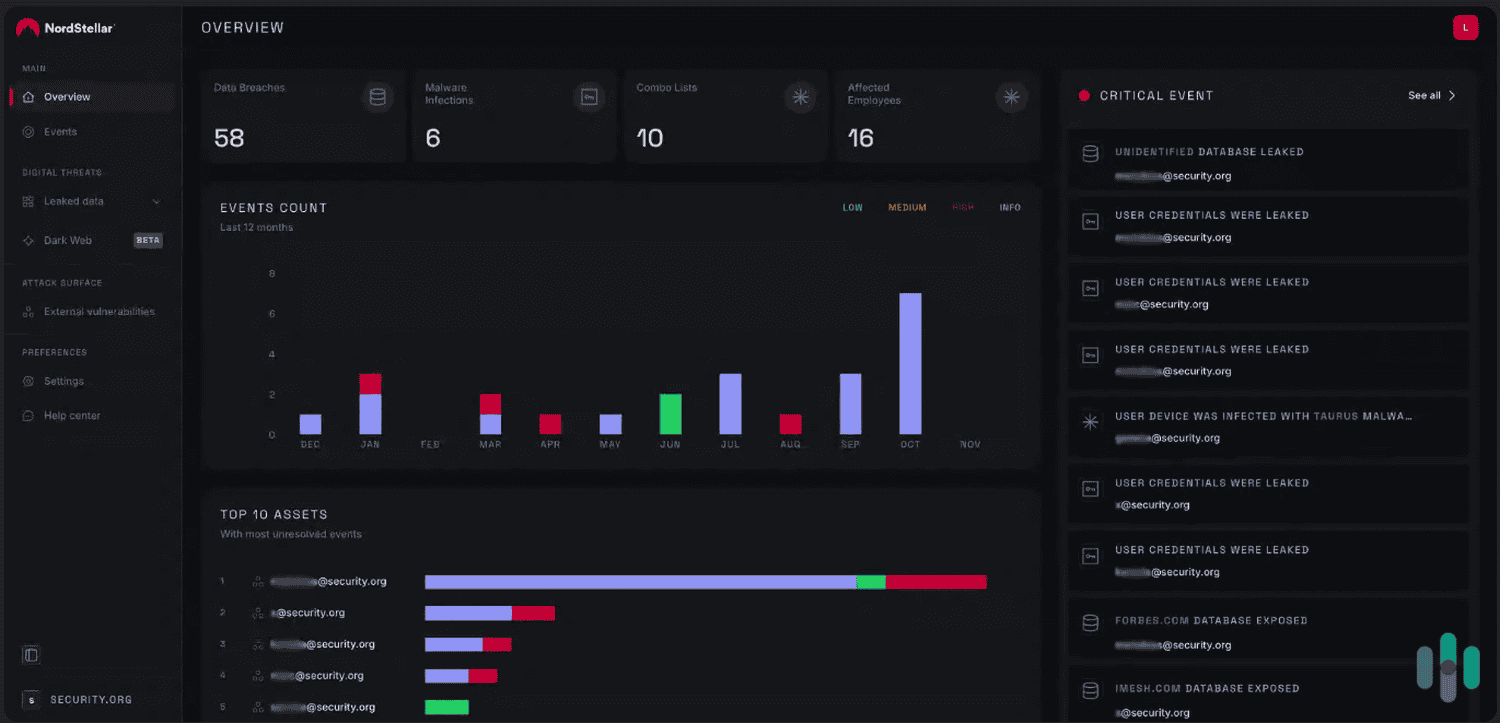

When we’re protecting our business, our highest priority is preventing an event from occurring in the first place. And in that regard, NordStellar stands well above the rest. They only offer their services to businesses and the results show. Every feature is aimed at protecting your whole company instead of just an individual.

NordStellar detected leaked credentials of our team members, most of which were email addresses found on the dark web. For instance, their leaked credential detection looks for the credentials of every employee in your business. That means if your secretary’s login details to their work email get leaked, you’ll get a warning. Account takeovers don’t need to target the IT department or CEO to do serious harm and infect your network, and NordStellar understands this.

What We Like

- Comprehensive protection designed for businesses

- Scalable plans to protect you and all of your employees

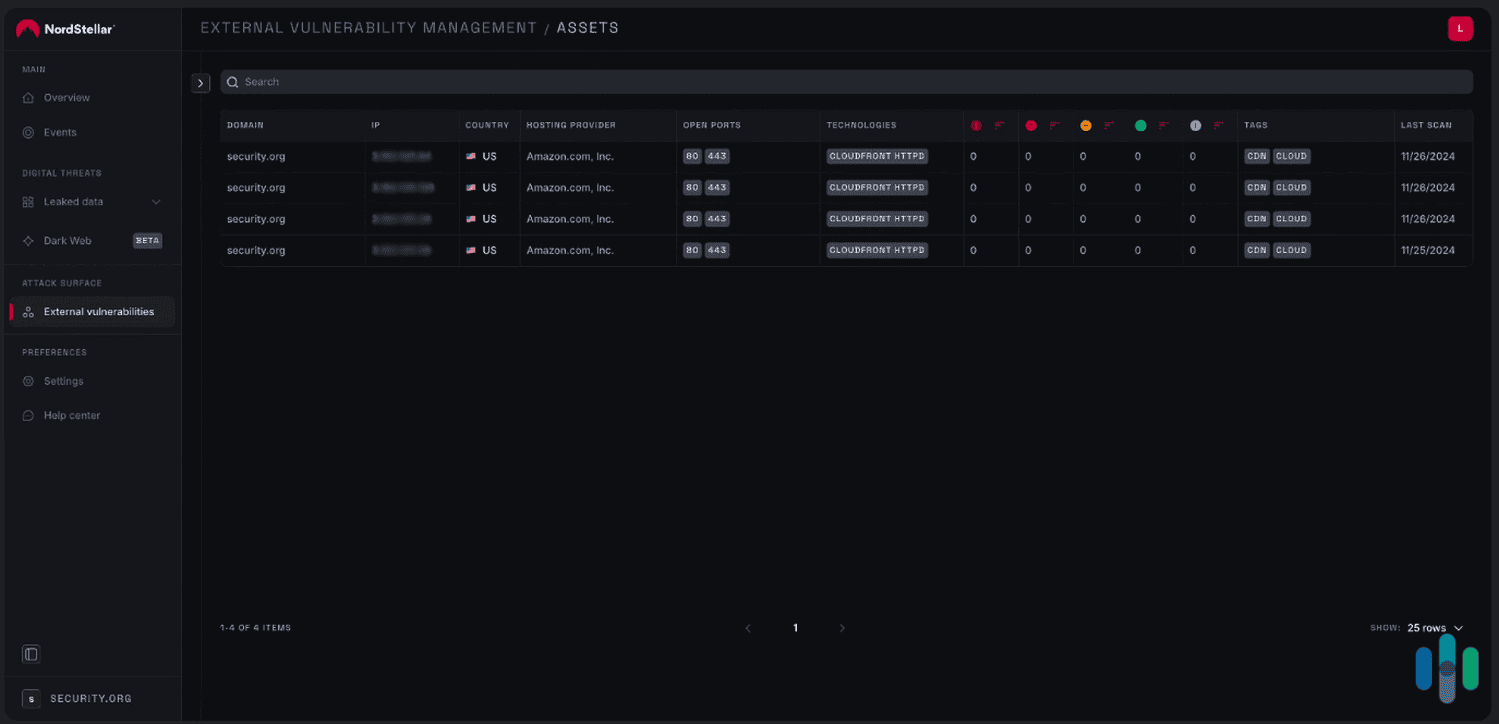

- Monitors all external-facing digital assets such as cloud resources and websites

- Dark web monitoring includes monitoring of Telegram channels

What We Don’t Like

- Pricing is only available as custom quotes

- No identity theft insurance

- New service with limited proof of effectiveness

- Primarily focuses on cybersecurity

Business Identity Monitoring

NordStellar works a lot differently than most other business identity monitoring services. While every service tries to prevent identity theft, most of them focus on helping you recover after an identity theft event occurs. This shows in the way they prioritize the amount of insurance they provide and the resolution services offered.

>> Learn About: How to Compare Identity Theft Protection Services in 2025

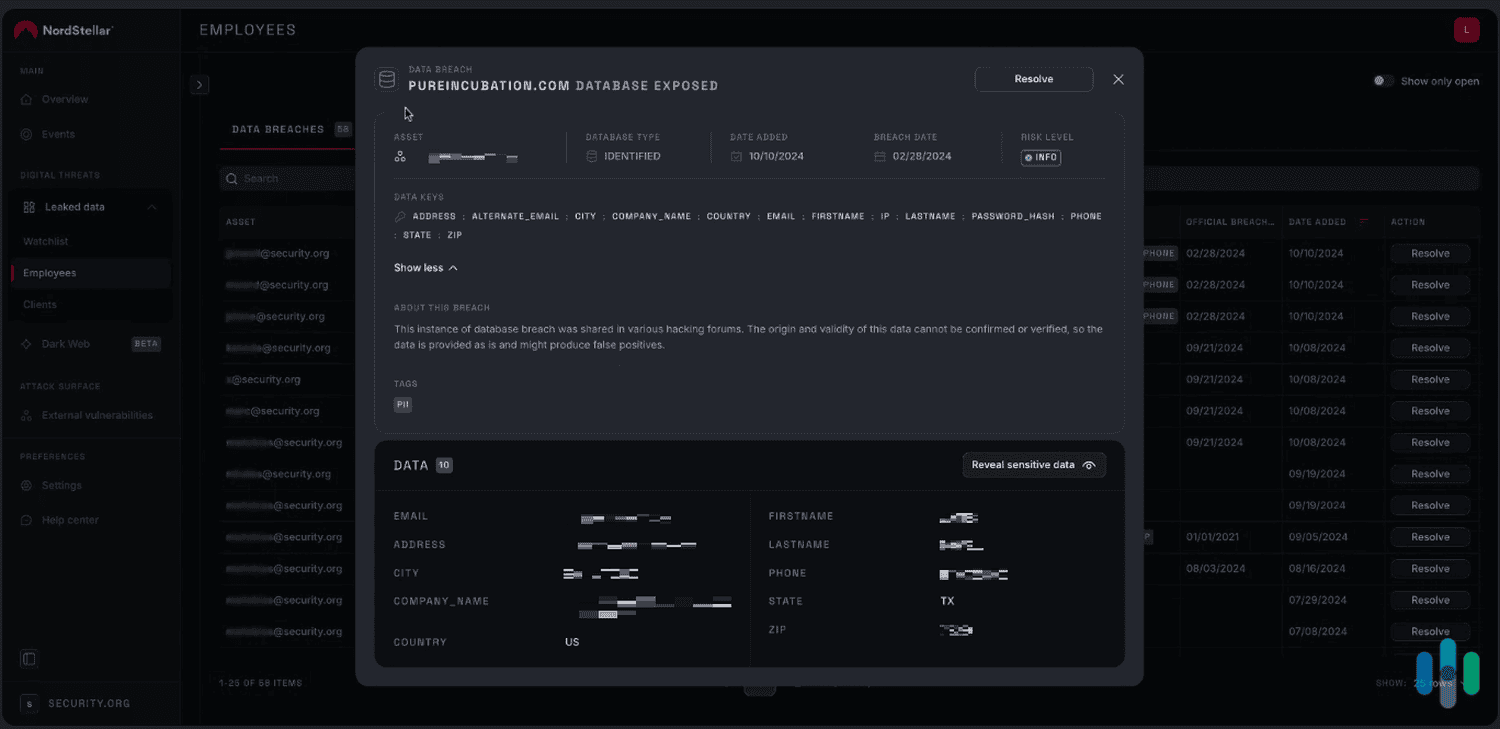

Instead of waiting until an event occurs, NordStellar focuses entirely on preventing an event from occurring in the first place. It’s proactive rather than reactive. While we were testing NordStellar, we got proactive protection through two main capabilities: data breach monitoring and dark web monitoring.

NordStellar found 56 data breaches that affected our team members; we managed to resolve all of them. First, there is data breach monitoring. NordStellar constantly scans data breach reports looking for information related to your business, whether it’s your business name or the login credentials of one of your employees. Then, you can change any passwords related to the breach to prevent any harm. That’s more thorough and advanced data breach monitoring than competitors. Most similar services don’t take into account the credentials of all your employees.

Did You Know: In most jurisdictions, companies must report data breaches. These reports share how the breach occurred and what data was compromised. Using these reports, identity theft protection services can figure out when your data is leaked.

As for dark web monitoring, NordStellar scans for keywords related to your business for a thorough approach. Most companies only scan for exact matches to your information. NordStellar also extends their dark web monitoring to channels on Telegram, which is an encrypted communication platform that hackers use to sell compromised data.

Pricing

To get started with NordStellar, you need to book a demo. And that’s exactly what we did. Once we requested our demo, a sales agent from NordStellar asked us about our business, how many employees we had, and what we were looking to get out of NordStellar. Our answer was business identity security. Then, we went on to book a data exposure assessment so they could provide us with a quote for their services and show us how the product worked.

NordStellar assessed our data exposure through a demo, including looking at our external-facing assets such as server hosts. After the demo, the representative informed us how much it would take to continue using NordStellar. They also informed us that the prices can vary wildly, depending on factors such as the size and nature of the business, number of employees, amount of external-facing assets, and more. Because of that, we’re opting not to provide any pricing information here and encourage you to book a demo for yourself to get a more accurate assessment. However, we would say that the price they quoted us is par for the course of other business identity theft protection solutions we looked at.

Cybersecurity

We weren’t surprised that NordStellar’s cybersecurity capabilities blew us away. After all, the same company that made NordStellar also made our favorite business VPN, NordLayer. It offers a lot, from reducing the attack surface of vulnerable digital assets to identifying malware on your business’ devices.

Our favorite cybersecurity tool from NordStellar is their session hijacking prevention. Session hijacking is when a website uploads a cookie onto your browser to steal data input on other websites. This can lead to compromised credentials and stolen sensitive data. NordStellar prevents this by identifying these cookies, invalidating the cookies, and notifying you of compromised devices so you can take action.

-

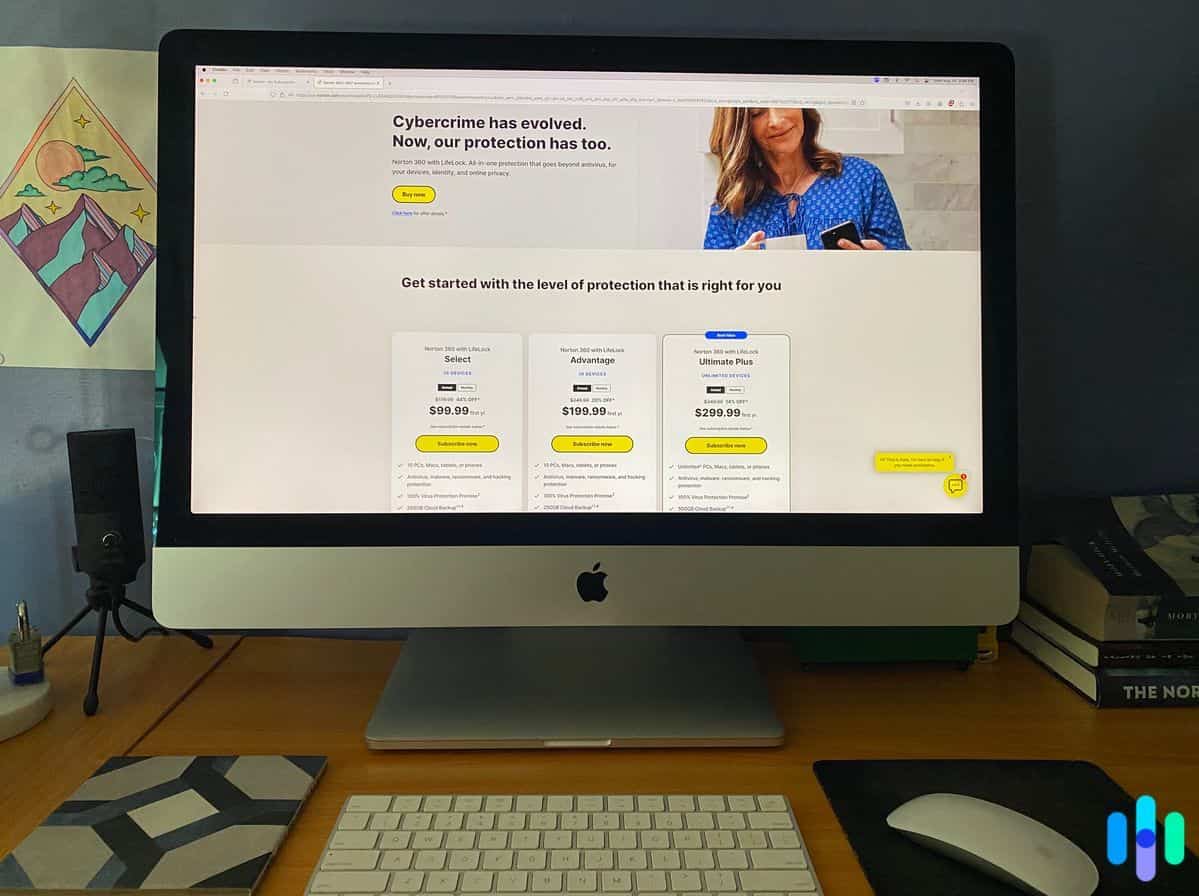

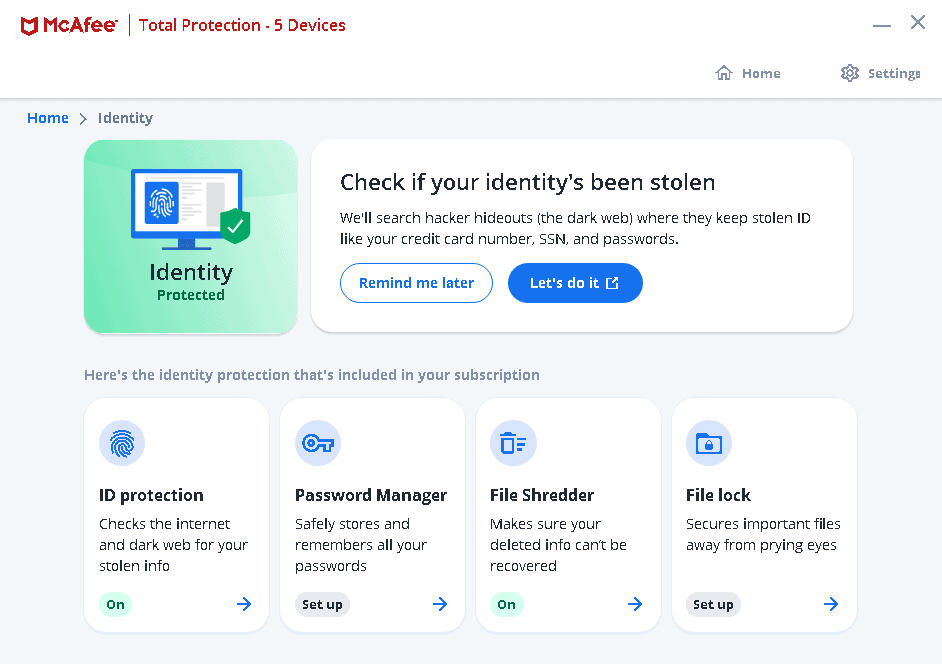

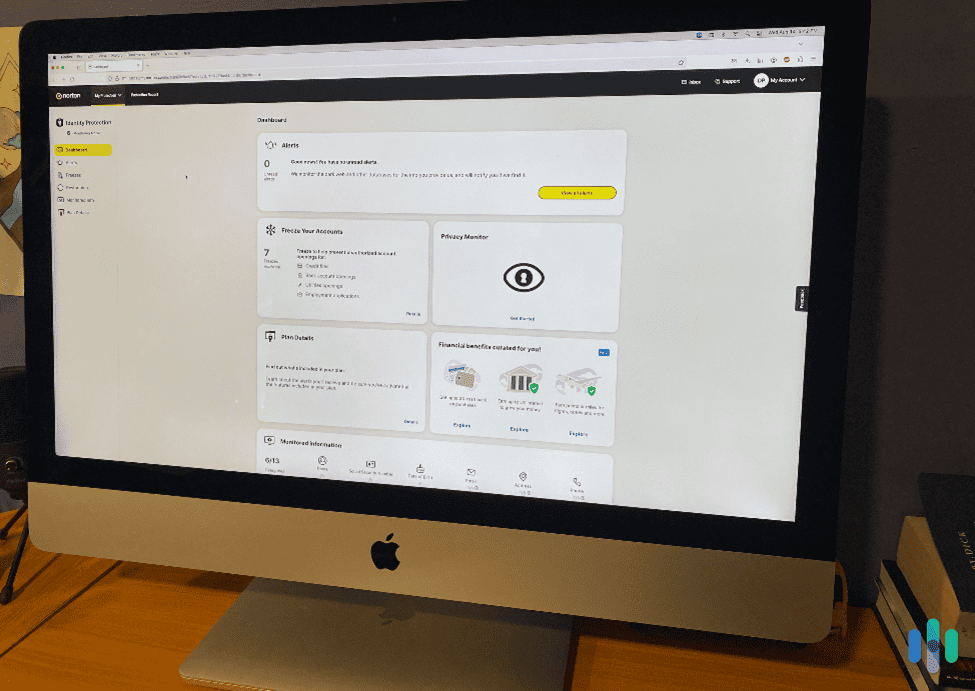

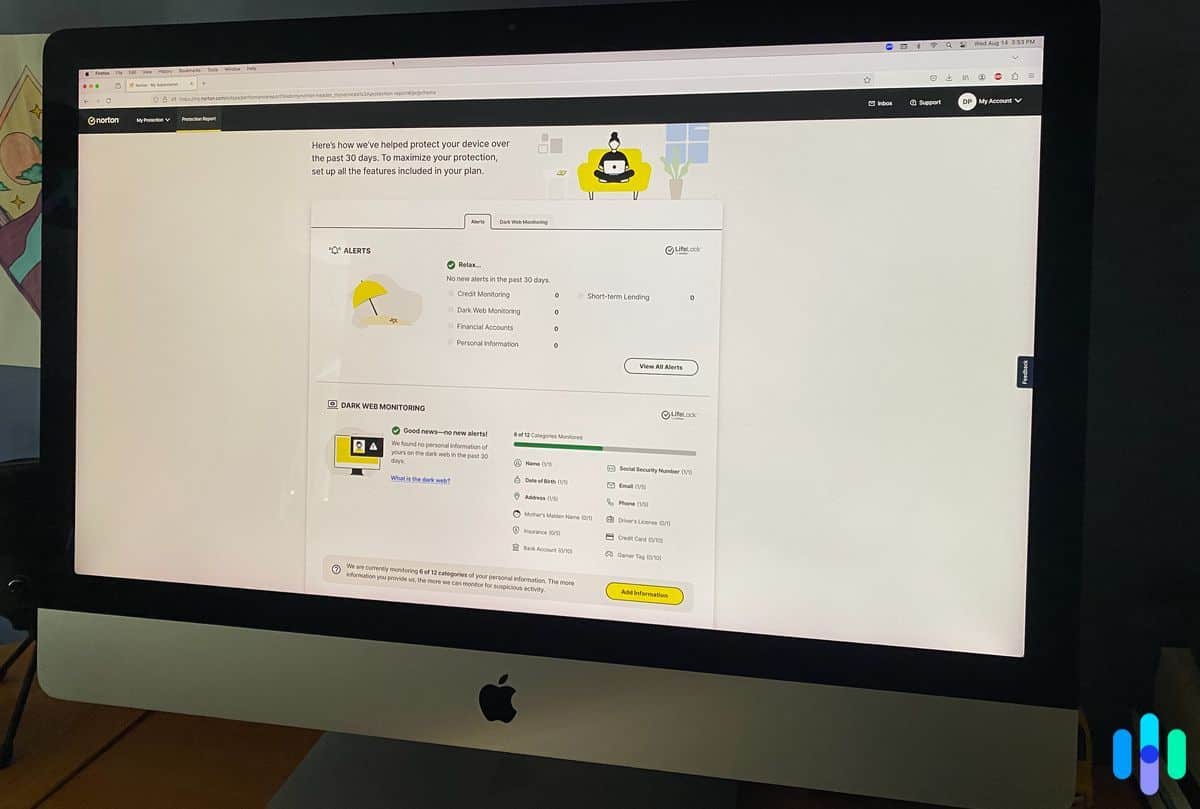

2. LifeLock - Best Credit Monitoring

View Plans Links to LifeLockProduct Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $7.50 and up Family Monthly Plans $18.49 and up Is LifeLock Right for Your Business?

If your main concern is someone using your business to fraudulently take out a line of credit, LifeLock is one of the best credit monitoring services. We’ll get into why soon. On top of their great credit monitoring, you can also pair LifeLock with Norton 360 for comprehensive cybersecurity protection. There’s even a dedicated small business plan for your cybersecurity needs.

What We Like

- High-quality credit monitoring capabilities

- Low introductory pricing at $3.33 per month

- Up to $3 million in identity theft coverage

- Identity Lock for your TransUnion credit file

What We Don’t Like

- No business plan for identity theft coverage

- Steep price increases for renewal after the first year

- Strong credit capabilities only available in top-tier plans

- With over eight plans, choosing the right one can get overwhelming

Business Identity Monitoring

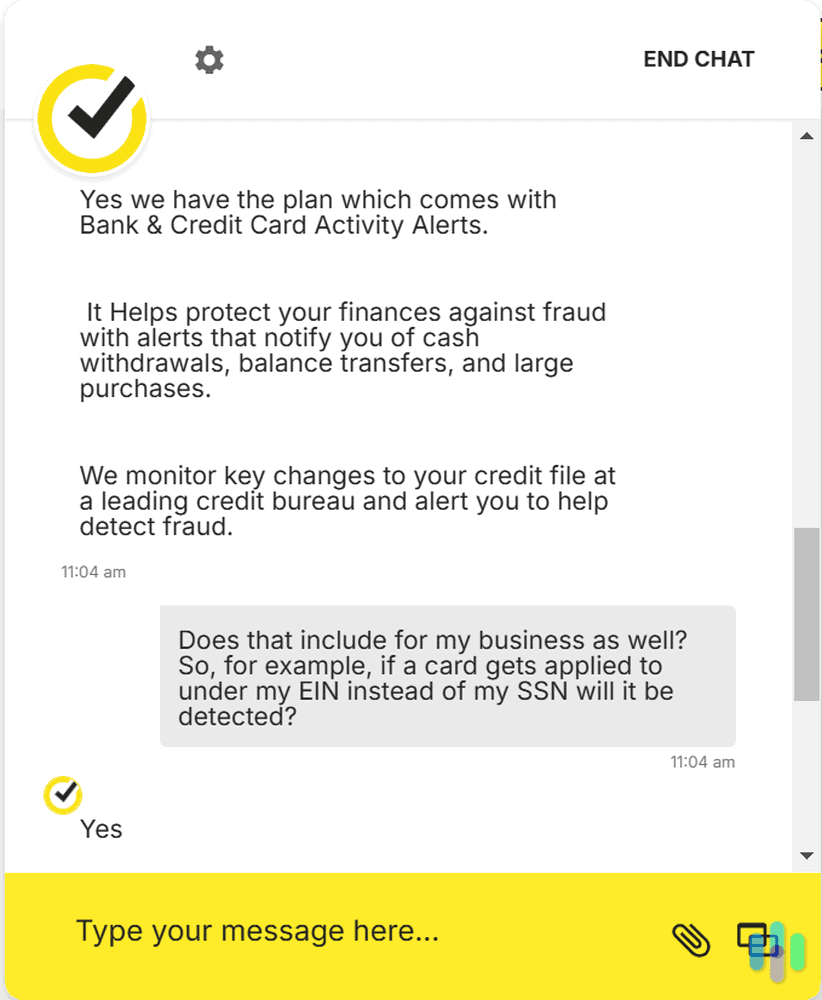

The best aspect of LifeLock’s business identity monitoring is its credit monitoring capability. First of all, LifeLock includes credit monitoring for your entire business as well as your personal credit. That means they don’t just monitor your personal credit files, but also the credit files of your business. And yes, they are different.

When we tested LifeLock, they monitored our business credit file and our personal credit file. They also offer the same monitoring for your EIN as they do for your SSN. We really like this capability, since it means nobody can apply for a business loan or business credit card using your business name. (Or, if they try, you’ll be the first to know.)

And those credit monitoring capabilities are strong. While testing LifeLock, we were able to check our credit report or score anytime we wanted. Most providers only offer weekly credit reports at best since that’s what can be acquired through Annual Credit Report for free.1 Identity Guard only offers annual credit reports. But they have other advantages. See how these two providers compare in our LifeLock vs. Identity Guard comparison.

Pricing

Choosing a LifeLock subscription couldn’t be easier with the website’s user-friendly interface. With such strong credit monitoring capabilities, LifeLock tends to cost more than Aura. However, we thought it provided enough value to justify the cost. Like we mentioned, there are a lot of LifeLock plans and they can be combined with Norton 360 for cybersecurity protection. So, here’s a breakdown of LifeLock’s plans and pricing:

LifeLock plan Identity Advisor Standard Advantage Ultimate Plus Monthly rate $4.99 $11.99 $22.99 $34.99 Monthly rate with Norton 360 n/a $14.99 $24.99 $34.99 Annual rate $39.99 ($3.33 per month) $89.99 ($7.50 per month) $179.88 ($14.99 per month) $239.88 ($19.99 per month) Annual rate with Norton 360 n/a $99.99 ($8.33 per month) $199.99 ($16.67 per month) $299.99 ($25 per month) Cybersecurity

LifeLock itself does not come with any cybersecurity capabilities. But, when paired with Norton 360, it comes with some of the best antivirus software for businesses. According to AV-Test, a third-party antivirus testing firm, Norton 360 stopped all malware threats in their most recent assessment.2 And going back, they’ve only had a handful of threats go undetected.

Pro Tip: It can seem tempting to bundle LifeLock with Norton 360 through the personal plans that LifeLock offers. But we recommend Norton 360’s business solution instead. You’ll need to buy them separately, but you’ll get access to cybersecurity that’s dedicated to business protection.

-

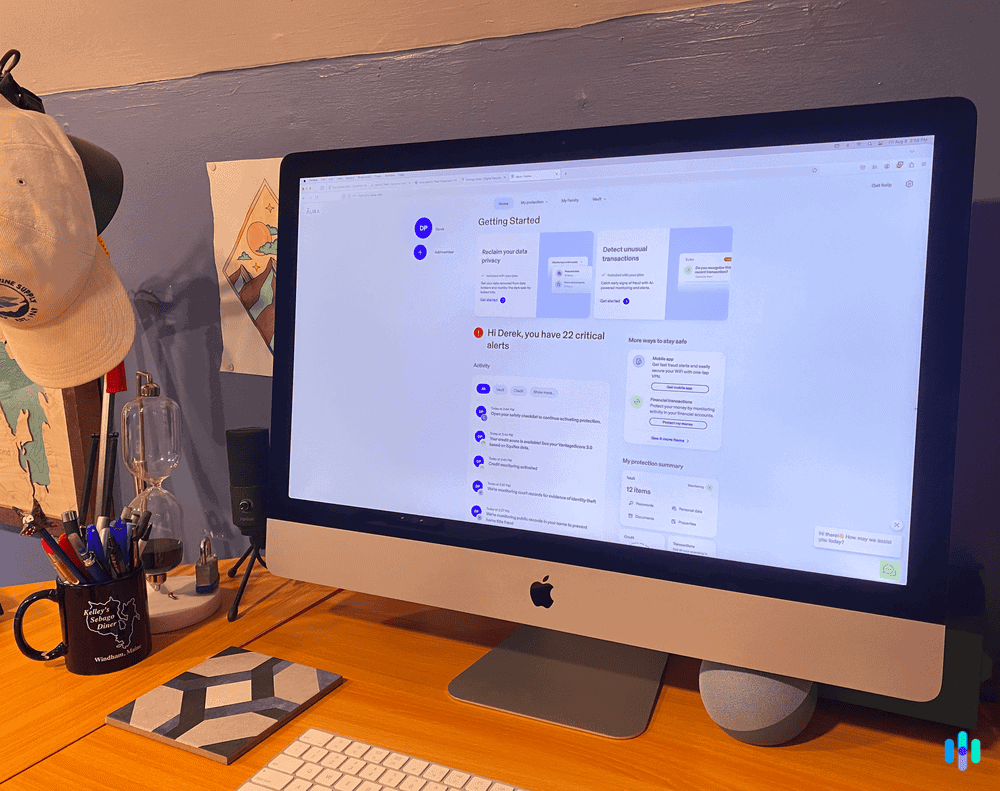

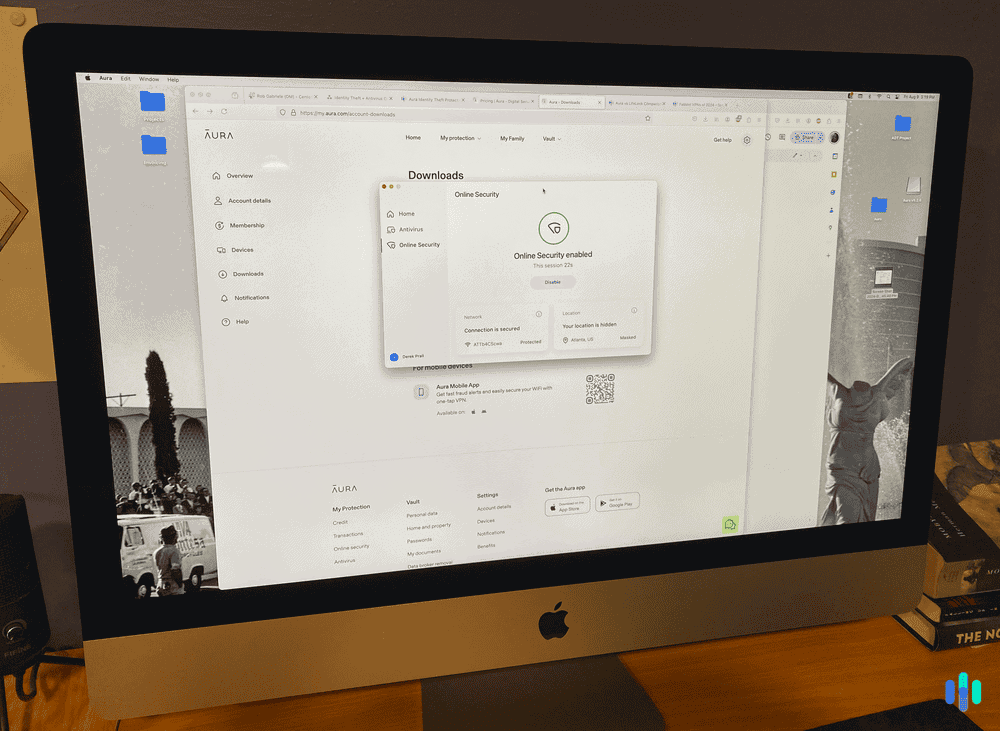

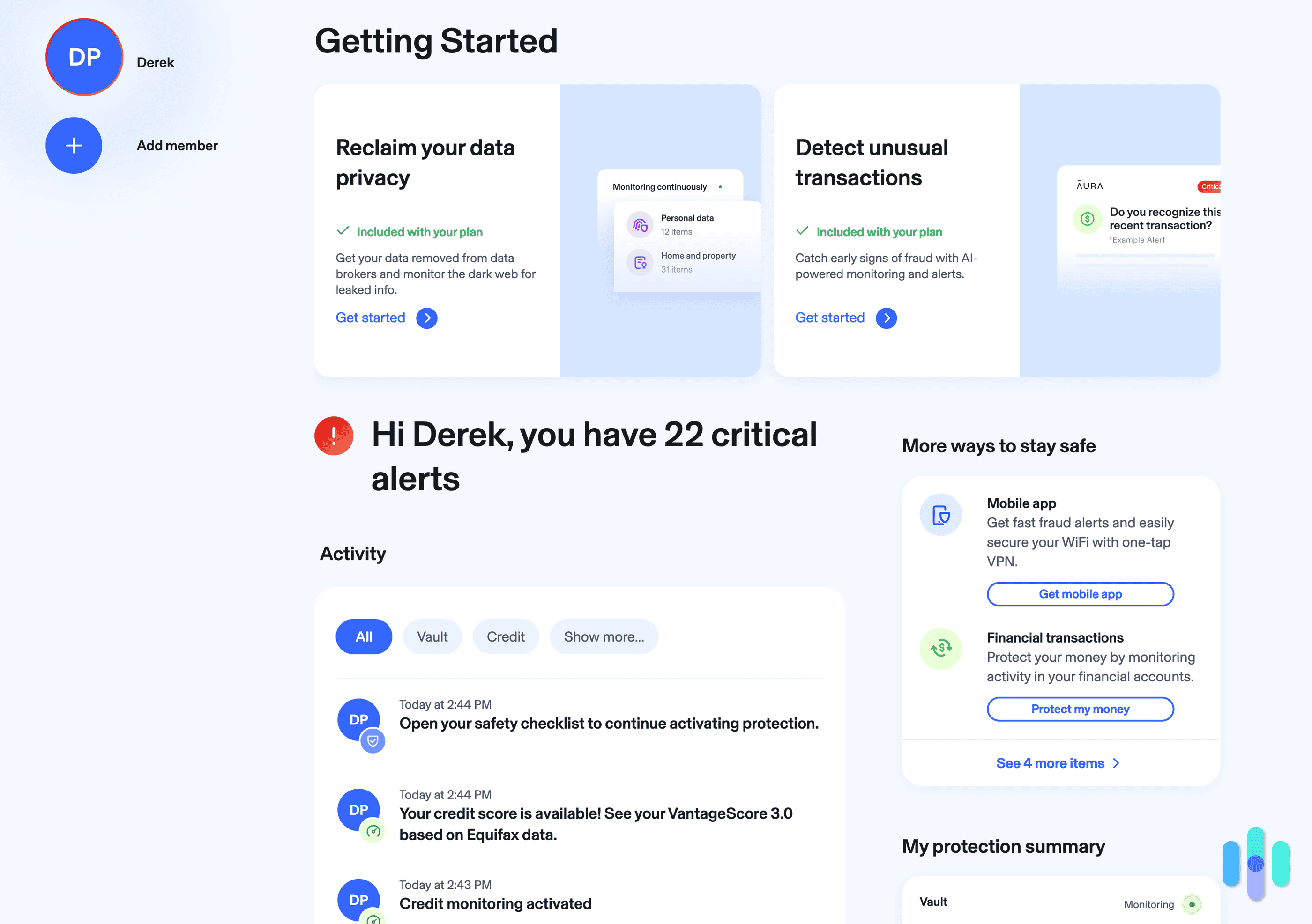

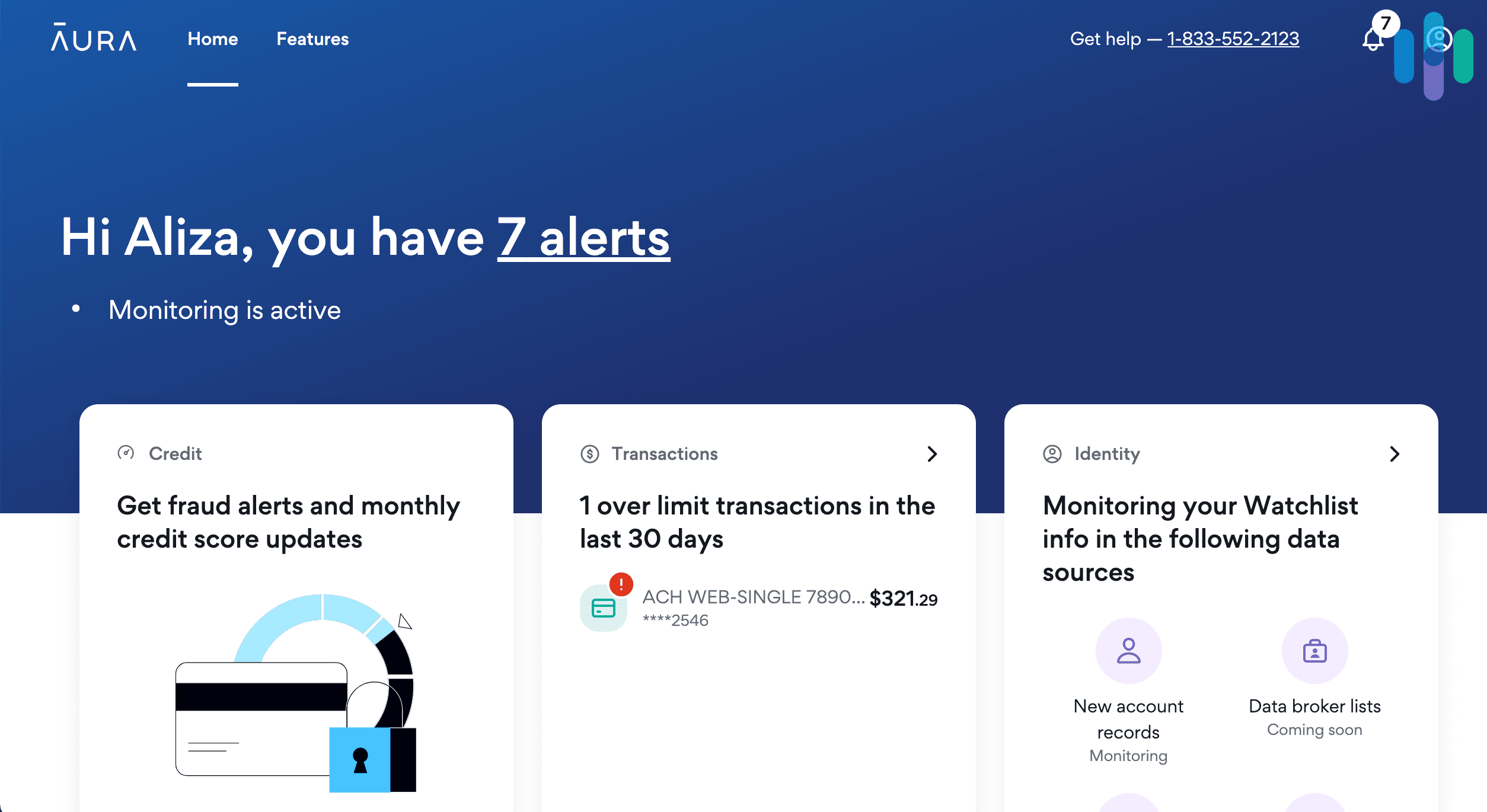

3. Aura - Best Intuitive Interface

View Plans Links to AuraProduct Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 14-day Individual Monthly Plans $12 Family Monthly Plans $45 Is Aura Right for Your Business?

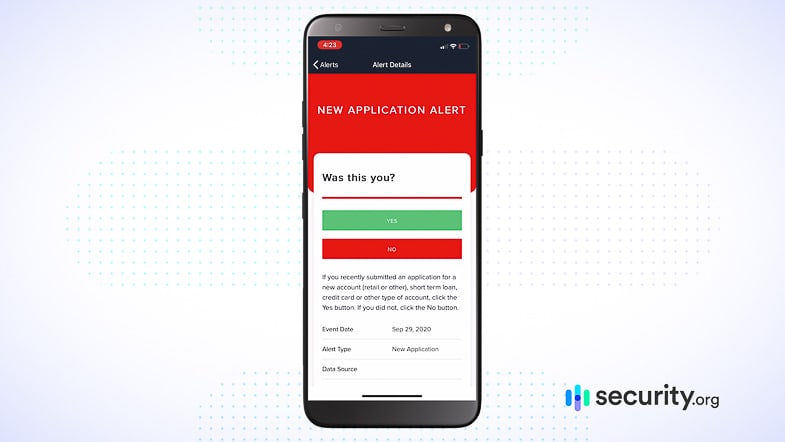

The thing we like most about Aura is how easy it makes identity theft protection. That goes for whether you’re protecting yourself, your family, or your business. Their plans are intuitive and the interface once you start using it just makes sense. An easy-to-use interface keeps you in control of your level of protection at all times.

While it lacks protection plans dedicated to businesses, Aura’s Individual package provides excellent credit and identity protection to business owners. Even though Aura doesn’t offer a dedicated identity theft protection service for businesses (only NordStellar offers that), they’re still a great choice. That’s because they still keep an eye out for all of your personal information, from your business email and Employer Identification Number (EIN) to your home address and Social Security number (SSN).

What We Like

- Intuitive interface

- Low-cost, all-inclusive plans

- Included password manager is useful for businesses

- Alerts arrive quickly

What We Don’t Like

- No dedicated plan for businesses or business owners

- VPN only has U.S. servers

- Can’t pick and choose capabilities to fit your needs

- Limited cybersecurity capabilities

Business Identity Monitoring

Although Aura doesn’t have a dedicated business identity monitoring plan, it can still work as an effective tool to safeguard business identities by protecting the owner. Aura works by having you input all of the information you want it to monitor. Since you’re the one who will input the information, you can include all of your business’ information as well.

One particular aspect we like about Aura for businesses is their financial transaction alerts. You can link your business accounts to get alerts related to your business as well. That way, you can put a stop to any potentially fraudulent transactions before they become a major issue.

FYI: Aura removes your data from people search sites and data brokers. That can cut down on the spam calls and solicitors your business receives, saving time for you and whoever you task with fielding calls at the office.

That said, we were disappointed that Aura only checked the dark web for account credentials, personal information, and investment accounts. NordStellar, on the other hand, tracks keywords related to you and your business for more comprehensive monitoring. LifeLock monitors the dark web for any information you give it.

>> Read About: Aura vs. LifeLock Comparison for 2025

Pricing

We like Aura’s pricing because they make it easy to choose a plan. Instead of figuring out which features you need, Aura includes all of their relevant capabilities in every plan. By relevant capabilities, we mean they don’t include things like parental controls in the Individual Plan. Instead, they split their plans into four categories: Kids, Individuals, Couples, and Families. Of course, the Kids plan has no use for businesses, but the rest do.

As for the plans that would work for a business, here’s how much they cost:

Plans Individual Couples Family Number of users 1 2 5 Monthly price $15 $29 $50 Annual price $144 ($12 per month) $264 ($22 per month) $384 ($32 per month) Pro Tip: Smaller businesses with less than five employees can use the Family plan to cover themselves and each employee. Giving your employees identity theft protection helps safeguard your business too, since some identity thieves can use an employee’s credentials to access your business.

Cybersecurity

Aura included useful cybersecurity tools, but it was more aimed toward personal use than business use. While Aura provides quality cybersecurity capabilities for individuals, its capabilities in a business environment are lackluster. Sure, it comes with a VPN and antivirus protection, but the device limit on both of them means they can’t protect all of the computers at your office unless you run a small business with few devices. And even in those cases, we still prefer NordStellar or LifeLock if you want cybersecurity with your identity theft protection. That said, we recommend investing in a dedicated cybersecurity solution for your business anyway.

>> Read More: The Best Business Antivirus Suites of 2025

-

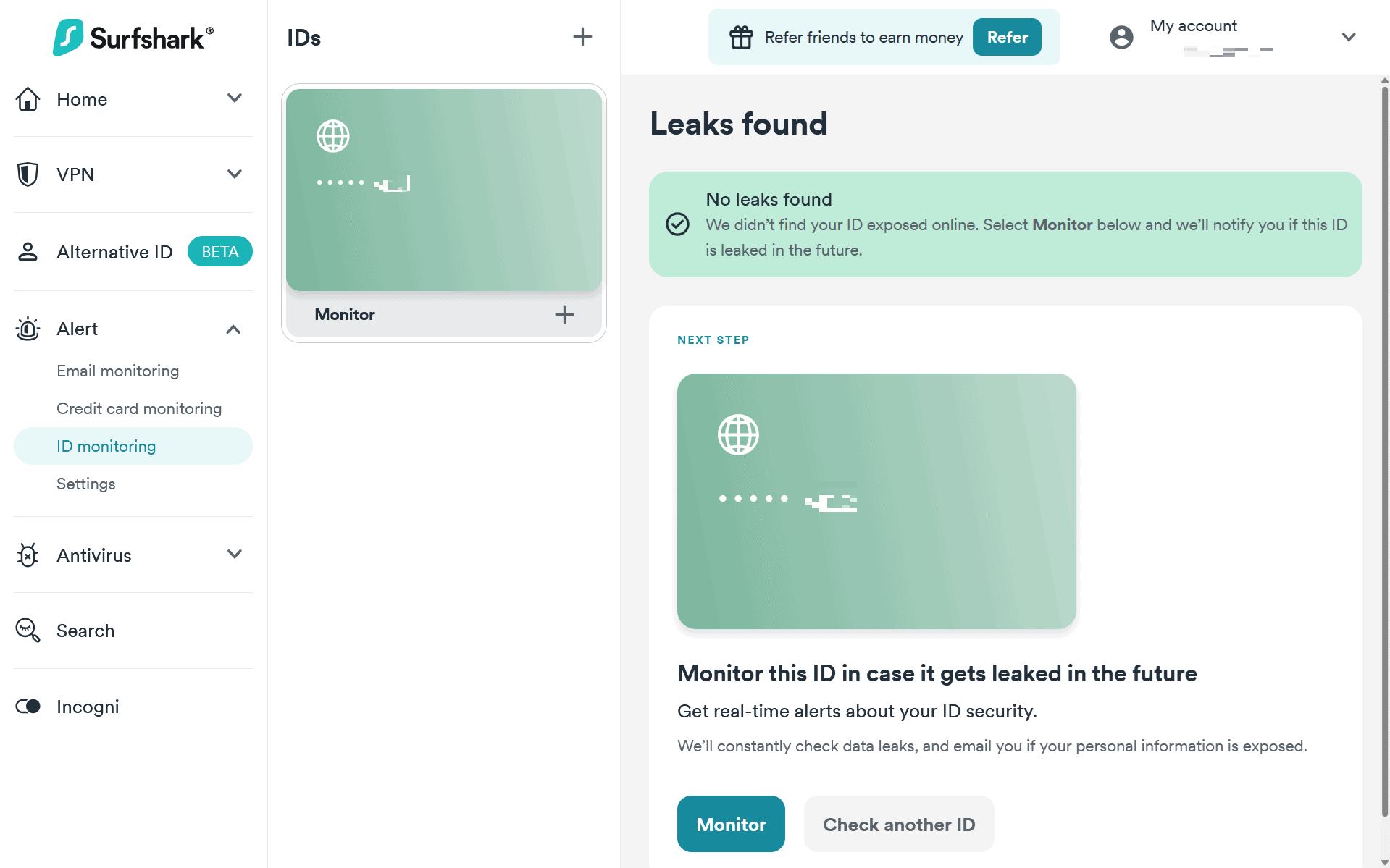

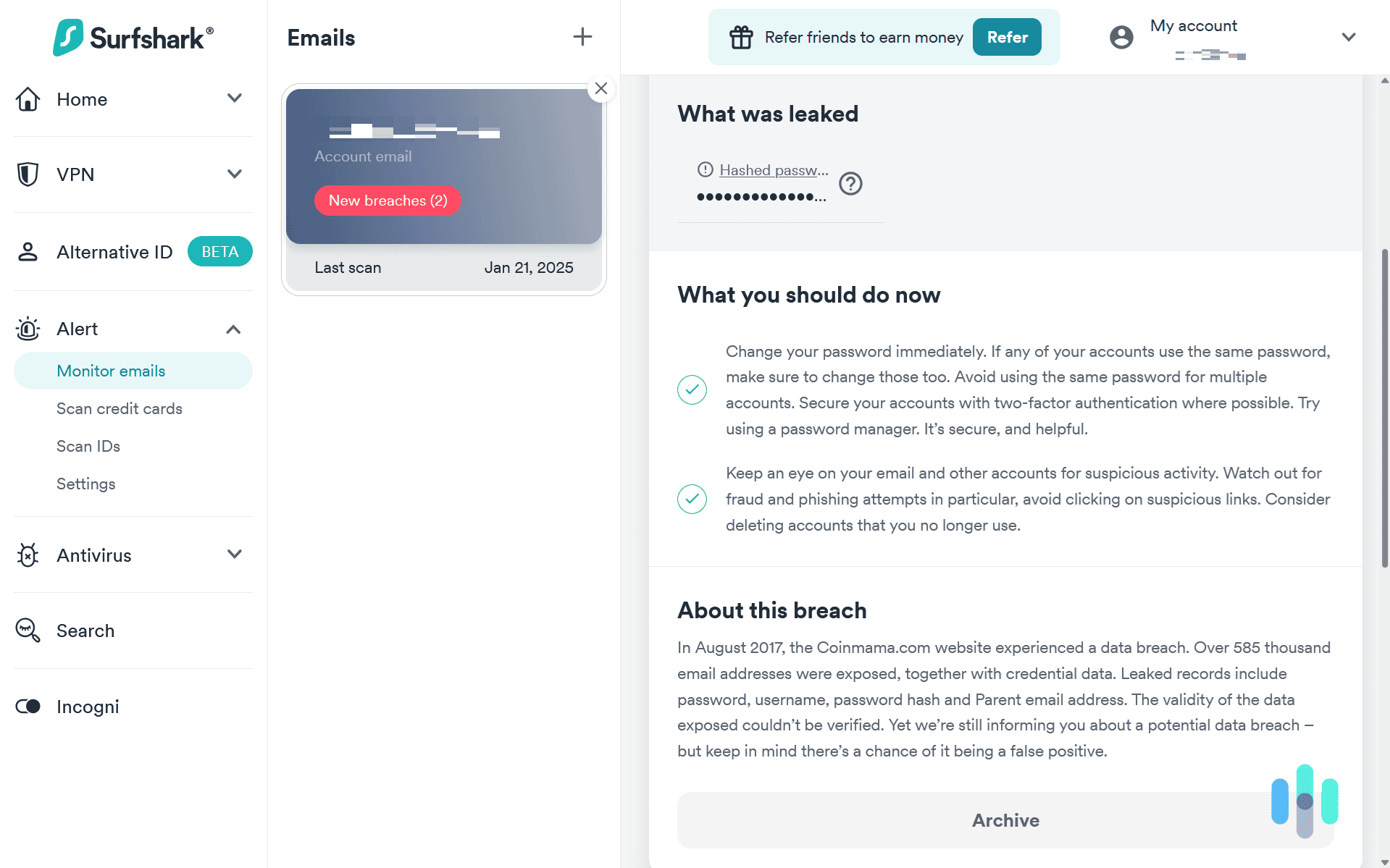

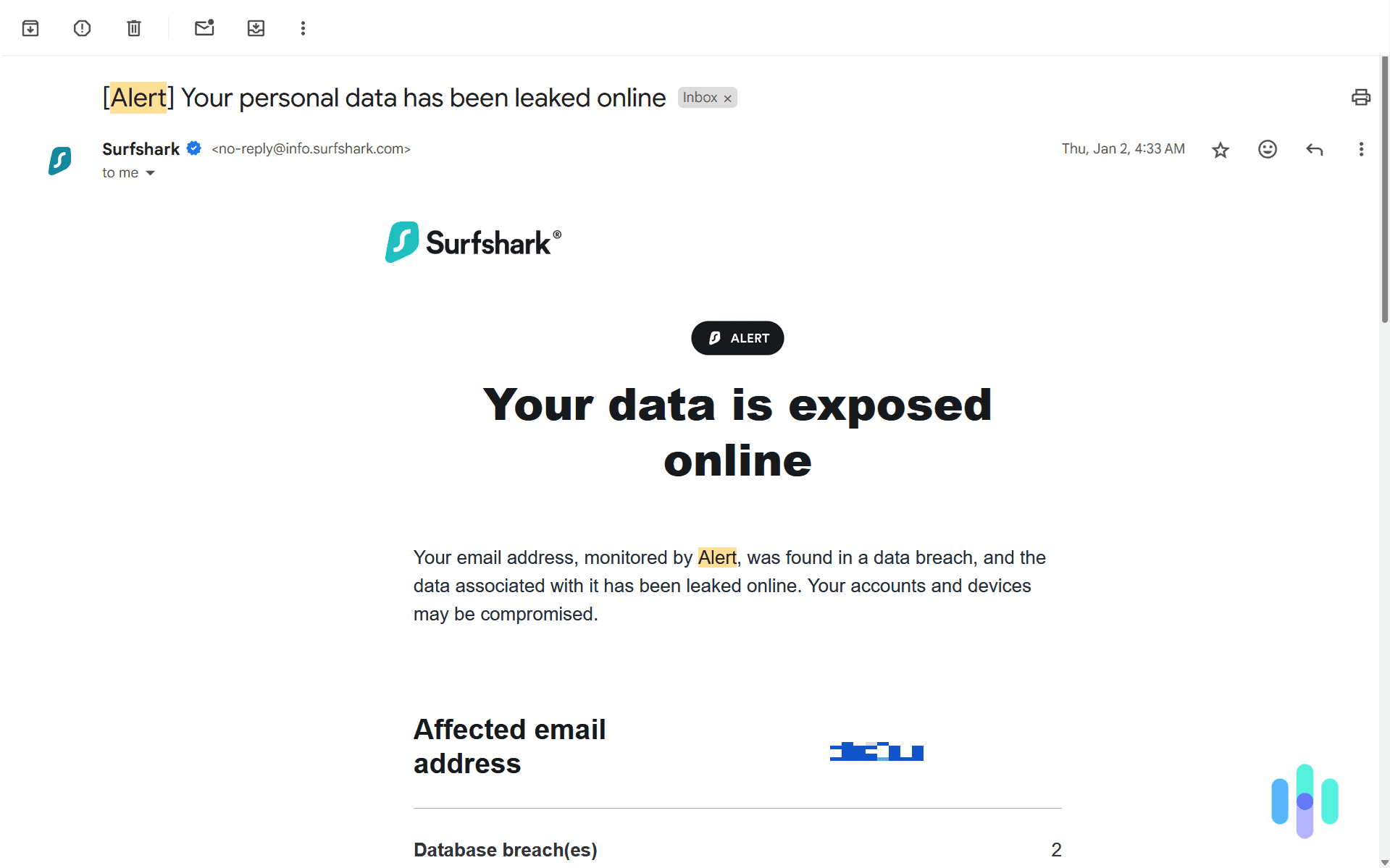

4. Surfshark Alert - Best Value Protection

View Packages Links to Surfshark.comProduct Specs

Dark Web Monitoring Yes Credit Reporting No Insurance Coverage No Free Trial 30-day money-back guarantee Individual Monthly Plans $2.49 and up Family Monthly Plans $2.49 and up Is Surfshark Alert Right for Your Business?

We manually opted into having Surfshark Alert monitor our SSN. Surfshark Alert offers some of the most affordable identity protection for businesses. Just make sure you’re ready to manually input all of the information you want monitored. As long as you’re willing to put in that work, Surfshark Alert provides some of the best value in the industry.

What We Like

- Affordable with prices starting at $2.69 per month

- Supports active monitoring for unlimited email addresses, IDs and credit cards

- Customizable data breach reports

- Subscription includes VPN and antivirus software

What We Don’t Like

- Must manually add all data to be monitored

- Free trial does not include Alert

- No credit reports or credit monitoring

- Lacks vulnerability management tools and a password manager

Business Identity Monitoring

Surfshark Alert notifies you of every data breach that includes an email address at your organization. Setting up Surfshark Alert for business identity monitoring takes a bit of work. It’s not like NordStellar where you just provide your domain name and they automatically start monitoring almost all of your online assets. With Surfshark Alert, you need to input all of the information you want monitored manually. But, it goes beyond just emails and online assets. You can also input things like your EIN so you get alerts anytime it leaks or shows up on the dark web.

FYI: If you find out your EIN was used fraudulently, you can report it to the IRS using Form 14039-B. Reporting this immediately allows the IRS to help you sort out any tax-related complications associated with the fraud.

Pricing

The price of Surfshark Alert varies based on the size of your business. For small businesses, with five or fewer employees, we recommend an individual Surfshark One plan. That gives you full access to Surfshark Alert and you can add as many identities, emails, and credit cards to monitor as you want. Here’s an overview of the pricing for Surfshark One plans, which include Surfshark Alert:

Sufshark One Plan Price per Month Monthly plan $17.95 Annual plan $3.39 Two-year plan $2.69 For businesses with five or more employees, Surfshark offers Team plans. That gives you an admin dashboard to manage each employee account providing more control over how your employees use Surfshark Alert. These plans cost $6.90 per user, but they also include a VPN and antivirus software for each user.

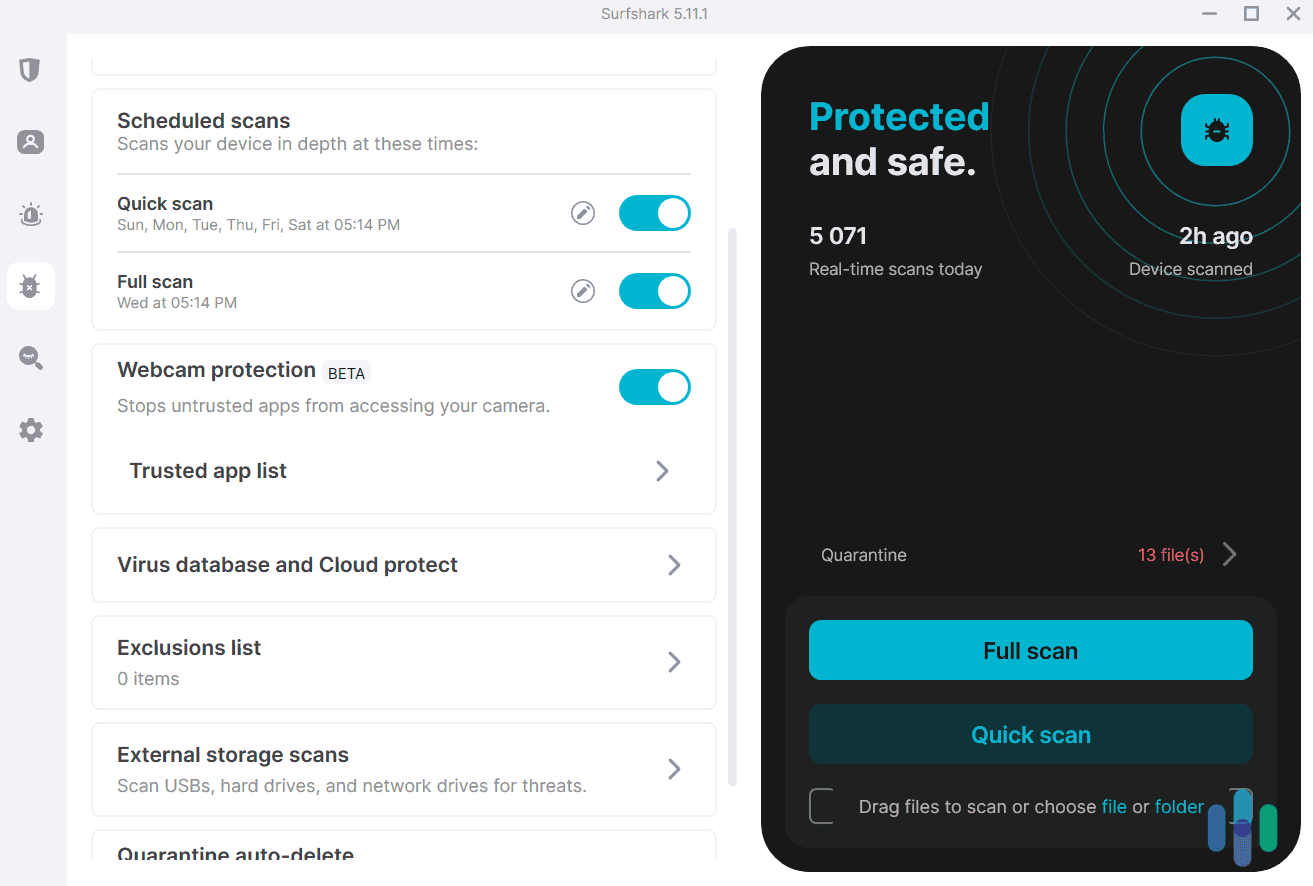

Cybersecurity

Surfshark Antivirus automatically scans our devices and quarantines suspicious files for us. Every subscription that includes Surfshark Alert also includes Surfshark VPN and Surfshark Antivirus. These are two top-notch services and the Team plan includes them for every member of your team. Check out our Surfshark VPN review and our Surfshark Antivirus review for a complete breakdown.

>> Check Out: Surfshark vs. NordVPN

-

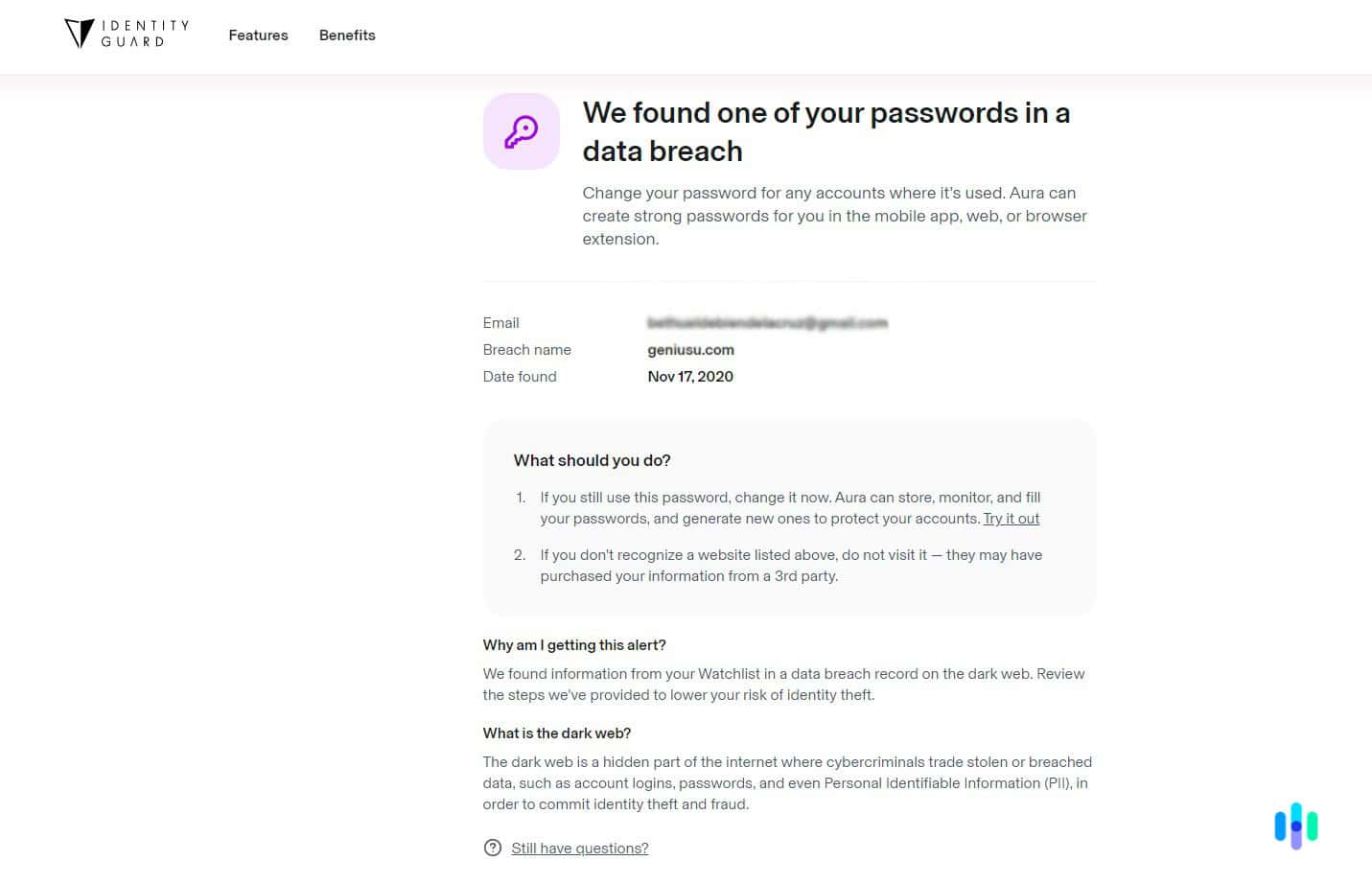

5. Identity Guard® - Most Affordable

View Plans Links to Identity Guard®Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $6.67 and up Family Monthly Plans $10 and up Is Identity Guard Right for Your Business?

For basic monitoring, it’s hard to beat Identity Guard’s $7.50 price tag. It doesn’t include any credit monitoring, but it’s the least expensive long-term option to get identity monitoring and insurance for you and your business. And there are free trial options with Identity Guard.

Just like Aura, Identity Guard offers excellent personal identity theft protection for business owners. The low price is Identity Guard’s main draw, but we actually liked the premium plan most for our business needs, since it included white glove fraud resolution. Anytime we saw fraudulent activity on one of our business accounts, we could call up Identity Guard and they would handle almost everything for us. So if you’re looking for an inexpensive plan for basic monitoring or premium fraud resolution, Identity Guard is our recommendation for your business.

What We Like

- Low prices starting at $7.50 per month

- Prices don’t increase after the first year

- White glove fraud resolution takes tasks off your plate

- Monitoring is powered by AI

What We Don’t Like

- Credit monitoring and reports are only available for mid-tier plans and above

- No dedicated business plans

- The Total plan is double the price of the Value plan but only adds credit monitoring and bank account monitoring

- The app has minimal capabilities

Business Identity Monitoring

As we said, our favorite part of Identity Guard’s business identity monitoring is the white glove fraud resolution. But that’s not the only good part of their business identity monitoring capabilities. We also liked the bank account monitoring that came with the Total plan (Identity Guard’s mid-tier plan). This feature let us set up all of our business accounts with professional monitoring so we would immediately be alerted to any suspicious activity.

FYI: We would have liked to see a dedicated business plan from Identity Guard. Using their personal plans for business protection was workable. However, features like home title monitoring and criminal monitoring didn’t give us much value.

Now, if you don’t want to spring for the higher-cost plans, the Value plan still includes dark web monitoring, data breach notifications, and high-risk transaction monitoring. In our opinion, those three features are the ideal combination for a low-cost business identity protection service.

>> Learn More: Identity Guard Credit Monitoring, Credit Scores, and Reporting

Identity Guard’s prompt and efficient handling of potential identity theft was its greatest asset. Pricing

Now that you know what business identity monitoring capabilities you can get with the Identity Guard plans, let’s go over how much they cost. Here’s an overview of Identity Guard’s pricing:

Identity monitoring plan Value Total Ultra Monthly rate $8.99 $19.99 $29.99 Annual rate $89.99 ($7.50 per month) $199.99 ($16.67 per month) $299.99 ($25.00 per month) Those are the prices for the individual plans. They also offer family plans, but for most businesses, the extra four people covered won’t provide much value.

Cybersecurity

Identity Guard’s cybersecurity capabilities are limited. They include a safe browsing tool and a password manager. And those tools will only work for you, so your employees will not be able to use them.

>> Related: The Best Password Managers in 2025

-

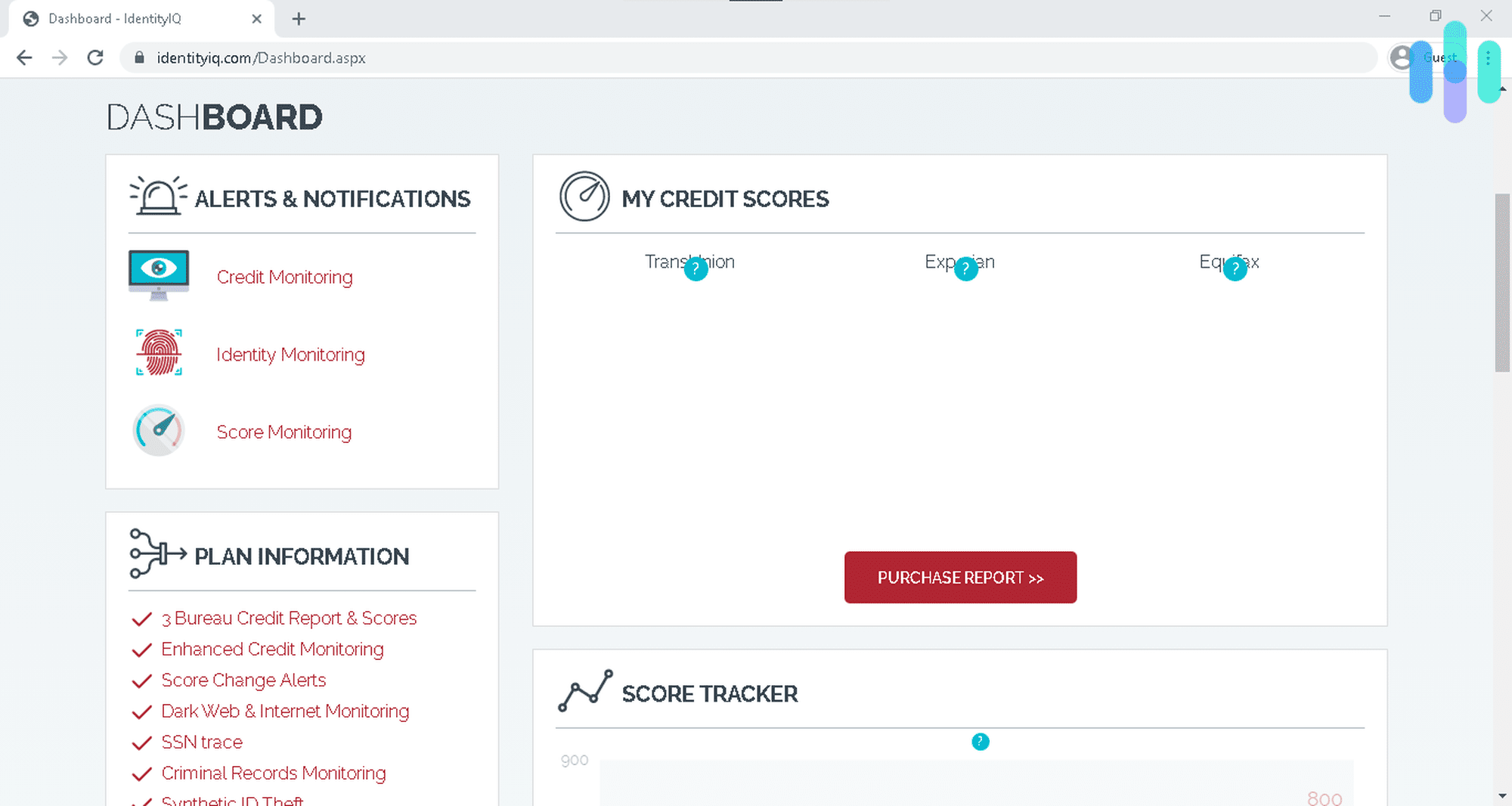

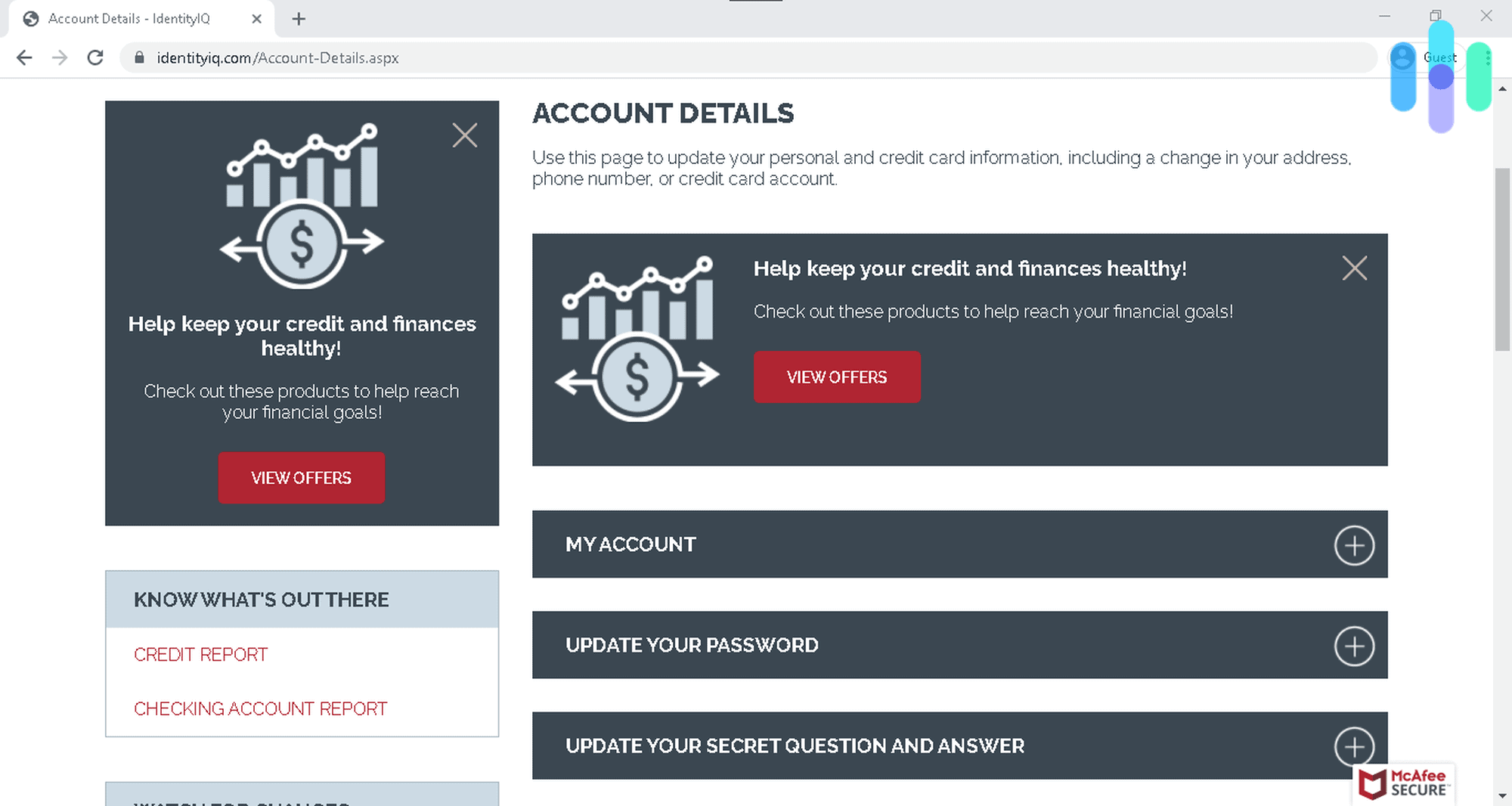

6. IdentityIQ - Best for Leveraging Credit

View Plans Links to IdentityIQProduct Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 7-day Individual Monthly Plans $8.49 and up Family Monthly Plans $25.50 and up Is IdentityIQ Right for Your Business?

What makes IdentityIQ stand out is its credit score simulator. It lets you see how any big financial decision will affect your credit score. That comes in handy when trying to leverage credit for business growth. You can see how applying for a new credit line might affect your credit score and better plan out your use of debt. This tool made it one of our favorite identity theft protection services with credit reporting.

Otherwise, IdentityIQ’s services and prices are fairly similar to Identity Guard, with the top-tier plan offering fraud resolution services.

IdentityIQ’s credit score tracker was our favorite feature, although it won’t really help protect your business from identity theft. What We Like

- Credit score simulator helps leverage credit to grow your business

- Identity restoration service is based in the U.S.

- All plans include credit monitoring for at least one bureau

- Application monitoring looks for all types of online applications in your name or your business’ name

What We Don’t Like

- Lacks a dedicated plan for businesses

- Top-tier plan with credit score simulator costs $29.99 per month

- No live chat support

- Can’t manage your plan in the app

Business Identity Monitoring

Beyond the awesome credit score simulator, which isn’t really an identity-monitoring feature, IdentityIQ helps monitor your business in an almost identical way to Identity Guard. But, no, they are not owned by the same company.

Did You Know: Not all forms of debt are bad. In some circumstances, debt can be leveraged to grow the money borrowed at a faster rate than the interest being accrued on the debt. In those cases, the debt is referred to as good debt.

That’s why we were able to put Identity Guard above IdentityIQ. Their services just barely edge out IdentityIQ, in our opinion. We found the fraud resolution from Identity Guard provided that white-glove feel, as their professionals walked us through each step to resolve cases of potential fraud. IdentityIQ still helped us resolve every potentially fraudulent transaction, but Identity Guard’s service was slightly more intuitive. We got that same feeling with almost all of IdentityIQ’s features. That said, the credit score simulator from IdentityIQ can really make a difference in your business.

Pricing

We signed up for IdentityIQ’s most expensive package — Secure Max — to test all its premium features. We’re fans of the way IdentityIQ breaks down their plans. All of them include credit monitoring for at least one bureau, and the upgrades in each plan are the extra features we want and expect for the higher price. For instance, going from the Secure Plus plan to the Secure Pro plan gives you three-bureau credit monitoring instead of one, and alerts you to credit score changes. We wish the credit score simulator was included in Secure Pro as well, instead of only with Secure Max, but we understand that’s asking for a lot.

Here’s how much each of IdentityIQ’s plans cost:

Plans Secure Secure Plus Secure Pro Secure Max Monthly rate $6.99 $9.99 $19.99 $29.99 Annual rate $71.30 ($5.94 per month) $101.90 ($8.50 per month) $203.90 ($16.99 per month) $305.90 ($25.50 per month) Cybersecurity

Since IdentityIQ doesn’t offer any business-specific plans, their cybersecurity capabilities are fairly limited. Even though they partner with one of our favorite personal antivirus providers, Bitdefender, they don’t offer support for enough devices to be useful for businesses — well, unless you’re a solo founder. Otherwise, your business may remain unprotected from a cybersecurity standpoint.

How We Chose the Best Identity Theft Protection for Businesses

As you know, we run a business. You’re on the site for our business. So, to choose the best identity theft protection for businesses, we put them to the test with our own business. We signed up for each provider, input all of our information, and let them go to work. That way, we could see the actual results of each provider. If we noticed one provider found suspicious activity that another one missed, we took note and adjusted our rankings.

We didn’t only look at how much suspicious activity each provider found. Our testing also looked for what types of suspicious activity each service looked for. Businesses require different protection than individuals, so we wanted to make sure every provider we recommend specifically looks for signs of business identity theft, such as suspicious activity related to our EIN.

After completing our tests on about a dozen identity theft protection plans, we put the results together, gave each provider a rank, and created this list.

What Is Business Identity Theft?

Business identity theft is similar to personal identity theft, except the thief uses a business’ information instead of a person’s information to commit fraud. It can also be referred to as corporate identity theft or commercial identity theft. Here are a few examples of business identity theft:

- Loan applications with your EIN — Your business has its own credit score through its EIN. Just like your SSN, identity thieves can use your EIN to apply for loans or lines of credit.

- Fake websites — Some identity thieves try to trick your customers using your information. They’ll set up a fake website that looks identical to yours with a similar domain name. Then, they’ll set up a form for your customers to fill out so that they can steal your customers’ information.

- Defrauding the government — Just like identity thieves can apply for loans using your EIN, they can also use it to submit fraudulent tax returns or apply for government subsidies.

How Can You Protect Your Business From Identity Theft?

Thankfully, you can take a proactive approach to protecting your business from identity theft. Here are three ways you can protect your business from identity theft:

- Subscribe to a business identity theft protection service. These services scan for compromised data related to your business so you can take action before an identity thief can do serious harm. Top-quality services also scan your internal network and devices for potential vulnerabilities.

- Train your employees. Identity thieves go for the lowest-hanging fruit. That means if they can easily steal one of your employee’s credentials and use those credentials to find the information they need to commit business identity theft, they will. But if you train your employees on digital security best practices, you can make sure your business isn’t the lowest-hanging fruit.

- Invest in cybersecurity. In most cases, business data gets stolen through digital means. Investing in tools like a VPN and antivirus software for your company can seal up potential leaks. However, some business identity theft can still happen as a result of people looking for sensitive documents in the trash or sneaking through your building. So also take your physical security seriously by investing in one of the best security systems for businesses.

Final Thoughts: Which Identity Theft Protection Service Best Protects Your Business?

In our opinion, NordStellar offers the best protection. But it requires a bit more of a commitment. You’ll need to contact their sales team, set up a demo, let them create a custom quote for your business, and then subscribe to start using the product. You can’t simply purchase a subscription and start using it right away like every other business identity theft protection service we recommend.

For an easier approach, we like Aura. Their interface is easy to understand and going with the Individual plan is the right choice for most business owners. Unfortunately, there isn’t a dedicated business plan, but the Individual plan still offers monitoring for your business’ information.

LifeLock provides a balanced approach, halfway between NordStellar and Aura. You can subscribe right away, but they offer a bit more for businesses, like unlimited credit reports. There’s a business plan for their cybersecurity solution, Norton 360, that you can pair with a LifeLock plan for more comprehensive protection. The best protection still comes from NordStellar, in our opinion.

No matter which service you pick, you’ll get your business’ information monitored by professionals who will give you a heads-up about potential fraud and risky data exposures.

Frequently Asked Questions About Identity Theft Protection for Businesses

-

What is the best identity theft protection for businesses?

After testing over a dozen identity theft protection plans, we found the best one to be NordStellar. It offers the most comprehensive security with a proactive approach to identity protection specifically for businesses.

-

Can a personal identity theft protection plan protect my business too?

In most cases, personal identity theft protection services also monitor your business’ information. But their cybersecurity tools tend to have device limits that prevent them from being useful in a corporate environment.

-

How much does business identity theft protection cost?

For dedicated business identity theft protection, expect the price to depend entirely on the size of your business. Bigger businesses require more protection. More employees means more devices and credentials that the identity theft protection service needs to protect.

-

Is business identity theft protection worth the price?

Yes, business identity theft protection is worth the price for most businesses. Someone stealing your business identity can impact your company’s reputation and cause significant financial harm. Protecting against those risks makes your company more robust.

-

Does business identity theft protection guarantee my protection?

No service can guarantee your business’ protection from identity theft. All they can do is reduce your risks and help you recover if you fall victim to identity theft.

AnnualCreditReport.com. (2024). Home Page.

annualcreditreport.com/index.actionAV-Test. (2024). Norton Internet Security.

av-test.org/en/antivirus/home-windows/manufacturer/norton/