Best Identity Theft Protection Services of 2025

Our top pick is Aura, as it offers excellent all-around protection starting at $9 per month for individuals or $25 for families.

- Includes a VPN for additional identity protection

- Offers credit monitoring from all three major bureaus

- Cyberbullying and online predator protection available

- Up to $1 million of insurance coverage

- Protect up to seven members of your family with one plan

- Features constant dark web scans

- Offers a dedicated restoration case manager and straightforward claims process

- Includes cyber extortion and online fraud insurance

- Premium plans add NordVPN and Incogni data removal service

Internet crime is soaring. From 2020 to 2024, losses from online scams jumped from under $4 million to over $16 million yearly.1 Personal data breaches and identity theft are at the top of the list. To protect themselves against fraud — and to seriously mitigate the damage if they fall victim — many households are turning to ID theft protection.

We’ve tested over 20 leading identity theft protection services, diving deep into their features, scrutinizing company policies, and analyzing pricing models. In the end, we decided to give Aura the top spot. It offers high-quality identity, credit, and digital protections starting at $9 per month. Its family plan for five adults and unlimited children costs only $25, making it one of the best value plans out there. LifeLock and NordProtect also made our top three.

Did You Know: Phishing is at the top of the FBI’s list of internet crimes with over 200,000 complaints in 2024.

The Top 7 Identity Theft Protection Services of 2025

- Aura - Best Overall Protection

- LifeLock - Best Digital Identity Theft Protection

- NordProtect - Best for Digital Security Bundle

- Identity Guard® - Best Identity Theft Alerting

- Surfshark Alert - Most Affordable Identity Protection

- IdentityIQ - Best Credit Protection and Monitoring

- McAfee Identity Theft Protection - Best User Experience

The Best Identity Theft Protection Services

-

1. Aura - Best Overall Protection

Uniquely, Aura offers triple-bureau credit monitoring and home title monitoring with all its plans, plus complete device and network protection.

Product Specs

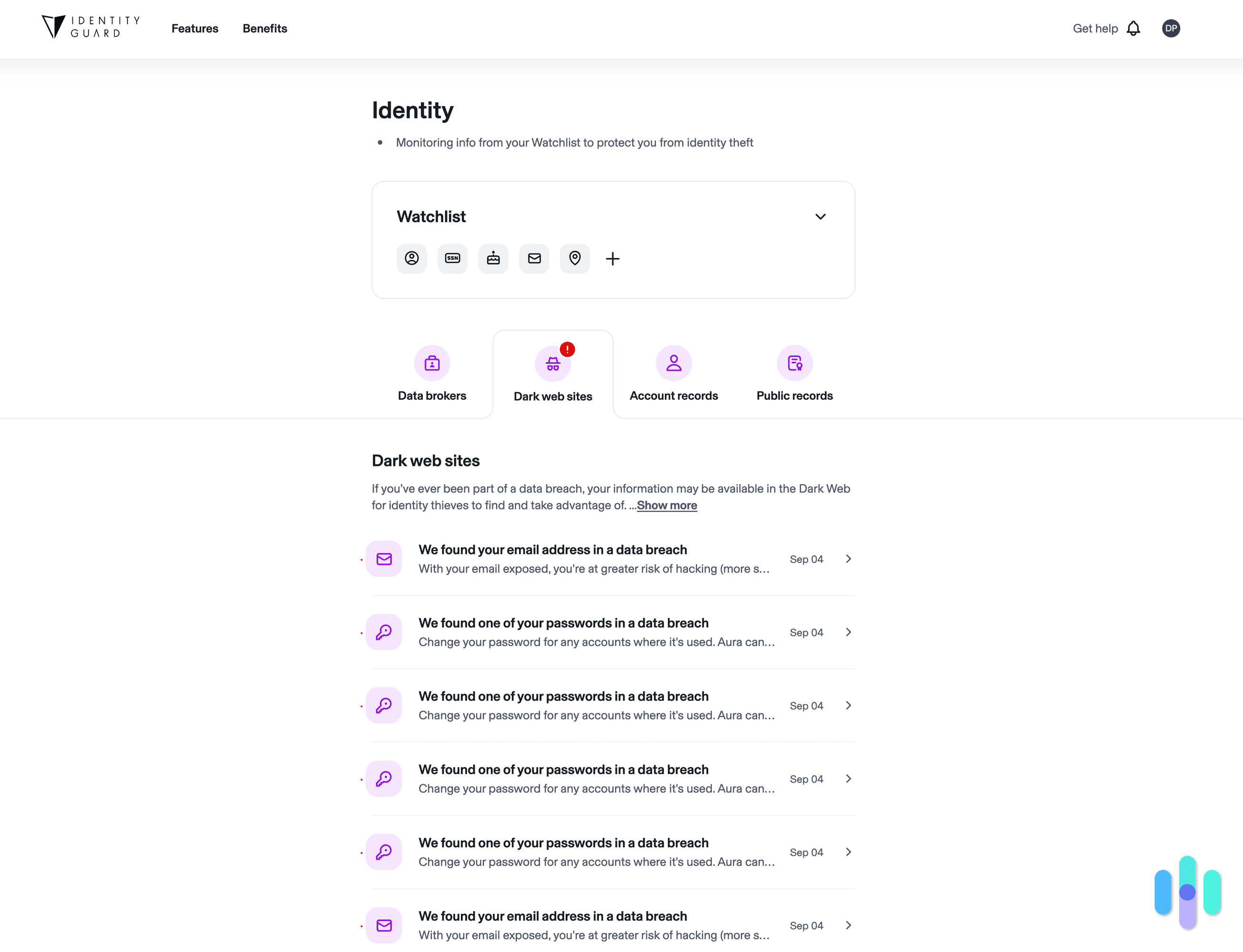

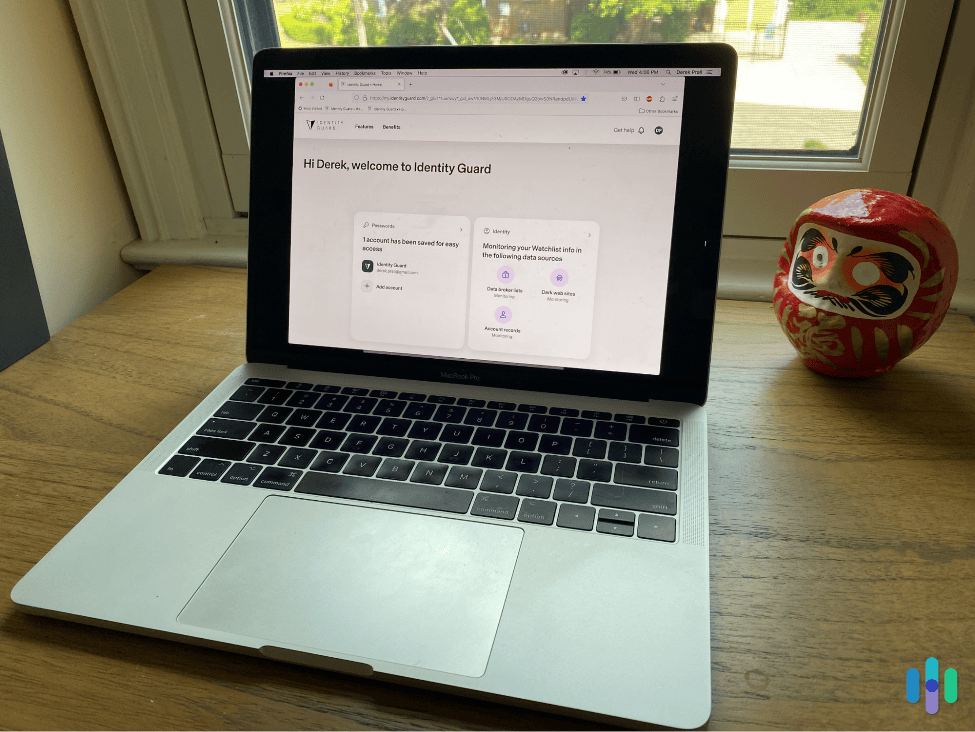

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 14-day Individual Monthly Plans $12 Family Monthly Plans $45 Aura Identity Monitoring

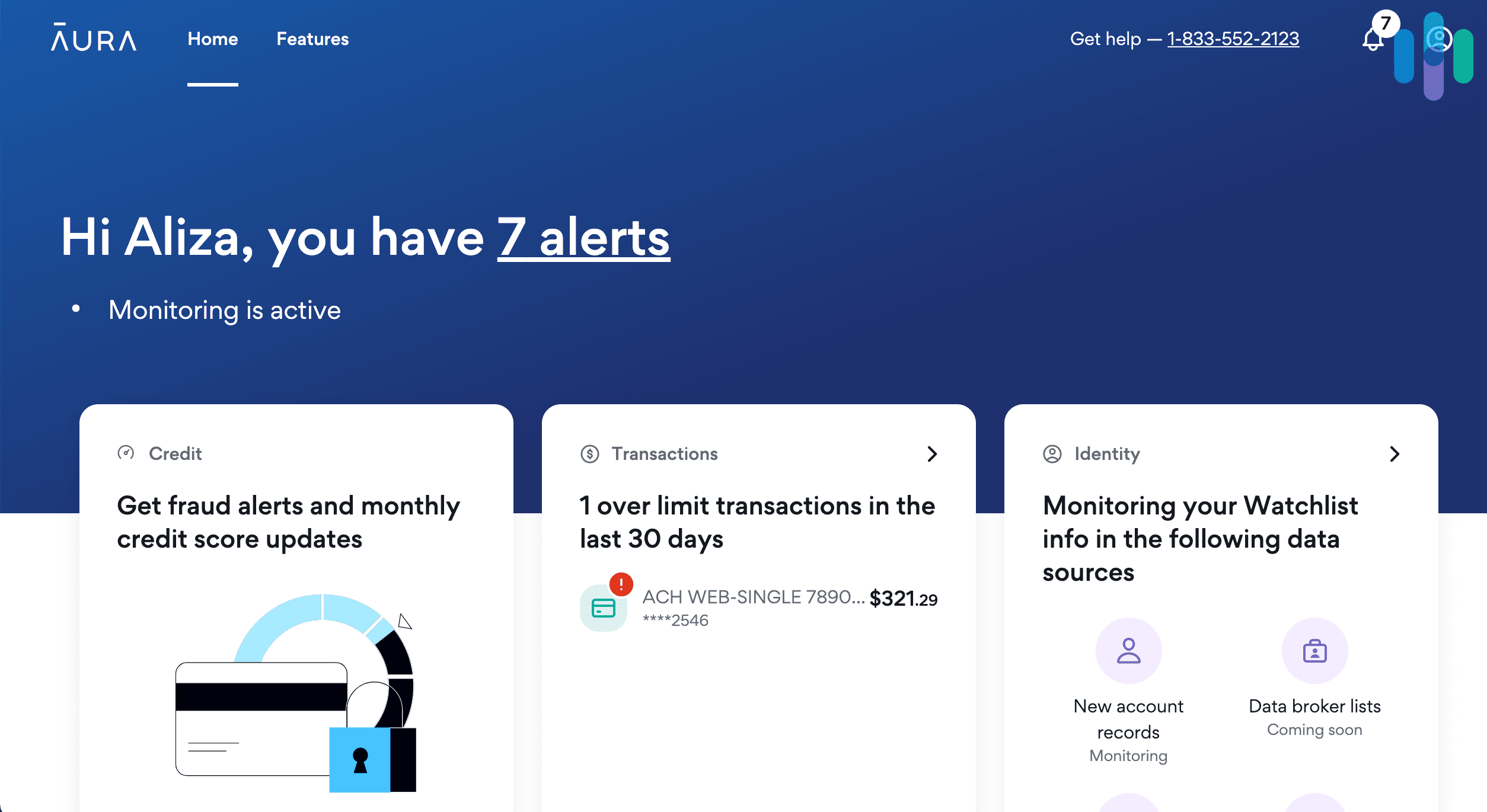

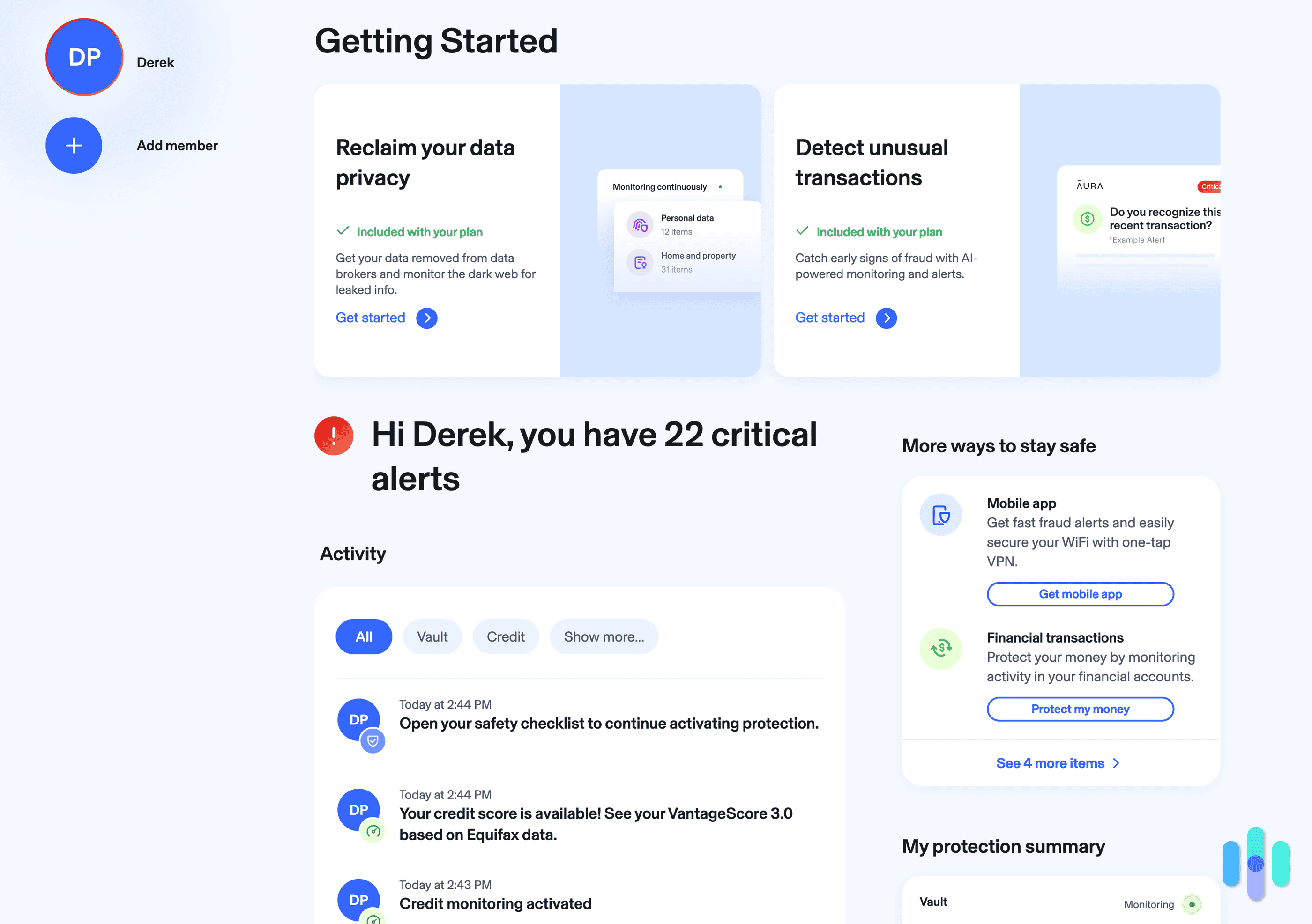

We had 22 alerts to check after signing up for Aura’s service. Aura monitors data breaches, online accounts, the dark web, and more. The service even includes home and auto title monitoring, a feature that most identity theft protection brands don’t offer. We’re impressed with this addition as it offers greater visibility over fraudulent activities like collateral loans.

>> Read More: The Best Identity Theft Services for Dark Web Monitoring

What We Like

- Fast alerts

- All plans offer the same core features

- Includes plenty of cybersecurity features

- Affordable plans starting at $12 per month

What We Don’t Like

- Included VPN connects only to U.S. servers

- Smartphone apps are a little difficult to navigate

- No cheaper subscription options since all plans are all-inclusive

- Offers the necessities but not much else

Aura Credit Monitoring

We rate Aura as one of the best credit protection services because every plan includes three-bureau credit monitoring. In comparison, LifeLock’s basic plan monitors just one bureau and NordProtect limits all tiers to single-bureau coverage. Identity Guard’s cheapest subscription doesn’t have any credit or debit monitoring.

FYI: Aura was constantly searching for high-risk transactions securing our sensitive details against payday loan fraud and other fraudulent activities.

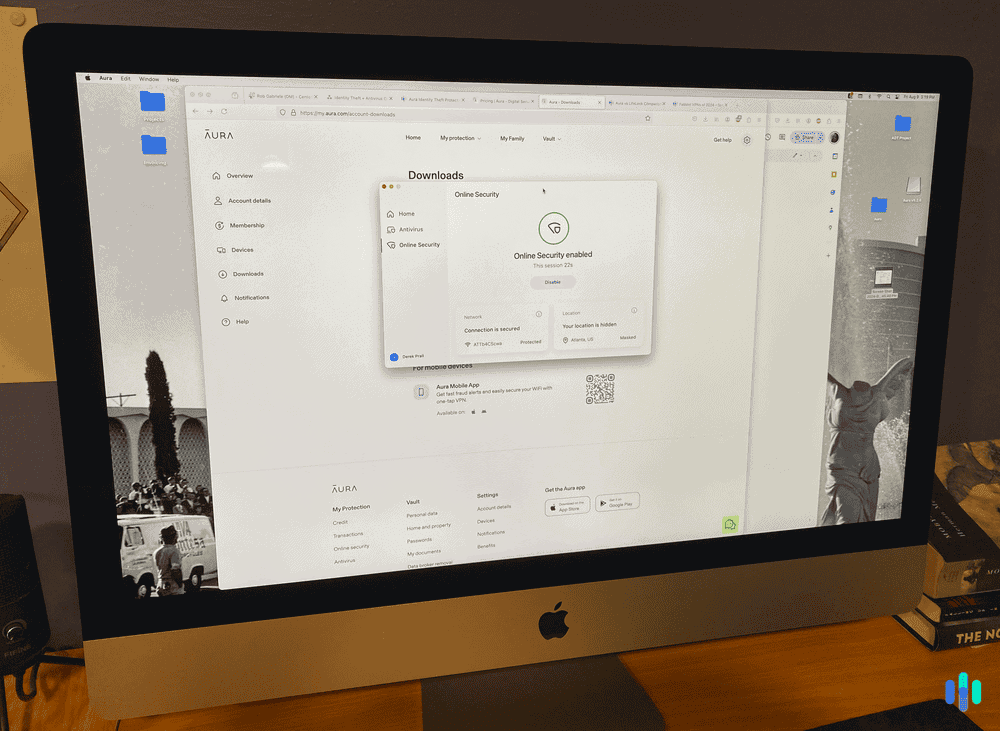

Aura Cybersecurity

Aura’s cybersecurity tools include antivirus software, a limited VPN, a password manager, an email alias, and a data removal service. That last one is particularly noteworthy because Aura also made our list of the best data removal services for its comprehensiveness and efficiency. The service gets your data off of data brokers for added privacy.

It’s worth mentioning, however, that Aura’s VPN didn’t make our list of the best VPNs. It’s decent and functional, but it lacks specialized features of other higher quality VPNs. It doesn’t have VPN servers for torrenting or servers for unblocking websites, for example. If you want a more robust VPN with your identity theft protection service, check out NordProtect below.

Did You Know: Only 6 percent of Americans use data removal services, but we’re seeing more identity protection services integrate their own privacy assistants, including Surfshark Alert (#5 on this list) and McAfee (#7 on this list).

Cybersecurity Features Coverage VPN Up to 10 devices per adult user Antivirus software Up to 10 devices per adult user Safe browsing Up to 10 devices per adult user Password manager Available for Chrome, Firefox, and Edge Email alias Available for Chrome, Firefox, and Edge Our Aura Experience

Unlike LifeLock, our next pick, Aura offers an all-in-one app for identity theft and cybersecurity protection. We recommend using the desktop app as it’s easier to enter information and navigate through all the features.

Given everything Aura can monitor, it took a while to upload our financial and personally identifiable information. We think the app’s interface could be more intuitive. Our setup took approximately two hours, including the time spent consulting Aura’s online guides for assistance.

FYI: Aura’s password manager includes an email alias tool you can use to generate fake addresses for online forms or accounts. You can use it inside Aura’s browser extension tool for Chrome, Firefox, Edge, and Safari.

>> See Also: The Best Passwords Managers for Chrome

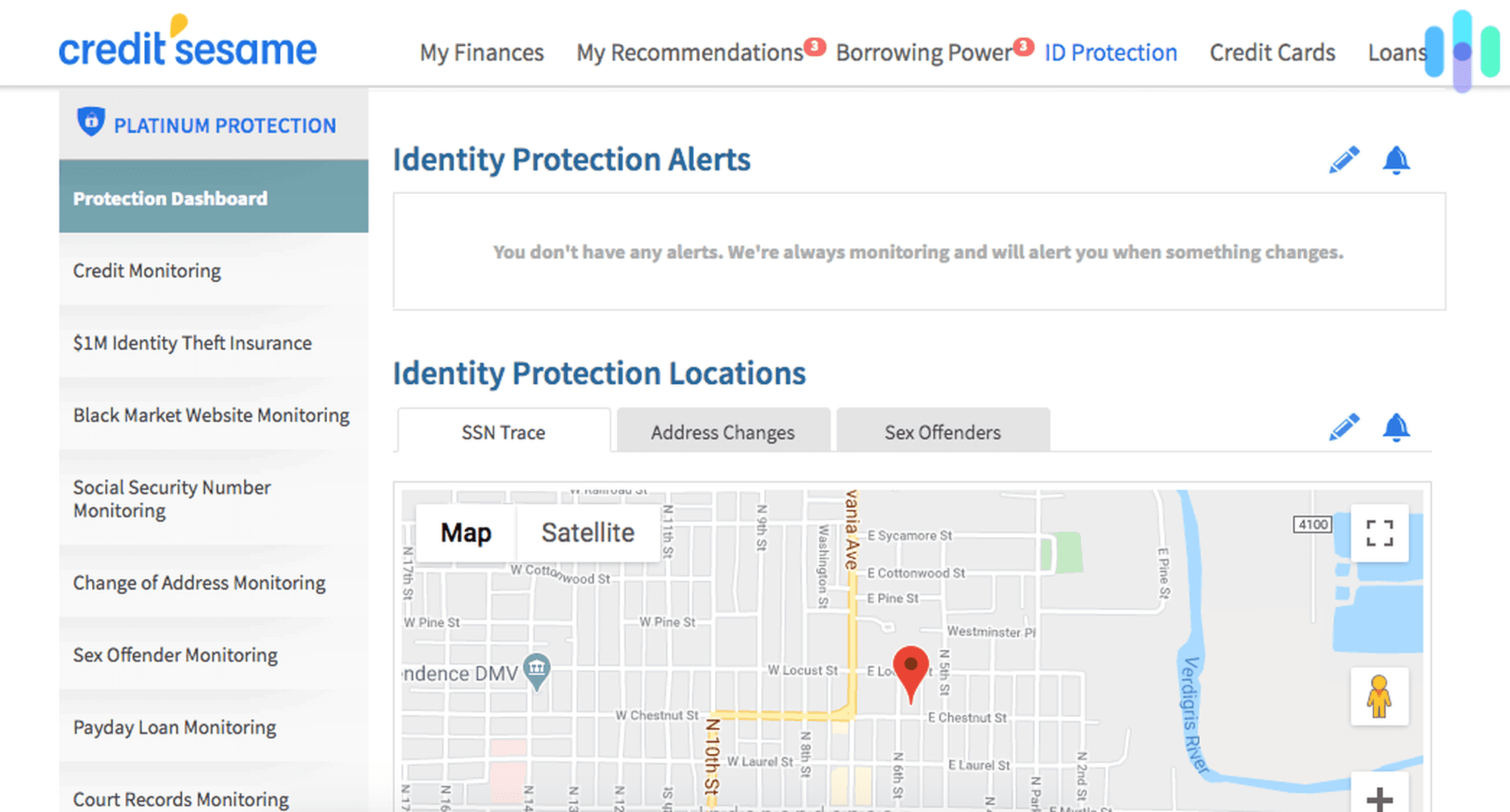

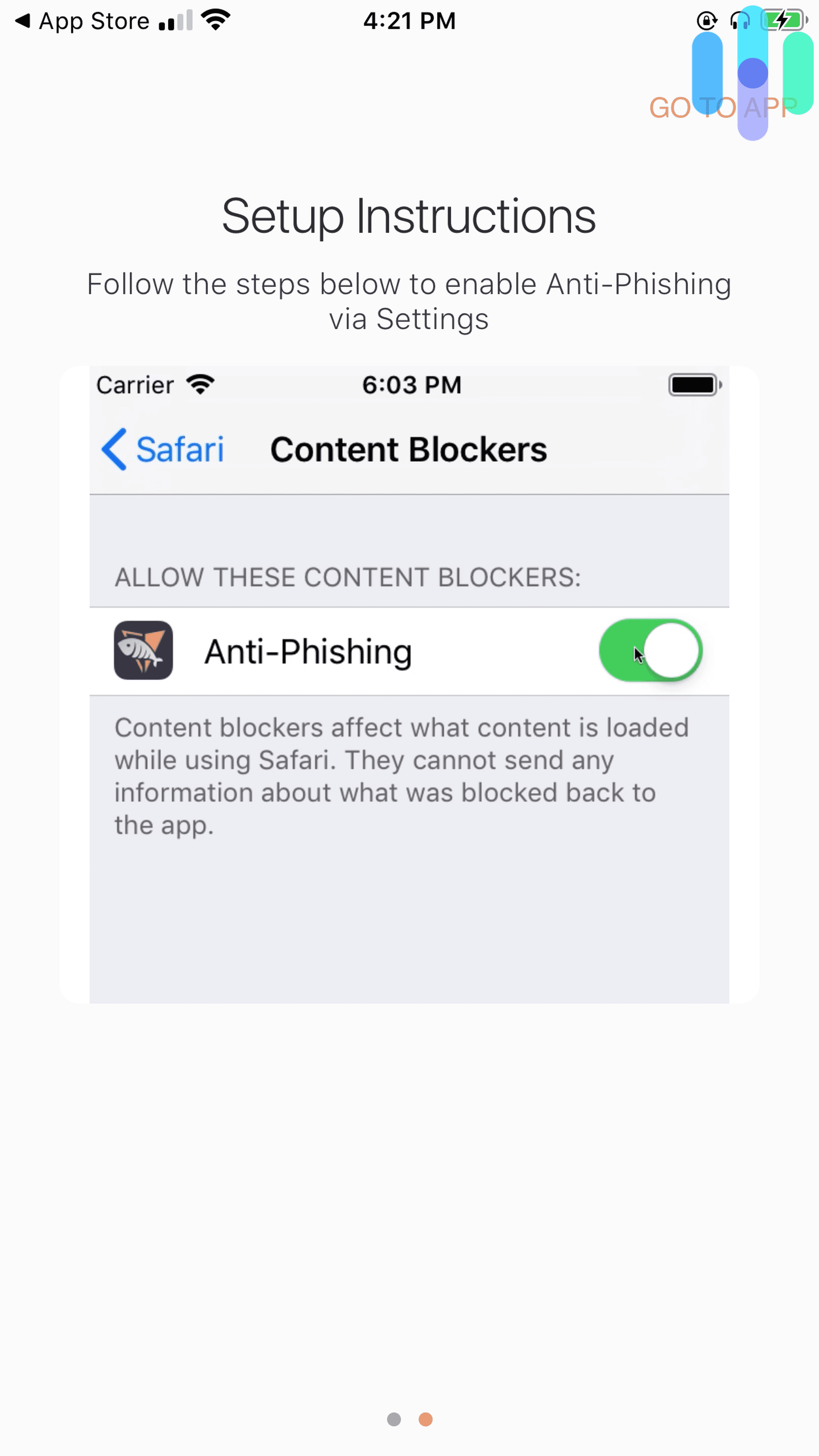

Enabling Aura’s secure browsing feature via the dashboard. After setup was complete, we rarely needed to interact with the service. We occasionally checked our Experian credit score, reviewed alerts, or updated information through the app. That was about it. Aura ran in the background of our daily digital life.

Aura Pricing

All Aura plans offer the same core features, so you don’t have to pick a tier; you just have to decide how many people to include. Aura has plans for individuals, couples, and families of up to five adults and unlimited children. We found this approach far less complex than choosing a LifeLock subscription.

Aura Plans and Pricing Individual Couple Family Kids Monthly billing $15 $29 $50 $13 Annual billing $144 $264 $384 $120 Average monthly cost for annual plans $12 $22 $32 $10 Coverage 1 adult 2 adults 5 adults, unlimited children Unlimited children (can be added to Individual or Couple plans) Our take-aways:

- Family plan. The Family plan is the best value for money. It’s a particularly good choice for families with grown children or grandparents who want identity theft protection.

- Kids add-on option. This is an excellent choice for single parents. The Individual plan with the Kids add-on offers comprehensive coverage for everyone at just over $20 per month.

- Parental controls. Both the Kids and Family plans come with parental controls for iPads, iPhones, and more, cyberbullying protection, and predator alerts.

Did You Know: Younger folks get scammed more often, but when seniors (70+) get scammed, they tend to lose the most money.2

-

2. LifeLock - Best Digital Identity Theft Protection

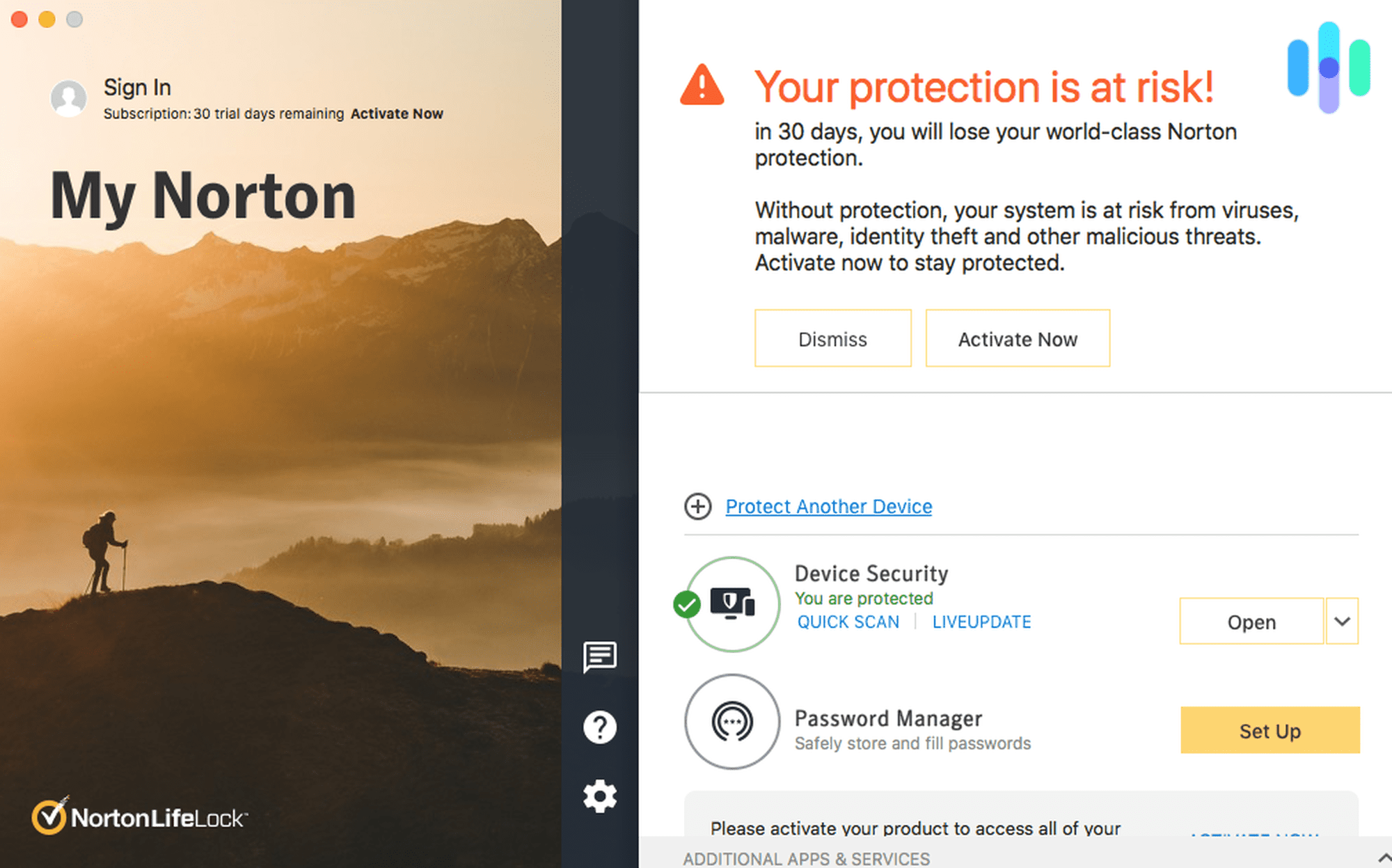

LifeLock combines family ID theft monitoring and total device protection with Norton 360 antivirus.

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $3.33 and up Family Monthly Plans $18.49 and up NortonLifeLock Identity Monitoring

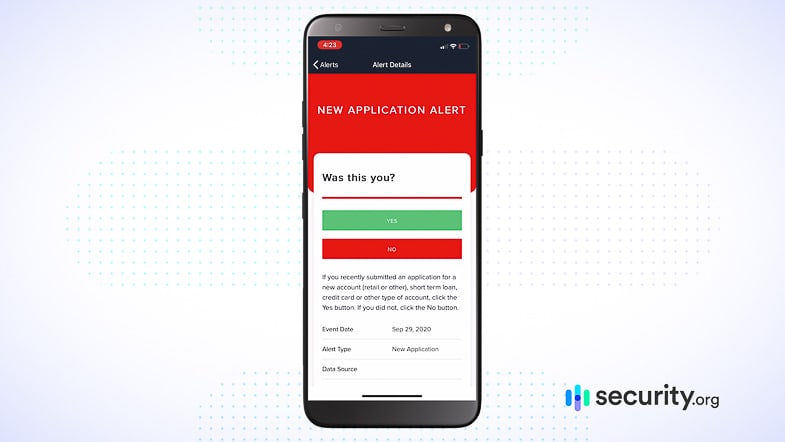

Setting up LifeLock takes time but the protections are worth it. We tested the Ultimate Plus plan since it provides credit monitoring at all three major bureaus, which we recommend. LifeLock notified us instantly when we applied for auto financing and opened a new savings account. By comparison, IdentityForce took several hours to alert us about the same activity.

>> Compare: LifeLock vs. IdentityForce

What We Like:

- Top-notch identity theft protection and cybersecurity suite in one

- Up to $3 million coverage

- Additional digital security features for children

- Synthetic identity theft protection

What We Don’t Like:

- Family plans for two adults and five kids can cost as much as $79.99

- Prices increase after the first year

- Multiple apps need to be installed

- Limited credit protection features in lower-tier subscriptions (Select, Standard, Advantage)

NortonLifeLock Credit Monitoring

Aside from monitoring credit files and new account applications, our LifeLock Ultimate Plus also monitored:

- 401(k) and investment accounts

- Bank and credit card activities (withdrawals, balance transfers, etc.)

- Payday loans with payday loan lock

- Buy now, pay later purchases

FYI: Not all LifeLock plans include three-bureau credit monitoring. In fact, only the Ultimate Plus plan does. If the $19.99 monthly fee is out of your budget, we recommend trying our second choice, Aura, with options starting from $12 per month.

NortonLifeLock Cybersecurity

One of the great perks of using LifeLock is that it’s part of the Norton family. This means you can combine a LifeLock package with a Norton 360 plan for extra cybersecurity. We chose Norton360 with LifeLock Ultimate Plus, which comes with Norton antivirus, one of our favorite antiviruses. Here’s what we got:

Norton 360 With LifeLock Ultimate Plus Coverage Antivirus software Unlimited devices Norton Secure VPN Unlimited devices Ad and tracker blocker Unlimited devices Privacy monitor (data removal service) Unlimited devices Cloud backup 500 GB Password manager Chrome, FireFox, Safari, and Edge Parental controls Unlimited devices Pro Tip: Norton360 comes with a virtual private network, or VPN. We strongly recommend using a VPN when you browse because VPNs encrypt your web traffic and hide your IP address from snoops like your internet service provider.

>> Related: The Top VPNs of the Year Tested by Experts

Our NortonLifeLock Experience

NortonLifeLock keeps its identity theft protection and cybersecurity tools separate. We downloaded two apps – a LifeLock app and a Norton app. While an all-in-one solution would be nice, Norton offers so many digital security tools that it makes sense to split them up for easier access.

NortonLifeLock helps remove our personal information from data broker sites. Don’t Be Alarmed: You’ll receive multiple security alerts from LifeLock in the first week as it identifies data breaches and exposed information. After the initial scan completes, you’ll see a decrease in notifications.

NortonLifeLock Pricing

We found NortonLifeLock’s pricing structure complex, particularly when combining LifeLock with Norton 360. We also noticed that LifeLock’s pricing for its higher-tier plans tend to exceed industry averages, but these plans deliver solid value. There are cheaper options from Aura and Identity Guard, though. Here’s a breakdown of Norton’s costs.

>> Also: Comparing the Top ID Theft Providers of [Year]

NortonLifeLock Individual Subscriptions Identity Advisor Standard Select Advantage Ultimate Plus Monthly price without Norton 360 $4.99 $11.99 n/a $22.99 $34.99 Monthly price with Norton 360 n/a n/a $14.99 $24.99 $34.99 Annual price without Norton 360 $39.99 $89.99 n/a $179.88 $239.88 Annual price with Norton 360 n/a n/a $99.48 $199.99 $299.98 -

3. NordProtect - Best for Digital Security Bundle

Identity theft protection services are just one tool to protect your online identity. NordProtect adds extra features that help stop threats before they happen.

View Plans Links to NordProtectNordProtect Identity Monitoring

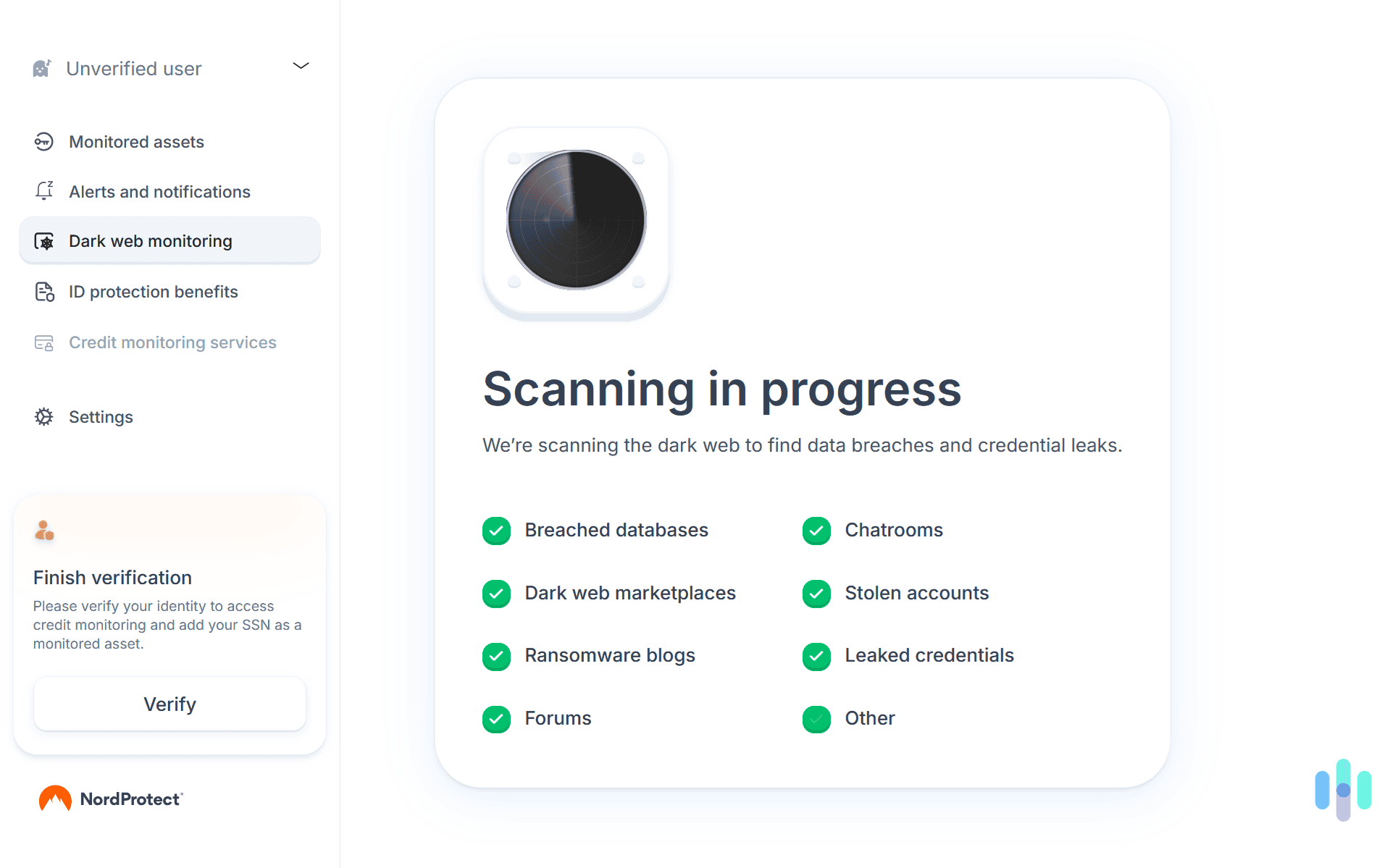

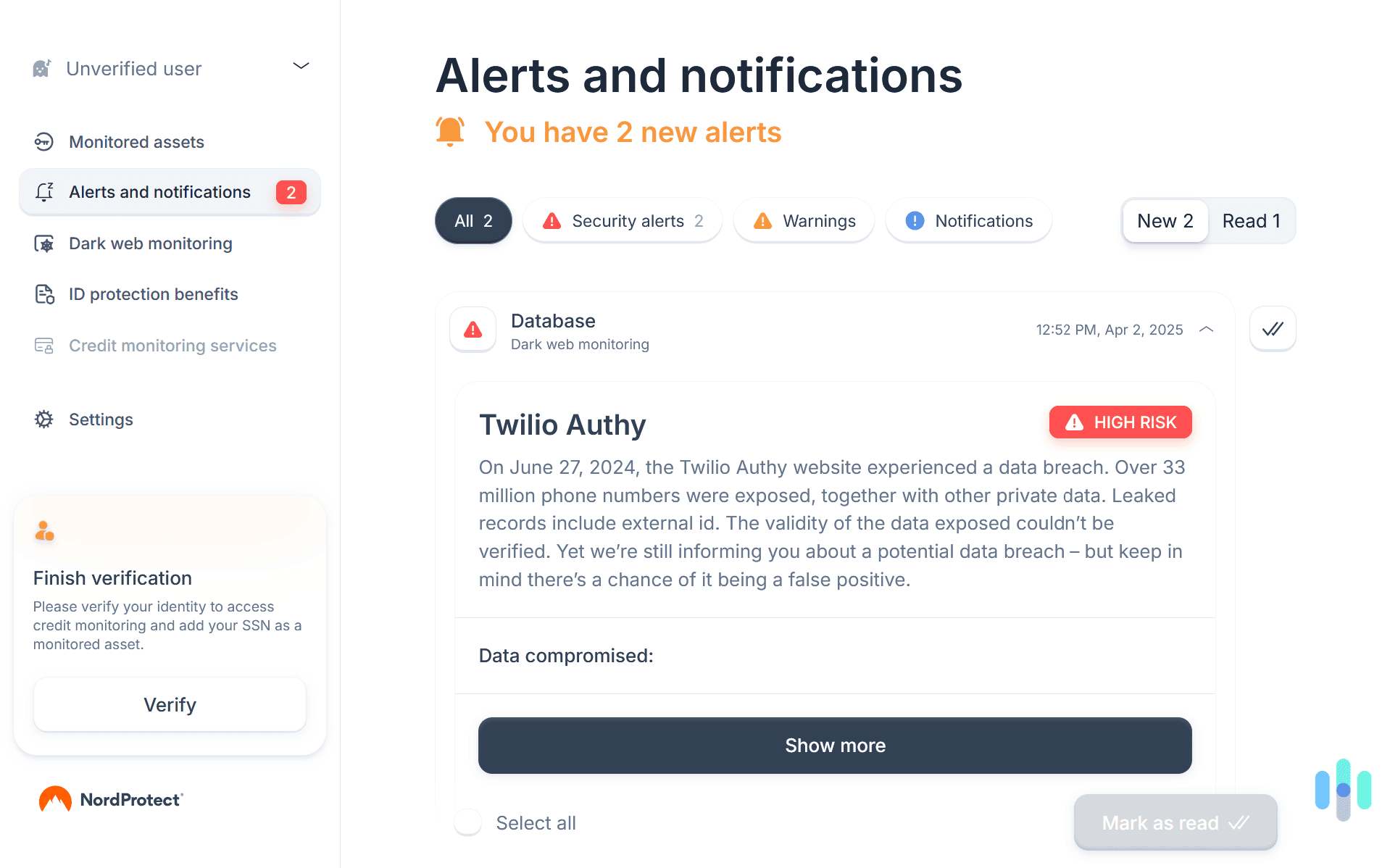

Our first scan of the dark web with NordProtect Like most reliable identity theft protection services, NordProtect includes all the essential features such as credit monitoring and recovery insurance. You can even bundle it with NordVPN and its antivirus-like tool, Threat Protection Pro.

>> Read More: The Best VPN Service of 2025

What We Like

- Fast alerts

- Up to $1 million insurance on all plans

- Cyber extortion and online fraud coverage available

- Bundle options with other Nord protects

What We Don’t Like

- No family plans

- Missing some identity monitoring services

- Only monitors one credit bureau

- More expensive than some competitors

NordProtect Credit Monitoring

Unlike LifeLock and Aura, NordProtect monitors your credit score and lines of credit with one bureau instead of three. You’ll get instant notifications whenever your credit score changes. It happened to us when someone tried taking a loan out in our name and when we were late paying a bill.

If you need to freeze your credit, NordProtect directs you to TransUnion’s website. You’ll deal with them directly to protect your score. It’s not as effortless as LifeLock and Aura, but it’s effective.

Watch this space: We interviewed NordProtect’s Managing Director for our NordProtect review and he revealed three-bureau credit monitoring will roll out in late 2025.

NordProtect Cybersecurity

It’s impressive that LifeLock and Aura offer cybersecurity tools, but they don’t match NordProtect’s offerings. With NordProtect’s Gold and Platinum plans, you get the full version of NordVPN featuring over 8.000 servers and ten simultaneous connections. By comparison, Aura offers a limited Hotspot Shield app.

>> Compare: Hotspot Shield Vs. NordVPN

NordProtect’s Platinum plan also comes with one of the best data removal services we’ve tested, Incogni. This service is also included in Surfshark’s premium plan. Incogni can remove your details from over 400 data brokers and people search sites, reducing scammers’ access to your personal information.

Our NordProtect Experience

We had to enable multi-factor authentication before using NordProtect. Once we set up Microsoft Authenticator, we uploaded our details, and NordProtect started monitoring our information.

Expert Tip: Turn off your VPN when verifying your information with NordProtect. We had trouble getting started, and Nord’s customer service told us it was because NordVPN was on in the background.

The first scan we ran was on the dark web. NordProtect can monitor up to five email addresses, phone numbers, and credit and debit card numbers. It should cover a household, even though NordProtect doesn’t offer dedicated family plans. While it’s a great feature, we’d like to see NordProtect add more options, like passport and driver’s licenses, in future updates.

NordProtect located our details from a data breach and shared the information that was leaked. After spending a month with NordProtect, we like that it offers preventative protections against online attacks as well as reactive alerts when threats are detected. Some of the monitoring features are lighter than LifeLock and Aura, but NordProtect is a reliable alternative if those services are not for you.

NordProtect Pricing

Like other Nord products, NordProtect’s core service is identical with all plans. The premium options include a few extra features like cyber attack coverage up to $10K, malware breach alerts, and criminal record monitoring. These tiers also add NordVPN and Incogni.

You can subscribe for two years, one year, or monthly. We recommend the two-year subscription as it offers the biggest savings. Here’s a breakdown of the costs of each plan.

Silver Gold Platinum Monthly $15.49 $21.49 $28.49 One year average monthly cost $7.49 $10.49 $13.99 Two years average monthly cost $5.49 $8.49 $11.99 -

4. Identity Guard® - Best Identity Theft Alerting

Identity Guard leverages IBM artificial intelligence to deliver advanced identity theft protection and credit monitoring.

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $7.50 and up Family Monthly Plans $12.50 and up Identity Guard Identity Monitoring

Identity Guard has been using AI to power its identity monitoring since 2018, and the results showed. Identity Guard discovered old and inactive online accounts that most other identity protection services we tested missed. Identity Guard also monitored our social media accounts for signs of hacking and spam messages, a feature only a few other services like McAfee offer.

Testing Identity Guard’s dark web monitoring feature. Pro Tip: Social media monitoring is available only to Identity Guard Ultra users. Lower-tier plans enjoy fewer benefits, which is why LifeLock ranks higher.

>> See Also: Identity Guard vs. LifeLock

What We Like:

- Affordable entry-level plans starting at $7.50 per month for individuals

- Family plans (as low as $12.50 per month) cover five adults and unlimited children

- Comprehensive social media monitoring under Ultra plan

What We Don’t Like:

- No “limited power of attorney” for identity recovery service

- Limited credit and personal finances protection in lower-tier subscriptions

- Entry-level Value plan doesn’t include custom fraud resolution services

Identity Guard Credit Monitoring

Like LifeLock, Identity Guard offers different tiers of credit protection. Only mid-tier plans and up monitor all three major credit bureaus. The top-tier Ultra plan offers the most comprehensive credit protection with:

- Credit and debit card monitoring

- 401(k) and investment account monitoring

- Experian credit lock

- Free annual three-bureau credit report

FYI: Anyone can get a free credit report from the three bureaus every week, but very few of us do or will. So professional credit monitoring is still the safer bet.

Identity Guard Cybersecurity

Identity Guard provides two additional cybersecurity tools: a Safe Browsing extension and a password manager. We don’t recommend managing highly sensitive passwords in your head, so the manager was a welcome find. The Safe Browsing extension was less of a draw. Though we’ve tested some pretty good browser-based antiviruses, the malware protection we got from TotalAV or Surfshark One was much better.

>>Also: Do I Need Antivirus for My Mac?

Pro Tip: Many top antivirus providers also have identity theft options, especially the top Windows antiviruses. Bitdefender, Trend Micro, and TotalAV, for example, all fold some form of ID theft monitoring into their malware protection.

Our Identity Guard Experience

We found Identity Guard’s desktop dashboard more intuitive than Aura’s. It was easier to review alert types and customize notifications. The mobile app isn’t quite as user-friendly. We struggled to add new information and switch between tools.

Identity Guard doesn’t have a very sleek app, but its alert system is quite good. Identity Guard Pricing

Identity Guard’s budget-focused Value plan is one of the most affordable options anywhere, but it and the Total plan both lack credit protection. This was a similar predicament we found ourselves in with Zander Insurance’s subscription plans. Only the Ultra plan includes credit monitoring, a core feature of ID theft monitoring you wouldn’t want to do without.

Identity Guard Plans Value Total Ultra Individuals $7.50 per month $16.67 per month $25.00 per month Families $12.50 per month $25.00 per month $33.33 per month Pro Tip: While Identity Guard doesn’t offer free trials, all annual plans come with a 60-day money-back guarantee. Identity Guard is also one of the best-value identity protection services for families.

-

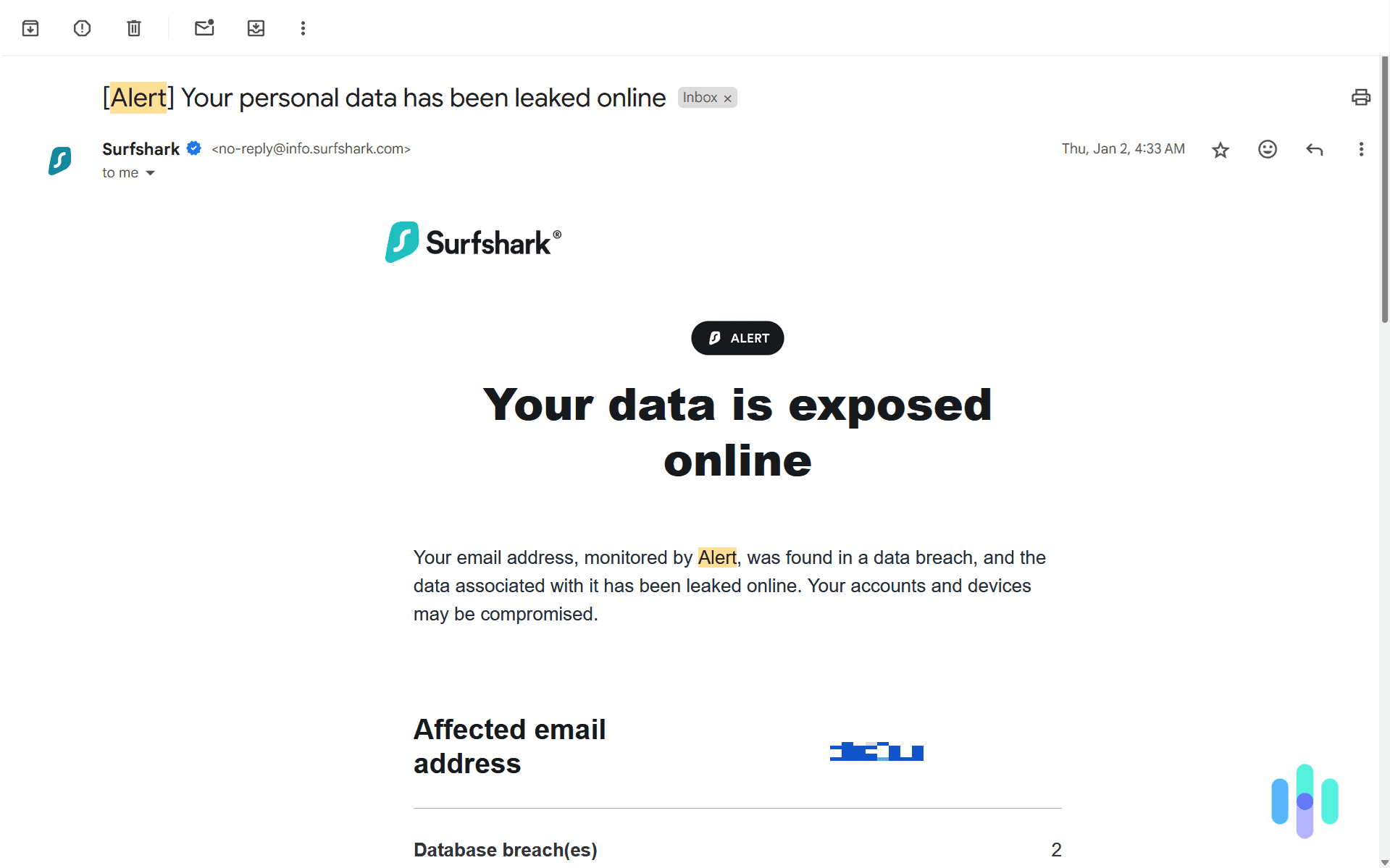

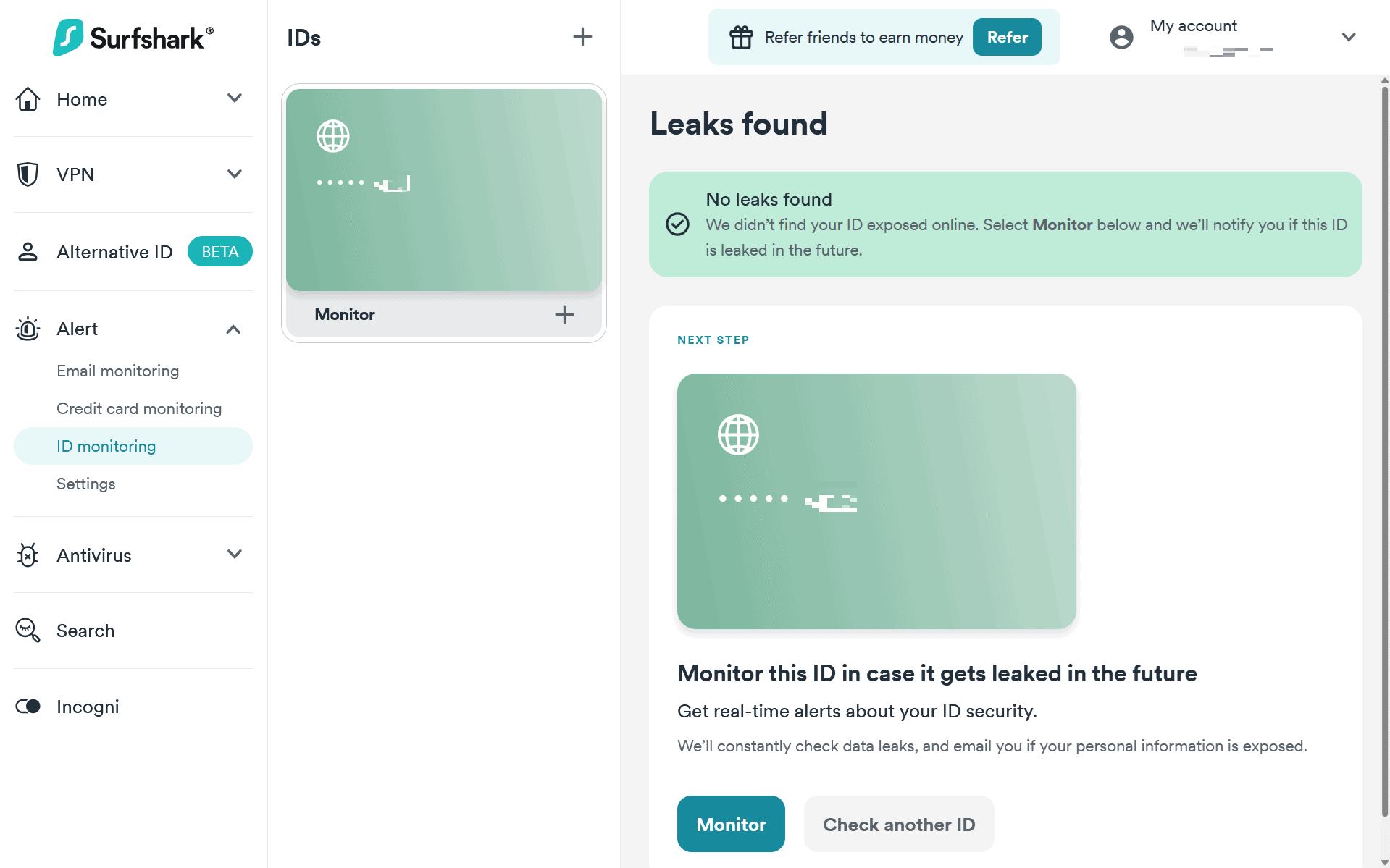

5. Surfshark Alert - Most Affordable Identity Protection

Surfshark Alert is affordable, easy-to-use ID theft protection with plenty of cybersecurity extras and plans starting at $2.69 per month.

View Packages Links to SurfsharkProduct Specs

Dark Web Monitoring Yes Credit Reporting No Insurance Coverage No Free Trial 30-day money-back guarantee Individual Monthly Plans $2.69 and up Family Monthly Plans $2.69 and up After using Surfshark Alert to scan our SSN for leaks, we opted to have it actively monitored. Surfshark Alert is perfect if you’re only concerned about what information has been exposed in data breaches. This helps you take preventive measures to avoid financial or reputational damage. In addition to identity theft protection, you’ll also get Surfshark’s antivirus tool and one of the cheapest VPNs around for added protection.

Pro Tip: When we signed up, Surfshark Alert scanned the web for any breaches involving our SSN. However, you can also have it look for your driver’s license and passport numbers.

What We Like

- Low prices starting at $2.69 per month

- Email, identity and credit card scans for unlimited family members

- Subscription includes high-quality VPN and antivirus software

- Scheduled data breach reports

What We Don’t Like

- No credit reports or credit monitoring

- You need to opt into active identity and credit card monitoring

- Lacks a password manager and vulnerability management

- Surfshark’s free trial does not include Alert

Surfshark Alert Credit Monitoring

Surfshark Alert doesn’t offer credit monitoring. The app can only look for card numbers in data breaches. Considering how widespread credit card fraud is, we recommend purchasing credit monitoring today.3

FYI: If you like Surfshark but want credit monitoring, consider combining your Surfshark subscription with Experian’s free one-bureau credit monitoring. Learn how in our Experian IdentityWorks review.

Surfshark Alert Cybersecurity

Surfshark specializes in cybersecurity. For the ultimate protection, we recommend the Surfshark One subscription, which includes its top-rated VPN and antivirus software. For an extra $1.50 a month on a two-year subscription, you can add Incogni, which is one of our favorite data removal services.

>> Learn More: Surfshark VPN Tested by Experts

Our Surfshark Alert Experience

Surfshark Alert notifying us of a data breach. Surfshark Alert is only accessible in Surfshark’s browser dashboard and on the mobile app. We recommend using the browser, as it’s easier to upload information, run scans, and activate features like active monitoring. The mobile app is handy as a check-in device. We used it to review alerts and read data leak reports.

Pro Tip: Surfshark Alert’s “Email” tab let us add as many email addresses as we wanted for Surfshark to actively monitor as well.

Surfshark Alert Pricing

As we’ve noted, Surfshark Alert comes with Surfshark One, which also includes a VPN and antivirus software. The top-tier Surfshark One+ plan also bundles in the data removal service Incogni. All these services make Surfshark One one of the most well-rounded, affordable digital security services on the market, if you’re willing to commit to a two-year contract. Here’s a breakdown of the subscription costs for plans that include Surfshark Alert.

Surfshark Plans and Pricing Surfshark One Surfshark One+ Monthly price $12.99 $14.99 Yearly price (+ 3 free months) $50.85 ($3.39 per month) $91.35 ($6.09 per month) Two-year price (+ 3 free months) $67.23 ($2.49 per month) $107.73 ($3.99 per month) >> Read About: Surfshark Antivirus Review & Pricing in 2025

-

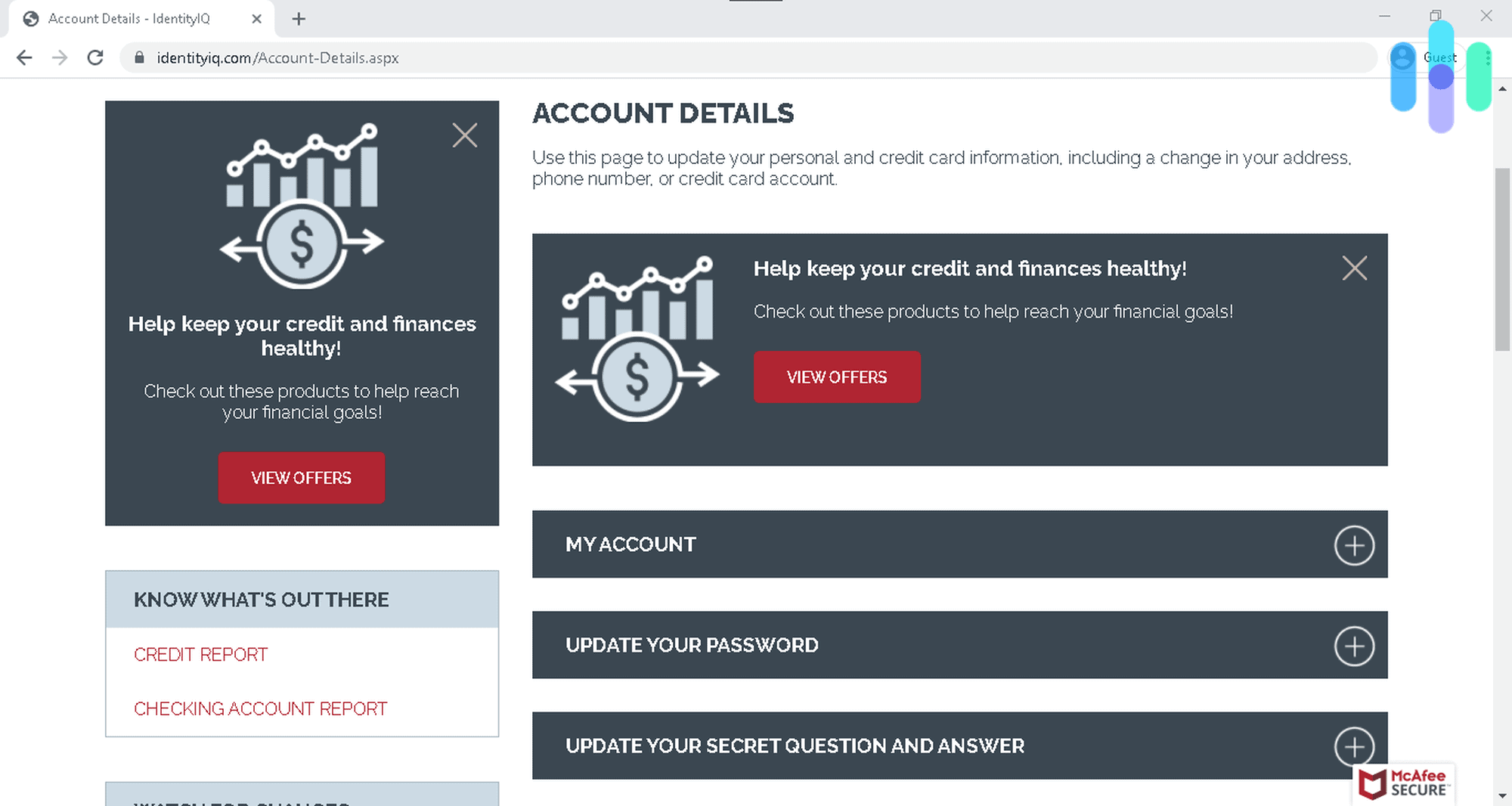

6. IdentityIQ - Best Credit Protection and Monitoring

IdentityIQ protects against a wide array of ID fraud, including dark web and criminal records monitoring.

View Plans Links to IdentityIQProduct Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 7-day Individual Monthly Plans $8.49 and up Family Monthly Plans $31.49 and up IdentityIQ Identity Monitoring

IdentityIQ’s dashboard made it easy to get a handle on our credit. IdentityIQ’s entry-level plan has some great features like dark web monitoring and SSN alerts, but their credit monitoring service is only available with mid-tier plans, Secure Pro and Secure Max, which also offers family protections. Additional privacy and security features include:

- Synthetic ID Theft Protection. Like LifeLock, IdentityIQ monitors public records for pieces of personal information – not just those that perfectly match your PII.

- Lost Wallet Assistance. IdentityIQ helps you cancel credit and debit cards, replace IDs, etc. if you lose your wallet.

- Opt-Out IQ. IdentityIQ automatically opts you out of junk mail subscriptions. It also registers your phone numbers with the National Do Not Call list.

Pro Tip: Opting out of junk mail subscriptions is one way to keep your personal data off the internet. You can also use a data removal service like Surfshark Incogni, Delete Me, or Kanary to automate the process.

>> Compare: Incogni vs. Delete Me

What We Like:

- Cybersecurity features provided by a top antivirus brand

- Adding cybersecurity features adds only $2 to $3 per month (cheaper than buying antivirus software)

- Features that help improve credit score

- Budget-focused Secure plan

What We Don’t Like:

- Doesn’t offer a lot of credit protection features

- Requires a third-party app for cybersecurity features

- Limited phone support

- Higher-tier plan with family protections (Secure Max) is expensive at $31.49 per month

IdentityIQ Credit Monitoring

The primary distinguishing factor between IdentityIQ subscription plans is how much credit protection they provide. In addition to three-bureau credit monitoring, our Secure Max (top-tier) plan gave us:

- Credit score change alerts

- Credit score tracker and simulator

- Monthly credit reports

Feature Highlight: Utility payments aren’t typically reported to the major credit bureaus, so they usually don’t impact credit scores. After using IdentityIQ’s Utility Payment Reporting tool for six months, however, our credit score improved by 12 points.

IdentityIQ Cybersecurity

IdentityIQ partners with Bitdefender for its cybersecurity tools. If you’re not familiar with Bitdefender, here’s our Bitdefender VPN review and our Bitdefender antivirus review. Bitdefender’s VPN was functional but nothing special. The antivirus, on the other hand, was top-notch with solid malware and phishing protection. In fact, it was almost on par with Norton, making IdentityIQ a good LifeLock alternative.

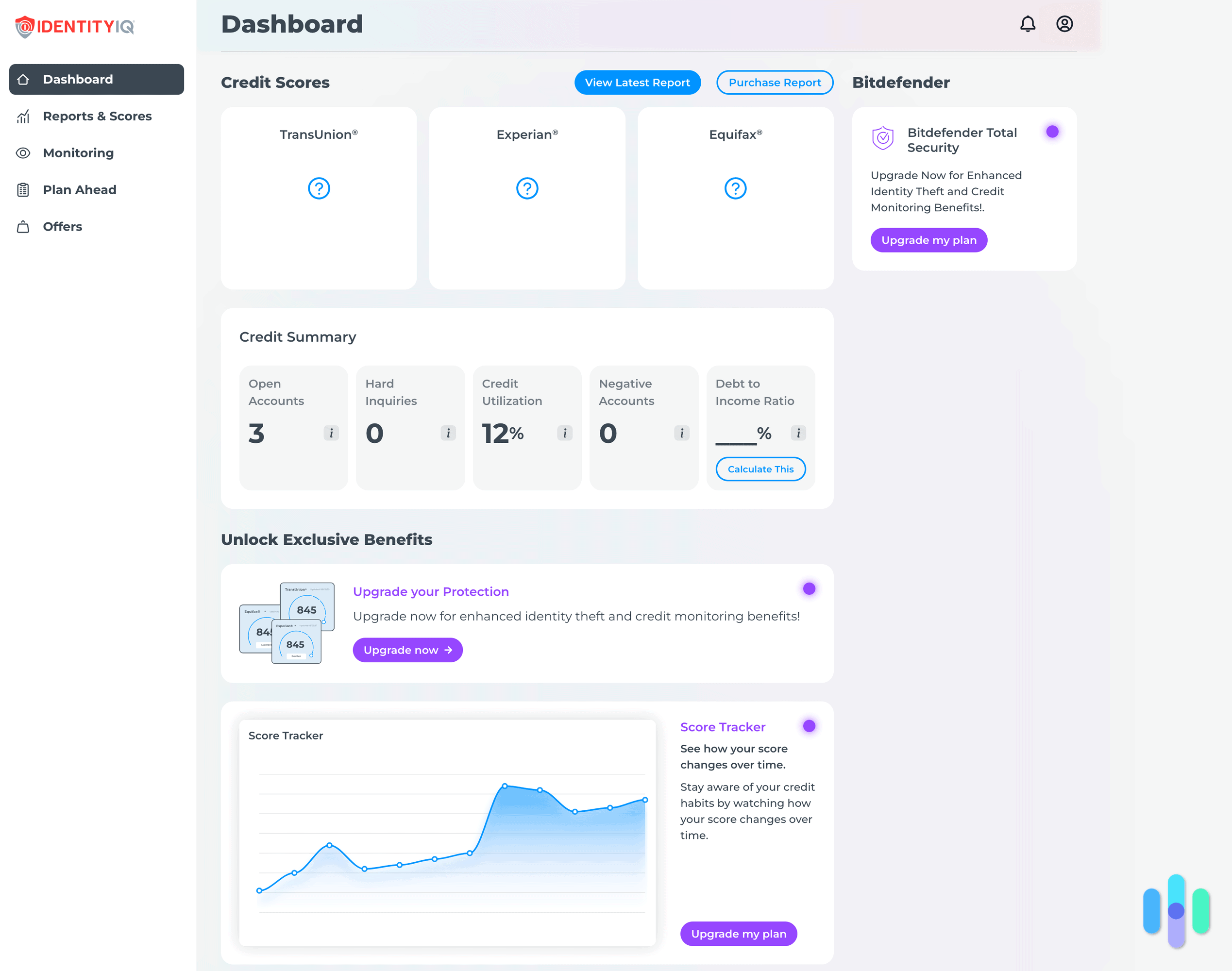

Our IdentityIQ Experience

The IdentityIQ app was easy to navigate but not as feature-packed as Aura’s. IdentityIQ also has separate apps for the VPN and antivirus. Though we’ve seen this before — Lifelock has separate apps — we preferred Aura and Surfshark’s single-app approach. The only major gripe we had with the app is that we couldn’t manage our data from there; we could only do that via the dashboard in our browser.

Using the IdentityIQ dashboard to test its credit monitoring tools. Did You Know: Everyone is entitled to receive a free copy of their credit reports once a week.4 With IdentityIQ, you can also request a copy of your credit report from the three credit bureaus once a month, every six months, or every year, depending on your plan.

IdentityIQ Pricing

IdentityIQ’s plans start from $8.49 per month, but you can save 15-percent by paying annually, bringing the monthly cost down to $7.44. To get full credit monitoring, we chose the Secure Max plan, which is $27 per month when paid annually. For an additional $2.50 per month, we added Bitdefender’s cybersecurity suite.

IdentityIQ Subscriptions Secure Basic Secure Plus Secure Pro Secure Max Monthly price $8.49 $11.49 $21.49 $31.49 Monthly price with cybersecurity features $10.49 $13.49 $23.49 $34.99 Annual price $86.61 $117.19 $219.19 $321.21 Annual price with cybersecurity features $106.99 $137.59 $239.00 $351.80 FYI: By itself, antivirus software costs $30 to $100 per year (around $2.50 to $8.50 per month), making IdentityIQ’s $2.50 VPN antivirus bundle very good value for money.

-

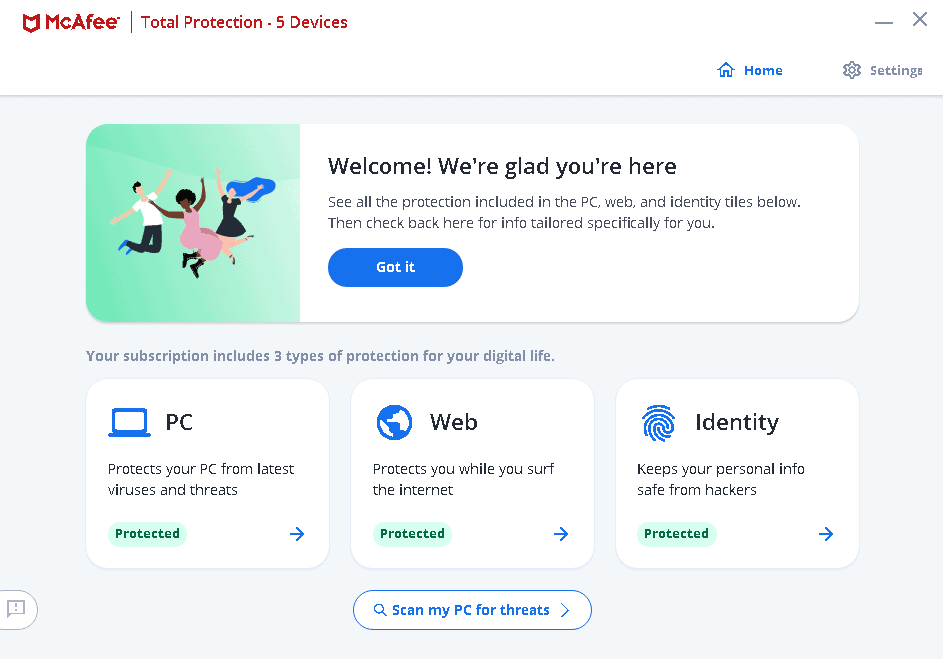

7. McAfee Identity Theft Protection - Best User Experience

McAfee combines decades of experience in malware protection with credit and identity monitoring to protect customers’ identities proactively.

View Packages Links To McAfeeProduct Specs

Dark Web Monitoring Yes Credit Reporting No Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $2.50 and up Family Monthly Plans $5.83 and up McAfee Identity Monitoring

McAfee doesn’t have advanced features like Aura’s home and auto title monitoring or LifeLock’s synthetic ID theft protection. But it still monitors over 60 different types of information, including:

- Drivers license numbers

- Insurance ID cards

- Tax IDs

- Usernames of online accounts

- Passport number

What We Like:

- Intuitively designed all-in-one app

- Affordable average monthly rates for the first year

- Data cleanup services

- Protection Score lets you know how safe you are

What We Don’t Like:

- All annual billing; no monthly billing option

- Three-bureau credit monitoring for top-tier plan only

- Some features you can activate only if you sign up for auto-renewal

- Price increases after the first year

Our McAfee dark web scan didn’t turn up any data breaches. McAfee Credit Monitoring

If you sign up for McAfee’s Ultimate plan, like we did, you can access these features:

- Credit freezes. You’ll be able to freeze/unfreeze your credit on demand, stopping unauthorized access to your credit accounts if you detect suspicious activity.

- 401K monitoring. McAfee will include your 401(k) and other investment accounts in its monitoring.

- Triple-bureau credit monitoring. Three-bureau credit monitoring is the most comprehensive monitoring available and what we recommend.

- Bank account monitoring. You’ll get an alert if someone tries to take over your bank account, a.k.a. account takeover.

McAfee Cybersecurity

We signed up for the Ultimate plan and used the personal data and online account cleanup tool to look for our personal information. It found our details on data broker sites and sent takedown requests. The tool even closed down old accounts we forgot we still had.

Pro Tip: McAfee’s antivirus is one of the best we’ve tested. For a full report, visit our McAfee review.

Our McAfee Experience

McAfee packs everything into one intuitive app. We uploaded all our information into the identity theft protection page and switched to the antivirus tool with one click to run a full system scan. McAfee’s Protection Score is a nice touch, highlighting focus areas to improve your online security.

Pro Tip: McAfee’s Protection Score is similar to our own Security Score, which helps readers gauge how safe they are both from physical dangers like home invasion, robbery, and theft, as well as cyberthreats like malware, hacking, and phishing.

McAfee has plenty of online resources that helped us get to know their service. McAfee Pricing

McAfee requires annual billing. However, there’s a 30-day money-back option in case you change your mind. While all plans also include cybersecurity features, the Basic and Essential plans only provide bare-bones scans and notifications. If you want full protection, you should consider the Premium plan or higher.

McAfee+ Plans Basic Essential Premium Advanced Ultimate For individuals $29.99 $39.99 $45.99 $89.99 $199.99 For families N/A N/A $69.99 $119.99 $249.99

Honorable Mentions

IDShield – Affordable Family Protection

You can cover up to 11 family members for $29.99 per month with IDShield’s family plans. This only gives you single-credit bureau monitoring, however. Triple-bureau credit monitoring, which we recommend, costs $34.99 per month. Both plans include minor child monitoring, which protects your kids when they’re online and monitors their SSN.

ID Watchdog – Protection With up to $2 Million Coverage

This Equifax-owned brand provides generous insurance coverage up to $2 million. While it doesn’t offer unique identity monitoring features, its credit monitoring stood out for monitoring high-risk transactions. It also let us set a threshold amount that would trigger those alerts.

Allstate – Identity Theft Insurance and Identity Restoration

Allstate offers white-glove identity restoration services and insurance with home title theft reimbursement of up to $1,000,000 per 12-month period and extra cybersecurity features courtesy of Webroot.

What Is Identity Theft?

Identity theft is a crime where someone uses the personal information of another person to commit fraud. Financial losses vary from victim to victim, and can be severe. Psychological stress is also very common for victims of ID theft.

In 2023, nearly a million Americans fell victim to identity theft, losing nearly $2 billion dollars.5 The most common type of identity theft involved credit card fraud, which affected more than 400,000 people. After that, loan fraud claimed nearly 150,000 victims.

>> Must Read: The Early Signs of Identity Theft

Identity Theft Explained

What Different Types of Identity Theft Are There?

There are many other different types of identity theft besides credit card fraud and loan fraud. Here are the most common:

- Financial identity fraud. This involves stealing money from your bank accounts, credit cards, or other personal accounts. To do that, thieves steal credit card numbers, hijack bank accounts, cash out investment accounts, etc.

- Medical identity fraud. This is when someone uses your medical insurance to pay for their medical bills. It can raise your health insurance rates and might even affect your present or future medical treatment.

- Senior identity fraud. Criminals specifically target older folks, knowing that they’re less likely to monitor accounts for identity fraud and more likely to fall for scams.

- Criminal identity theft. You can end up with a criminal record without breaking any laws if an identity thief uses your personal information or stolen ID at a traffic stop or when arrested.

- Child identity fraud. Thieves target children’s SSN to stack payday loans and make a quick getaway, get a driver’s license, or abuse credit under a child’s name. This sort of identity theft could go unnoticed for years.

- Tax fraud. The goal is to get your tax refund. You could become a victim of tax fraud even if you’re unemployed or actually owe the government a tax payment. Fraudsters can easily submit phony income in your name, then change your listed address to receive a refund check.

How to Protect Yourself From Identity Theft

Aside from subscribing to a top-tier identity theft protection service, there are steps you can take to keep your identity safe. Here are the most impactful ways to protect yourself from identity theft:

- Use strong passwords. An account breach is one of the most common ways for your identity to get stolen. Using strong passwords and regularly changing your passwords keeps your accounts secure even if your password leaks. Enabling two-factor or multifactor authentication makes your accounts even more secure. Use our free password generator to get started.

- Monitor your credit score. Reading through your whole credit report every month or so is a lot of work, but you can at least keep track of your credit score. If you notice a sudden change that’s unrelated to your own activity, take a look through your credit report for suspicious activity.

- Dispose of sensitive documents appropriately. Don’t throw documents with your sensitive information in the trash; shred them instead. If you don’t own a shredder, you can find and use one for free at most office supply stores.

- Take immediate action after suspicious activity: If you notice suspicious account or credit score activity, take action immediately. Alert the FTC, file a police report, contact your bank (if necessary), and change the passwords of any compromised accounts.

Pro Tip: A quality identity theft protection service will handle most of the above steps for you, but we still recommend familiarizing yourself with identity theft protection best practices.

Understanding Identity Theft Protection Services

Identity theft protection services monitor our PII and credit files to catch early signs of identity theft. They also provide safety nets in the form of insurance and identity restoration services.

- Identity theft prevention. Modern identity theft protection services offer cybersecurity features that help you stay on top of your online data and prevent online identity theft. Those features often include antivirus software, VPNs, and password managers.

- Identity theft monitoring. Identity protection also means detecting signs of theft to prevent damage. Services generally monitor credit reports and scores, the dark web, public records, and other places where stolen identities might appear.

- Identity recovery: If your identity is stolen, an expert case manager will help with the legal side. They’ll arrange for lawyers to contact credit reporting agencies and help get documents notarized.

- Identity theft insurance: In the event of financial loss, you may be entitled to reimbursements for stolen funds, legal and expert fees, and other out-of-pocket expenses.

How Much Does Identity Theft Protection Cost?

Pricing for ID theft protection varies, depending on which features you require. Plans with triple-bureau credit monitoring, for example, are always more expensive. Some services cost as little as $10 per month, while others cost more than $30. The average price is somewhere between $14 to $16 per month for individuals. For family plans, expect to pay between $20 to $30 per month.

Who Needs Identity Theft Protection?

We all have personal data, so we could all fall victim to identity theft. However, some people need it more urgently than others. Visit our “What is My Security Score” tool to determine your risk for identity theft.

Identity Theft Protection Alternatives

Of course, identity theft protection services aren’t the only ways to protect yourself from identity theft. There’s plenty you can do yourself. Here are some tips from our identity theft, cybersecurity, and home security experts:

- Don’t throw any important documents away; if you have to get rid of them, use a paper shredder.

- Check your mailbox regularly to cut down on the risk of mail theft.

- Use strong, unique passwords for each of your accounts and keep them in an encrypted password vault. We’ve tested all the best password managers and our top picks are RoboForm and Keeper.

- Use antivirus software to prevent hackers from gaining access to your devices and accounts. TotalAV is our favorite antivirus this year.

- Always use a VPN on public Wi-Fi networks and preferably at home too. We recommend NordVPN, but Surfshark and ProtonVPN are excellent choices too.

- Only give your SSN (and any other sensitive details) when it’s absolutely necessary.

- Regularly check your credit report from the three reporting bureaus; also keep on eye on your personal financial accounts.

Our Methodology: How We Picked the Best Identity Theft Protection of 2025

We tested over 20 ID theft protection services for at least three months and often much longer. Here are the criteria we used to select our top seven:

- Credit monitoring. Ideally, we prefer services that monitor our credit at all three major bureaus and that update us instantly when they detect activity.

- Financial monitoring. Our top services should also monitor our finances, making sure no one has accessed our payment information, bank accounts, credit cards, etc.

- Identity theft insurance. In case we fall victim to theft, we want our ID theft protection service to cover us with at least $1 million in identity theft insurance.

- Privacy policy. We read each company’s privacy policy to see how they protect the personal information we give them. We prefer not to entrust our data to companies that sell it to third parties.

- Encryption. The encryption used to protect our information should be military-grade 256-bit AES, which is fortunately the standard among identity theft protection providers today.

- Value for money. We’re always on the lookout for companies that offer enough protections (ID theft and cybersecurity) to justify the price tag.

Recap

Identity theft protection services constantly monitor your personal and financial information. Once they detect suspicious activity, you get an instant alert. Manually reviewing your data risks missing something or noticing an anomaly when it’s too late.

While it’s another subscription, you can save money by bundling digital security tools like antivirus protection and VPNs with an identity theft protection service. It’s one of the reasons why we rate brands like Aura, LifeLock, NordProtect, and Surfshark as some of the best around.

FAQs

-

Do I need identity theft protection?

ID theft protection has a few major advantages to self-monitoring. You can act quicker if fraud is afoot. It’s also less stressful when you know your data is safe and that you’re covered in the event of theft.

-

How much does ID theft protection cost?

Costs vary depending on how comprehensive your plan is. But you can expect to pay between $10 and $30 per month.

-

Which is the best identity theft provider?

Our top pick is Aura for its affordable subscriptions that offer all-around identity, credit, and digital protections. It’s especially great for families. LifeLock, NordProtect, Identity Guard, and Surfshark are also very good choices.

-

How can I save on ID theft protection?

The best way to save on ID theft protection is to choose a service that bundles in other digital safety tools. That way you’ll combine several subscriptions into one.

-

Which identity theft protection services include cybersecurity tools?

Fortunately, many of them. All of the providers on this list, for instance, bundle in tools like VPNs, antivirus, and password managers, making them all-around digital security tools.

-

FBI. (April 23, 2025) FBI Internet Crime Report 2024.

-

Federal Trade Commission. (2025). Consumer Sentinel.

https://public.tableau.com/app/profile/federal.trade.commission/viz/ConsumerSentinel/Infographic

-

Department of Justice. (2025). U.S. Government seizes approximately 145 criminal marketplace domains.

-

Federal Trade Commission. (2023). You now have permanent access to free weekly credit reports. consumer.ftc.gov/consumer-alerts/2023/10/you-now-have-permanent-access-free-weekly-credit-reports

-

Federal Trade Commission. (April 24, 2025). Identity Theft Reports.

public.tableau.com/app/profile/federal.trade.commission/viz/IdentityTheftReports/TheftTypesOverTime