Reported losses due to investment scams continue to skyrocket.

Did you know in 2023, $4.6 billion was stolen from everyday people like you and me?1 This is up from $3.8 billion in 2022 and $1.7 billion in 2021. Cryptocurrency scams are also one of the top payment methods for losses, with $1.4 billion lost in 2023.

One of the methods criminals use to steal these funds is the pig butchering scam. They trick people into high-yield investments or fraudulent schemes with promises of incredible returns. In this article, we’ll go into how it works, how to avoid the scam, and what you can do if you’ve already been scammed.

What is a Pig Butchering Scam?

A pig butchering scam is when criminals build long-term relationships with victims. They gradually “fatten them up” with trust before stealing their money. These scammers invest weeks or even months building fake romantic or friendship connections. They start by gaining your trust, manipulating your emotions, and ultimately exploiting your financial situation with false promises of guaranteed high returns. Here are some of the ways they do it.

| Method | Description |

|---|---|

| Group Chats | You randomly get added to a group chat on WhatsApp, Telegram, or Facebook Messenger, where the topic revolves around cryptocurrency investments or achieving financial independence. Most people in the chat are fake accounts controlled by the scammers. |

| Private Messages | The “secretary” of a well-known investor slides into DMs. They give advice on trades and tell you to conduct them using a brokerage account they’ve set up on your behalf. |

| Fake Websites or Apps | Within the group and private messages are links to fake websites or apps. They are designed to steal your personally identifiable information and deposit funds into their bank accounts. |

FYI: According to the 2022 Internet Crime Report, victims of pig butchering scams are people between the ages of 30 and 49.1 The scammers target people with significant financial resources who flaunt them on social media.

How It Works

A lot of work goes into a pig butchering scam, so they can be hard to spot. But here is the most common approach they take:

- Fake personas: The scammer creates fake identities using AI-generated photos or stolen images. They might pose as successful crypto traders, investment advisors, or even potential romantic partners. These profiles often include fake success stories, luxury lifestyle photos, and false testimonials.

- Making contact: They will reach out to you on social media or messaging apps. Some pig butchering scams even take place on dating platforms. The scammer will build rapport and ask you about your financial situation. They might attempt to move you to another messaging platform with end-to-end encryption.

- Introducing investment opportunities: As the conversation continues and the scammer builds trust with you, they will share an investment opportunity. They may refer to it as something to invest in together so you can both achieve financial freedom. But to participate, you’ll need to download an unauthorized app or visit a fake investment platform website.

- Encouraging more investments: Once you invest, you’ll start receiving fake reports showing significant returns on your investments. The goal is to encourage you to spend more so you can reach your financial goals faster.

- Ghosting: At some point, the scammer will disappear, and contacting them will be impossible. Your access to the website or app will also be blocked.

Signs of Pig Butchering Scams

While pig butchering scams are sophisticated and tough to spot, there are some red flags that might trigger your spidey sense. These are the ones that I recommend keeping an eye out for:

Unsolicited Messages

Watch out for “wrong number” texts that turn into friendly conversations. We also suggest ignoring messages from attractive strangers who start discussing investments. On dating apps, be suspicious if matches immediately want to move to encrypted messaging apps like WhatsApp or Telegram. We recommend blocking them if they start mentioning cryptocurrency or forex trading opportunities.

>> Read More: Online Dating Safety: A Guide to Preventing Romance Scams

Promises of Fast Money

The promise of earning thousands of dollars quickly is something we all wish was true. But most of the time, it’s not. Always do your own research on investments, and don’t believe any reports, images or case studies sent to you by people on the internet you barely know.

An Urgency to Invest

Scammers can’t help themselves and want fast results. They’ll tell you there is a limited time to invest and pressure you not to miss out on these once-in-a-lifetime opportunities. It’s important to stay strong and do your research first to avoid losing your money.

Requests for Your Personal Information

Another method scammers use is promising to invest on your behalf. All you need to do is hand over your address, phone number, Social Security number and other private details. However, they will use this information to steal your identity and take out loans in your name.

Did You Know: You’re probably shocked at how much information is available online if you’ve ever Googled yourself. But did you know you can get rid of some of these details? You can do it manually by requesting Google to remove this information or use data removal services that send requests on your behalf.

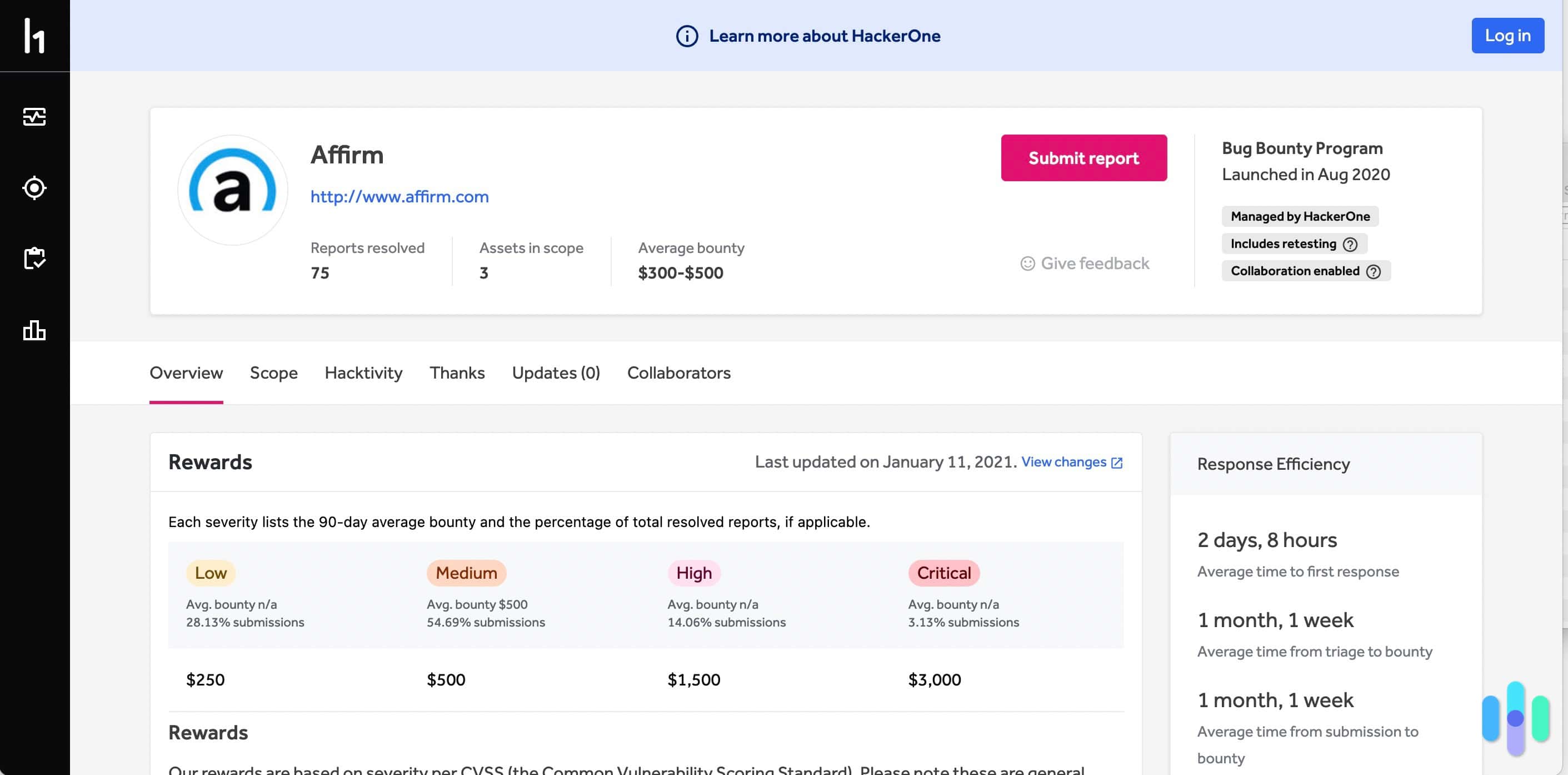

Using Unregistered Investment Platforms

If someone directs you to an investment platform, verify its legitimacy through FINRA’s BrokerCheck or the SEC’s Investment Adviser Public Disclosure database. Scammers will create sophisticated fake platforms that look like legitimate trading sites. These fraudulent platforms will show fake profits and may even allow small initial withdrawals. They’re designed to build your trust before blocking access to larger amounts.

Complicated Cash-Out Rules

Some red flags include demands for “taxes” or “fees” before withdrawal. They may also require you to deposit more money to access your funds. Sudden account freezes due to alleged “irregular trading activity” are also a red flag. Legitimate investment platforms never ask for extra deposits to withdraw your own money.

Lack of Details of the Investment

The more questions you ask about the investment, the less information you’ll receive. If everything they say is inconsistent or vague, you should end the conversation immediately or fact-check the details you’re given to confirm your gut feeling that this is a pig butchering scam.

Attempts to Separate You From the Group

In group chats, someone will always reach out to you directly. They’ll use private messages for a personal touch and convince you to invest in their scheme. You should always ignore these attempts and leave the group chat.

>> Read More: Staying Safe from Chatbot Scams

How to Avoid Pig Butchering Scams

There are strategies you can use to avoid falling victim to pig butchering scams. If you encounter one of the signs above, this is what you should do:

- Change your social media profiles to private: Check your privacy settings and who can send you connection requests. On some platforms, you can hide your name when people search for it.

- Ignore unsolicited requests to join group chats: If you receive a random request to join a group chat, leave it immediately. You should also be curious about friend requests from strangers and random people sliding into your DMs.

- Report any suspicious activity: We recommend reporting all suspected pig butchering scams to the FBI’s Internet Crime Complaint Center (IC3) at ic3.gov, the FTC at ReportFraud.ftc.gov, and your state’s attorney general’s office. Make sure to include all communication records, transaction details, and website URLs.

- Don’t share your personal information: Remove the connection or delete the message whenever someone asks for personal details like your bank account, credit card, or Social Security number.

- Stay informed on scammer tactics: Scammers constantly evolve their strategies. They use different forms of manipulation to steal money from you. Stay up to date with the latest scams so you’re always one step ahead.

FYI: Scammers are also finding new and creative ways to hack phones. However, if you’re using one of the best antivirus apps, it’s easy to get rid of them before they steal any of your info.

What to Do if You’re Scammed

Don’t blame yourself if someone has scammed you. There may be options to get your money back and protect your identity to avoid further damage.

We recommend contacting your financial institution first. Some banks can reverse wire transfers if caught within 72 hours. For cryptocurrency transactions, recovery is extremely difficult. You can still report them to the exchange platform, though. Credit card transactions offer the best protection through chargeback rights. We suggest documenting everything by saving all messages, transaction records, and screenshots as evidence for law enforcement and potential recovery efforts.

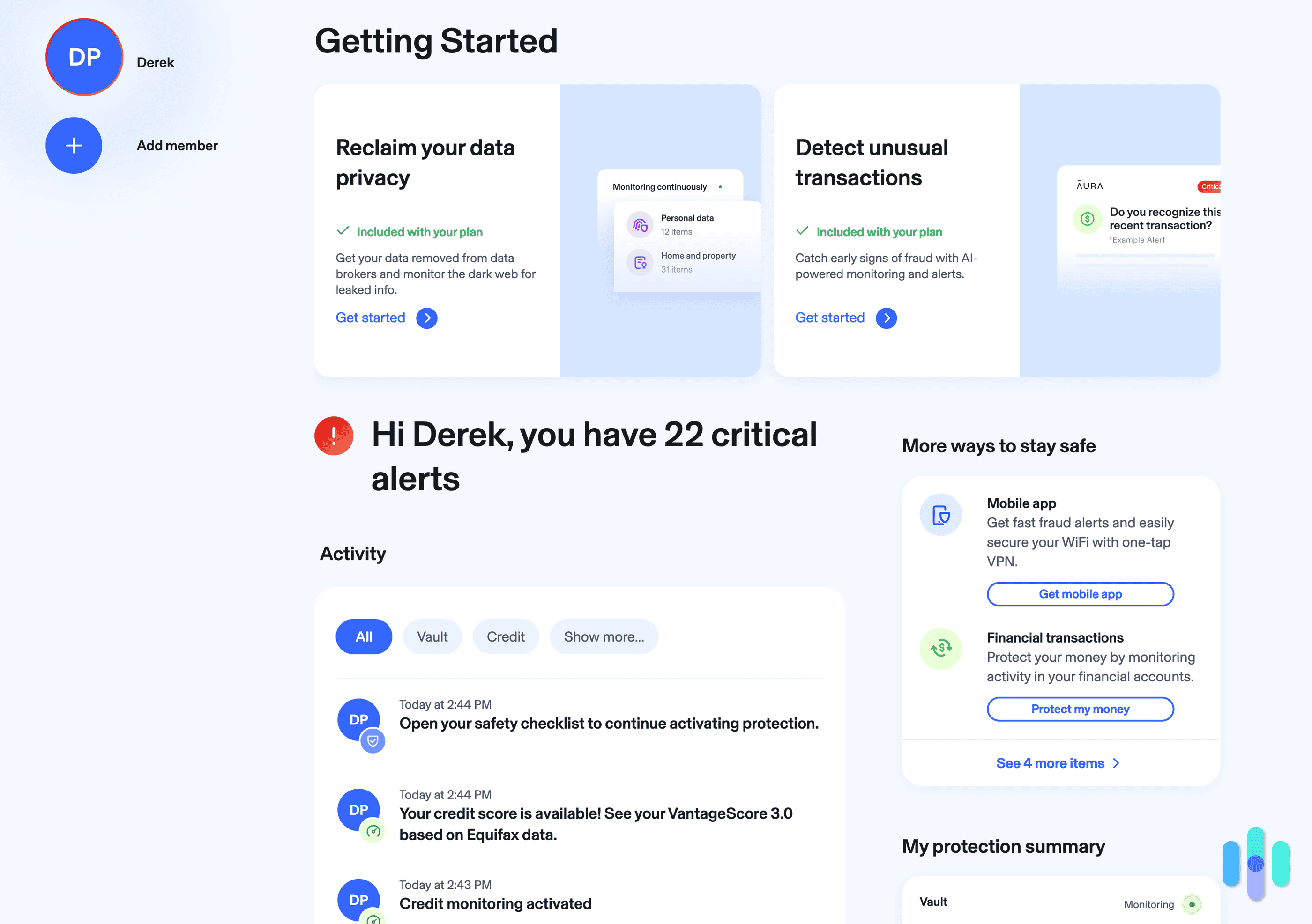

If you’ve given the scammer personal information, you should get identity theft protection services. It saves you from constantly checking your bank accounts for unauthorized payments or reviewing your credit score. The best identity theft protection services even include reimbursements of up to $1 million to help cover out-of-pocket expenses related to reclaiming your identity.

>> Learn More: Identity Theft Prevention: Tips and Techniques for 2026

Protect Yourself Online

Pig butchering scams prey on human emotions and trust. These sophisticated operations can drain life savings and retirement funds in a matter of weeks. The scammers are patient, professional, and incredibly manipulative. They’re not just after quick cash. They’re playing the long game for a bigger payday.

While losing your savings will sting, having your identity stolen can be even worse. Scammers will use your personal information to set up loans in your name and damage your credit. It’s one of the reasons we recommend identity theft protection services to help reduce the risk of losing everything.

FAQs

-

How do you report a pig butchering scam?

File a complaint with the FBI’s IC3 at ic3.gov, report to the FTC at ReportFraud.ftc.gov, and contact your local FBI field office. We also recommend notifying your bank, the cryptocurrency exchange if applicable, and your state’s attorney general’s office.

-

How much has been lost to pig butchering scams?

The FBI estimates that Americans lost approximately $4 billion in [citaiton id=”2″]2023.[/citation]

-

How to respond to pig butchering texts?

We recommend that you don’t respond to unsolicited messages. If you are randomly added to a group chat, you should leave it immediately and block the person who sent the invitation.

-

Why is it called pig butchering?

The term is an analogy comparing fattening pigs before slaughter with building trust with victims over time.

-

Can you get your money back from a pig butchering scam?

Recovery depends on the payment method used. Wire transfers may be reversible within 72 hours, credit cards offer chargeback protection, and cryptocurrency transactions are challenging to recover. Contact your financial institution immediately for the best chance of recovery.