Suspected spam calls on your phone. Website links from questionable email addresses where Amazon is spelled with two Z’s. Text messages about parcels you’re 63 percent sure you didn’t order.

It seems like a new scam is launched every day, trying to drain your bank account of your money.

So what is considered a scam in 2025? Does it need to involve AI, or can you count when McDonald’s forgets to include your McNuggets sauce?

In this article, we’ll break down the definition, the most common scams today, and how to protect yourself.

Here’s what you need to know.

What Is a Scam?

The Data Book by the FTC reported U.S. citizens lost $10 billion to scams in 2023.1 That’s one billion dollars higher than the year prior.

Scams come in many forms. Some include:

- Impersonating law enforcement or government officials to convince you to give them your personal information

- Acting as recruiters for job opportunities with interview or onboarding requests often involving you purchasing an item with an expected reimbursement that never comes through

- Trying to convince you that you’ve won the lottery or a major cash prize that you need to pay to redeem or give your personal information.

But the goals are always the same. Get as much money as possible, steal your identity, or both.

>> Read More: How to Check if Someone Is Using My Identity in 2025

Common Types of Scams

Like technology, scammers have evolved with new schemes to exploit your emotions or lack of technical knowledge. These are the most common schemes they use today.

Blackmail Scams

An email hits your inbox. Unfortunately, it’s not the latest Uber Eats specials. It says it’s from you, and the sender’s email address is also the same one you use. Is it a message from the future warning you not to buy that burgundy corduroy jacket as it will result in a series of unfortunate events?

No, it’s a scam. The body of the email is a threat to release sensitive information about you to your friends and family or on social media. But they promise they won’t as long as you wire them money or cryptocurrency. They don’t even have their fingers crossed behind their back.

Despite their threats, they most likely made up the whole story. The best thing you can do is not pay the ransom and report the email to the authorities.

>> Further reading: How to Report a Scam

Lottery and Prize Scams

Have you ever received a call or message claiming you’ve won a lottery or a major prize in a sweepstakes event such as Publishers Clearing House? Before you jump for joy, you realize there’s one problem. You never entered. The other issue is that they’re saying you’ll need to make a one-time payment for fees and taxes to receive the reward.

Did You Know: Lottery and sweepstakes scams make up 4.4 percent of total scams, and they impact the citizens of Alaska the most. You can learn more in our article on the most common fraud in your state.

Even if they explain it was your Aunt Mabel who entered you into the competition, you shouldn’t give them any financial information. Especially if they demand an immediate payment.

Charity Scams

Some scammers take George Costanza’s idea of creating a fake charity too far. Instead of donating money to The Human Fund, these people set up phony organizations designed to steal your money. They’ll flood you with calls and texts to tug on your heartstrings during the holiday season or after a natural disaster.

One tactic they try is claiming they’re following up on a payment you haven’t settled. They’ll request the funds immediately via wire transfer or cryptocurrency. Instead of reaching for your credit card, ask for detailed information about where they are calling from. Get their physical address and phone number, then do some research to see if they’re legit.

Debt Collection Scams

Not many things can break us into a cold sweat faster than a call from the IRS claiming we have an outstanding debt. Scammers know this and try to use it to their advantage.

FYI: Aura is our top choice for credit protection services. Not only does it include three-bureau credit monitoring, but it also protects your finances by providing alerts for high-risk transactions. Check out our review of Aura for a full breakdown of our experience using them for a month.

But if this is your first interaction with the IRS, it’s a scam. They will only call you if you have a significant amount of back taxes, have ignored their mail, or sneaked out the back door of the office when they’ve shown up for a quick chat. So you can hang up and wipe the sweat from your brow.

Impostor Scams

Scammers have embraced artificial intelligence and use it to clone the voices of loved ones. They’ll ask for money, gift cards, or some sort of compensation to help them out of a jam. It sounds like your friend or family, but it’s actually someone you’ve never met who could be on the opposite side of the world.

The giveaway is that they call from a private or different phone number. We recommend speaking to a relative or friend close to the person allegedly contacting you. Validate the story before making any transactions.

Phone Scams

There are many ways scammers will try to turn your smartphone against you. Some of the common methods include:

| Scam | What is it? |

|---|---|

| Robocalls | Automated calls from your bank advising you of suspicious withdrawals or payments made from your account. If you stay on the phone long enough, you’ll get transferred to someone who will try to get your bank details. |

| Apps | Fake applications that look identical to the real thing. However, the developer has a different name, which isn’t verified by the app stores. |

| QR codes | Scammers will place QR codes in popular locations to try to get you to pay for products or services. Some will even ask you to create an account to proceed, which involves handing over your personal information. |

| SIM swap | If a scammer gets control of your phone, they can reassign your SIM card to their device. They’ll then log into your accounts and gain access, even if you have multifactor authentication. |

| Fake one-time passwords | After receiving a one-time password, someone claiming to be from the company will call and request the code. |

Romance Scams

There is a reason the TV show “Catfish” is still running. A lot of people are duped on dating apps where, instead of catching feelings, they get tricked into sending money, only to be ghosted once the transfer is complete. That’s why we made a guide to online dating safety.

>> Check Out: Safety While Dating

But it doesn’t just happen on dating apps. I had someone slide into my LinkedIn DMs wanting to meet for coffee at my local cafe. But first, they needed me to transfer some money to cover travel expenses. The lesson is that the minute someone requests money from you, you should end the conversation no matter how long you’ve been talking.

Online Purchase Scams

If the price of a PlayStation 5 with two controllers on Facebook Marketplace looks too good to be true, it probably is. The Better Business Bureau found that fake online sales made up 30 percent of reported scams in 2022.2

Pro Tip: If your phone is hacked, giving them the boot is easy. Take a look through our roundup of the best antivirus software. Any one of them can keep your phone safe from hackers.

The scam can involve selling something they never intended to send. Other times, they might purchase an item you’ve advertised on a marketplace and cancel it with the bank after they’ve received it. There are usually steps you can take with the website to recover your funds. If not, contact your bank.

>> Related: The Pig Butchering Scam Explained

Employment Scams

Job seekers need to be careful about where they submit their resumes. Some scammers take your personal information from these documents. Others set up interviews and ask you to complete employment forms to get more sensitive details like your Social Security number.

Another common scam involves getting you to purchase equipment or training courses from your supposed new employer. Once they have your money, you’ll never hear from them again. If you come across these scenarios, withdraw your application.

Tips to Avoid Getting Scammed

While scammers are becoming more creative in their ways to trick you, there are steps you can take to stay safe.

- Be skeptical: If someone contacts you out of the blue, whether it’s a friend or government official, don’t take their word for it. If they ask for your personal information, passwords, or one-time codes, always verify their authenticity.

- Don’t click on random links: When you get a message or email, validate the sender before clicking on any links. Open your browser and go to the website instead.

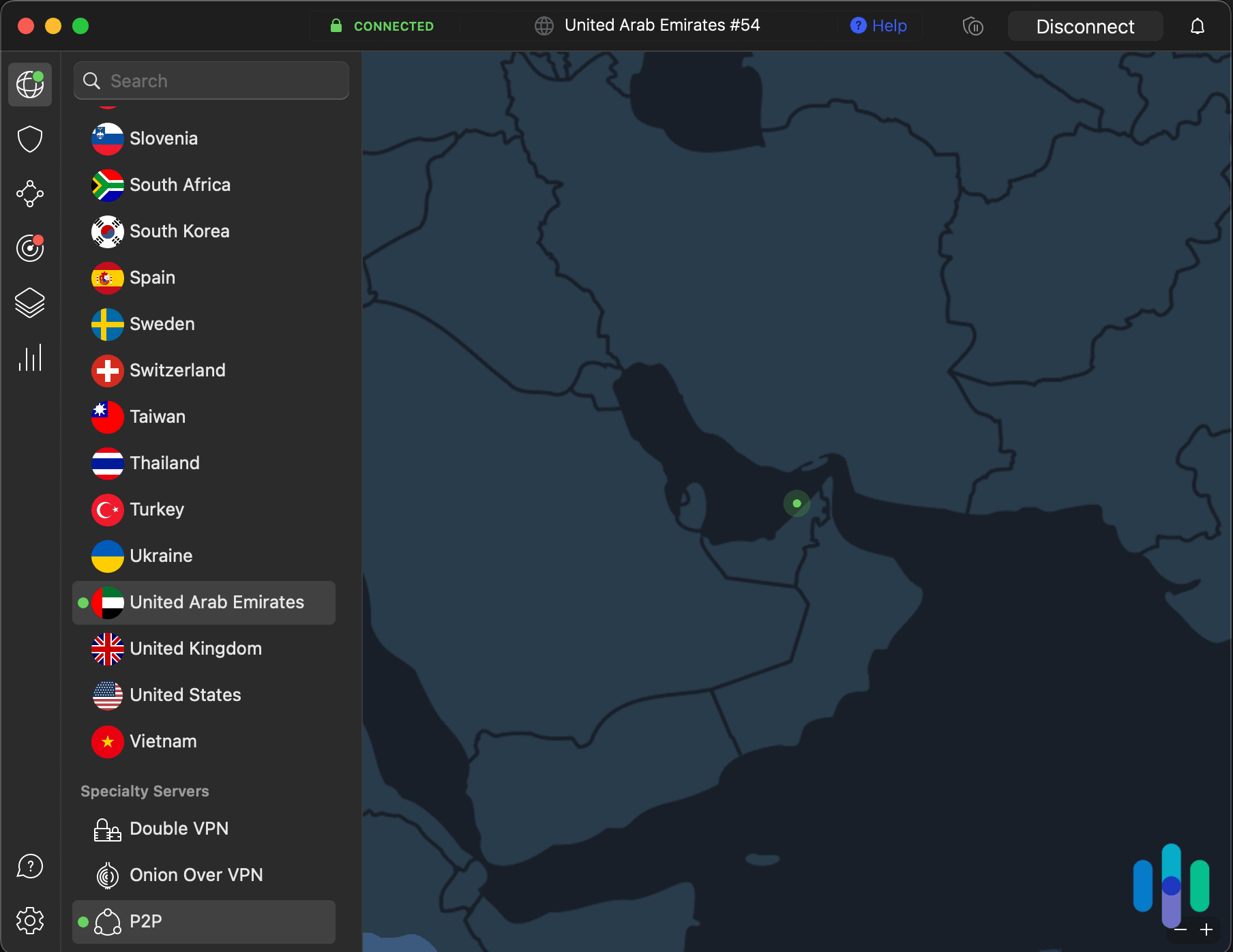

- Protect your devices with a VPN: If you’re using a phone or laptop on public Wi-Fi networks, always connect to a VPN first. We’ve reviewed some of the best VPNs for Android and the best VPNs for iPhones. They’ll keep your information confidential and ensure no one can intercept your internet traffic.

- Activate multifactor authentication: Always opt in to this feature if you see it. We recommend sending codes to email addresses instead of phones to avoid SIM-swapping scams, which is when someone can get messages sent to your phone number.

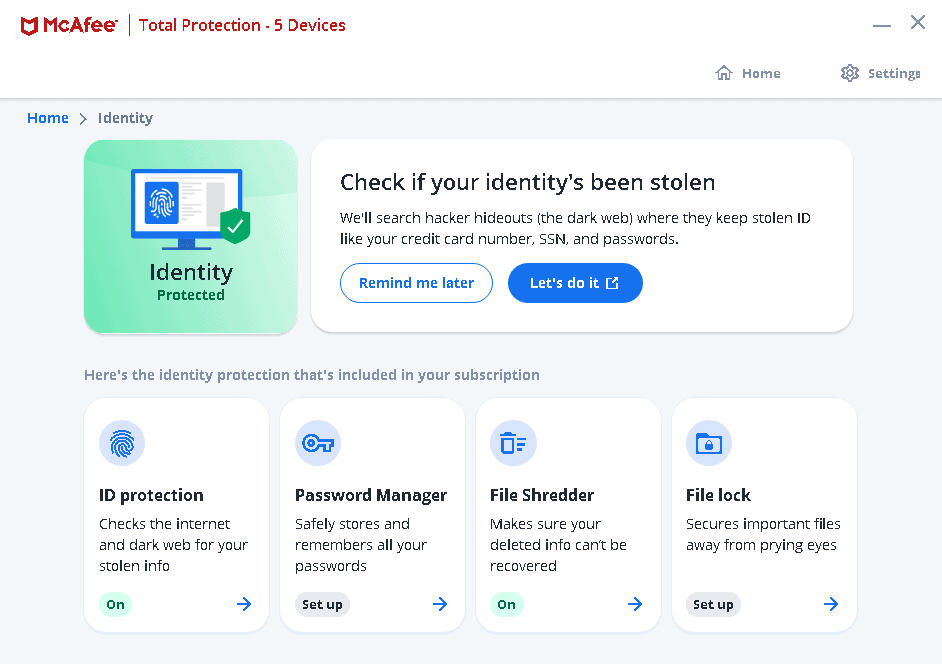

- Invest in identity theft protection: You don’t have to fight scammers alone. Identity theft protection services monitor your data and alert you when there is suspicious activity on your bank account or if someone is using your information to take out loans.

What to Do if You Get Scammed

If you have lost money or your personal information has been leaked, the first thing you should do is contact the authorities. Gather all the information you can and pass it along.

While it’s not guaranteed you’ll get your money back, and it’s challenging to remove private information from the internet, you can take steps to avoid further damage. We recommend signing up for an identity theft protection service, which can monitor your data and alert you whenever suspicious activity occurs.

Take a look at our article on the best identity theft protection services for some recommendations.

FAQs

-

Who are the people that deal with scams?

The FBI is the primary enforcement agency dealing with cybercrime. The Federal Trade Commission also gathers reports from customers and investigates companies and individuals breaking the law.

-

How much money is scammed each year?

The FTC reports that over $10 billion was lost in 2023.3 There were over 2.6 million frauds reported.

-

How many scam calls happen per day?

According to the National Consumer Law Center, 33 million scam robocalls are made daily.4

-

Do people ever get money back after being scammed?

You might be able to reverse a transaction with your financial institution or credit card company. But you’ll need to speak to them and discuss your situation.

-

Is it better to decline or ignore spam calls?

If your phone alerts you to a spam call, you should ignore it. Declining it lets the scammer know the number is active, which means they’ll keep trying.