Do you remember the days when you went to dinner with friends, the check would come, and the entire table would start looking like they were doing the Macarena while they patted their bodies, searching for their cash stash?

But, like the Macarena, this dance has passed us by.

Thanks to peer-to-peer digital payment apps like Zelle, you can avoid awkward payment-schedule conversations because you didn’t get cash before that first bite. Now, it’s a race not to be the last notification that funds have been transferred.

But can you use a payment platform like Zelle while still taking your personal digital security seriously? Is Zelle the safest platform to use in this scenario? Are you exposing yourself to fraud or scams by using it?

Let’s see.

What Is Zelle?

Zelle lets you send and receive money to and from other U.S. bank accounts. It’s run by a private company and owned by some of the country’s more respected financial institutions, including Bank of America, Capital One, and Wells Fargo. According to Insider Intelligence forecasts, 80 percent of the U.S. population has Zelle connected through their banking app.1 And that includes us.

FYI: Zelle works similarly to Venmo, but there are some differences. For example, Venmo charges for rapid transfers between one and three days, whereas Zelle and its affiliated banks do not. Differences like these are why we created a separate guide on if Venmo is safe.

What Is Zelle?

Zelle lets you send and receive money to and from other U.S. bank accounts. Insider Intelligence claims that 80-percent of the U.S. population has Zelle connected through their banking app.1 Although it’s owned by some of the country’s most respected financial institutions, including Bank of America, Capital One, and Wells Fargo, we still take the necessary steps to secure our account and devices when using Zelle. One way is by installing antivirus software, like the three we tested below, to prevent spyware or malware from compromising our accounts.

How Does Zelle Work?

You don’t need to fund a separate account like PayPal to use Zelle. It links directly to your bank account. However, there are limits on the dollar amount and frequency of transfers. This will differ between banks.

>> Read About: Is PayPal Safe?

We’ve used Zelle dozens of times and like it for how easy it makes sending money. To transfer funds, all you have to do is:

- Enroll your email or mobile number in the banking or Zelle app.

- Use the recipient’s email address or phone number linked to Zelle to find them.

- Choose the amount to send, hit submit, and the money will be on its way.

Funds are transferred in minutes if the recipient is enrolled with Zelle. If they’re not, they’ll receive an invite, and the money will be released within three business days.

FYI: Rest assured, many banks offer two-factor authentication options for Zelle transactions for additional security. This feature is in place to protect your funds and ensure that you’re the only one sending them.

Is There a Risk to Using Zelle?

While Zelle is convenient, it has limitations. One of the biggest risks is that it doesn’t offer purchase protection. The company’s website emphasizes that the service should only be used to transfer money between friends, family, and people you trust. This means that if you use Zelle for a transaction with someone you don’t know well, you may not have recourse if something goes wrong. That’s unlike marketplaces, like AliExpress, which offer buyer protections. These buyer protections are one of the reasons we consider AliExpress safe.

The main reason is that once you hit that transfer button, you can’t reverse it. That’s why the company doesn’t recommend using Zelle to make purchases on eBay or Facebook Marketplace in case you don’t receive the product or it’s not what you expected. Also, be on the lookout for chatbot scams as well as phishing text messages when using peer-to-peer marketplaces like eBay and Facebook Marketplace.

>> Learn More: How To Change Location on Facebook Marketplace

Can You Get Scammed on Zelle?

Unfortunately, several types of Zelle scams are in operation today, and they’re becoming increasingly sophisticated. If you’re already a user, it’s crucial to be aware of these scams and know how to avoid them. Here are some common ones to watch out for.

| Type of Scam | How it Works |

|---|---|

| Work From Home |

|

| Transfer to Yourself |

|

| Account Upgrades |

|

| Refunds |

|

| Phishing |

|

Did You Know: According to the FTC, imposter scams totaled $2.6 billion in 2022.2

How to Protect Yourself When Using Zelle

Any type of online transaction comes with risks. That’s why we recommend using one of the best VPNs to encrypt your network and taking the relevant steps to protect your identity. In addition to staying alert and vigilant, follow these tips:

- Only Send Money to Trusted Contacts: Zelle recommends transferring funds to people you know and trust. Don’t use the platform to purchase items on marketplaces from individuals you’ve never done business with.

- Always Verify Recipient Information: Double-check you’re sending money to the right person before you hit the submit button. It’s almost impossible to reverse a transaction, and having a conversation with the person you accidentally made richer is never fun.

- Use Two-Factor Authentication: This additional security measure requires an extra piece of evidence, besides your password, to prove your identity. It could be a one-off code or your fingerprint. Either way, it ensures you’re the only person sending funds and adds more protection to transactions.

- Stay Informed on Scams: If you see a news article or social media post about Zelle, it’s important to take note. You might think it will never happen to you, but knowing the latest scams can help you recognize and avoid them. In our opinion, staying informed is one of the best ways to prevent being scammed online.

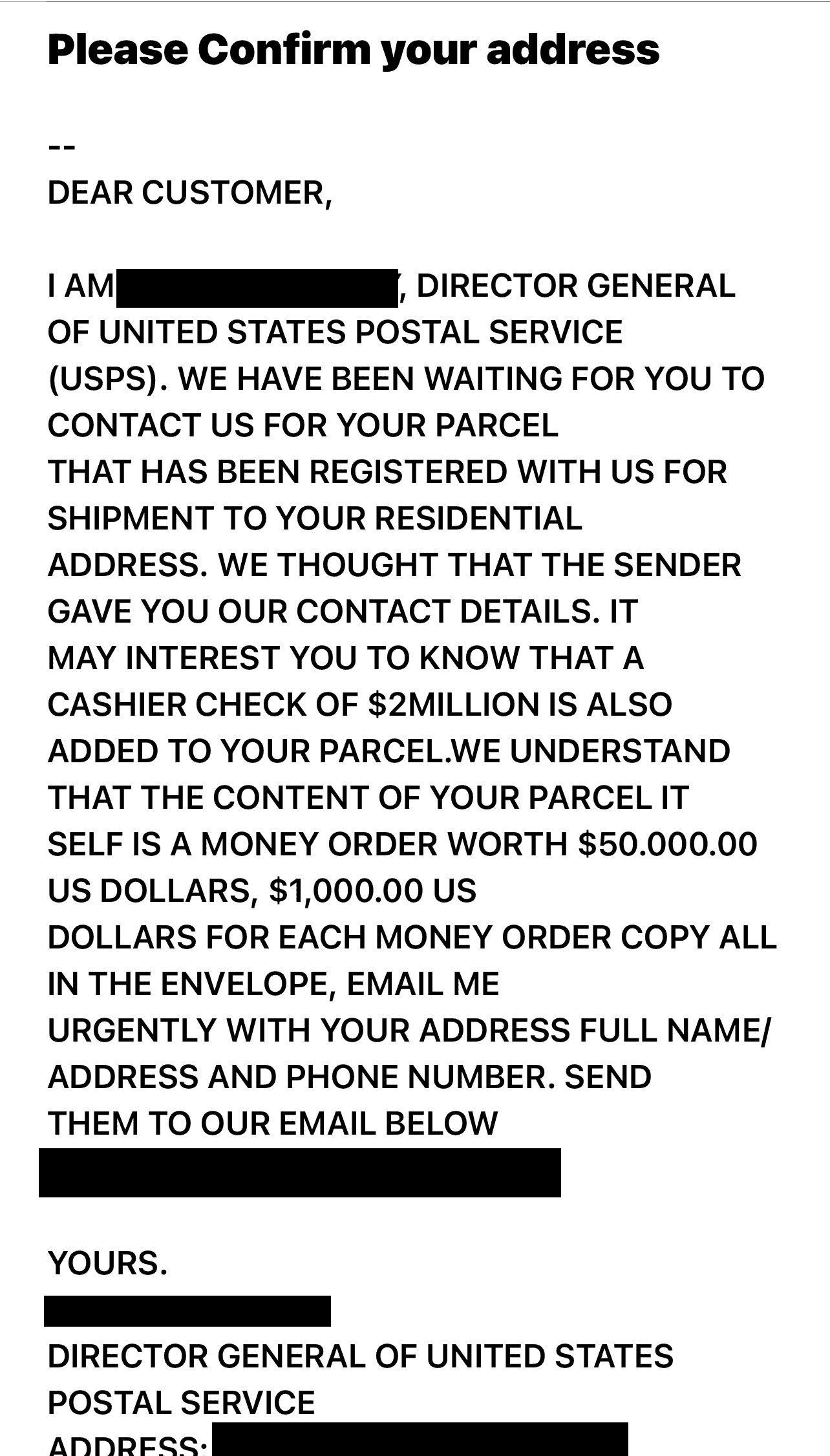

- Look for Telltale Signs: Many scams are easy to spot. They often make spelling or grammar mistakes and have a sense of urgency. If you’re ever in doubt, contact your financial institution to validate that the communication is authentic.

>> Read More: Don’t Get Hooked: Recognizing Phishing Attempts

What to Do If You’re Scammed on Zelle

If you sent money to David S. instead of David T. or you’ve been scammed, you can take steps to get your money back from Zelle. Here’s what you should do.

- File a fraud claim with your bank. For it to be successful, the transaction must have been an unauthorized transfer, an incorrect transfer, or a miscalculation by the financial institution.

- Send a request through Zelle to recover the funds. Tap the Request button in the app, look for the contact information, and enter the amount you want back. You can also include a note. If the person denies your request, you’ll receive a notification.

- In your Zelle or banking app, attempt to cancel the payment. This will work if the other person doesn’t have a Zelle account.

- Contact Zelle at 1-844-428-8542 to report the scam. They also have an online form you can fill out.

- File a police report. Provide as much information as possible and detail the steps you’ve taken. You’ll get a reference number you can use to retrieve updates.

- Take the necessary steps to protect your credit score and identity.

On top of talking to Zelle directly, we typically inform our identity theft protection provider of any scams we encounter as well. Most of the best identity theft protection services offer some amount of reimbursement for stolen funds. While not every scam will be covered, it’s always worth talking to your provider.

>> Read About: The Best Identity Theft Protection with Credit Reporting

FYI: Scams, identity theft, and fraud vary from state to state. For example, debt collection fraud is twice as likely in Michigan and Tennessee compared to other locations.

Verdict: Is Zelle Safe?

Despite being a target for scams and fraudulent activities, Zelle is safe to use when transferring cash to friends, family, and people you know well — for example, your babysitter or neighbor.

It doesn’t offer payment protection like PayPal; however, it does feature two-factor authentication and is backed by some of the country’s most reputable financial institutions. But you must still stay vigilant and protect yourself to ensure you’re the only one spending your hard-earned cash.

FAQ

-

Will Zelle refund your money if you get scammed?

Zelle approves claims on a case-by-case basis. You’ll need to follow the steps above to start the process of retrieving your funds.

-

Is Zelle safer than PayPal?

PayPal and Zelle have similar security protocols and encryption. They both have strict controls and offer two-factor authentication for payments. Zelle has the additional advantage of being embedded into many banking apps.

-

Can someone access your bank account through Zelle?

No one will see your account information when you send or receive money with Zelle. Many of the scams that occur on the platform happen when people are tricked into performing a transaction.

-

What does a fake Zelle email look like?

Zelle emails end with Zelle.com or Zellepay.com. If the address ends with gmail.com or aol.com, it is not from the platform.

-

What should I do if I receive a Zelle payment from a stranger?

You might be tempted to spend free money. Who wouldn’t? However, if someone transfers you cash on Zelle, it could be someone trying to scam you into transferring funds to them. We recommend contacting Zelle to report the incident and following their instructions.