Have you found yourself at an online checkout with Affirm as an option, but still aren’t sure if it’s legit or safe? As security experts who have used Affirm several times, we’ve found that Affirm is generally safe. So, yes, it’s a real payment option from a trusted fintech company.

However, we also noticed several things that might make Affirm risky for some customers. For example, as a buy now, pay later merchant, Affirm doesn’t offer the same level of protection as other credit cards and financial institutions.

That’s not to say it doesn’t take measures to safeguard consumer’s personal information, because it does. However, there are key differences that you should consider before fully choosing Affirm over other merchants. These include its positioning on loan protection, data security, refund and return policies, interest rates, and how it resolves disputes. Continue reading our safety guide on Affirm to figure out if it’s the most secure option for you.

Did You Know: Twenty-nine percent of online users have become victims of their financial accounts being hacked in 2024. Here’s how to protect yourself from account takeover incidents.

How Does Affirm Work?

Affirm is a top contender among other buy now, pay later companies. Essentially, Affirm is a financial provider that allows its users to buy items “now” and pay for them “later.”

But how does it really work? Well, when you’re at the checkout online and find yourself staring at a far-too-large total (we blame the shipping too), Affirm may pop up as a payment option. If you decide to go that route, Affirm will first review your credit, your payment history within Affirm, and a few other financial details to determine whether or not they’ll approve the loan amount.

If you get approved, you’ll have the option to add more items to your basket — we’re kidding, you probably shouldn’t. In all seriousness, if you get approved then you’ll be presented with a few different payment plans. These will vary based on how much your purchase is, but will range from one to 48 months.

Three, six, and 12 months are the most commonly offered options, though. And it’s as simple as that. The total amount plus interest (if any) will be displayed upfront so you always know how much you’re paying.

Approval usually takes a few seconds — the same goes for unapproved loans. Once you confirm a payment plan, you’ll pay some of it upfront and the rest in the agreed installments. Happy shopping!

Did You Know: You have many payment options for online shopping! Several stores accept payments directly from Venmo. Here’s how to stay safe when using Venmo.

Affirm Security Practices

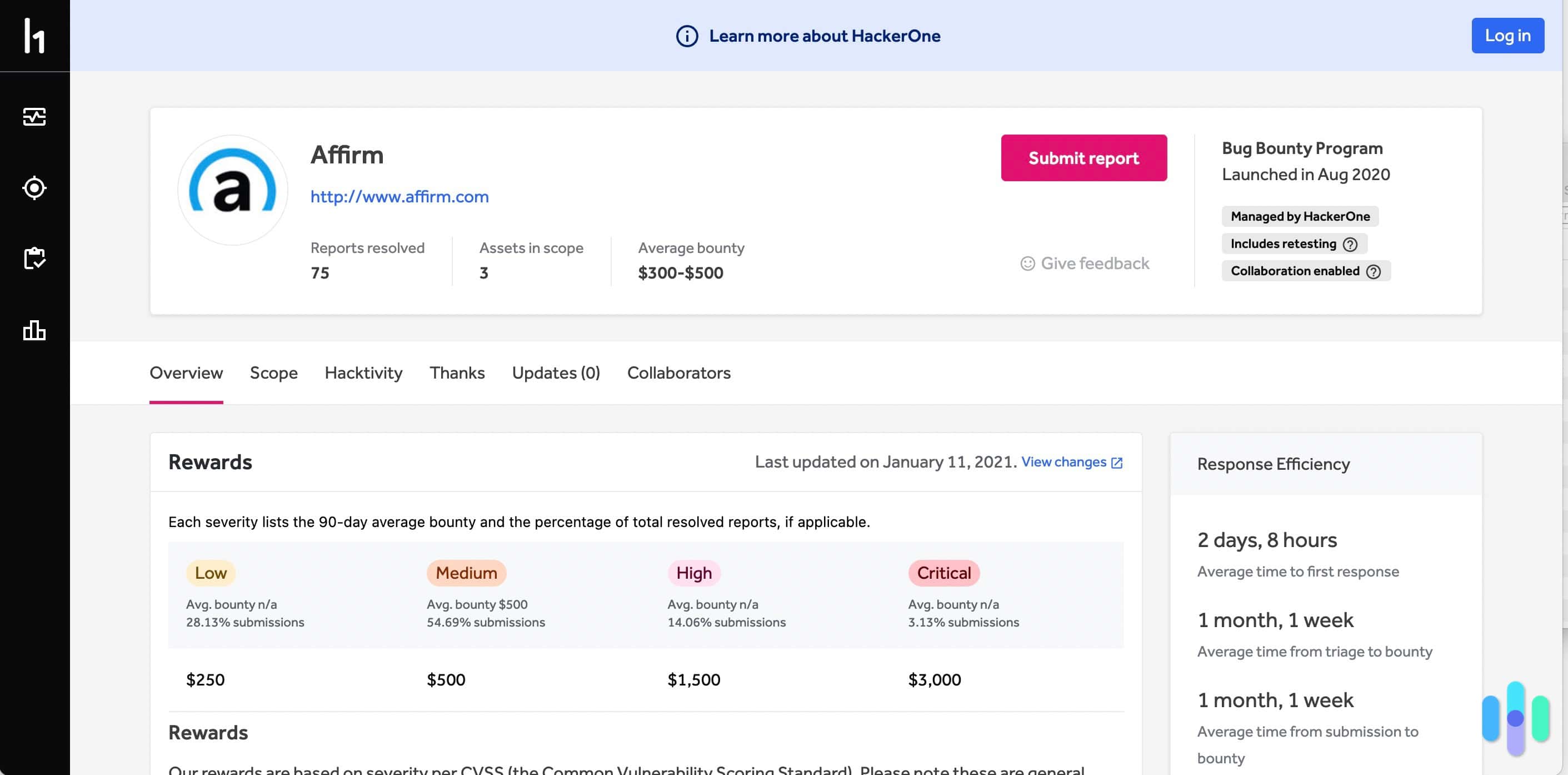

We explored Affirm’s Trust Center1 and security posture2 to identify its security practices. We found that it uses a healthy combination of safety methods to keep user data and transactions protected. Although these pages on the company’s website left out concrete details, we can assume it’s for security reasons. Still, here’s an overview of the security practices implemented by Affirm:

- Secure transmission protocols. Affirm ensures safe and private communication between customers and servers. It employs transmission protocols,3 including HTTPS and Transport Layer Security (TLS), to make sure data stays protected from unapproved third parties.

- Continuous monitoring. This merchant uses advanced technologies and tools to spot and respond to malicious activity. We’re talking about unusual login attempts, unauthorized access attempts, abnormal purchasing patterns, and more.

- Encryption. Sensitive information is kept private on Affirm thanks to its encryption standards. These methods are used in transit and at rest on Affirm systems, further preventing data breaches by turning information into an indistinct format that requires decryption keys.

- Security audits. Affirm employs trusted firms to conduct regular security assessments and audits. This helps them identify vulnerabilities in their infrastructure and systems. Ultimately, the goal is to ensure Affirm’s security is up-to-date and effective for its users.

- Incident response plans. Affirm has procedures in place to prevent, identify, and mitigate data breaches and security issues. This plan uses select technologies and tools that monitor any suspicious activity on a user’s account and across Affirm systems.

The Facts About Affirm

| Who founded Affirm? | Max Levchin is the founder and current CEO of Affirm. |

|---|---|

| When was the finance company founded? | Affirm was founded on Jan. 1, 2012. |

| How many people use Affirm? | As of June 30, 2023, nearly 36 million consumers used Affirm for transactions. |

| How much revenue does Affirm generate? | According to Yahoo! Finance,4 the fintech company reported a revenue of $591.1 million at the start of Q2 in 2024. |

Risks of Using Affirm

Affirm might be a convenient way to pay, but keep in mind there are some risks you should be aware of. For some, these risks may not outweigh the benefits of using Affirm for purchases. However, for those who may struggle to budget or make payments on time, the challenges are greater. There’s also the question of security and privacy.

Taking our personal experience with Affirm into account, here are a few risks to consider when using it:

- Impact on your credit score. Any missed or late payments on Affirm loans may be reported to credit bureaus (was that Kohl’s blouse really worth it?). This can negatively impact your credit report the next time you check it, so be sure to stay diligent with your payments.

- Returns. If you haven’t gathered it yet, Affirm does charge customers interest on its loans. This is important to keep in mind when it comes to returns, since Affirm will only refund the principal amount of each loan. That means they’ll keep any interest paid to them. This may be a small price to pay, but when it comes to larger purchases it can add up. Remember to always review the terms and conditions of each payment plan or loan so you aren’t surprised later.

- Debt increase. This risk may seem minimal at first, since the point of using Affirm is that you don’t have to pay everything all upfront, thereby accumulating a bit of debt. In small quantities, debts aren’t inherently a bad thing. However, this merchant makes it easy to take out quick loans and increase your debt ratio. If you have a budgeting issue, Affirm’s payment solutions may lead to overspending and too much debt. There’s also the case of high interest rates and fees on these loans, which can further increase how much you end up spending.

- Security and privacy. Whenever you share sensitive or private information online, there’s a risk. Affirm does its best to employ security practices that safeguard user data, but customers should always be cautious when making transactions. Ensure your connection is secure and that you’re making purchases with authorized vendors.

- Disputes. Several customers have shared their challenging encounters when it comes to dispute resolutions on Affirm. While Affirm itself creates a clear path for customers to make disputes, many have found the process can be daunting or complex.

- Identity theft. Preventing identity theft is a concern that often comes up when sharing personal and financial information online. While Affirm does have strict security practices in place to protect user data and transactions, there’s always a risk of phishing scams, data breaches, account takeovers, and more. To stay safe, ensure your Affirm purchases are made through verified merchants and that you never give up sensitive information to unauthorized users.

Pro Tip: Read our Identity Theft Protection Guide to protect yourself and your family online and offline.

Is Your Information Safe With Affirm?

As we mentioned earlier, Affirm takes user security and privacy very seriously. It conducts security audits and assessments, encrypts sensitive information, monitors malicious activity regularly, employs transmission protocols, and has incident response plans in place to prevent security issues.

While Affirm does what it can to ensure consumers are safe, no system is ever fully spared of security risks. However, we found that with its robust security plans and a bit of vigilance, you most likely won’t ever encounter a security issue. Here are the main ways Affirm protects your information:

- Security checks: Affirm takes several measures to protect accounts from unwanted logins. One way it does this is through regular security checks. Affirm may prompt you to provide identity verification details if any suspicious activity is detected or if there are any changes upon sign-in.

- Multifactor authentication: Another way Affirm keeps its customers safe is by using multifactor authentication. Doing so adds another layer of protection since it requires more information along with your password. They may ask for a fingerprint, security question, or special key.

FYI: If Affirm doesn’t sound like a match for you, there are other buy now, pay later merchants to consider, like PayPal. Take a look at our overview of PayPal’s safety and security measures before trying it.

How to Stay Safe When Using Affirm

By following the tips below, you can take advantage of Affirm’s benefits without compromising your safety. Staying aware and remaining vigilant when using any financial service or product online can help you notice and respond to any security threats.

Here are a few things we do to stay safe when using Affirm:

- Make sure a site is secure. A good indication of a safe site can be the “HTTPS” or a lock symbol near the URL. Depending on the browser you use, your address bar may also turn green, which indicates a safe and encrypted connection.

- Stay diligent when using public Wi-Fi. It’s always best to leave the important web browsing for when you’re on a secure network. If you can help it, avoid accessing financial accounts that require personal or sensitive information when using public Wi-Fi networks. The same goes for using mobile hot spots, as they’re also susceptible to breaches and fraud.

- Pay attention to malware. Malware, or malicious software, is any type of software made to corrupt or gain access to unauthorized systems, accounts, devices, or networks. A computer is affected most often when you open an attachment, click on pop-ups, or download items. To stay safe, never open attachments or download anything without making sure it’s from a trusted and secure third party.

- Protect your login information. Making sure your login credentials are safe, private, and challenging to guess will keep you the safest. Remember, your data is as safe as the password you choose. Also, refrain from sharing this information with anyone.

- Review the privacy policy. Affirm’s privacy policy helps its users understand how their information is collected and redistributed. Ensure you review its privacy statements and terms of service to protect your information in every possible way.

>> Read About: Best Virtual Private Networks (VPNs)

Affirm’s Privacy Policy

A truly secure company will have a privacy policy in place to guarantee your data and personal information isn’t redistributed to everyone with an internet connection. Affirm’s privacy policy clearly states that it collects the following information:

- Contact information. Name, phone number, email, and address.

- Financial information. Bank account numbers, credit scores, credit and debit card details, and other payment information.

- Location and demographics. Age, date of birth, and other demographics.

- Government IDs and documents. Utility bills, passports, IDs, bank statements, and other identifying details.

Affirm may share your information with the following parties:

- General. This includes affiliates, employees, vendors, merchant partners, marketing providers, and other third parties.

- Affiliates. This is done for underwriting and processing loans.

- Credit bureaus. This may also include other service providers.

This is only an overview of the data collection portion of Affirm’s privacy policy.5 We suggest reviewing the entire privacy policy to understand how you can best protect yourself.

Bottom Line: Is Affirm Safe to Use?

It’s hard to guarantee anything in life, and user safety on Affirm is no exception. We can’t say for certain identity thieves won’t find a way to hack any financial systems — it’s happened before. What we can ensure is that Affirm won’t sell or purposely leak your credit or financial information. It also goes above and beyond to protect user data.

The bottom line? We think Affirm is generally safe to use, and so do many of the 36 million consumers who’ve used it. Just remember to use a secure site when navigating Affirm, avoid using public Wi-Fi and mobile hot spots, pay attention to malware, and always keep your login information to yourself.

Frequently Asked Questions

-

Does using Affirm affect your credit score?

Affirm states that “only some” loans are reported to Experian. Creating an account, checking purchasing power, four interest-free payment plans, and pay-now transactions won’t affect your credit score.

-

What credit score do you need to use Affirm?

There’s no current public credit score needed to use Affirm. However, there are certain eligibility requirements, including residency, age, having a Social Security number, and owning a phone with a U.S.-based phone number that has SMS capabilities.

-

Can you increase your Affirm credit limit?

According to Affirm, your spending limit is automated to ensure the highest limit possible.

-

Does Affirm charge you any interest?

Loans through Affirm vary based on your credit score. They can fall anywhere between 0 percent and 36 percent.

-

Does Affirm charge any hidden fees?

Affirm doesn’t charge fees of any kind. That includes late fees, prepayment fees, annual fees, and account closing fees.