I’ve lost count of the number of dreams where I answer my phone to someone saying I’ve won the Publishers Clearing House sweepstakes. I’m then instantly transported to a shop counter where I’m buying Ghostbuster-style Air Jordans that are locked behind a glass case.

But thousands of people get these calls daily. They usually follow with a request to wire money to a bank account to cover taxes and processing fees. This is just one of the signs of Publishers Clearing House scams.

In this guide, we’ll reveal exactly what the scam is, the red flags you should watch out for, and what to do if you accidentally fall for it.

What Is the Publishers Clearing House Scam?

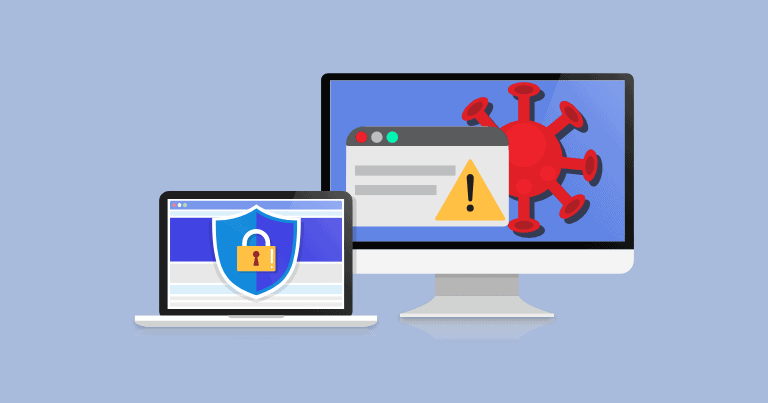

The scam involves an email, text message, phone call, or social media message claiming you won a prize in the Publishers Clearing House sweepstakes. It’s often a considerable figure. We’re talking thousands or even millions. But you can only claim the winnings by wiring money, paying with gift cards, or handing over personally identifiable information.

Sometimes, people are sent fake checks with a phone number to call for instructions on how to cash them. They’ll ask you to wire some of the funds, which forces you to pay the difference when it bounces.

>>Learn More: What is a Scam, and How Can You Avoid One?

Is Publishers Clearing House a Scam?

It’s important to set the record straight immediately. Publishers Clearing House is a legitimate business. The company has been around since 1953 and sells magazines and merchandise.

Publishers Clearing House also organizes contests, games, and sweepstakes as a strategy to promote subscriptions. According to its website, it has given away over half a billion dollars in prize money.1

FYI: Publishers Clearing House was sued by the Federal Trade Commission in 2023 over some misleading wording on its website.2 The company insinuated contestants had to make a purchase to enter the sweepstakes. Publishers Clearing House paid $18.5 million to customers and updated its terms and conditions.

Protecting Yourself Against Publishers Clearing House Scams

Publisher Clearing House scams are just one type of the many types of scams you should protect yourself against. To protect yourself from these types of scams and other malicious activities, we suggest securing your devices with antivirus software. Here are three we’ve tested and recommend.

Does Anyone Win From Publishers Clearing House?

The legitimate Publishers Clearing House promotes the previous winners of their sweepstakes on their websites. For prizes under $600, winners will receive a check via certified mail that’s ready to cash.

For larger prizes, the company shows up on your doorstep with a giant check and film crew. They’ll also hand you a regular-size check you can take to the bank.

Types of Publishers Clearing House Scams

There are a few ways the Publishers Clearing House scam can happen. These are the most common approaches.

Social Media Notifications

If you get a message on social media from Publishers Clearing House, you can ignore it. Scammers set up fake accounts on all the major social media platforms and slide into DMs, hoping someone will believe them.

In extreme cases, they’ve even set up fake accounts for Publishers Clearing House employees. The best action you can take is to ignore these requests and report the account to the social media company.

>> Find Out: The Data Big Tech Companies Have on You

Scam Calls

When they can’t get to you on social media, they’ll try calling you. Scammers will pretend to be representatives from Publishers Clearing House and ask you to verify your identity to claim the prize. They will even request a payment to cover processing fees and taxes.

However, you should hang up immediately. Publishers Clearing House never calls winners. They also never ask them to make a payment over the phone with money or gift cards.

Claims Agents

One of the messages you might receive via phone or email is a notification to contact a claims agent. It’s a common trick to give you the impression that you’re dealing with a professional organization.

However, the goal of the claims agent is to get as much of your personally identifiable information as possible. They will sell these details on the dark web or use them to steal your identity.

Fake Checks

Publishers Clearing House sends checks for prizes under $600. If you get a check in the mail for a higher amount, then it is a scam.

If it’s under $600 and requires you to pay legal fees or insurance before cashing the check, it’s also a scam. Publishers Clearing House checks can be taken directly to the bank and cashed.

Did You Know: Prizes, sweepstakes, and lotteries were the third most common type of fraud in 2023. Some of the top payment methods for losses were from bank and wire transfers, with over $2.1 billion stolen.3

How to Identify the Scam

The first sign of the Publishers Clearing House scam is when you receive an email, text message, phone call, or social media message. The company will never attempt to contact you in this way. Here’s how you can tell what is real and what isn’t.

| Real Winner | Scam |

|---|---|

| You entered the Publishers Clearing House sweepstakes on pch.com. | You didn’t enter the sweepstakes, and no one entered it for you on your behalf. |

| The Publishers Clearing House prize patrol knocks on your door and greets you with a giant check, a bunch of balloons and flowers. Smile, you’ll also be on camera. | You’re contacted via phone, message, or email stating you’ve won the Publishers Clearing House sweepstakes. |

| You receive an award notification with a check for less than $600 via certified mail. | You’re asked to pay a fee over the phone or call another number to claim your reward. |

| Your name will appear on the Publishers Clearing House website on the winners page. | After paying the fee and providing your information, you never hear from the company again. |

What to Do If You’re Scammed

If you are a victim of the Publishers Clearing House scam, there are steps you can take to minimize the damage. This is what we recommend:

- Contact Publishers Clearing House directly: You can confirm the correspondence you’re receiving is real while letting them know about the details of the scam.

- Call the U.S. Postal Service: If you’ve received a fake check, let the USPS know, and they can update their processes to reduce the number of other people receiving them.

- Report the scam to the Federal Trade Commission: Fill out an identity theft report. It will help dispute fraudulent transactions and repair your credit if scammers attempt to take out loans in your name.

- Speak to your bank: Monitor your transactions and let the bank know you’ve been scammed so they can take the necessary steps to protect your funds and identity.

- Freeze your credit: Use an identity theft protection service to lock your credit and stop scammers from taking out loans in your name.

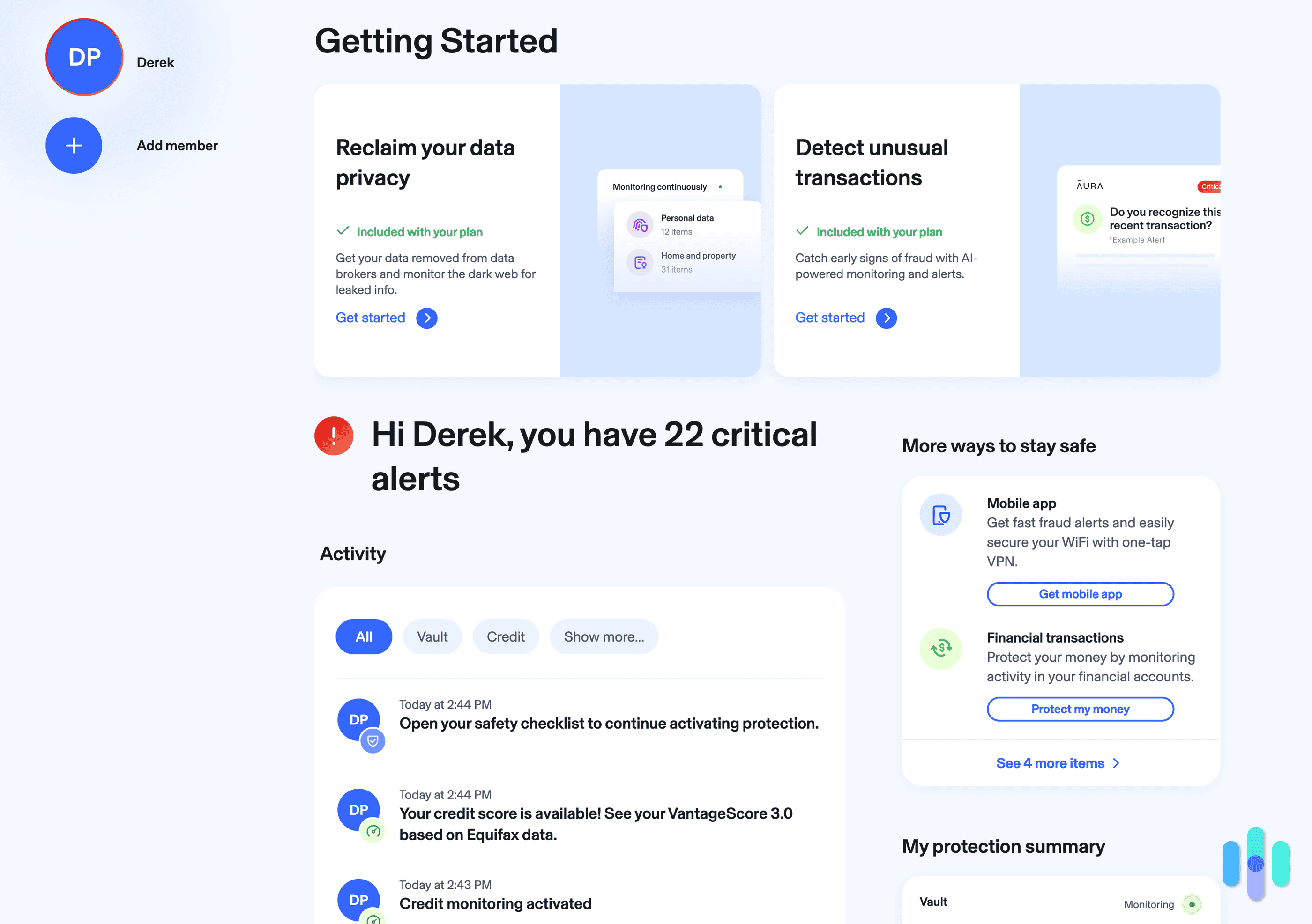

- Invest in identity theft protection services: The best identity theft protection services can do all the monitoring for you and scrape the dark web for your personal details in case it’s up for sale on criminal forums.

FYI: It’s also a good idea to change your passwords. Scammers will attempt to crack it using the information they have. We recommend using our random password generator to create something unique that doesn’t reference your first pet or favorite band in high school.

How to Avoid Getting Scammed

We’d all love to believe we’ve won millions of dollars. But unfortunately, scammers prey on these dreams. The moment we let our guard down and hand over personal information, we risk having our identity stolen and the hard-earned money in our bank accounts drained.

It’s time-consuming and challenging to monitor everything attached to our name, phone number, address, and bank details. But an identity theft protection service makes it easier. It detects unusual transactions, notifies you when someone is using your Social Security number and sends alerts if anyone tries to take out loans with your details. Most importantly, it can help you get your life back on track if someone steals your identity.

FAQs

-

How does Publishers Clearing House pick a winner?

A computer randomly selects winners from all the eligible entries. They sometimes have manual drawings. Each entry is numbered, and a random number generator determines the winning ticket.

-

What are the chances of winning anything from Publishers Clearing House?

According to their website, the chance of winning the grand prize is one in 7.2 billion.

-

Can you win a Publishers Clearing House prize without entering?

No, you have to enter to be eligible to win one of the prizes.

-

Can someone else enter you in the sweepstakes?

Publishers Clearing House allows people to enter other contestants into the sweepstakes.

-

How do you verify if a prize notification is legitimate?

If you want to confirm you’re a winner in the Publishers Clearing House sweepstake, we recommend calling them at 1-800-459-4724.