Over 37,000 cases of employment identity theft were reported in the last year.1 That’s 37,000 people who had issues with their taxes, got audited by the IRS, or had to resolve fraudulent employment history. And that’s just in the last year.

We hope we can bring that number down. To do that, we brought together our identity theft protection experts to create this comprehensive guide to preventing employment identity theft. Of course, we can’t bring your risk down to zero, but if we can save one person from becoming an employment identity theft victim, we can sleep easier at night. So, let’s dig in.

>> Read About: Identity Theft Prevention: Tips and Techniques for 2025

Key Findings

- Employment identity theft is the eighth most common category of identity theft out of 30 categories.

- People steal identities for employment due to a criminal past, work history, or citizenship status that prevents them from working.

- The IRS can help you identify employment identity theft by notifying you of potential fraud or inconsistencies with your taxes.

- Some employment identity theft notices from the IRS will have a hotline number you can call for more information and assistance.

What is Employment Identity Theft?

Employment identity theft is when a person uses someone else’s identity for their employment authorization. They use the stolen identity for everything from applying for a job to paperwork for tax withholdings. This puts fraudulent employment history on the victim’s record at a minimum. At worst, we found that it can result in an audit by the IRS.

Did You Know: We created a guide on how to check if someone is using your identity in 2025. That way you can get one step ahead of the criminals before they do any real damage to your identity.

To better prevent employment identity theft, we needed to understand the motivations of these criminals first. There are a few reasons someone would use a stolen identity for their employment information. They might not have the required citizenship status for a job they want. Others commit employment identity theft to pass background checks whether that’s due to a criminal past or an unsavory work history.

Get ID Theft Protection

Check out our favorite identity theft protection services.

How to Prevent Employment Identity Theft

Since we need the same information for applying for a job as we do for applying for a loan, the ways to prevent employment identity theft are largely the same as how we protect ourselves from traditional identity theft. That is, we need to keep our personal information that identity thieves could use for work authorization safe. Here’s how our experts keep their identities protected:

- Store documents with confidential information securely — All of our documents with confidential information go in a locked filing cabinet. We could do better, but it’s enough for us since we have one of the best home security systems protecting that filing cabinet too.

>> Learn About: Securing Confidential Personal Data Both Online and Offline

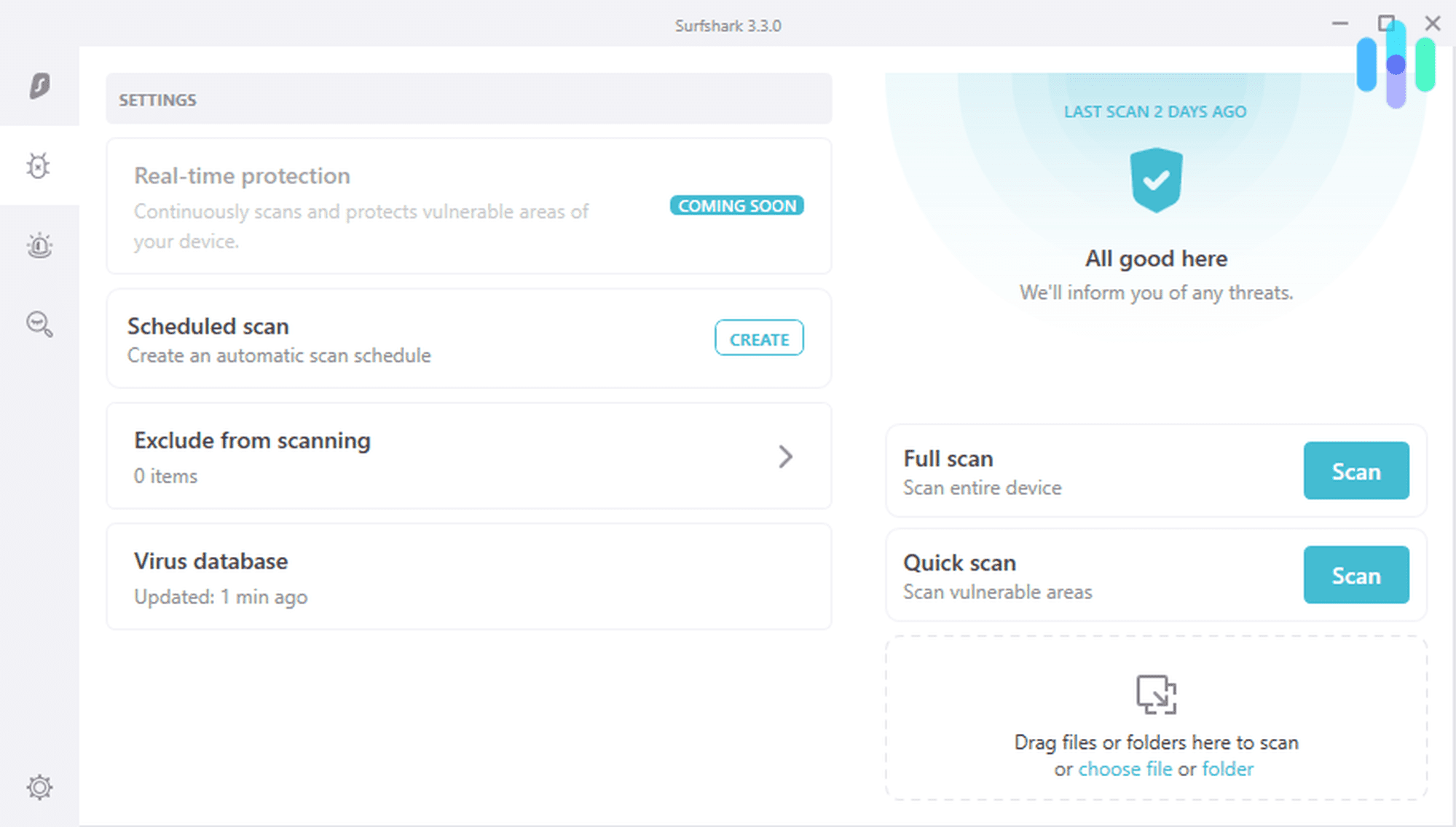

- Keep devices protected — Spyware and other types of malware are some of the common ways identity thieves steal Social Security numbers. You can protect your devices by installing the top antivirus software on each device and keeping it up to date.

- Never input personal information on public devices — Public computers, tablets, and other devices are prone to that same spyware we just warned you about. There’s also the risk of someone peering over your shoulder watching you type in your information. We recommend keeping your personal information off of public devices entirely.

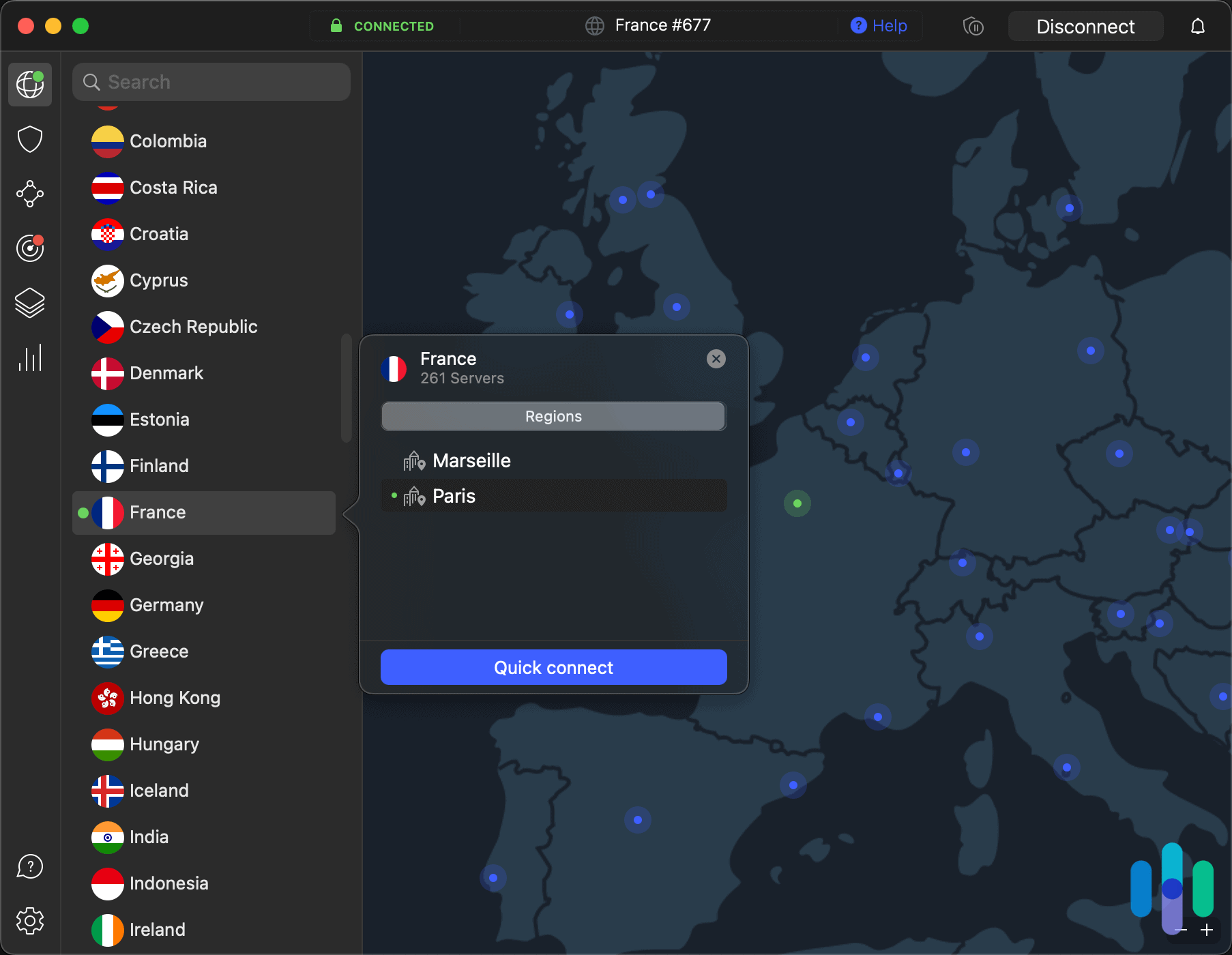

- Maintain secure online connections with a VPN — When you input your personal information into an online form and hit submit, that data gets sent from your computer to the website. Someone can intercept that data if it’s not encrypted with a high-quality VPN.

- Keep your address updated with the IRS — Most of the warning signs of employment identity theft that we’ll cover next are letters you’ll get in the mail from the IRS. If the IRS still has the apartment you lived at last year as your address on file, you might not get those letters, leaving you exposed.

4 Common Warning Signs of Employment Identity Theft

We know nobody likes getting a letter from the IRS, but that’s most people’s first warning of an employment identity theft attempt. We’ll get into the letters you should keep an eye out for as well as some other agencies that could tip you off on an employment identity theft attempt.

Here are the four most common warning signs of employment identity theft:

- Receiving an IRS notice — There are a few different notices you might receive from the IRS if you are the victim of employment identity theft. They’ll either ask for verification of income you don’t recognize or send an employment-related identity theft notice.

- Data breach notification — Depending on where you live, the companies you deal with might be required to send you a data breach notification if your data gets leaked. Getting one of these notifications should put you on high alert for identity theft and make sure to change any passwords that were leaked.

Pro Tip: The only thing you can do to prevent your data from leaking in a data breach is to limit the number of companies you share your information with. Every time you share your information with a company, you’re trusting them to keep your information secure.

- Employer tax form addressed to you — Every employer sends out W-2 and 1099 forms to its employees and contractors. When you get these in the mail, always verify the information they contain. Discrepancies are a sign of employment identity theft.

- Adjustment or denial of Social Security benefits — The Social Security Administration sends letters when your Social Security benefits get adjusted or denied. If you get one of these letters without taking action yourself, someone’s using your identity or there was a clerical error. Either way, you need to look into it.

How to Recover From Employment Identity Theft

No matter how much someone has done with your stolen identity, you can recover. The sooner you take action, the easier your recovery will be.

How you recover from employment identity theft differs greatly from traditional identity theft. So, here are the steps our experts would take to recover from employment identity theft:

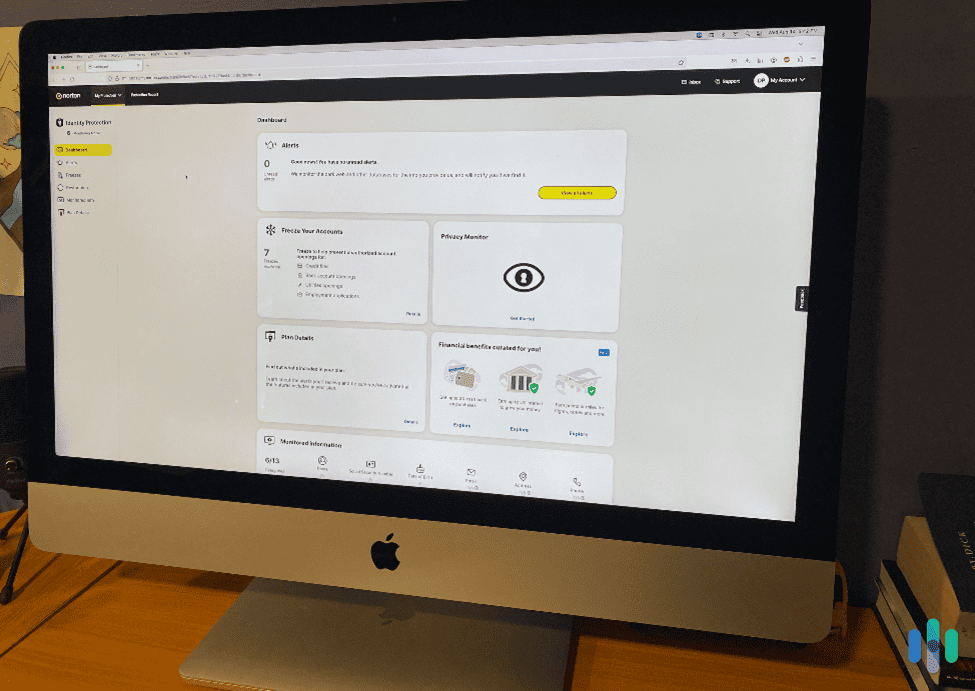

- Contact our identity theft protection service — We would get support from one of our favorite identity theft protection services first and foremost. They’ll tell us exactly what we need to do based on our specific circumstances and help us create a recovery plan. Without an identity theft protection service, you can get guidance on creating a recovery plan for your circumstances from IdentityTheft.gov.2

>> Learn More: Best Identity Theft Restoration Services in 2025

- File an identity theft report — We’d need to head over to IdentityTheft.gov anyway since that’s where we can file an identity theft report.

- Call the IRS if the notice includes a number — Some of the notices the IRS sends related to employment identity theft will include a number you can call for more details. We always recommend calling to gather as much information about the incident as you can.

- Request our credit report — Our Social Security number being used in an employment identity theft attempt means it could have been used for other purposes as well. We’d request a credit report as the first step and then go through all of our other personal accounts to look for fraudulent activity.

FYI: You can request a free three-bureau credit report every week from AnnualCreditReport.com.3 It used to be only once a year, but that changed during the COVID lockdowns since identity theft was on the rise. Now, you don’t need to hold back on getting your credit report anytime you want it.

- Never include unearned income when filing taxes — Even if we got a notice from the IRS saying there was income we earned that we did not report, we still would not include that income if we didn’t earn it. Getting that notice of income we didn’t earn means someone else used our Social Security number for their earnings.

Final Thoughts

While employment identity theft won’t result in an arrest warrant out in our name like criminal identity theft or a massive loan on our credit report like synthetic identity theft, it can still cause a headache. And that headache could come in the form of an audit by the IRS.

So, taking the preventative measures we outlined here seriously and keeping an eye out for the warning signs can save you a hassle in the future. We show you how to round out your identity protection in our guide to identity theft protection using monitoring tools, free resources, and identity theft coverage.

FAQs About Employment Identity Theft

-

How do I report employment identity theft?

You can report employment identity theft on IdentityTheft.gov. The IRS also has an identity theft affidavit form you can use to report the incident for tax purposes.

-

Why did someone use my identity for work?

People use stolen identities for work due to citizenship issues, reported work history issues, or a criminal record preventing them from obtaining work with their identity.

-

Can I check if someone used my identity for employment?

You can request your tax records and transcripts from the IRS which will show you all of your records. Someone using your identity for employment would show up since the employer would need to report the employee’s earnings.

-

Why did I receive a W-2 from a company I don’t work for?

Receiving a W-2 or 1099 filled out with your information from a company you don’t work for could mean someone fraudulently used your identity.

-

What can happen if someone steals my identity for their employment?

Someone using your identity for employment means the IRS will think you have another job. The employer of the identity thief will report the thief’s earnings as though they were your earnings. This means the IRS will think you owe them more than you do and can result in you getting audited to clear up these circumstances.