Allstate Identity Theft Protection Services

- Family, individual, and business plans available

- 30-day free trial for all personal plans

- Monthly contracting

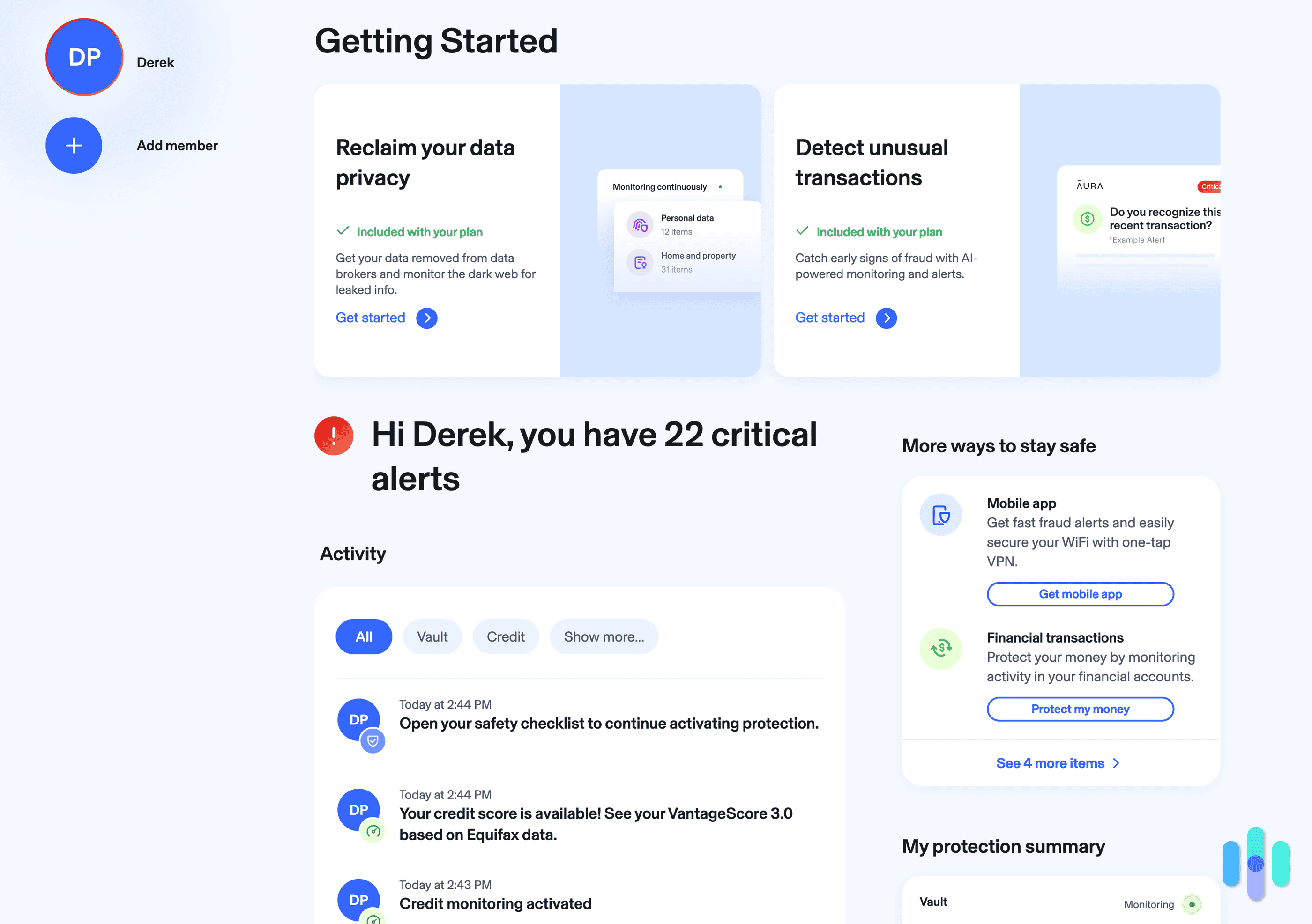

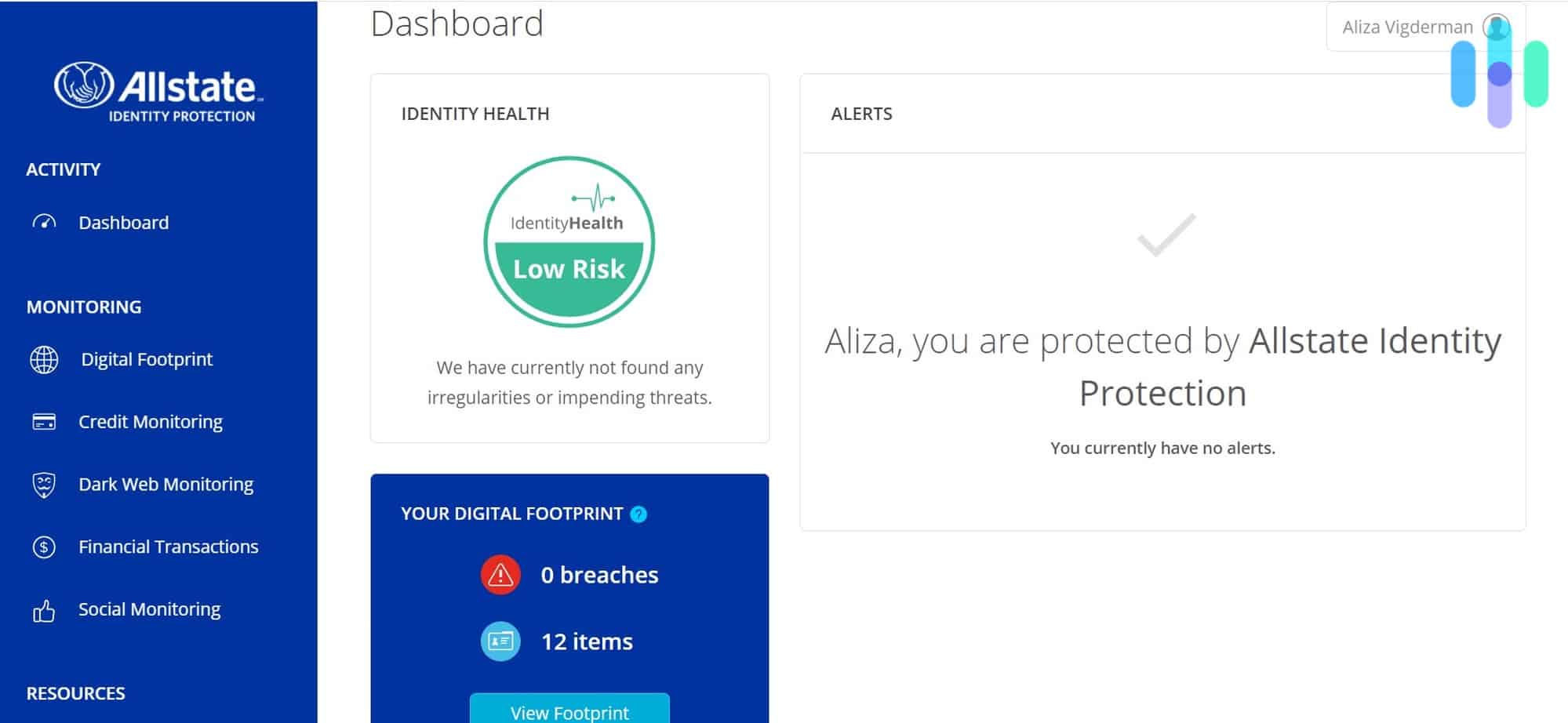

You probably know Allstate from their famous commercials, but if you’re anything like us, then you may not be aware that they also offer an identity theft protection service. They have plans for individuals, families, and businesses; we signed up for their individual Premier plan. We’ve broken it down in terms of pricing and features below, but for now, here’s a quick overview of Allstate’s prices.

Monthly plan costs

| Allstate identity theft protection plans | Monthly cost |

|---|---|

| Essentials plan for individuals | $9.99 |

| Essentials plan for families | $18.99 |

| Premier plan for individuals | $17.99 |

| Premier plan for families | $34.99 |

Can I Use Allstate for Free?

Let’s back up for a second. Allstate offers a free, 30-day trial for any of their personal plans, but you’ll have to put down a credit card when you sign up; it just won’t be charged for a month. This was a great way for us to test out Allstate, although we ended up doing so for much longer than the initial 30 days. Hey, don’t knock us for being thorough!

There is one free service that’s available for a limited time, although Allstate doesn’t specify just how long. Any Sam’s Club members can get the Digital Footprint service for free. All you have to do is sign up and sync your Digital Footprint with your email address. Then, your inbox will be scanned for possible identity threats, while you’ll get tips for staying safe online. If, as a Sam’s Club member, you want more protection than your Digital Footprint, your pricing options may look a bit different from everyone else’s — but we’ll get to that soon.

Identity Protection Price-to-Features Ratio

As we discuss AllState’s pricing below, pay attention to what’s included in each subscription. Not all services offer the same features, so while some may be more wallet-friendly, you might not get all the coverage you need. As a good baseline, the three identity protection services listed below offer good price-to-features ratio. They are affordable, they have well-rounded feature sets, and they come with useful extras. See these top AllState alternatives here:

Allstate Pricing Options

Allstate has plans for both personal and business use. Let’s start with personal.

Personal Plans

Allstate makes pricing pretty simple, with two plans: the Essentials plan and the Premier plan. Both are available for both individuals and families, making Allstate a great identity theft protection service for families. Compared to the other best identity theft protection services on the market, Allstate’s pricing is reasonable, starting at just $9.99 a month for individuals like us or $18.99 a month for families. Again, we signed up for the Premier plan so we could test out all the features, detailed below.

| Feature | Essentials | Premier |

|---|---|---|

| Allstate Digital Footprint | Yes | Yes |

| Full-service remediation | Yes | Yes |

| Identity monitoring | Yes | Yes |

| $1 million expense coverage | Yes | Yes |

| Financial monitoring | Yes | Yes |

| $50,000 stolen funds reimbursement | Yes | Yes |

| Tax fraud refund advance | No | Yes |

| Social media monitoring | No | Yes |

| Priority member support | No | Yes |

| Credit card transaction monitoring | No | Yes |

| Dark web monitoring | Yes | Yes |

| Identity health status | Yes | Yes |

| Status email | Yes | Yes |

| Solicitation reduction | Yes | Yes |

| Credit monitoring | Yes | Yes |

| Monitoring of high-risk transactions, student loans, bank account transactions, 401(k) transactions | No | Yes |

| Support over email, full-service remediation, 24/7 support line, lost wallet assistance | Yes | Yes |

| 30-day free trial | Yes | Yes |

| Monthly cost for individual | $9.99 | $17.99 |

| Monthly cost for family | $18.99 | $34.99 |

Now, in terms of users, the family plan covers the account holder plus four family members. This was a bit surprising to us, as most identity monitoring plans for families cover two adults and up to 10 children, so Allstate is a better option for smaller families. However, if you have a spouse and more than three kids, we’d recommend buying a family plan from a company like Experian, which covers 12 people total. Learn more about Experian’s pricing here.

Note: Allstate’s family plan only covers five users total, while most family plans cover up to 12 users.

Business Plans

Allstate also offers identity theft protection for businesses. Believe it or not, just as businesses need VPNs, they also need to protect against identity theft. In fact, thieves love to impersonate businesses, as they have more money in their banks, higher credit limits, and often minimal digital security.1 That being said, Allstate doesn’t list any business pricing on their website; to find out what it’ll cost, you’ll have to contact them directly.

Discounts for Sam’s Club Members

Not only do members of Sam’s Club get the Digital Footprint for free, but they also can save up to 30 percent on Allstate’s paid subscriptions.2

| Features | Essentials | Complete | Elite |

|---|---|---|---|

| Digital Footprint | Yes | Yes | Yes |

| Email scan | Yes | Yes | Yes |

| SSN monitoring | Yes | Yes | Yes |

| Credit card transaction monitoring | No | Yes | Yes |

| Expense reimbursement | $50,000 | $500,000 | $1 million |

| $50,000 stolen funds reimbursement | No | No | Yes |

| Breach alerts | Yes | Yes | Yes |

| Credit/debit card scan | Yes | Yes | Yes |

| Identification monitoring | Yes | Yes | Yes |

| Web login/password scan | Yes | Yes | Yes |

| IP address monitoring | No | No | Yes |

| Credit monitoring | Yes | Yes | Yes |

| Credit scores and reports | No | Yes | Yes |

| Credit score tracking | No | No | Yes |

| Monitoring for high-risk transactions, 401(k) transactions, student loan activity | No | Yes | Yes |

| Bank account transaction, takeover, and application monitoring | No | No | Yes |

| Social media account takeover protection | No | Yes | Yes |

| Social media reputation monitoring | No | $50,000 | $50,000 |

| 401(k) and HSA reimbursement | No | No | Yes |

| Tax fraud refund advance | Yes | Yes | Yes |

| Solicitation reduction | Yes | Yes | Yes |

| Identity health status | Yes | Yes | Yes |

| Lost wallet assistance | Yes | Yes | Yes |

| Full-service remediation | Yes | Yes | Yes |

| 24/7 support line | Yes | Yes | Yes |

| Email support | Yes | Yes | Yes |

| Club Membership monthly cost for individuals | $7.99 | $13.49 | $18.75 |

| Club Membership monthly cost for families | $13.49 | $24.75 | $33.75 |

| Savings | 20% | 20% | 20% |

| Plus Membership monthly cost for individuals | $6.99 | $11.75 | $16.25 |

| Plus Membership monthly cost for families | $11.75 | $21.45 | $29.25 |

| Savings | 30% | 30% | 30% |

Can I Cancel?

Again, you can cancel Allstate within the first 30 days after purchasing and never get charged. Beyond those 30 days, all of Allstate’s personal plans are month-to-month, so you won’t get charged extra if you stop the service. Of course, the subscription has auto-renewal, so you will have to cancel by either:

| Cancellation method | Contact information |

|---|---|

| cancel@allstateidentyprotect.com | |

| Phone | 1-855-821-2331 |

- Emailing cancel@allstateidentituprotect.com

- Calling 1-855-821-2331

Pro Tip: If you want to try out Allstate without paying, cancel within the first 30 days to avoid a charge on your credit card.

What We Liked

We liked a number of things about our identity theft protection from Allstate, including but not limited to:

- Financial monitoring: Although we weren’t thrilled that Allstate doesn’t monitor all three major credit-reporting agencies in the U.S. (just one), they do provide monitoring for:

- High-risk transactions

- Student loan activity

- Credit card transactions

- Bank account transactions

- 401(k) transactions

- Dark web monitoring: The dark web is a scary place full of stolen passwords from events like phishing and data breaches. Fortunately, Allstate scanned the dark web for our emails, credit and debit cards, web logins, driver’s license numbers, and passport numbers.

- Social media monitoring: Our social media presence matters beyond socializing. Often, we don’t realize how much of our personally identifiable information (PII) is visible through our accounts. Allstate’s software would have alerted us if anyone tried to take over our social media accounts, as well as scanning for signs of:

- Threats

- Vulgarity

- Explicit content

- Cyberbullying (monitoring for this is especially useful for keeping kids safe on the internet)

- Violence

- $1 million reimbursement maximum: All of Allstate’s plans would cover a maximum of $1 million in expenses if our identities were stolen; however, the Essentials plan has a stolen funds reimbursement maximum of only $50,000, which increases tenfold with the Premier plan.

- Great Android app: When we tested out the Allstate Identity Protection app on our Android phone, we had no issues getting alerts and checking our credit scores in a flash.

More Allstate Services

In addition to their identity theft protection service, Allstate offers a number of services, most of them insurance plans covering:

- Auto

- Home

- Renters

- Condos

- Motorcycles

- Business

- Life

- Roadside

- Boats

- Motor homes

- Off-road vehicles

- Phone protection

- Pets

- Events

- Landlords

- Retirement and investments

- Voluntary employee benefits

We didn’t see any bundles between the identity protection service and any of Allstate’s other services, so it’s most likely you will have to pay for them separately.

About Allstate

We’ve been seeing the Allstate commercials for years, but we didn’t really know much about the company before digging in. As it turns out, they have a pretty interesting background. Sears’ president and board chairman, General Robert E. Wood, founded Allstate in 1931, about 90 years ago. With the rapid rise of automobiles at the time, the company started with auto insurance, sold by mail. By the 1950s, Allstate had moved into life, health, personal liability, and commercial insurance; by the ’70s, they had expanded internationally to Japan. In the ’80s, Allstate had 31 regional offices in the U.S. and the largest claim staff in the insurance industry. In the new millenium, Allstate became publicly traded.3

While it’s not clear exactly when they started their identity theft protection service, Allstate’s long history makes them more trustworthy in our eyes — the ADT of identity theft protection. To learn more about our experience testing out the service, read our Allstate identity theft protection review.

Allstate and Privacy

Now, because Allstate is based in the U.S., they’re subject to the Five Eyes, Nine Eyes, and 14 Eyes surveillance alliances, so technically, the government could force them to share customer data. That’s concerning, as we had to give Allstate a ton of our PII for them to monitor our identities effectively. However, all of the identity theft protection services we’ve tested out are based in the U.S., so we couldn’t really get around that.

That being said, we weren’t thrilled with Allstate’s privacy policy either, mainly due to the fact that they logged information like our IP address and browsing history along with our PII. What’s worse is that the company shares this information with third parties, including marketers, advertisers, and data providers. It’s safe to say that if you want to keep your data as private as possible, Allstate may not be for you.

Recap

Allstate’s pricing is reasonable, especially if you’re a Sam’s Club member. While we couldn’t find any deals and discounts, you won’t have to break the bank too much with Allstate. However, we can’t recommend it to families with more than five members, as not everyone will be covered. Still, for individuals and smaller families, as well as businesses, Allstate remains a viable identity theft protection option.

FAQs

Since most people aren’t aware that Allstate offers identity protection in the first place, we’re answering the questions we get the most (and believe us, there were a lot of questions!).

-

What is Allstate Identity Protection?

Allstate Identity Protection is software from the insurance company Allstate that monitors credit, financial areas, and the dark web for a user’s personally identifiable information (PII) in hopes of preventing or detecting identity theft.

-

What is the best identity protection?

The best identity theft protection services are LifeLock, IdentityIQ, Identity Guard, IdentityForce, ID Watchdog, Experian IdentityWorks, Credit Sesame, PrivacyGuard, Zander Insurance, IDShield, and IDnotify.

-

Is Allstate Identity Protection safe?

Allstate Identity Protection is safe, although the company logs more user data than we’d like and shares it with advertising partners. But in terms of trustworthiness, Allstate’s more than 90 years in business make it a safe bet for identity theft protection.

-

Are identity protection plans worth it?

Identity protection plans are worth it. They typically cost no more than $20 a month and include a maximum reimbursement of $1 million in the event of identity theft. Considering that the average loss from identity theft is $1,343 according to the U.S. Department of Justice, this potential loss makes identity protection plans a good investment.

-

Business ID Theft. (2021). What is Business Identity Theft?

businessidtheft.org/Education/WhyBusinessIDTheft/tabid/85/Default.aspx -

Sam's Club. (2021). Get Allstate Digital Footprint™ for FREE*

allstateidentity.samsclub.com/ -

Allstate. (2021). Allstate History & Timeline.

allstate.com/about/history-timeline.aspx