Best Identity Theft Protection with Fraud Detection

With real-time alerts from the three major credit bureaus and fraud protection for the whole family, we recommend LifeLock.

- Monthly credit reports from Equifax let you monitor your own credit

- Mobile app makes it easy to respond to alerts no matter where you might be

- Up to $1 million in credit fraud protection

- Provides real-time alerts from all three major credit bureaus

- Offers credit fraud detection that covers the whole family

- Utilizes IBM Watson’s artificial intelligence to protect you from fraud

- Highly-rated app provides constant updates on the state of your credit

- Password manager and VPN offer an extra layer of fraud protection

- Offers fraud detection for every member of your family

How common is credit card fraud? For 2018 the US Federal Trade Commission reported more than 150,000 cases of identity fraud involving established or brand-new credit card accounts. Collectively the victims were charged billions in unauthorized funds! Also in 2018 the “private” data about roughly 150 million Americans was detected in database breaches. This information, which includes SSNs and more, could be sold on the dark web anytime.

Identity fraud is common enough that the cost of the best identity theft protection services out there is well worth it. A low-priced subscription can easily pay for itself, as the best plans 1) help prevent and minimize damage, and 2) include $1,000,000 no-deductible insurance policies to cover stolen funds and pay for expertly managed identity restoration. On top of those two benefits, some identity theft protection services offer a whole lot more. Learn what you should expect from your service provider in our identity theft protection guide.

Here we share the best ID theft protection companies that can alert you to suspicious data from all three major credit bureaus. Click a name to jump ahead, or read straight through to learn how people steal credit card numbers.

Types of Fraud Covered

| Credit card | Yes |

|---|---|

| Insurance | Yes |

| Medical | Yes |

| Tax | Yes |

Along with credit card fraud detection, the best identity theft protection plans can help you recover from ID fraud with minimal hassle. They’ll replace your stolen funds and assign experts to restore your name. Their work can save you hundreds of hours! Here’s a list of the companies featured in plans above:

Best Identity Theft Protection with Credit Card Fraud Detection

- LifeLock - Best Credit Card Activity Alerts

- Identity Guard® - Best Credit Card Fraud Detection Overall

- Aura - Best Fraud Detection App

- Surfshark Alert - Most Affordable Credit Card Monitoring

- IdentityForce - Best Credit Card Monitoring

- ID Watchdog - Best Value Credit Card Fraud Detection

- Experian IdentityWorks - Best Credit Card Fraud Assistance

How Criminals Get Credit Card Numbers

Criminals fraudulently use more than 150,000 US-based credit card accounts in a typical year. Sometimes fraud results from old-fashioned pickpocketing or someone using a lost card, but fraudsters can be terribly clever. Here are some ways they might obtain your credit card account number.

Account Takeover

A credit card account takeover involves a criminal using your personal information, such as your home address and mother’s maiden name, to convince your credit card company that they are you. The person then claims that your card has been lost or stolen, and/or that you’ve changed addresses. This prompts the card issuer to mail a new card. The criminal then receives your card at a new address or manages to intercept your mail delivery.

Fraudulent Credit Card Applications

A person who has your “private” information can apply for credit in your name. Even if the application is denied, it can hurt your credit score! The theft protection plans outlined below can send real-time alerts and help you maintain and improve the credit score you’ve earned.

Counterfeit Cards

An identity thief can manufacture counterfeit copies of your credit card after getting the number on the dark web or elsewhere. Chip-and-PIN technology in many new credit cards helps reduce this sort of credit card fraud, but new card technology can be copied too.

Card-Not-Present Fraud

This type of credit card fraud doesn’t require a physical card. With card-not-present fraud, a criminal with your card information can drain your resources by making online purchases or placing orders through the mail. This kind of fraud is on the rise as credit card chips are making point-of-sale fraud more difficult.

The companies below can help keep your accounts safe. They scan the dark web for stolen card numbers, send credit bureau alerts, show your real-time credit scores, and take other proactive measures for subscribers. They also provide generous insurance policies for stolen funds and can expertly manage identity restoration.

Detailed List of the Best Identity Theft Protection with Credit Card Fraud Detection

-

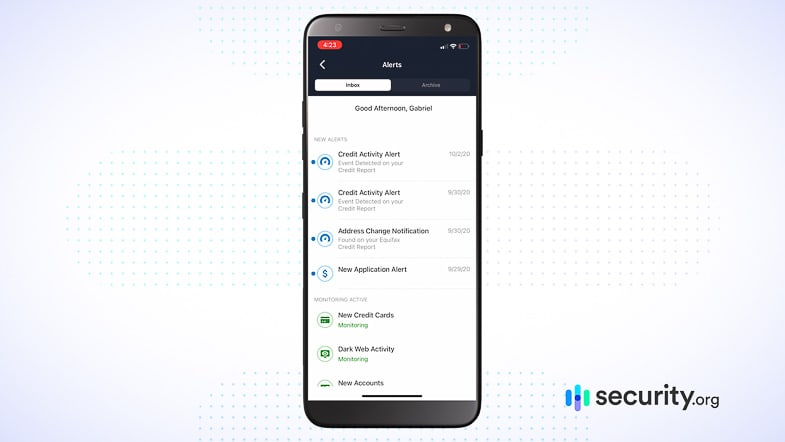

1. LifeLock - Best Credit Card Activity Alerts

View Plans Links to LifeLockProduct Specs

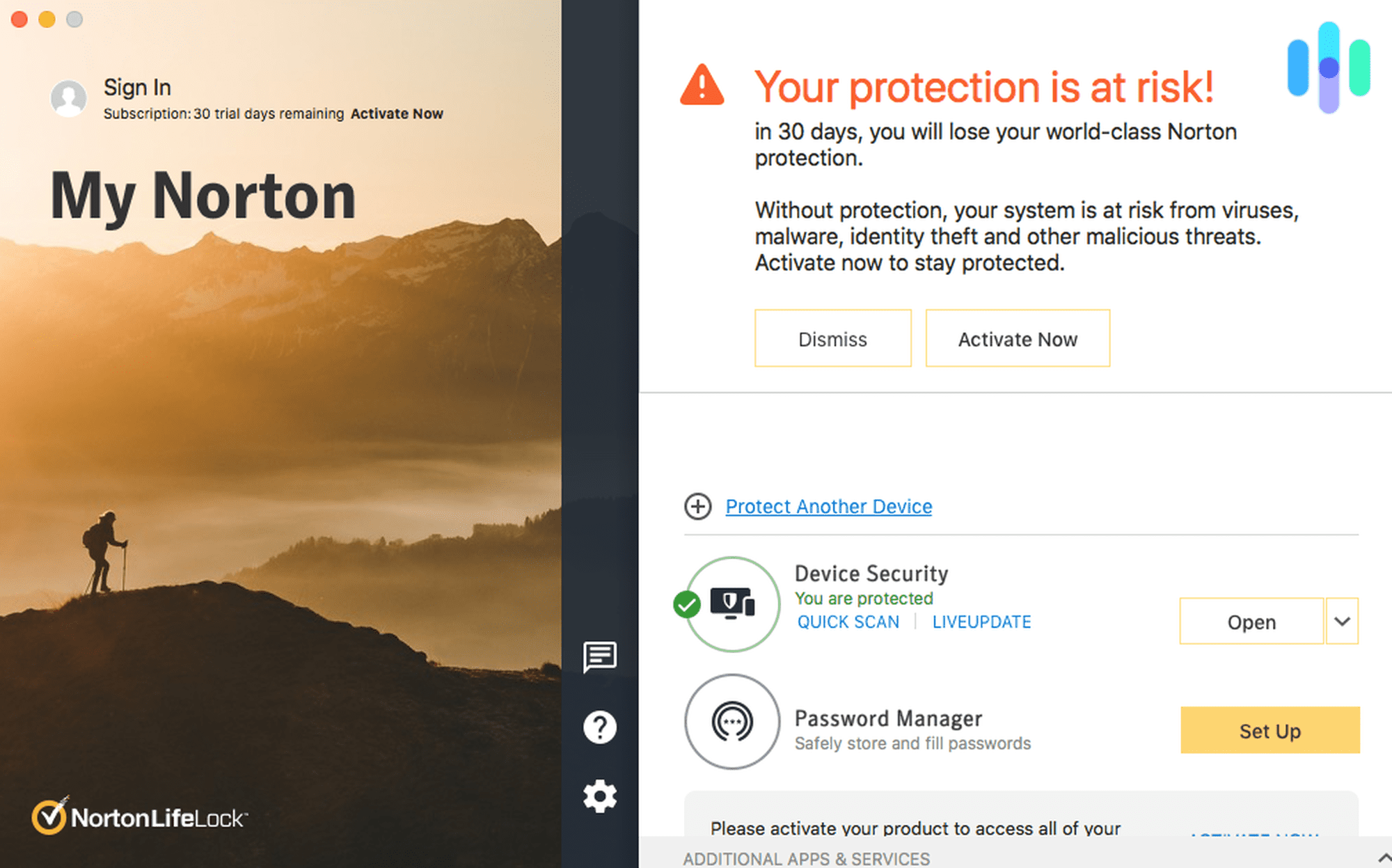

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $7.50 and up Family Monthly Plans $18.49 and up LifeLock is a comprehensive ID protection company with some of the best credit card activity alerts for people on the go. With a LifeLock Ultimate Plus plan you can get real-time alerts involving Equifax, Experian and TransUnion as well as your banking accounts, investment accounts, social profile and more. LifeLock can send these alerts by smartphone, landline, and email. Their mobile app makes it easy to respond to notices from wherever you are, and you can talk or text with an Arizona-based identity restoration specialist whenever needed. A generous insurance policy is included, as detailed below.

With LifeLock Ultimate Plus you’ll get credit score updates too:

- Monthly Equifax credit reports

- Triple-bureau Vantage scores once per year

An Ultimate Plus subscription costs $25.99/month for a single adult. That’s a bit higher than what you’d pay with Identity Guard Premier (above), but with LifeLock you get the extra benefit of Norton 360 protection for desktop and mobile devices. Norton 360 give you a virtual private network for anonymous browsing. The software suite also has antivirus and anti-phishing software, dark web alerts, and other features to help you avoid trouble. The best Norton 360 LifeLock subscription also provides generous cloud storage (500GB) to back up your devices.

More than five million individuals and families are currently LifeLock subscribers. Those with the top-tier plan are especially well-insured against identity theft, as Ultimate Plus includes the following coverage:

- $1,000,000 stolen funds reimbursement

- $1,000,000 personal expense compensation

- $1,000,000 payment for lawyers, notaries, and other ID recovery experts

Like the other leading companies, LifeLock charges no deductible if you need to access ID theft insurance. Their yearly subscriptions come with a 60-day money-back guarantee. You can also choose month-to-month service.

-

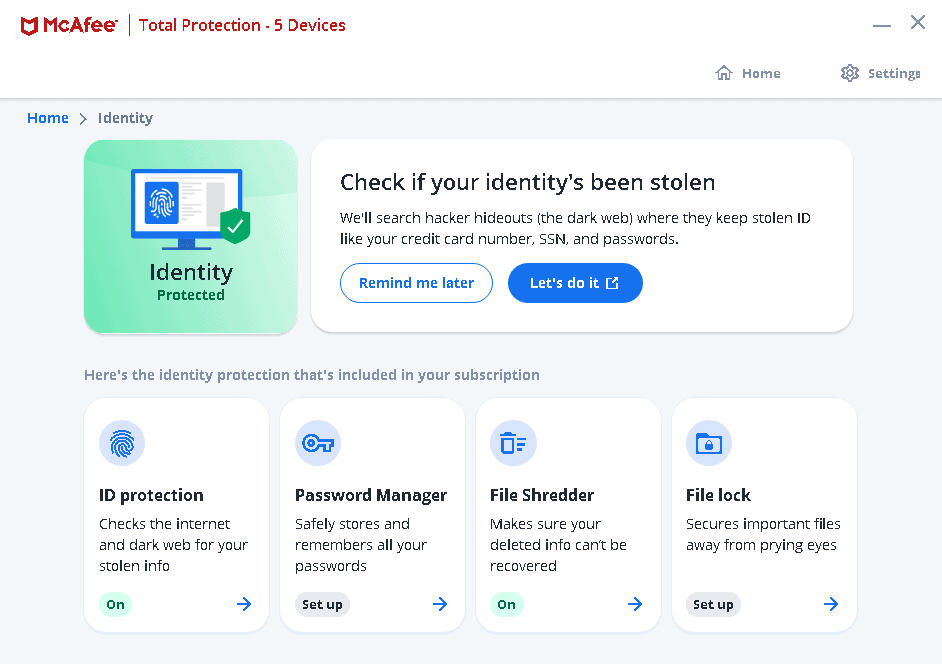

2. Identity Guard® - Best Credit Card Fraud Detection Overall

View Plans Links to Identity Guard®Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $6.67 and up Family Monthly Plans $10 and up Identity Guard is a Virginia-based company with the distinction of best credit card fraud detection overall. With a month-to-month or yearly subscription you can get real-time alerts about suspicious activity from all three credit bureaus (Equifax, Experian and TransUnion). These alerts are available with plans called Total and Premier, which are priced at $16.67/month and up for individuals, and $25 and up for families. Each plan also provides for up to $1,000,000 in stolen funds reimbursement.

Credit card fraud alerts can arrive via the Identity Guard mobile app, by traditional phone, email, and SMS text. An alert includes recommended next steps, and the Identity Guard mobile app and desktop dashboard both make it easy to respond quickly if needed. They also let you set the sensitivity of the alert system.

Additionally a Premier Identity Guard plan ($20.83/month and up) can help you track credit scores with:

- Monthly score updates based on TransUnion data

- Annual reports with Vantage 3.0 scores reflecting data from all three major bureaus

Along with credit monitoring and reporting, every subscriber gets the benefit of IBM Watson artificial intelligence. A Watson supercomputer scans the dark web and indexed sites to help Identity Guard alert you about major identity data breach news and specific incidents of your data being posted without your consent. An early warning may give you the chance to change passwords or take other actions to minimize risk.

Social media monitoring, cyberbully alerts, bank account monitoring, 24/7 support, and other services are included with the Premium plan too.

In sum, Identity Guard is a trusted partner for real-time credit monitoring and other ID theft protection services. About 50 million personal and family accounts have been served by Identity Guard over the past couple of decades, and the company has an A+ with the Better Business Bureau. You can try a plan free for 30 days.

-

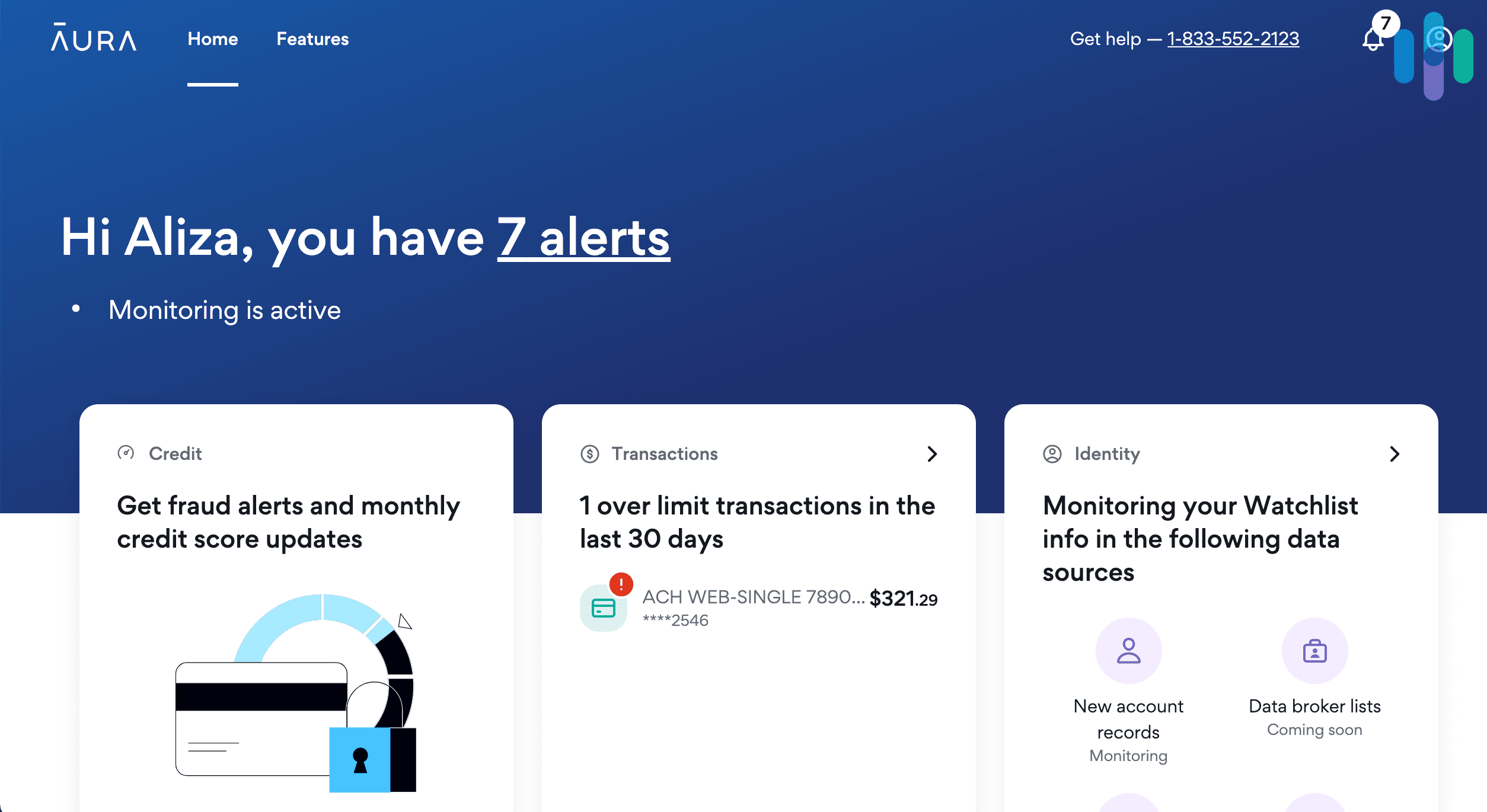

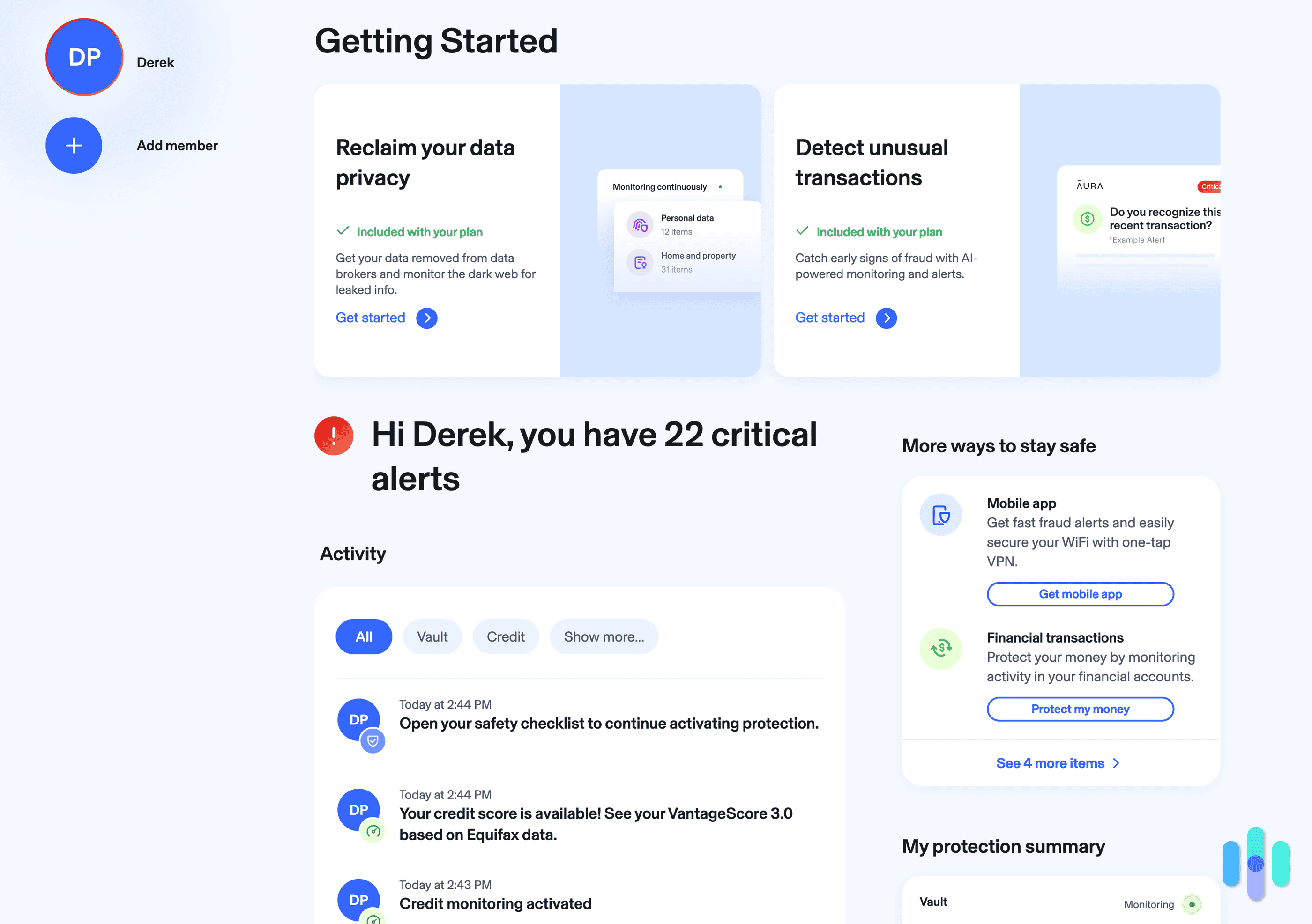

3. Aura - Best Fraud Detection App

View Plans Links to AuraProduct Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 14-day Individual Monthly Plans $12 Family Monthly Plans $45 A fraud detection service is only as good as its app, and Aura’s is one of the best apps we’ve tested. It isn’t just the design, which is great. The folks at Aura have solved a crucial problem for all of us security geeks who used to need five different apps to manage our digital security. They’ve packed everything into one app, starting with instant fraud detection alerts — banking, SSN, credit, etc.

You also get a password manager, VPN, and virus protection with Aura, so say goodbye to three more apps right there.

The price for all of this protection is, surprisingly, on the cheap side. $11-$12 per month for individuals and couples isn’t bad. We like that Aura has thought about “couples,” by the way, and not just families. But if you are a family, the more the merrier because Aura caps its family plan at $50, no matter how many kids you have. Read about the rest of Aura’s family perks in our Aura features and pricing guide.

In the meantime, here’s a quick breakdown of Aura’s best fraud detection features:

- 24/7 fraud support

- Real-time fraud alerts

- Up to $1,000,000 in coverage

- Unlimited SSN monitoring

- Credit monitoring at all three major bureaus

- VPN and malware protection

- Encrypted password manager

- Parental controls and cyberbullying alerts

- Free trial with 60-day money-back guarantee

-

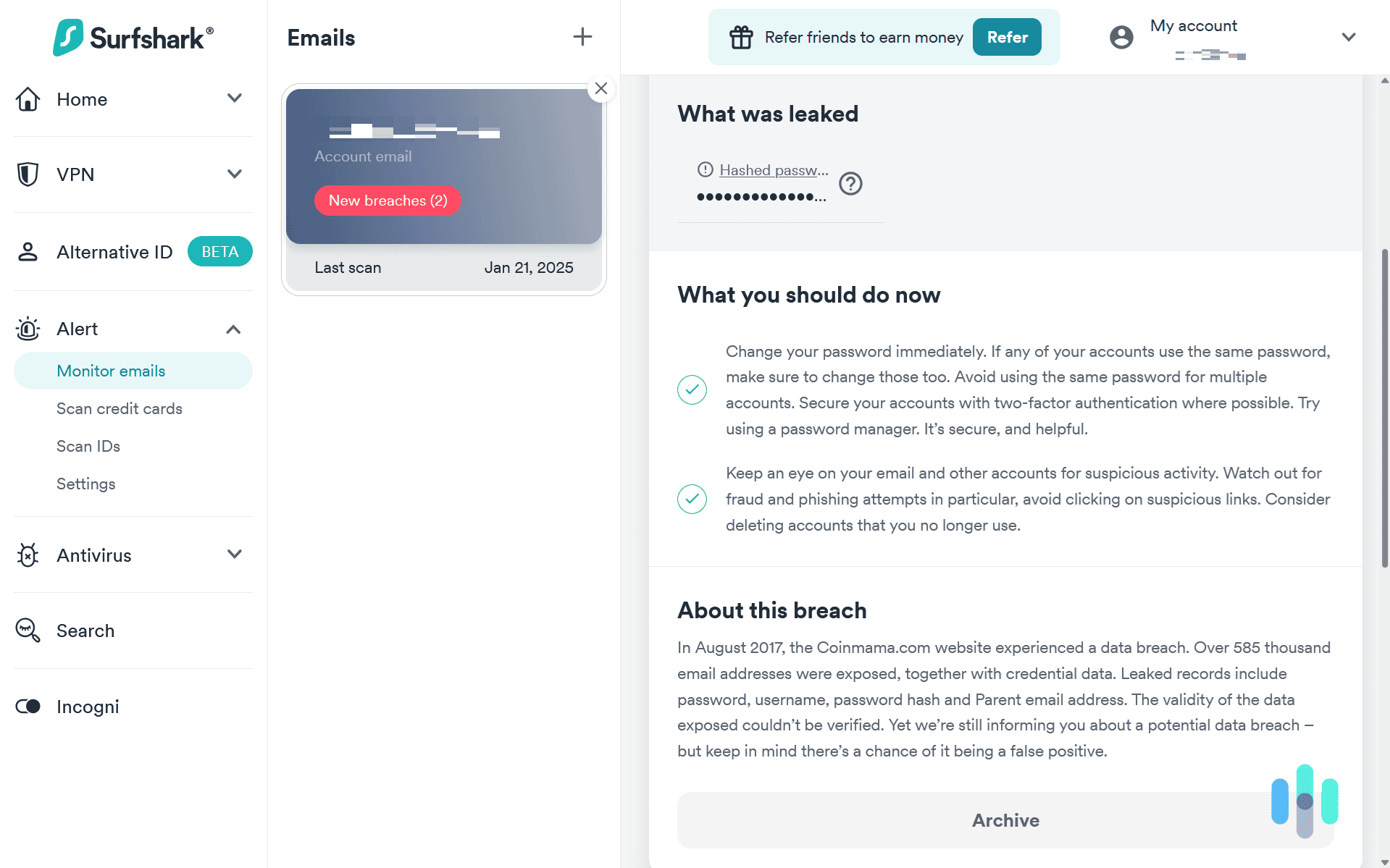

4. Surfshark Alert - Most Affordable Credit Card Monitoring

View Packages Links to Surfshark.comProduct Specs

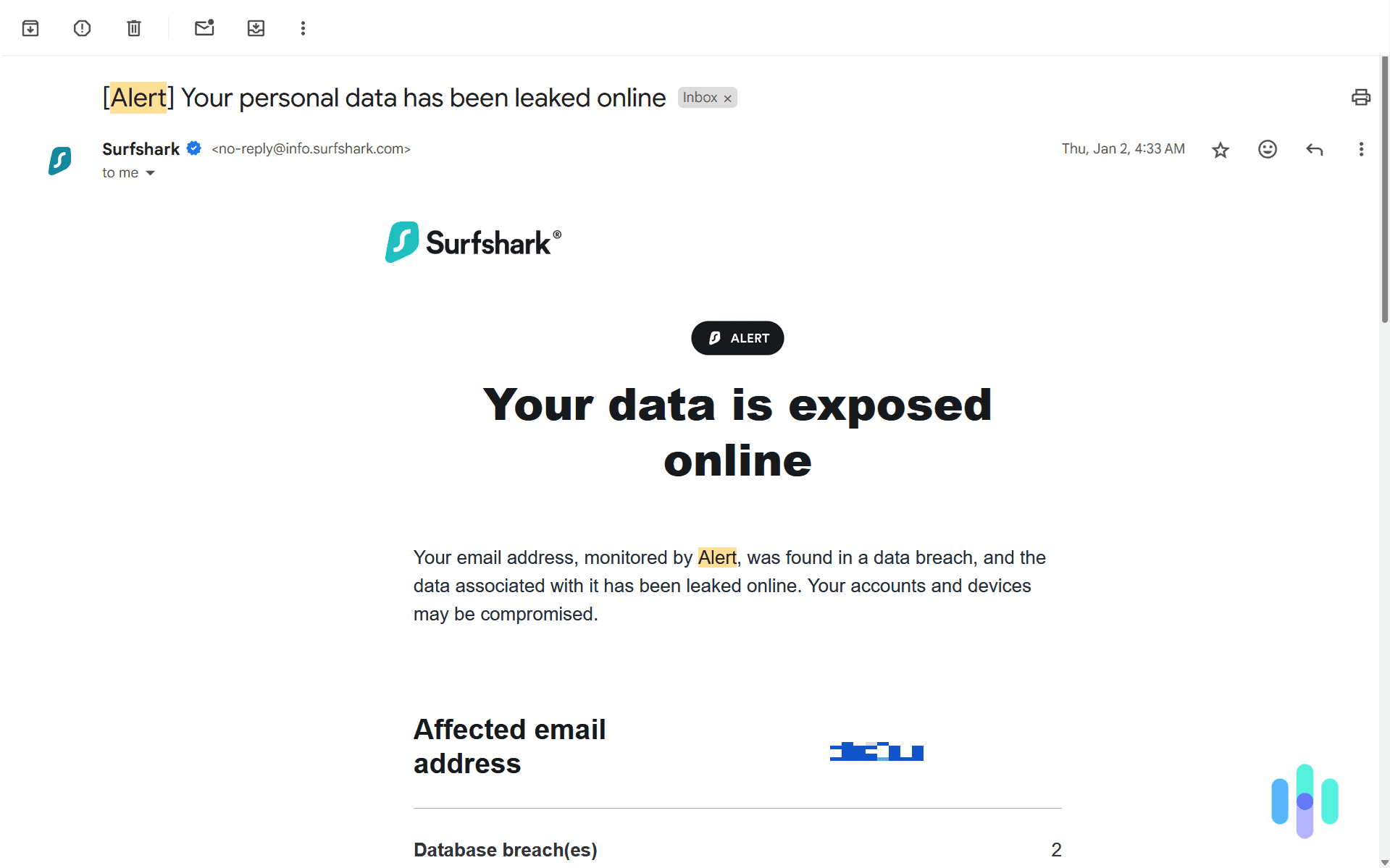

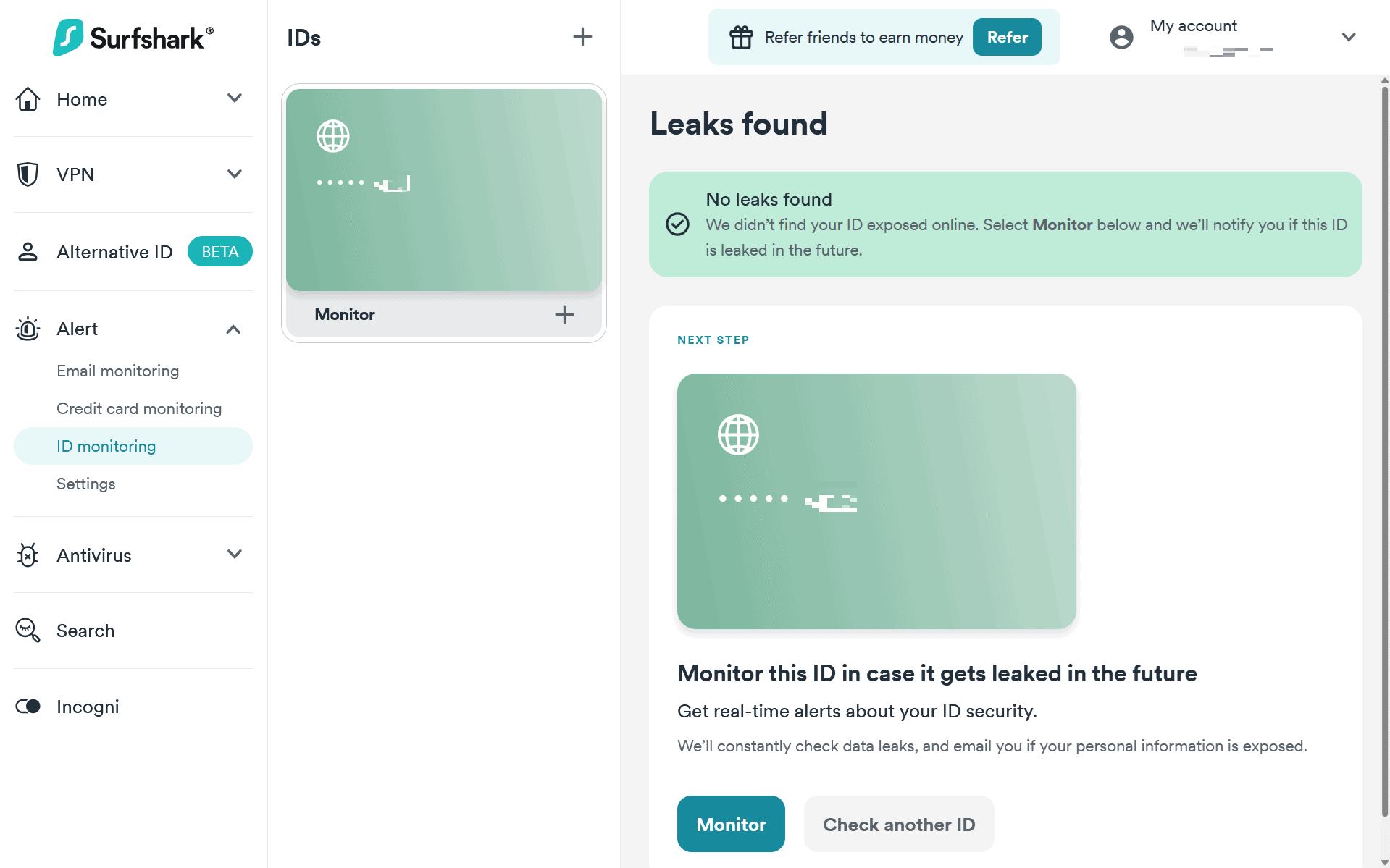

Dark Web Monitoring Yes Credit Reporting No Insurance Coverage No Free Trial 30-day money-back guarantee Individual Monthly Plans $2.49 and up Family Monthly Plans $2.49 and up We added our Visa credit card to Surfshark Alert so we would get a notification if it leaked. Surfshark is best known for its top-tier but affordable VPN. Check out our Surfshark VPN review to read more about it. Recently, however, they added Surfshark Alert to their Surfshark One and Surfshark One+ bundles. That’s Surfshark’s version of identity theft protection, although they don’t offer any insurance. They only monitor for leaks on the dark web or in data breaches.

Despite it not being a traditional identity theft protection service, Surfshark’s monitoring and online privacy tools make it a solid choice for fraud detection and prevention. And they do it for an affordable price. Here’s how much Surfshark’s plans that include Alert cost:

Surfshark Subscriptions Surfshark One Surfshark One+ Monthly plan $17.95 $20.65 Annual plan $50.85 ($3.39 per month) $91.35 ($6.09 per month) Two-year plan $72.63 ($2.69 per month) $115.83 ($4.29 per month) >> Read About: Surfshark Antivirus Review & Pricing in 2025

Pro Tip: If you want to take advantage of the best rates through Surfshark’s two year plan, don’t worry, you won’t be locked in immediately. Surfshark offers a 30-day money-back guarantee on their annual and two-year plans so you can test it out for a full month before committing.

When Surfshark finds out a piece of your information leaked, they notify you and tell you what to do next. During our test of Surfshark Alert, our email was involved in a data breach. So, Surfshark told us to change all of our passwords with accounts using that email. If we got a notification that our credit card leaked, Surfshark would have told us to place a temporary hold on the card immediately.

Here are the directions Surfshark provided after they found our email in a data breach. -

5. IdentityForce - Best Credit Card Monitoring

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $19.90 and up Family Monthly Plans $39.90 and up IdentityForce is a Massachusetts-based company known for the best credit card monitoring with daily score tracking. With a month-to-month or annual plan called UltraSecure + Credit you can get three-bureau alerts by mobile phone, landline or email. Monthly rates start at $19.99 for an individual, and the plan provides up to $1,000,000 in identity theft compensation and ID restoration. Family rates are quoted by phone.

Additionally the Ultra Secure + Credit plan can help you avoid fraud and maximize your credit score with:

- Real-time scores and reports available from all three bureaus

- A credit change simulator in the mobile app and desktop applications

Similar to LifeLock above, IdentityForce can provide cybersecurity for all your devices. They’ve long provided anti-phishing and anti-keylogging software for desktop, and in November 2019 IdentityForce enhanced its subscription benefits with Mobile Attack Control by Sontiq. This cybersecurity mobile app can guard against spyware, unsecured Wi-Fi connections, rogue apps, and other risks to connected smartphones and tablets. It’s available exclusively to IdentityForce members.

Finally, parents/guardians of tweens and teens might especially appreciate the anti-cyberbullying feature of the UltraSecure + Credit family plan. It alerts adults if minors on the account seem to be involved in online bullying, and it provides an easy way to reach out for help. Also for family safety, alerts about sexual predators known to be in your neighborhood can be sent to your account. Enrolling children is wise for other reasons too, such as SSN tracking and stolen funds compensation.

You can try IdentityForce credit alerts, credit score tracking, smartphone security, and other features free for 14 days.

-

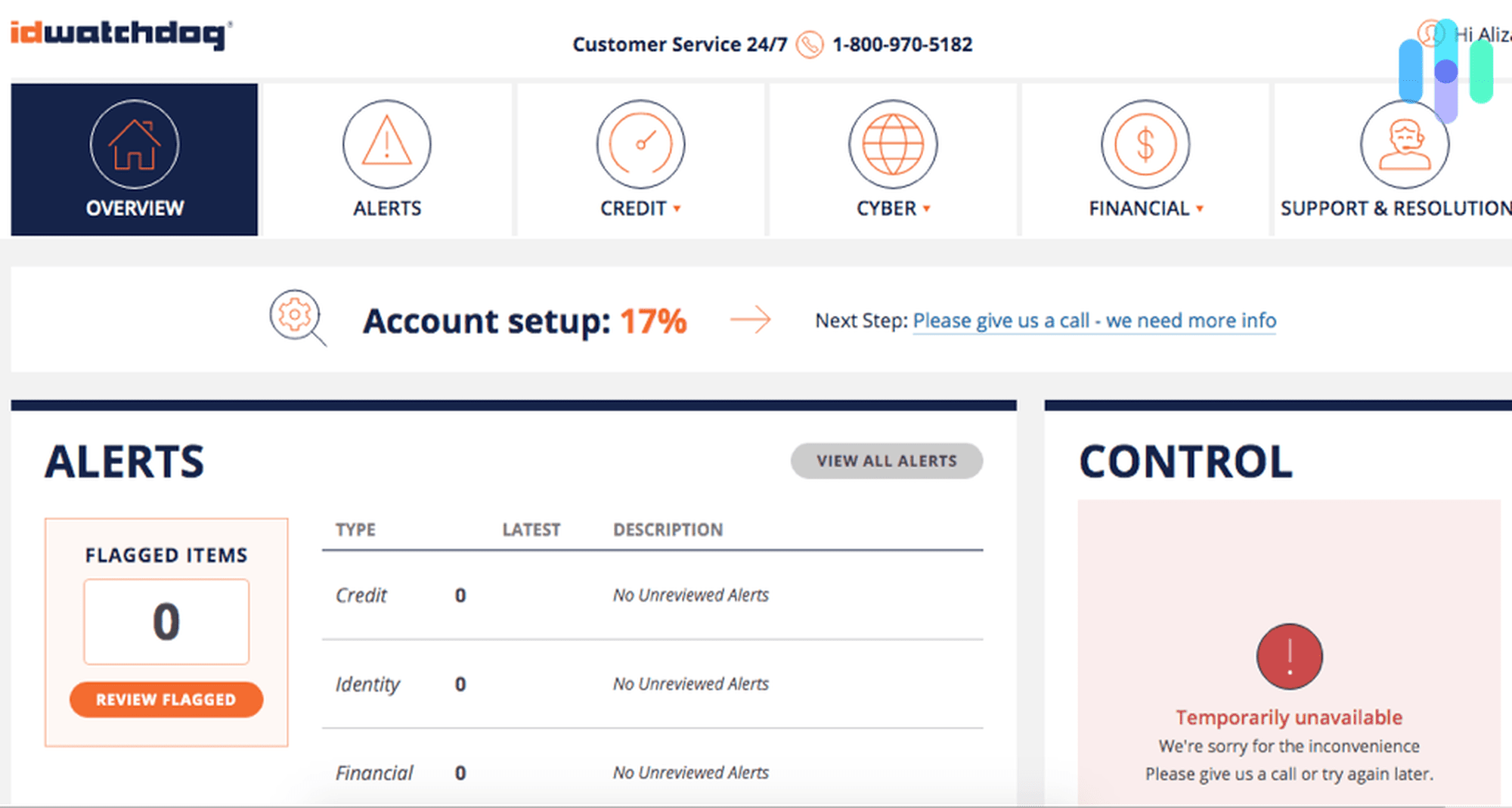

6. ID Watchdog - Best Value Credit Card Fraud Detection

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $12.50 and up Family Monthly Plans $20 and up ID Watchdog is a Denver-based ID protection company bought by Equifax in 2018. They offer the best value credit card fraud detection with ID Watchdog Platinum, a plan available at $18.25/month for one adult or about $32/month for a family. Platinum service can alert you to activity from all three bureaus by smartphone, landline, or email. Like its best competitors, ID Watchdog can send credit alerts by mobile phone, landline, and/or email. In case you need assistance, ID Watchdog has experts ready for support at all hours.

Other credit-related perks of the Platinum plan are:

- An Equifax score tracker built into the mobile app

- Easy locking/unlocking of Equifax and TransUnion reports

ID Watchdog combines credit card monitoring with dark web scanning and other proactive measures to help minimize your risk of ID fraud. In case of serious breaches, each Platinum policy includes $1 million insurance for stolen funds and related expenses. It also backs up your 401K and health insurance savings account with $500,000 coverage. Each policy has no deductible.

Children get the same stolen funds insurance as adults, and ID Watchdog is also a great choice family-wise in terms of social media monitoring: The company can alert parents to possible cyberbullying on Instagram, Facebook, YouTube and more. With the mobile app and desktop platforms you can get guidance about the best cyberbullying response right away.

Free 14-day trials are available. Service is available month-to-month and with full-year discounts. ID Watchdog will grant a pro-rated refund on annual plans if you aren’t satisfied.

-

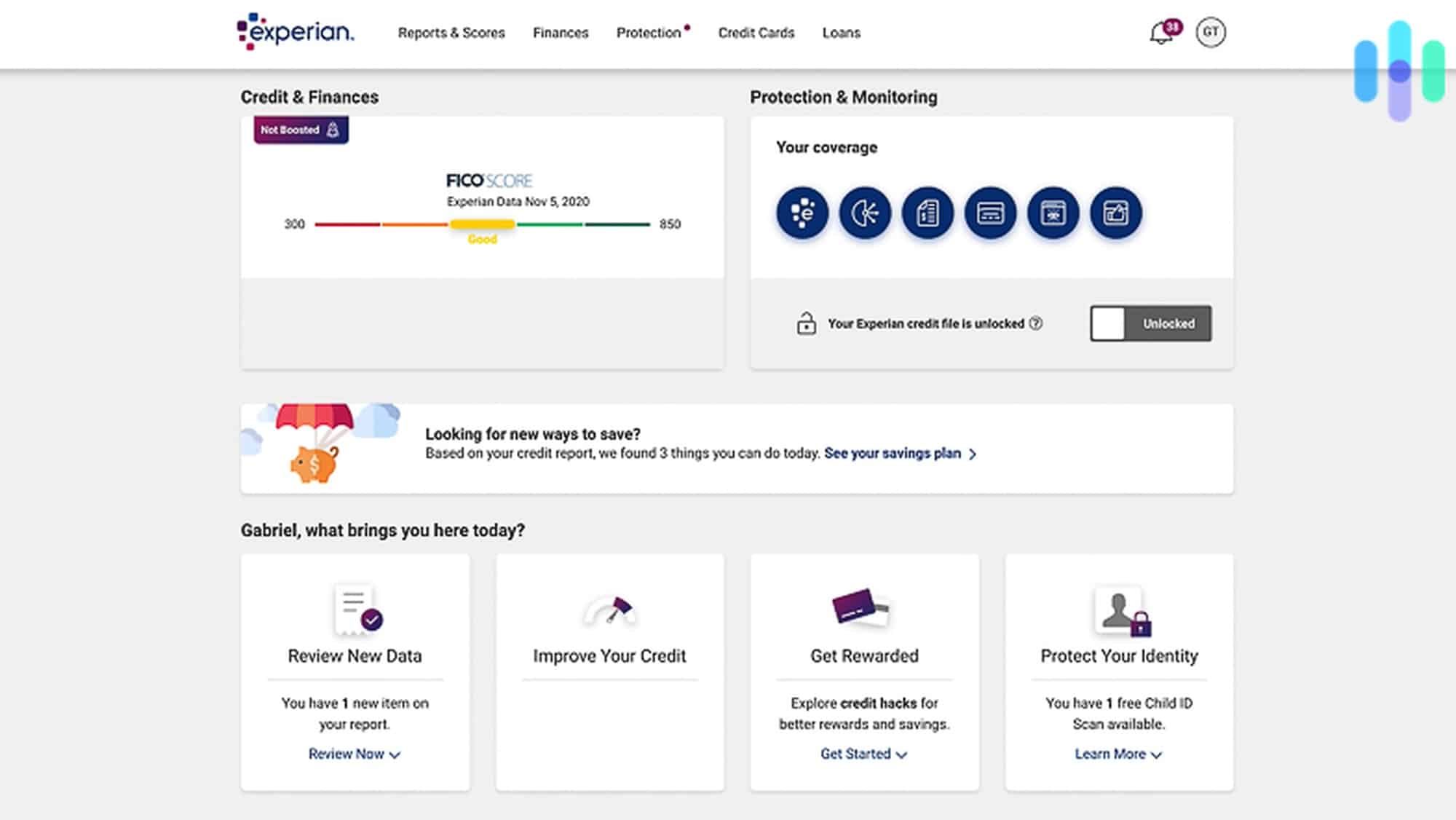

7. Experian IdentityWorks - Best Credit Card Fraud Assistance

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans Starting at $24.99 per month Family Monthly Plans $34.99 and up The credit bureau Experian owns IdentityWorks, an ID protection service with the best credit card fraud assistance. Their proactive Premium plan can give you daily updates to your Experian FICO score and helps monitor against fraud with quarterly FICO score reports from all three bureaus.

Also with the Premium plan you can conveniently lock/unlock your Experian credit report by smartphone or web. The plan’s dark web monitoring, court records monitoring, and other proactive features further help reduce the risk of serious identity fraud.

This top-tier service starts at just under $17/month with annual service for one, or $19.95/month when you pay for a month at a time. Family deals are available for one adult with children and for two adults with children.

Like other ID protection plans above, the Premium Experian IdentityWorks plan is among the best for families as well as individuals. Social media monitoring and convicted sex offender alerts are among the features that help keep children safe. Furthermore Experian checks P2P sites for sensitive files that minors may have inadvertently or deliberately shared.

If your identity is compromised, you’ll get expert assistance at no cost. The Experian Premium insurance plan is generous, even compared with the leading competitors, as it includes coverage for child care, elder care, lost wages, and other expenses you might incur while working to restore your identity. Specifics are:

- $1 million insurance limit

- Up to five weeks of lost wage replacement

- Up to $2,000 in family care coverage

You can try Experian IdentityWorks free for 30 days. The prices above reflect yearly deals. Month-to-month plans are available too.

Summing It All Up

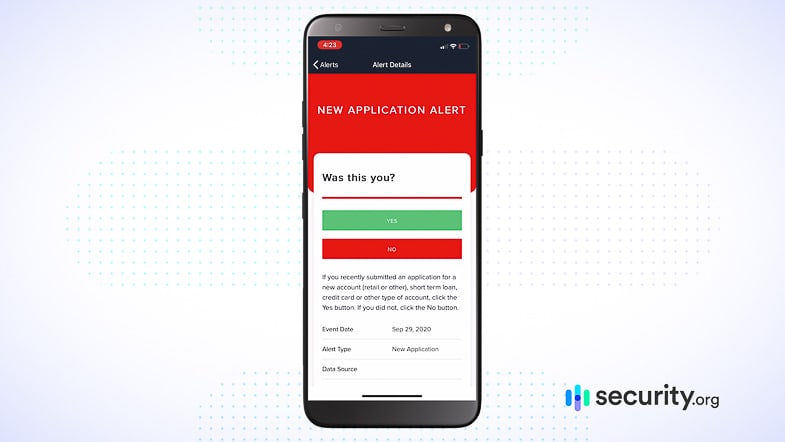

We’ve all been annoyed once or twice when we go to buy something big with our credit card only for it to get denied since it thinks it’s fraud. But, just because it was a bit annoying doesn’t mean it’s useless or unnecessary. Really, it’s the complete opposite. These fraud detection checks prevent fraudulent activities on a daily basis. So, why not get identity theft protection with fraud detection to monitor all of your transactions and activities for fraud, not just your credit card transactions? That’s what makes sense to us at least.

Fraud detection should be one of the key features in any identity theft protection service you buy. It keeps your activities in check and whenever it detects fraud, all you have to do is say that you are the one making the transaction. Even though it might annoy you every once in a while, that minor annoyance outweighs the difficulties of reversing fraudulent transactions or activities by a ton.

FAQs about Identity Theft Protection with Fraud Detection

-

If my credit card has fraud detection, do I need identity theft protection with fraud detection?

While there is a bit of overlap between your credit card’s fraud detection and the fraud detection with your identity theft protection service, your credit card fraud detection only covers transactions made with your credit card. It doesn’t detect fraud related to activities with your identity. That’s where identity theft protection with fraud detection comes in. For example, if you live in Florida and someone tries to use your identity to take out an auto loan in California, your identity theft protection with fraud detection should prevent that activity from taking place.

-

Isn’t identity theft protection and fraud detection the same thing?

Most identity theft protection services include fraud detection, so it can seem like they’re the same service. But, identity theft protection only helps you identify when someone steals your identity. Fraud detection helps you identify fraudulent activity across all of your accounts, so it can alert you of suspicious wire transfers, loan applications, and a whole lot more.

-

What does identity theft protection with fraud detection cover?

Generally, fraud detection focuses mostly on credit card activities. They’ll usually learn your normal activities to identify outlier activities based on your historical transactions. This data gets compared to other users to identify suspicious activity. From there, your identity theft protection service will notify you, or better yet stop, of any suspicious activity.